Rising oil prices have been the talk on the street. Both Wall and Main street. Investors and traders are betting on higher prices due to geopolitics, while main street is worried higher fuel costs will eat into their monthly income as the inflation and rising interest rates hit the middle class. I am here to say that oil prices are likely to be heading higher on big news from the EU.

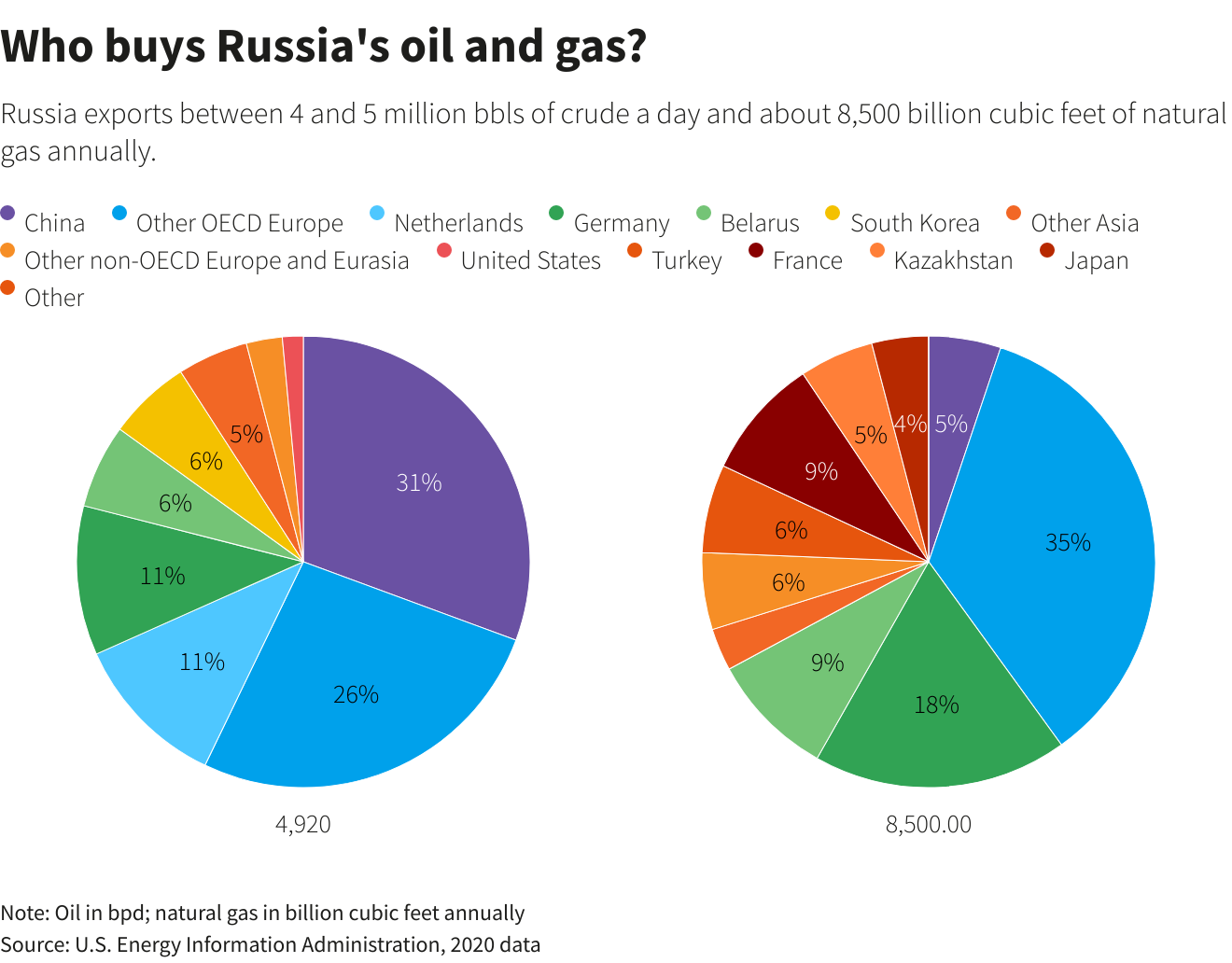

It came out that the EU is indeed working on an embargo on Russian oil. It could be unveiled as early as this week. The EU is awaiting the results of the French election which will take place on Sunday April 24th. By the time you are reading this article, the results will have come in. Everyone is expecting Macron to win, but there is a chance that Le Pen can shock Europe. Macron is all for a Russian oil embargo. Le Pen is taking a looser stance with Russia.

But it isn’t just about the French election. The EU is split. Germany continues to resist a full out ban as it would plunge them, and Europe, into a recession. Germany, Hungary, and Austria, as well as some other EU members, continue to resist an immediate outright ban on Russian oil, although Germany signaled earlier this month that it could end its dependence on Russian oil this year.

JP Morgan is warning that a full Russian embargo would initiate an amazing price run on Brent crude oil. An immediate EU ban on Russian oil could send prices to $185 a barrel! If the middle class is upset with the current price at the pumps…it could get worse.

