A Need for Alternatives

$54.898M Market Capitalization

ERYTECH Pharma (ERYP.Q) announced today that the Company has sold its US manufacturing facility to Catalent, a leading contract development and manufacturing organization (CDMO) in advanced therapies. Under the terms of the agreement, Catalent has agreed to purchase ERYTECH’s US facility for a total consideration of $44.5 million. That’s not all though. I suggest you keep reading for the full picture.

“In Catalent we have found a great partner for the manufacturing of our innovative red blood cell-derived products, and we believe that this strategic partnership will meet our long-term manufacturing needs in the United States,” commented Gil Beyen, Chief Executive Officer of ERYTECH.

Current staff on site of roughly 40 people will be offered Catalent’s employment. However, ERYTECH isn’t necessarily abandoning its Princeton facility for a quick buck. Instead, the Company and Catalent have entered into a long-term supply agreement, under which Catalent will manufacture ERYTECH’s eryaspase for clinical and commercial supply in the US.

Catalent will also offer its expertise in late-stage and commercial manufacturing of advanced therapy medicinal products with respect to product characterization, commercial production, regulatory inspections, and approvals. Sounds like a pretty sweet deal, especially considering the Company’s latest developments. Speaking of which, let’s talk about ERYTECH’s latest publication.

British Journal of Haematology Publication

On April 6, 2022, ERYTECH announced the results from a NOPHO-sponsored Phase 2 trial of eryaspase in acute lymphoblastic leukemia (ALL) patients are now published in the British Journal of Haematology (Br. J. Haematol). The Br. J. Haematol is a peer-reviewed medical journal focusing on hematology and other blood-related topics. This includes blood diseases, such as ALL, and their treatments.

“The study demonstrated that eryaspase, given at a convenient schedule every two weeks, provides a sustained asparaginase enzyme activity level above the recommended threshold for other Asparaginase treatments…We conclude that eryaspase seems to be a promising treatment alternative for ALL patients with hypersensitivity to PEG-asparaginase,” said Dr. Birgitte Klug Albertsen, the Principal Investigator.

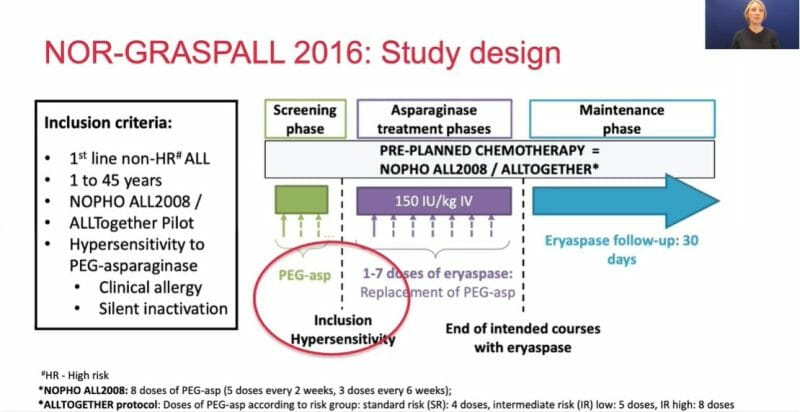

The Company’s Phase 2 NOR-GRASPALL-2016 trial evaluated the safety and pharmacological profile of eryaspase in ALL patients who had previously experienced hypersensitivity reactions to pegylated (PEG) asparaginase therapy. Believe it or not, PEG asparaginase, sold under the brand name Oncaspar, has nothing to do with asparagus. Instead, PEG asparaginase has traditionally been used to treat ALL.

However, the enzyme itself, asparaginase, has been associated with treatment-limiting toxicities. In particular, hypersensitivity is one of the most common reasons for the discontinuation of asparaginase therapy and is observed in up to 30% of patients. To make matters worse, the discontinuation of asparaginase therapy is associated with inferior event-free survival.

