Uranium is required for nuclear power plants. Like aeroplanes, when something goes wrong with nuclear – it’s dramatic – it makes headlines and burns into everyone’s brain.

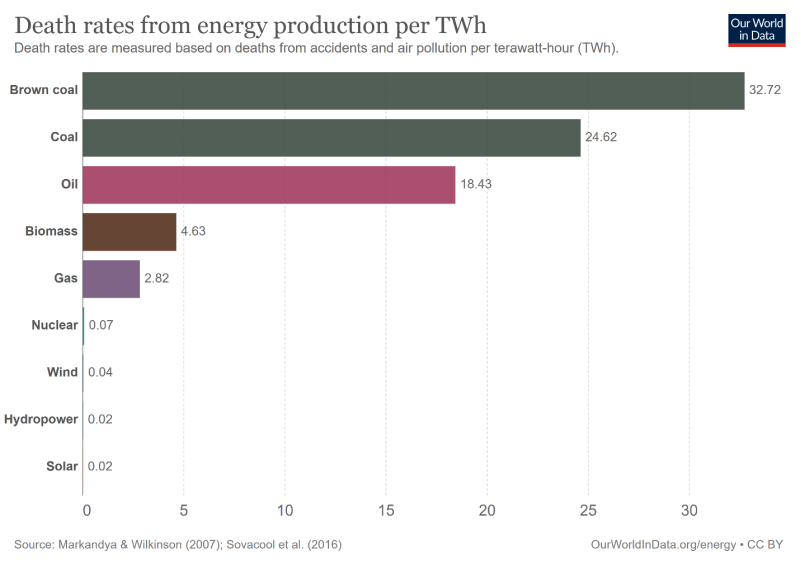

But judged by the cold metric of human deaths per Kilowatt/hour – nuclear reactors are 40 X safer than gas and 330 X safer than coal .

Nuclear energy now supplies 10% of the world’s electricity and is responsible for one-third of global carbon-free electricity.

Fifty-five power reactors are currently being constructed in 19 countries, notably China, India, Russia and the United Arab Emirates.

Azincourt Energy (AAZ.V) is focused on the strategic acquisition, exploration, and development of alternative energy/fuel projects, including uranium, lithium, and other critical clean energy elements.

