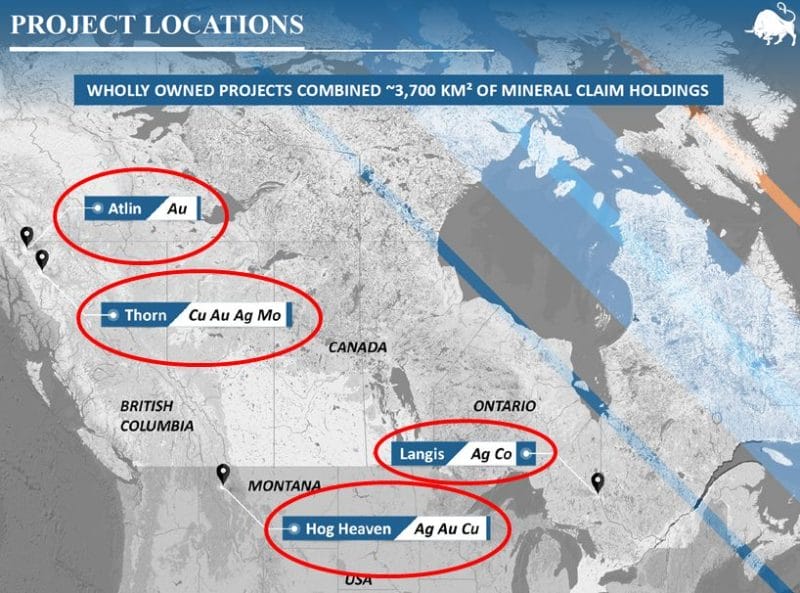

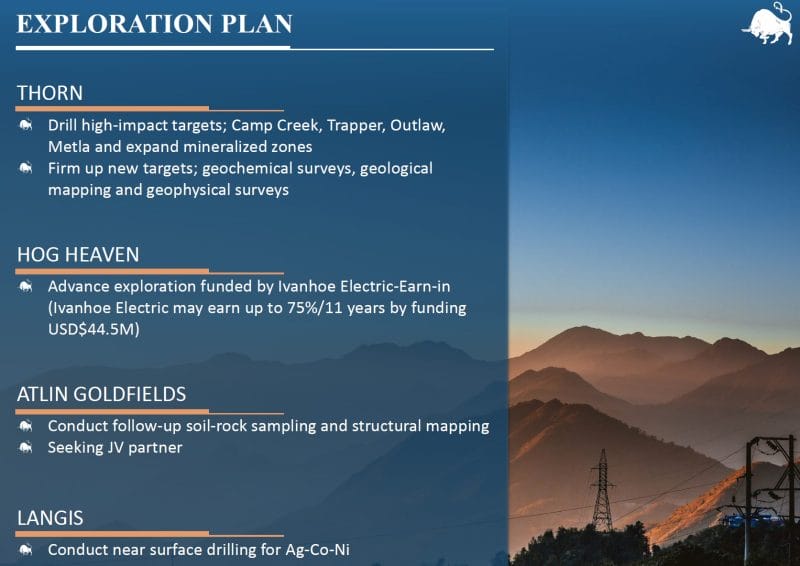

Brixton Metals (BBB.V) owns four exploration projects:

- Thorn copper-gold-silver project, BC

- Atlin Goldfields Projects, BC

- Langis-HudBay silver-cobalt Project in Ontario

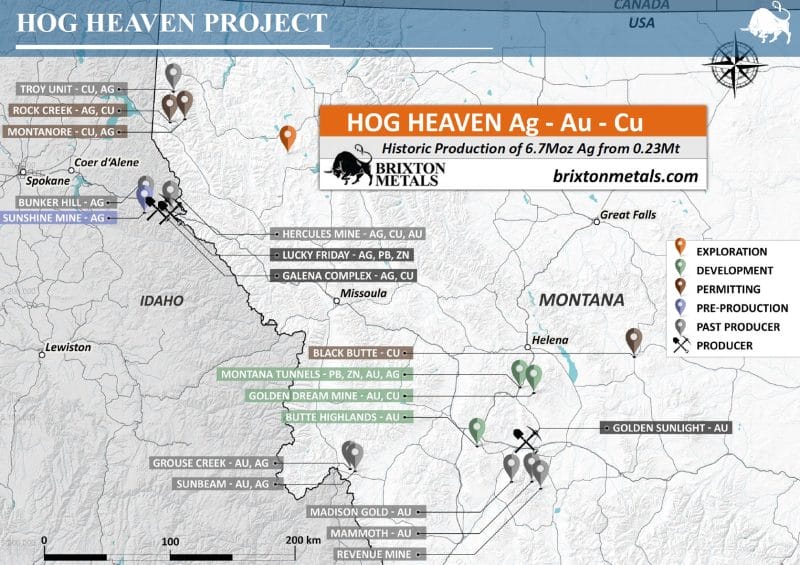

- Hog Heaven Copper-Silver-Gold Project in NW Montana, USA

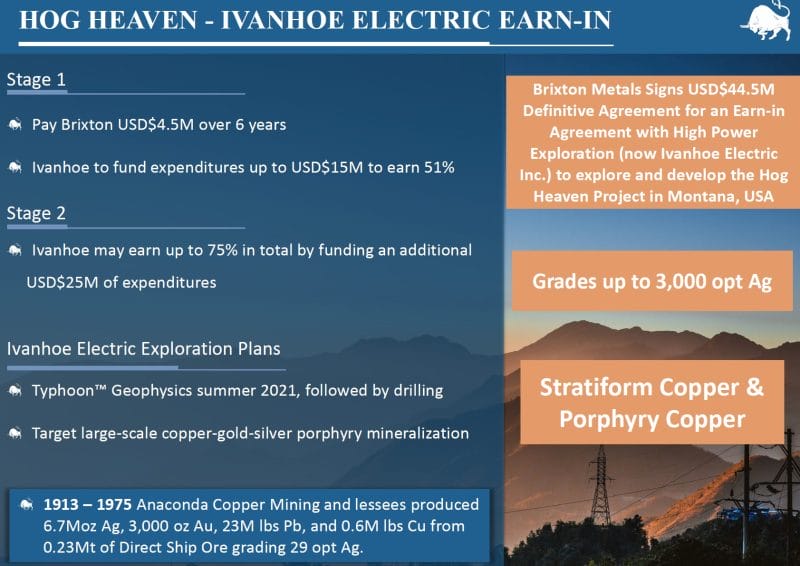

Note: Hog Heaven is under option to Ivanhoe Electric.

The three primary targeted metals (gold, silver, copper) are all attracting inflows of investor dollars.

Macro economic data (money printing, global debt) supports bullish gold sentiment. Solar power is a massive demand driver for silver. The electrification of everything means that current copper supply can not meet rising global demand.

“A recent World Bank report said demand for minerals needed for low-carbon technologies could increase by 500% by 2050,” reports CBC, “and that responsible mining, with environmental safeguards, would be required if global climate goals were to be met”.