A full immediate ban would cut over 4 million barrels per day (bpd) of Russian supply. The good news? The EU can’t be stupid enough to do a full out ban and hit their economies hard. They are likely to take the same approach they did with Russian coal. A gradual phase out ban of Russian oil over several months. JP Morgan sees this cutting 2.1 million bpd of Russian supply to Europe, and would not impact the price of oil as much as a full out ban.

The recent headlines that have been impacting the oil markets are from China, the US and OPEC. Oil prices remain subdued on falling demand in China due to lockdowns. But when they end, demand will rise.

On the US side of things, we know the Americans are selling off their emergency reserves to flood the market with supply to bring down oil prices. Some say this is a dangerous thing to do in case we get into a situation where there is an energy shortage due to embargoes and reduced production. The Americans will not have barrels in their emergency reserves for a rainy day. Others say the US is sending all this oil to Europe so they have enough when they begin to phase out Russian oil.

OPEC has warned the oil prices are rising due to geopolitics and they will not take further action to increase supply. This is what I was worried about. President Biden started an oil price war with OPEC last year dumping reserves. OPEC just cut supply to keep prices elevated and move higher. They are not increasing their supply and I just wonder if they cut supply to keep oil prices elevated. Let’s not forget that many of these nations want higher prices for government coffers. This dump and reduced supply game could lead to oil and energy shortages as the worst case scenario. Let’s hope we don’t go down that path.

