As a white woman it is basically sacrilegious to have not yet talked to you about Becky. Growing up in Westside Vancouver, I was inundated with Becky moms and young, bouncy Becky’s to-be. Before I go into it, I must clarify that a Becky should not be confused with a Karen. They are similar in nature, but one is racist and has a bad haircut (Becky wouldn’t be caught dead with Karen’s spiky, side-swept, blonde, inverted bob-lob).

Speaking from experience, a Vancouver Becky is typically 10 minutes late, usually holding an unrealistically large caffeinated drink, always has her hair and makeup done to perfection but will still say things like “my god I’m such a mess”, drives a Range Rover or something that looks like a Range Rover, is wearing an outfit that is somehow acceptable to wear to lunch but is also fit to run a marathon in, owns an expensive handbag, and, notably, has a manicurist she knows by name that she’ll casually “pop in” to fix a chipped nail.

We all hate Becky, and we all complain about Becky but at night in our room we have all had that half-fantasy of living life as a Becky. In other words, embracing one’s inner “Basic Bitch”. Because whether we like it or not, the Becky’s of the world appear to be thriving – so it only makes sense that their investment strategy would do the same.

What is the $Becky Portfolio?

The rise of the “Basic Bitch” is reminding investors everywhere of a simple rule: invest in what you know. The Becky strategy is, in every iteration of the word, basic. It focuses on investing in American lifestyle brands that sell (typically) overvalued and (typically) overpriced products and services to rich and upper-middle-class (typically white) women.

The ‘Becky’ exchange-traded fund is not an officially listed ETF but rather, a simulation that focuses on where the basic bitch spends their money. In simpler terms, it is an attempt to track the spending habits of well-off women (for a cute financial literacy refresher: exchange-traded funds are just a type of index fund that tracks a basket of stocks).

The typical Becky ETF invests in things like Apple, Lululemon, Netflix, Pinterest, Peleton, Facebook, Estee Lauder, and whatever other big companies you picture a Becky enjoying and buying (and no, Estee Lauder is not nearly as out of place as it sounds – I too thought this was a brand for 60+ and 60+ only, but turns out it includes the likes of Bobbi Brown, Clinique, La Mer, Smashbox, Mac Cosmetics, Tom Ford beauty, Le Labo and a hundred other overpriced beauty products you’ve probably bought at Sephora).

This is backed by, like, the Harvard Business Review.

The Becky investment strategy stems from an article in the Harvard Business Review called Female Economy, which found that women make a significant amount of the purchasing decisions in households (I don’t really think any of us needed Harvard to tell us this).

The article also told us that women make the purchasing decisions for 94% of home furnishings, 92% of vacations, 60% of automobiles and 51% of consumer electronics (again, Harvard, I don’t think this is ground-breaking research).

The study further suggests 6 types of female consumers. In Becky’s case, the ETF is constructed around the brand of consumer titled “The Fast Tracker”.

Harvard says that the Fast Tracker is part of the “economic and educational elite” who “seeks adventure and learning”. I don’t know why they had to write this like a Christian Mingle profile, but you get the gist. They are the girls on dating apps who have photos on a romantic balcony in the South of France (not to be confused with the girls in a hostel in Bali). They represent 24% of the population and 34% of earned revenue. These women have solid financials and independent personalities that enable them to spend a large portion of their money for all their Becky heart’s desire.

Be like Buffet, but as Becky, because she’s cuter. Duh.

Even my non-finance people have heard the name Warren Buffet. He’s the guy who sort of looks like a mushroom and is revered as one of the most successful investors of all time.

Buffet bought into the American dream (i.e., American consumerism from every angle and by the age of 30 became a millionaire). He famously said, “for 240 years it’s been a terrible mistake to bet against America, and now is no time to start.”

He’s also the one that even more famously said “diversification is protection against ignorance.”

This similar logic tracks for Becky.

The number one goal of most businesses is to make money. The more people spend money at a given company, the more profitable it becomes. Becky is part of the cohort of women who drive 70-80% of consumer spending. Investing in Becky’s spending seems relatively foolproof.

Personally, I am all for supporting the little man and investing in what you believe in. Becky, however, (unfortunately), doesn’t tend to give a shit about that sort of thing. But I guess, on the other hand, who am I to say that one can’t believe in a pumpkin spice latte and matching blue Lululemon set.

Becky’s Performance:

Ok so like, this all seems obvious. Invest in brands with cult-like followings. But will I actually make money off of the Becky strategy?