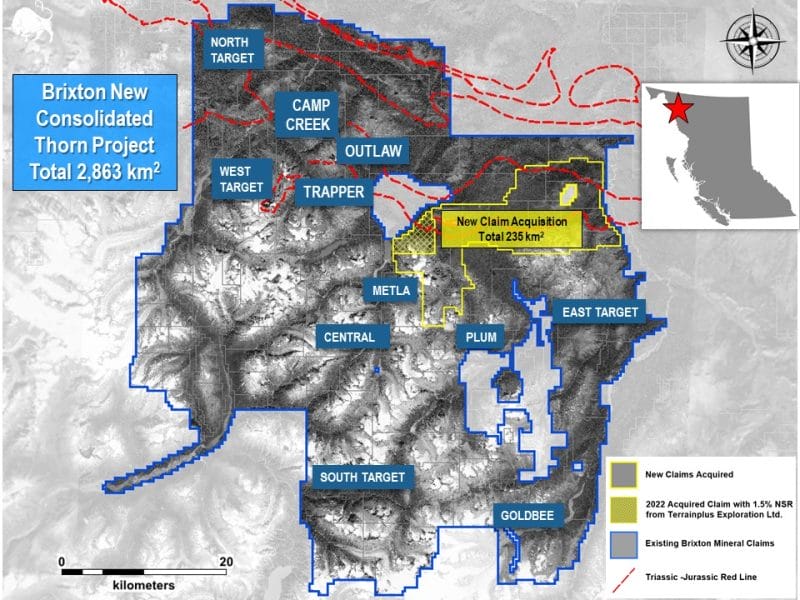

April 21, 2022, Brixton announced the acquisition of mineral claims contiguous with and further consolidating its Thorn Project to a new total of 2863 square kilometers of mineral tenure.

Highlights

- A new 235 square kilometers land package encompassing 35km of the prospective Triassic-Jurassic Red Line, an important marker for copper-gold deposits within the Golden Triangle

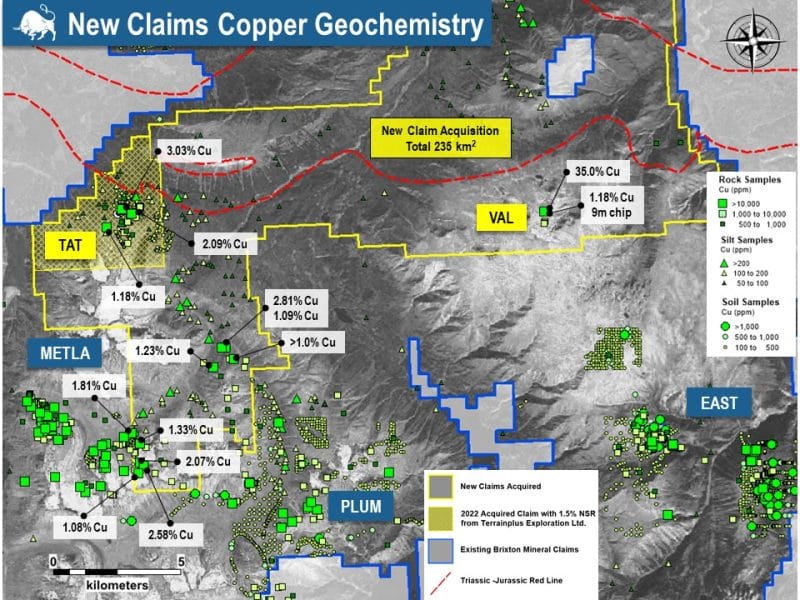

- The Val Showing yielded up to 35% copper from a rock grab sample of bornite-chalcocite quartz vein material and a 9m rock-chip sample returned 1.18% copper