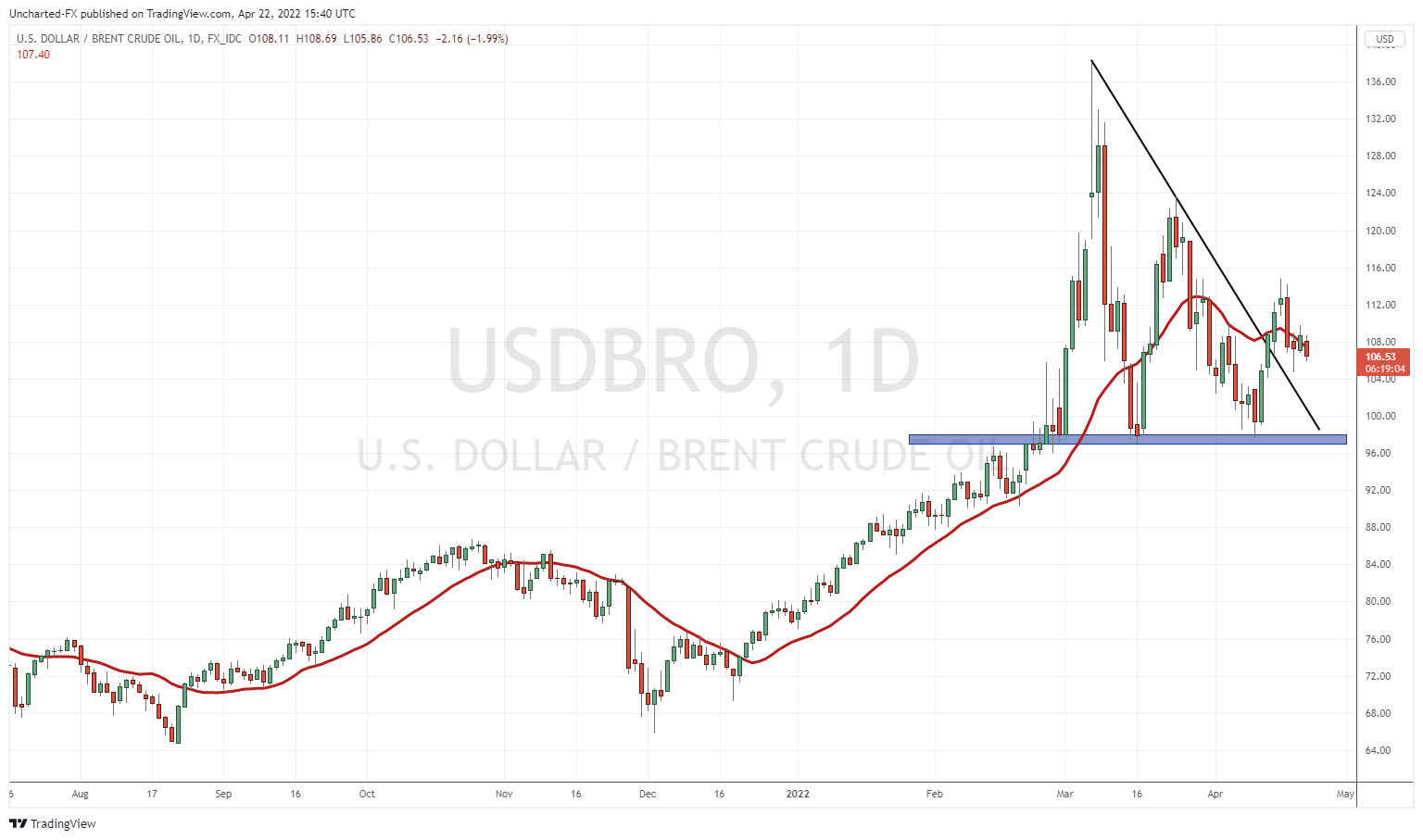

Above are the daily charts of West Texas and Brent Crude. I am looking at the CFDs so the numbers may slightly differ from the futures markets. But the charts and technicals look exactly the same.

What I want to highlight are two things. Firstly, we have a major support near the $100 psychological important number on both charts. West Texas is a bit lower around $95. Secondly, we have broken above a trendline which is a bullish breakout. As long as we remain above it, we are likely to retest recent highs of 2022. A technical guy like me just thinks that perhaps we will get some sort of news that the market is beginning to price in.

Meanwhile Natural Gas hit levels not seen since 2008 before pulling back. It is conceivable that after a Russian oil embargo, there might be one for Russian gas. Europe would be dependent on LNG from the US. Luckily, we are entering Spring and Summer, but higher natural gas prices and oil prices are going to be a brutal combo for the middle class come Fall and Winter.

So how to play this? Well you can be like me and trade CFDs and futures. However, I think it is prudent to have some sort of Oil ETF or major that pays a dividend in your portfolio. Have some energy exposure. Let’s not forget Warren Buffett and Occidental Petroleum. Last year people questioned the Oracle of Omaha’s choice of buying energy as his first purchase post covid stock market drop. He’s done well.