Enter Eryaspase (GRASPA®)

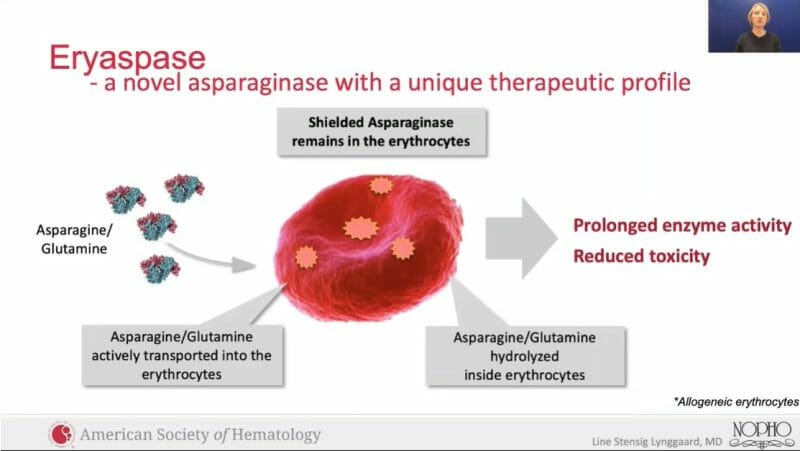

Eryaspase represents ERYTECH’s lead product candidate, which consists of L-asparaginase encapsulated inside donor-derived red blood cells. Eryaspase then targets the cancer cells’ altered asparagine and glutamine metabolism. It is worth noting PEG asparaginase has a longer half-life and a decreased incidence of hypersensitivity reactions compared to L-asparaginase.

As a result, this has prevented the use of L-asparaginase in fragile patients and other indications. However, by encapsulating L-asparaginase utilizing the Company’s proprietary ERYCAPS® platform, ERYTECH is expanding the therapeutic window and broadening the scope of L-asparaginase to other oncology indications, including pancreatic cancer and triple-negative breast cancer.

If you would like to know more about ERYTECH’s ERYCAPS® and eryaspase, check out the Company’s short 55-second clip above or here! Impressively, eryaspase has already received Fast Track designation from the US Food and Drug Administration (FDA) for the treatment of advanced pancreatic cancer and ALL patients who have developed hypersensitivity reactions to PEG asparaginase.

Additionally, the FDA and European Medicines Agency have granted eryaspase orphan drug status for the treatment of pancreatic cancer and ALL. Put simply, orphan drug status grants a company exclusive marketing rights for a seven-year period, along with other benefits, to recoup the costs of researching and developing drugs to treat rare diseases.

Although eryaspase has received Fast Track designation and orphan drug status, it is not an approved medicine. The Company produces its product candidates for the treatment of patients in Europe at its GMP-approved manufacturing facility in Lyon, France, and previously for patients in the US at its GMP facility in Princeton, New Jersey, which has since been sold to Catalent.

NOR-GRASPALL-2016

Since I have referenced it 101 times, let me explain what hypersensitivity is. In relation to the medical field, a hypersensitivity response refers to the body’s immune system producing undesirable responses by identifying harmless substances as harmful. Basically, a hypersensitivity response is like calling a small child a threat. Although, if there are enough of them I would still probably lose. Probably.

As previously mentioned, up to 30% of patients end up developing hypersensitivity when treated with asparaginase, making further treatment impossible. ERYTECH’s eryaspase is intended to serve as an alternative, providing prolonged asparaginase activity with reduced toxicities. In order to explore this, the Phase 2 NOR-GRASPALL-2016 trial was conducted.

“We are proud to be working with the NOPHO group in conducting this study in ALL and hopeful that study results provide the possibility of an alternative treatment for ALL patients with hypersensitivity to PEG-asparaginase…We have an ongoing dialogue with the U.S. FDA regarding a potential regulatory approval in this indication based on the NOPHO-sponsored trial,” said Dr. Iman El-Hariry, ERYTECH’s Chief Medical Officer.