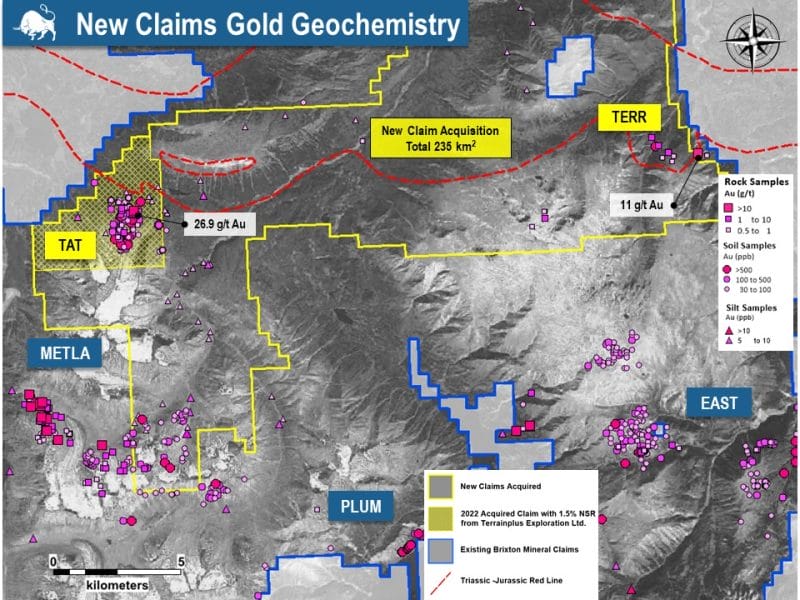

- The Tat polymetallic veins, yielding up to 26.88 g/t Au, 48 g/t Ag and 0.52% Zn from rock grab samples. Porphyritic alteration is observed at the Tat Target area, including a chalcopyrite-bearing grab sample with 3.03% Cu and 1.02 g/t Au

- The southern end of the new claims includes several anomalous copper and gold values in rocks and soils expanding the Metla Porphyry Copper-Gold Target area

New Consolidated Thorn Claims.

Copper Geochemistry of the New Claims and Metla Target.

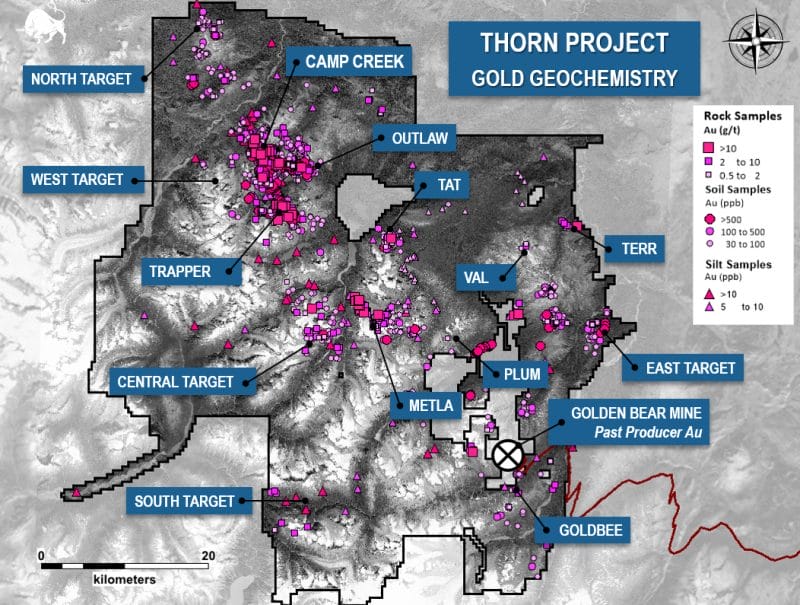

Gold Geochemistry of the New Claims and Metla Target.

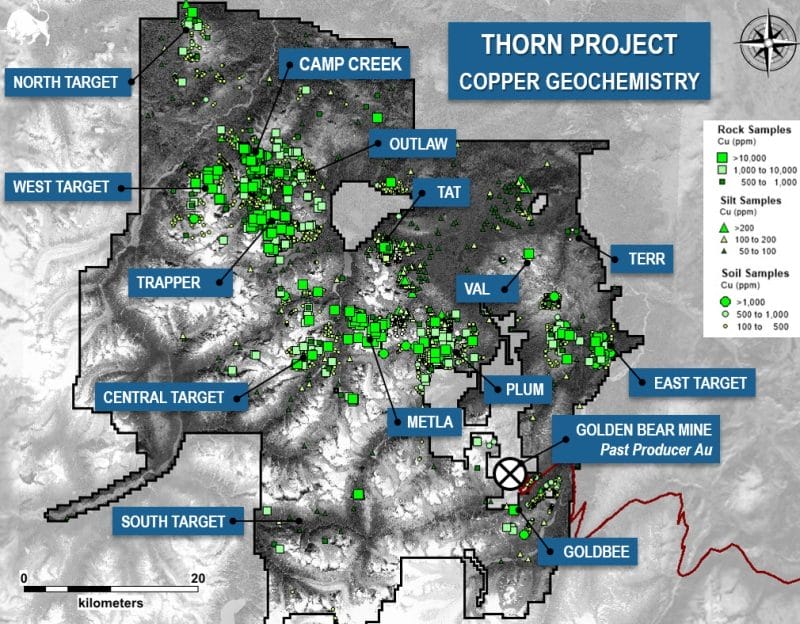

Copper Geochemistry of the Newly Consolidated Thorn Project.