Other ways are to play the TSX and the Norwegian OBX. Both markets are dominated by energy and thus printed new all time record highs in 2022. Any forex traders reading this? The Canadian Loonie and Norwegian Krone are good bets. Even the Russian Ruble if you can still trade it on with your broker. I would pair them with weaker currencies like the Japanese Yen and the Euro (CADJPY, EURCAD, EURRUB, NOKJPY, EURNOK etc).

But let’s take a look at some oil plays that caught my attention on the Canadian markets.

Pulse Oil (PUL.V)

Market Cap ~ $ 12 Million

Pulse Oil Corp. engages in the exploration and production of oil and natural gas projects in Alberta. It owns 100% interests in the Bigoray assets covering approximately 5,349 net acres of land in the Bigoray area of Alberta; and the Queenstown assets covering approximately 3,023 net acres of land in the Queenstown area of Alberta.

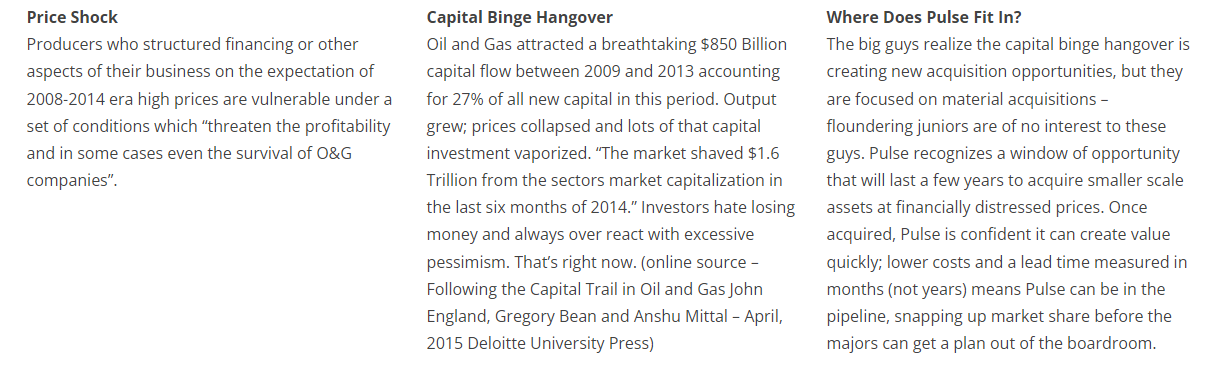

The company is led by Drew Cadenhead and Garth Johnson, and the goal is to take advantage of the current window acquisition opportunity to build a well located, productive and profitable property portfolio positioned for exceptional growth using Pulse Oil’s enhanced oil recovery program (EOR).

Recent news is about a $12.5 million financing at $0.05 per share. If it closes, the company has the cash for catalysts and long term goals.