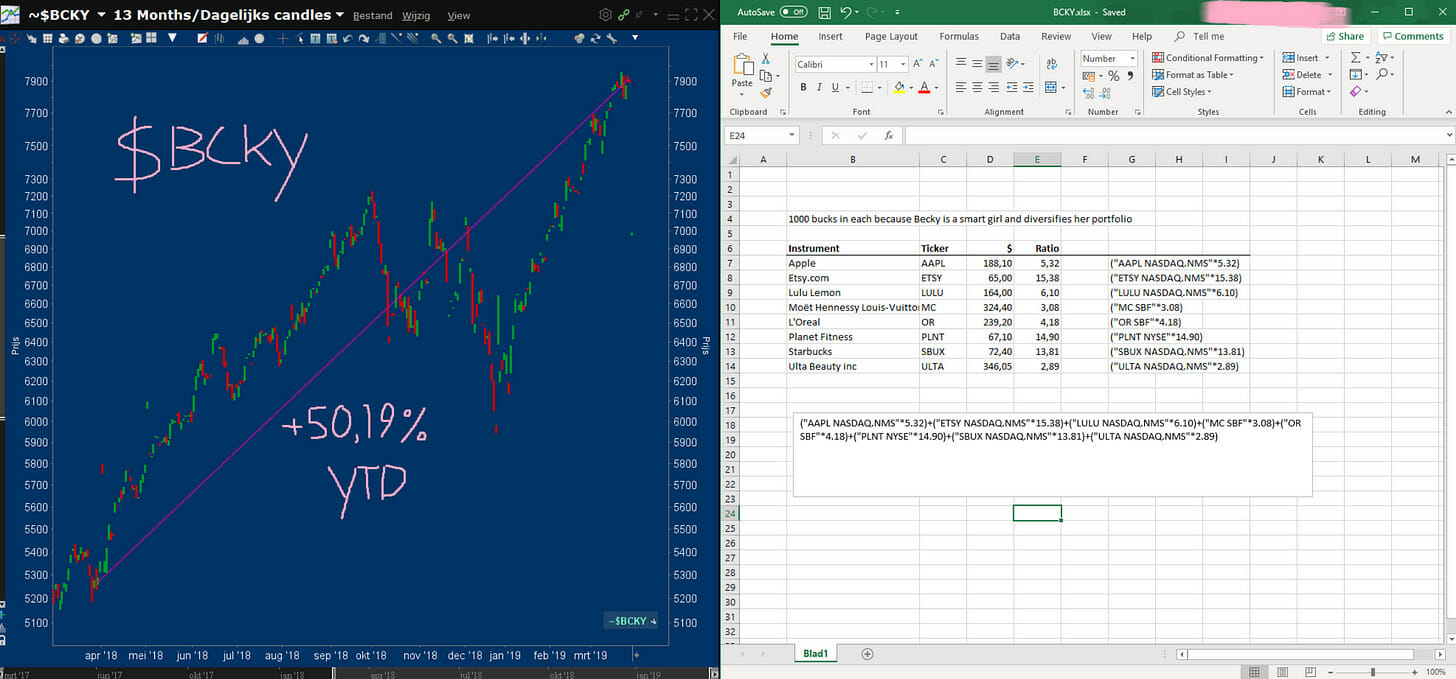

TrackInsight found Becky’s performance between January 2015 and December 2020 gained 1,079% compared to the US market’s S&P 500 index, which rose 84%.

In Becky’s words, “that’s like actually so good. I love this for me”.

The American image is highly exportable. Meaning, these “Becky” companies have worldwide appeal. The Basic Bitch obviously transcends international borders. And on the financial front: despite the Becky portfolio being made up of mostly American-based companies that operate on the $USD, they are not tied to a single currency. Because they are internationally renowned… And the Basic Bitch transcends international borders… Get it?

The investment strategy has become popular on Reddit, with at-home investors posting updates on how their own version of the Becky ETF is tracking…

(If I’ve sold you on Becky, people typically build their portfolio with anywhere from 5-15 blue-chip companies).

To my Becky’s, my wannabe Becky’s, and the Chad’s who want to date the Becky’s…

This is not a drill. This is not a creepy internet joke where boys sexualize their stock portfolio. This is a proven investment strategy and a true Legally Blonde moment.

It pays to be basic.

Until next week.

Leave a Reply