Gold Geochemistry of the Newly Consolidated Thorn Project.

Brixton Metals Begins IP Geophysical Survey at its Langis Project, Ontario

On April 11th, 2022 Brixton Metals announced the beginning of a 70 line-km Alpha IP Geophysical Survey and surface sampling-mapping campaign at its wholly owned Langis Project located in the Cobalt Camp of Ontario, Canada.

“Over the past year the company has spent significant time remodelling all results and has identified three domains of interest,” stated Chairman and CEO of Brixton, Gary R. Thompson. “The domains include cobalt-nickel associated with the Archean basement rock, gold within the Algoman Syenite and native silver+-cobalt found within most lithologies”.

The results from the IP survey, mapping and geochemical sampling will allow us to refine the drill targets for the 2022 fall drill program,” added Thompson.

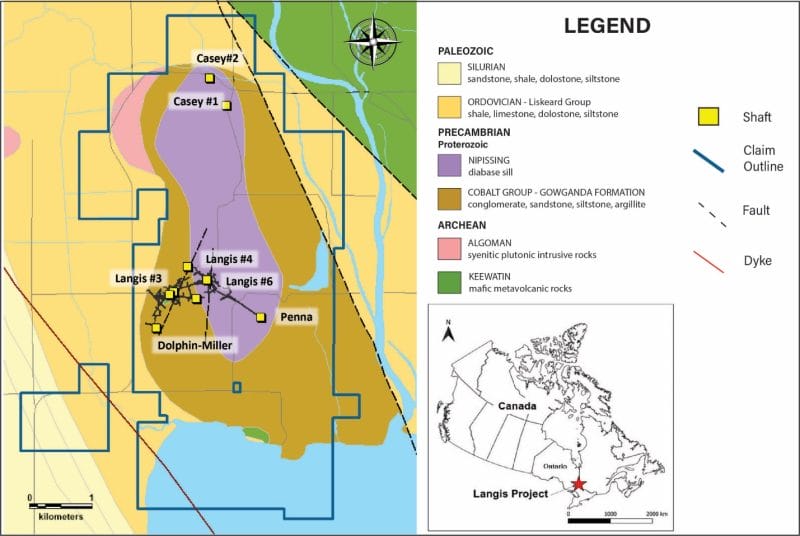

Location and geology of the Langis Project.

“Historically there has been limited surface mapping and sampling on the Langis property due to the lack of outcrop exposure and a thick sequence of glaciolacustrine Pleistocene overburden which covers most of the property, particularly to the east,” states Thompson, “A small-scale reconnaissance program to map exposed outcrops and collect rock samples is planned for the early spring once preliminary results from the Alpha IP survey have been received”.

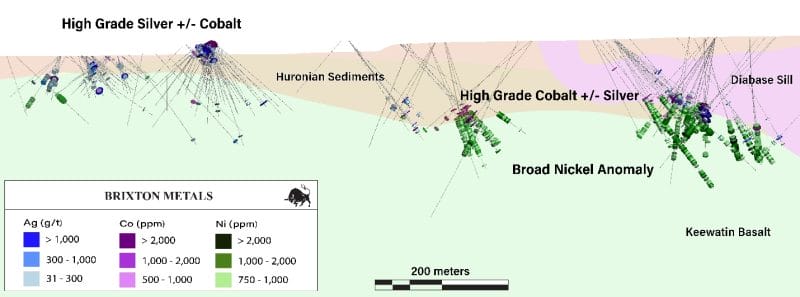

East-West Cross Section viewing north, showing silver, cobalt and nickel of the Langis Project.