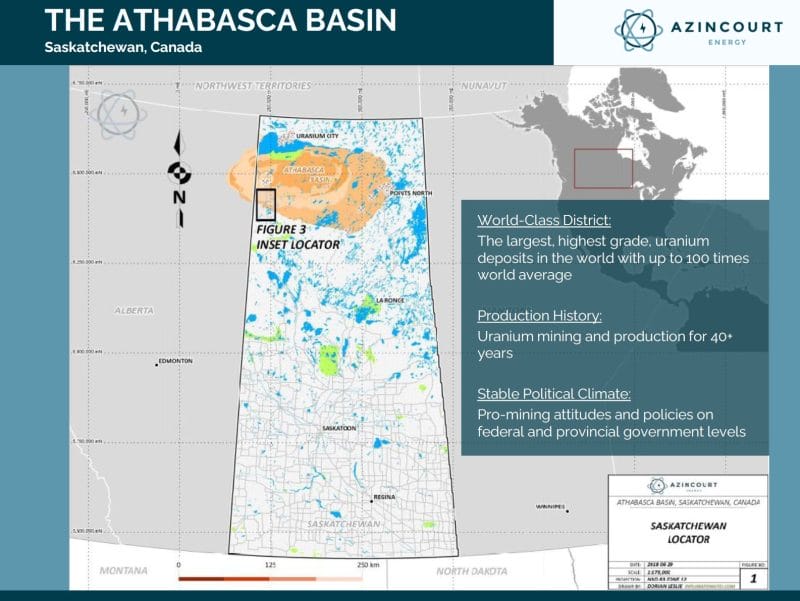

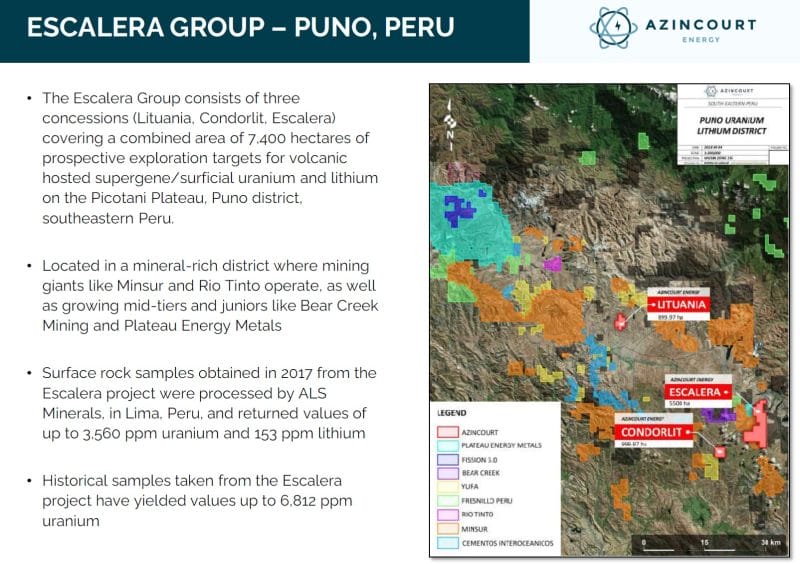

AAZ is developing its majority-owned joint venture East Preston uranium project, and its recently acquired Hatchet Lake uranium project, both located in the Athabasca Basin, Saskatchewan, Canada, and the Escalera Group uranium-lithium project, located on the Picotani Plateau in southeastern Peru.

On April 19, 2022 Azincourt announced a 2.5/1 share consolidation.

On April 07, 2022 AAZ announced it has signed an L.O.I with Oberon Uranium, whereby Oberon would be granted an option to acquire the Escalera Group, a 100%-owned series of uranium-lithium exploration located in southern Peru.

Oberon Uranium is a private uranium company which has the option to acquire 100% of the Lucky Boy uranium project, a past producing uranium mine located in Arizona, USA.

Under the terms of the LOI, Oberon has 90 days to conduct due diligence on the Projects, following which Oberon has the right to negotiate an option to acquire 100% interest in the Projects from the Company by completing the following proposed payments and expenditures:

- $25,000 cash and 100,000 shares of Oberon upon signing a definitive agreement;

- $25,000 cash, 250,000 shares and $50,000 in work expenditures on or before the 12-month anniversary of the definitive agreement;

- $50,000 cash, 250,000 shares and $200,000 in work expenditures on or before the 24-month anniversary of the definitive agreement;

- $50,000 cash, 250,000 shares and $250,000 in work expenditures on or before the 36-month anniversary of the definitive agreement; and

- $100,000 cash, 250,000 shares and $500,000 in work expenditures on or before the 48-month anniversary of the definitive agreement;

For a total commitment of $250,000, 1,100,000 shares and $1,000,000 in work expenditures. During the term of the option, Oberon will be responsible for all costs and expenses associated with maintaining the Projects in good standing, including any required regulatory filings and maintenance fees.

Three weeks ago, Azincourt Energy closed a $5.1 million Private Placement.

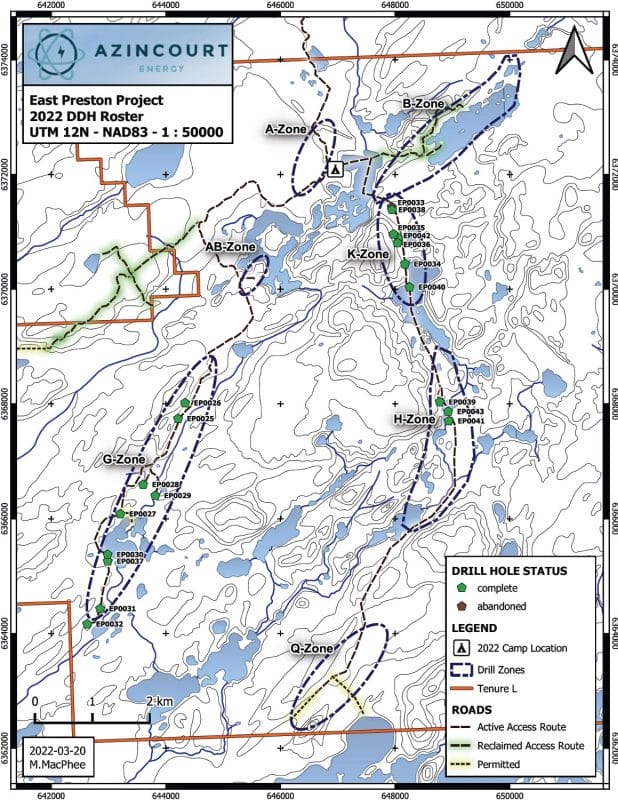

The Winter 2022 exploration program at the East Preston uranium project, located in the western Athabasca Basin, Saskatchewan, Canada, has been completed.

A total of 5,004 meters was completed in 19 drill holes over eight weeks duration. Drilling was focused on the G-, K-, and H-Zones.