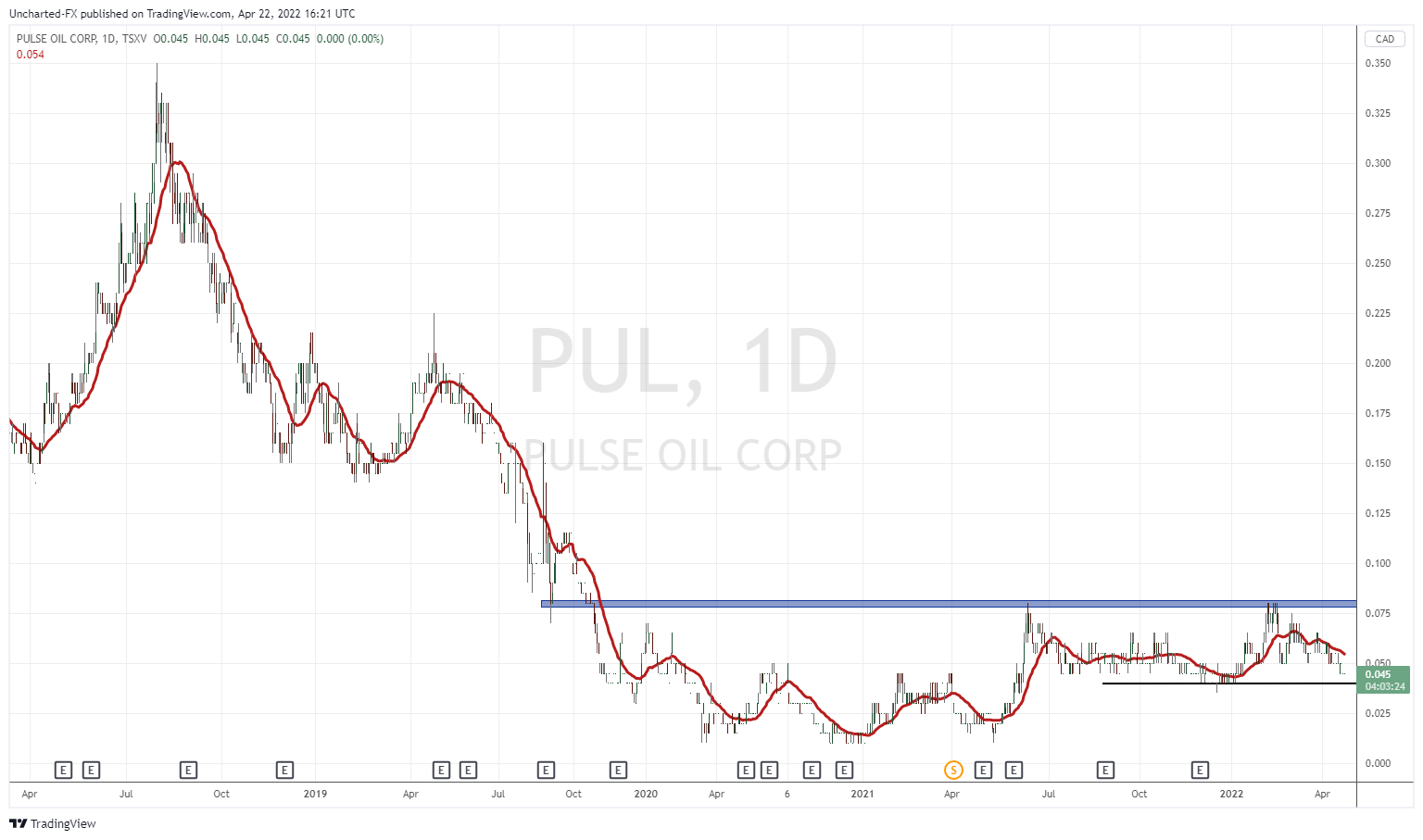

For you traders out there, I am spotting a broader cup and handle pattern here. A break and close above $0.075 is required to trigger this. A trigger means a reversal pattern and the start of a new uptrend.

We don’t want to see the stock close below $0.035 as it would invalidate the handle part of the pattern. The stock looks like it is bottoming, and any major catalyst would provide you with a nice return on your money.

Southern Energy (SOU.V)