Three distinct mineralization trends have been identified at Langis from historical work and more recent drilling by Brixton:

- Silver mineralization is primarily hosted in vertical, dilatant zones and shear veins within the Huronian sediments

- High-grade cobalt mineralization is present in broad envelopes hosted largely within the Keewatin Basalt, often at or below the contact of Huronian sediments

- A broad nickel anomaly appears to be present at depth below the cobalt mineralization and proximal to the Huronian-Archean unconformity

Previous exploration and historic mining at Langis have largely been focused on silver production; however, the potential exists for significant cobalt-nickel mineralization in the area.

Additionally, the property remains largely underexplored for its gold potential, particularly within the Archean Algoman syenite to the northwest of the mine property, which is part of the regionally prospective intrusive complex within the Abitibi Greenstone belt, known for its economic gold endowment.

Brixton’s 100%-owned Langis Mine Project is a past producing mine located 500 kilometers north from Toronto, Ontario, Canada.

The silver mineralization occurs as native silver within steeply-moderately and in some cases shallow dipping veins, veinlets, and as disseminations, rosettes and fracture infill.

The Langis Mine produced 10.6 million ounces of silver and 358,340 pounds of cobalt. Historically, the combined mines in the Cobalt Camp produced over 550 million ounces of silver with 30-50 million pounds of cobalt as a by-product.

On March 24, 2022 Brixton announced it has entered into a Letter of Intent (L.O.I) with Pacific Bay Minerals (PBM.V) giving Pacific Bay he Option to acquire 100% interest in the Atlin Goldfields Project located within the traditional territory of Taku River Tlingit First Nations, Atlin, British Columbia, Canada.

Chairman and CEO Gary R. Thompson Stated, “We are excited to have Pacific Bay take on the Atlin Goldfields Project. “This deal would mark Brixton’s second Option Agreement,” stated Brixton Chairman and CEO, “Having optioned the Hog Heaven Project to Ivanhoe Electric in recent years. It provides value add for Brixton shareholders while the Company focuses on the flagship Thorn Project.”

Terms of the Agreement:

Under the terms of the Letter Agreement, Pacific Bay may acquire up to a 100% interest in the Atlin Goldfields Project, by completing the following:

- Pacific Bay may earn a 51% interest in the Property by completing $3,500,000 in Exploration Expenditures, paying $1,725,000 cash, and issuing 5,000,000 Pacific Bay shares, on or before the 4th anniversary of the closing of the Agreement.

- If the 51% interest earn-in has been completed, Pacific Bay may earn an additional 49% interest in the Property by completing an additional $3,500,000 in Exploration Expenditures, paying $1,500,000 cash, and issuing 5,000,000 Pacific Bay shares, on or before the 7th anniversary of the closing of the Agreement.

If Pacific Bay exercises the 51% earn-in and elects to not exercise the additional 49% earn-in, Pacific Bay and Brixton will enter into a joint venture, whereby the interest in the property will revert to 49% in favour of Pacific Bay and 51% in favour of Brixton, with each party then participating in programs and budgets according to their pro-rata interests.

If Pacific Bay completes the option and acquires 100% of the Property, Brixton will retain at 2% Net Smelter Return Royalty (NSR), with 1% of the NSR purchasable at any time by Pacific Bay for $2,500,000.

On March 3, 2022, Brixton Metals announced that it has received a 2nd payment of USD $500,000 for the Hog Heaven Project which is currently being operated under a definitive earn-in JV Agreement with Ivanhoe Electric.

Hog Heaven is an advanced stage high sulphidation epithermal copper-silver-gold project with porphyry potential and historical production located in the state of Montana, USA.

Between 1913 and 1975, Hog Heaven produced 6.7 million ounces of silver, 3,000 ounces of gold, 23 million lbs Pb, and 0.6 million lbs Copper.

Ivanhoe Electric is a privately-owned mineral exploration and development company led by Chairman and CEO, Robert Friedland. The company holds the option to acquire up to 75% interest in Hog Heaven through a USD $44.5 million spend.

“We are looking forward to further understanding the mineral potential of this high-grade district,” stated Ivanhoe Electric CEO Robert Friedland, “in our pursuit of critical metals to support the electrification of everything.”