The study evaluated the safety and pharmacological profile of eryaspase in ALL patients who have previously experienced hypersensitivity reactions to PEG asparaginase. It was conducted by the Nordic Society of Pediatric Haematology and Oncology (NOPHO) at 21 clinical sites in the Nordic-Baltic countries of Europe, enrolling a total of 55 patients. The primary objectives were asparaginase activity and safety, both of which were met.

Eryaspase Results:

- demonstrated sustained asparaginase activity above the specified thresh hold (>100 U/L) 14 days after the first infusion in 92.5% of patients

- generally well tolerated when added to chemotherapy

- almost all patients were able to receive the intended courses of asparaginase; a median of 5 doses per patient

- of 55 patients, only two had severe allergic reactions and were withdrawn from eryaspase treatment

As for ERYTECH’s publication in the Br. J. Haematol, the paper’s title is “Asparaginase Encapsulated in Erythrocytes as Second-line Treatment in Hypersensitive Patients with Acute Lymphoblastic Leukaemia.” Nice and succinct, right? If you’re interested in reading the paper for yourself, it can be found online here.

Financials

On March 14, 2022, ERYTECH provided various business and financial updates for Q4 2021. If I were to talk about all of the Company’s business updates you would likely die of old age before finishing this article so I won’t subject you to that. Biopharmaceutical articles are hard enough to read as it is. Instead, let’s cut right to the cheddar, otherwise known as ERYTECH’s financials.

As of December 31, 2021, ERYTECH had cash and cash equivalents of €33.7 million, or approximately USD$38.1 million. This represents a decrease from €44.4 million on December 31, 2020, and €38.0 million on September 30, 2021. The Company attributes this decrease to a €57.1 million net cash utilization in operating activities and investing activities. For the full details, check out the official press release here.

“We are very encouraged by the progress we are making towards seeking approval for our lead product candidate GRASPA®…Our BLA is ready to be submitted quickly once the FDA will have completed its review of the last information requests and gives us the green light to submit. The review of our strategic options is advancing well and different partnering discussions are in advanced stages of negotiation,” said Gil Beyen.

At the time, ERYTECH believed that its current cash position, without considering future proceeds from potential strategic options, could fund its planned operating expenses and current programs well into Q3 2022. If my mediocre writing doesn’t do it for you, those who are interested can access ERYTECH’s Q4 2021 and FY2021 Presentation here.

However, upon the closing of the transaction with Catalent for ERYTECH’s US facility, the Company’s cash and cash equivalents are expected to be approximately €55 million with the addition of the €40.8 million purchase price. With a reduction in yearly cash disbursements of approximately $7.5 million related to expenses associated with the Company’s Princeton facility, this cash is now expected to fund ERYTECH’s operations until mid-2024.

In the near future, specifically in Q2 2022, ERYTECH intends to file a Biologics License Application (BLA) for eryaspase in hypersensitive ALL. Previously, the Company had initiated a dialogue with the FDA in 2020 to evaluate the potential of eryaspase. Following discussions, the FDA prompted ERYTECH to submit a pre-BLA meeting, advancing the Company’s hopes of marketing approval in the US.

Based on ERYTECH’s discussion with the FDA, the Company announced on July 21, 2021, that it believes its regulatory package can potentially support approval of eryaspase in hypersensitive ALL patients. It goes without saying that the approval of eryaspase in the US would be a gargantuan milestone for ERYTECH.

Let’s not forget that the Company also has a Phase 1 trial in first-line pancreatic cancer ongoing in the US. Pairing this with ERYTECH’s latest long-term supply agreement with Catalent, I would say the Company is well-positioned for the streamlined marketing of eryaspase in the US, assuming its BLA is accepted.

ERYTECH’s share price opened at $1.90 today, up from a previous close of $1.22. The Company’s shares were up 45% and were trading at $1.77 as of 12:46 PM EST.

Leave a Reply