Market Cap ~ $56 Million

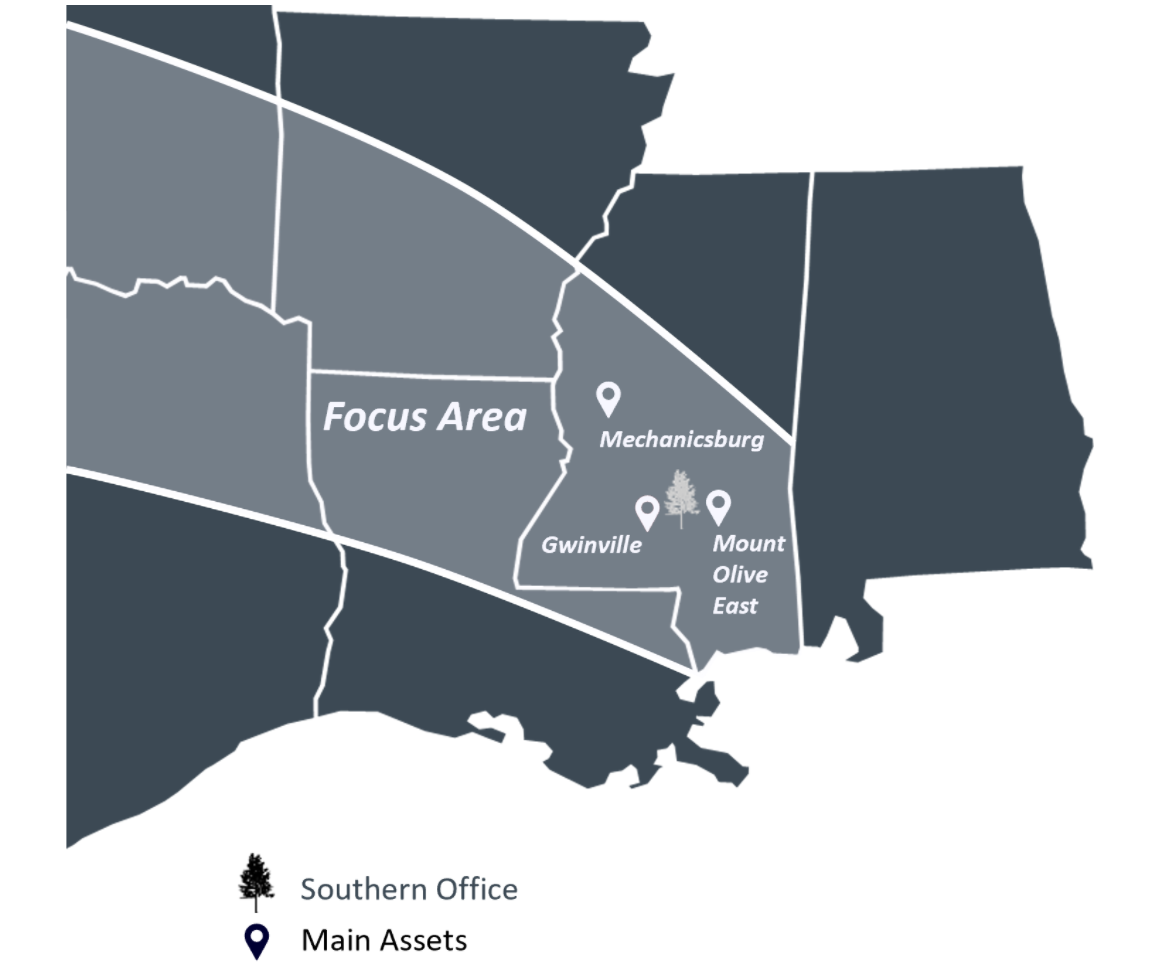

Southern Energy (SOU.V) is a natural gas exploration and production company. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Its principal properties are Central Mississippi Assets that covers an area of approximately 31,000 acres containing oil and gas production at Gwinville, Mechanicsburg, Williamsburg and Mount Olive, and Mississippi.

The company’s strategy is very simple: use management’s expertise in the South Eastern Gulf Coast area to add proven developed producing assets and execute low risk development drilling to achieve growth in reserves. The end goal is to build a high-margin asset base of sufficient scale with significant low-risk drilling inventory that continues to generate cash flow.

I believe Southern Energy is a stock to watch for geopolitical and ‘new world’ purposes. They are near LNG terminals, and if Europe wanes away from Russian gas, they will need American LNG. Production of LNG will need to increase to meet export demand. Southern Energy is in a great position to capitalize from this.

I covered the technicals of Southern Energy in early March 2022. Take a look at the chart and what I laid out when the stock was trading at $0.56. My analysis on the movement has been spot on and we have hit my resistance target.