A total of 420 samples were collected throughout the program and sent to the Geoanalytical Laboratory at the Saskatchewan Research Council in Saskatoon, Saskatchewan for analysis.

Complete assay results, expected to be received beginning in late April, 2022 and into June, will be reported once received, reviewed, and verified by the Company’s QP.

“The discovery of these alteration zones, both along the same trend, covering almost two kilometers of ground within these two separate zones, is a very important development,” said President and CEO, Alex Klenman. “With 5,000 meters of drilling we were able to establish 1,700 meters of alteration, that’s a pretty good ratio.”

“We know that alteration is associated with uranium deposition, acting as a halo proximal to deposition. The area in and around these zones is now a clear priority for continued drilling. The assay results will give us a really good idea of what we’re into and we’re eager to see what comes back from the lab,” continued Klenman.

April 1, 2022 Azincourt CEO Alex Klenman sat down with Equity Guru’s Chris Parry to discuss recent news, and AAZ’s business objectives.

“A few weeks ago, we announced the discovery of an 800-meter alteration zone at our East Preston project,” stated Klenman, “We’ve since grown that 800-meters to about 1700-meters. Once that news came out, the institutional support that we’ve garnered over the last year, was eager to continue to support. They offered us money.”

“If you put a bowl of food down in front of us, we’re going to growl and we’re going to eat it all,” continued Klenman, “We also decided to do a 2.5/1 share consolidation. The institutional funds were aware of this prior to be closing out the placement and not one order was pulled, which tells you the support that we continue to have.”

“You’ve been on this thing for a while,” observed Parry, “And it’s starting to pay off. You’ve played the long-game. You’ve been open to everybody. As a journalist, I appreciate that. Whenever I’ve asked you a tough question, that you’ve had a good idea and haven’t shirked away.”

“It takes a special set of brass balls to walk through the fire, and then turn around and walk straight back through it again,” continued Parry, “Now you’re sitting on a lump of cash, which is going to go into the ground.”

“East Preston was virgin ground,” confirmed Klenman, “It had never really been drill tested in any sense of the term. We put lots of money into the Geochem, airborne surveys, geophysical surveys. And that’s how we got to where we’re at. We are incrementally improving the project, with every round of work we do.”

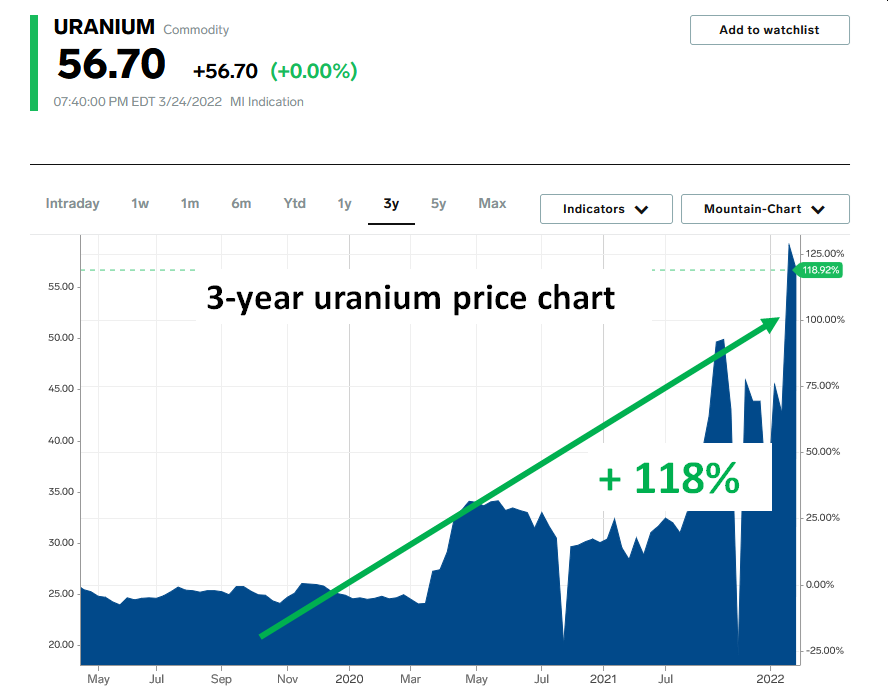

Uranium prices have climbed 50% in 2022. Russia accounts for 28% of global uranium production.

“The risk of Western import bans on Russian uranium supply has contributed to this year’s surge in prices for the nuclear-energy element,” states Markets Insider.

AAZ is perfectly positioned to benefit from the surging global uranium demand, and constrained supply.

Full Disclosure: Azincourt is an Equity Guru marketing client.

Leave a Reply