Now we remain between support at $0.60 and major resistance at $0.75. If we break resistance, we make a nice run to $1.00. Some really good volume and gains in the past few trading days. This is one stock to have near the top of your energy watchlist.

InPlay Oil (IPO.TO)

Market Cap ~ $ 347 Million

InPlay Oil (IPO.TO) is a junior oil and gas exploration and production company with operations in Alberta focused on light oil production. The Company operates long-lived, low-decline properties with drilling development and enhanced oil recovery potential as well as undeveloped lands with exploration possibilities.

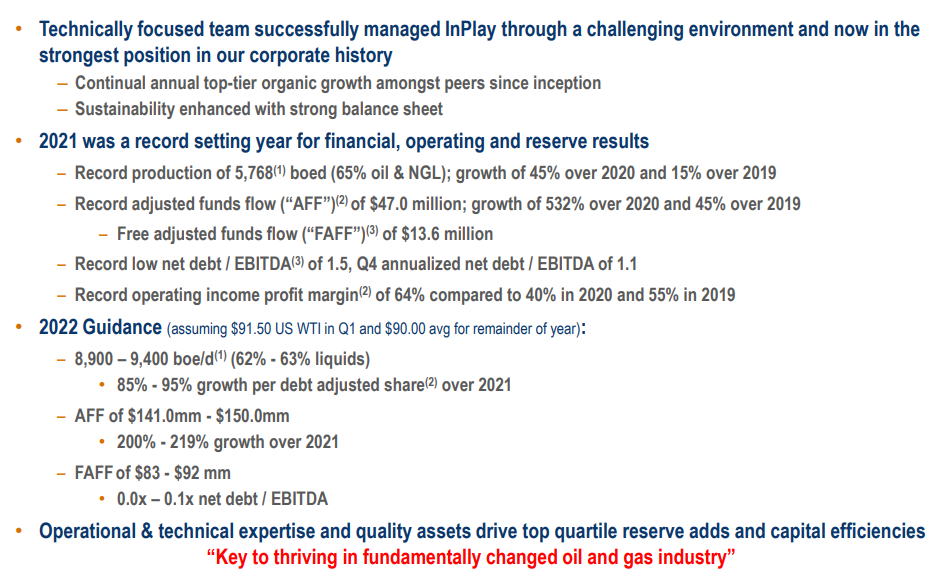

The company had a record setting 2021 on the financial, operating and reserves side of things. Here are highlights:

- Achieved record average annual production of 5,768 boe/d(1) (65% light crude oil and NGLs), an increase of 45% from 2020 at 3,985 boe/d(1) (68% light crude oil and NGLs) and an increase of 15% compared to pre-COVID levels of 5,000 boe/d(1) (66% light crude oil and NGLs) in 2019. Annual average production per weighted average basic share increased 31% compared to 2020.

- Generated record annual adjusted funds flow (“AFF”)(2) of $47.0 million ($0.67 per weighted average basic share(3)), an increase of 532% compared to $7.4 million ($0.11 per weighted average basic share) in 2020 and an increase of 45% compared to $32.5 million ($0.48 per weighted average basic share) in 2019, our prior record year. Excluding the impact of realized hedging losses, AFF for 2021 would have been $59.9 million.

- Increased operating netbacks(4) by 203% to $34.63/boe from $11.45/boe in 2020 and 52% from $22.75/boe in 2019.

- Realized annual record operating income(4) and operating income profit margin(4) of $72.9 million and 64% respectively compared to $16.7 million and 40% in 2020; $41.5 million and 55% in 2019.

- Reduced operating expenses to an annual record $12.83/boe compared to $14.43/boe in 2020 and $14.36/boe in 2019, despite rising costs of services in the industry.

The stock printed record highs at $4.62 before retreating. I see major support coming in around the $3.60 zone. I can draw an uptrend line which would also connect with the support at $3.60. This is a company I like as an up and comer producer and positioned to grow. Perhaps even an acquisition target sometime in the future.

Leave a Reply