A member of the Canadian Mining Hall of Fame, Friedland has been called the “undisputed king of junior development” by the Mining Journal, which named him one of the industry’s 20 most influential people.

“The mining industry has been down for such a long time that most participants forgot what up looks like,” Friedland recently told BC Business, “So since everything by nature is cyclical, we’ve had most of the money in the world for the last 20 years go into broadband Internet, the cloud, telecommunications and other clearly disruptive technologies.”

“But of course, mining also benefits from all of those disruptive technologies,” added Friedland, “People are waking up to the fact that certain elements in the periodic table are going to be huge winners.”

“Historically, most of the previous operators focused on the shallow high-grade silver and gold oxide mineralization,” explained Brixton Chairman and CEO, Gary R. Thompson, “Some of the old underground workings assayed up to 3,000 ounces per ton silver. Our thinking is that this shallow precious metal enriched high-sulphidation style mineralization is related to a copper rich porphyry.”

- Completed a 14,500-meter re-logging program of current and historic drill core

- Re-sampled approximately 2,600 pulp samples from historic drill holes at Flathead Mine and Ole Hill (assays pending)

- Collected 337 soil samples and additional rock chip samples

- Confirmed and updated geological mapping across the district

- A 3D induced polarization (IP) survey along with a ground gravity survey was conducted over the entire project

- Completed a Phase 1 Environmental Site Assessment (ESA)

Ivanhoe Electric is working to re-classify the historic mineral resources to NI 43-101 compliant standards.

Additionally, geophysical surveys have been completed to assist with identifying additional zones of high-grade mineralization, as well as porphyry-style mineralization, throughout the district.

January 21, 2022 Brixton provided highlights of the results of its 2021 exploration activities and outlined its 2022 exploration plans to advance the district-scale Thorn Copper-Gold-Silver-Molybdenum Project.

The Thorn Project is located 90km ENE from Juneau, Alaska and is situated within the traditional territory of the Tahltan and Taku River Tlingit First Nations.

Corporate Highlights from 2021

- Brixton raised $12.2M including strategic investor Crescat Capital and is now fully funded for its 2022 exploration at the Thorn Project

- Ivanhoe Electric Inc. consolidates shares-warrants held by Robert Friedland and the HPX USD$44.5M/11-year Earn-in Agreement on Brixton’s Hog Heaven Copper-Gold-Silver Project

- Expanded the technical team by the addition of Colin McGillivray, Senior Modeler and Susan Flasha, Corporate Development

Thorn Project Highlights from 2021

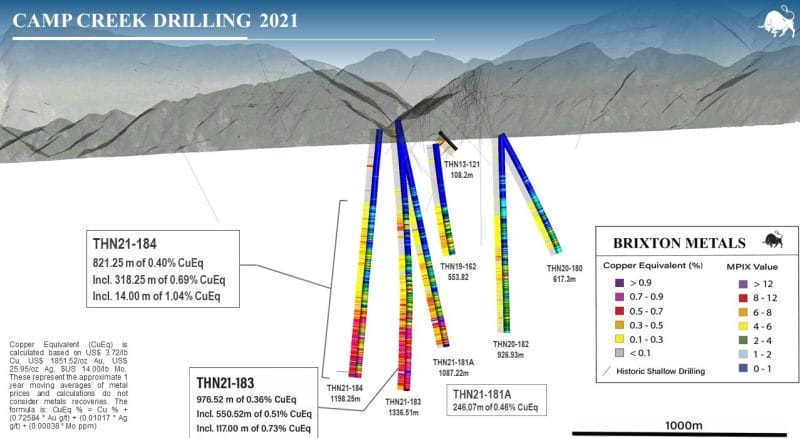

- Confirmed a new discovery of a Cu-Au-Ag-Mo porphyry at the Camp Creek Target: THN21-184 yielded 821.25m of 0.40% CuEq including 318m of 0.69% CuEq including 14m of 1.04% CuEq. The target remains open at depth

- Completed 5770.12m of drilling, consisting of 2662.78m at Camp Creek and 3107.34m at Trapper

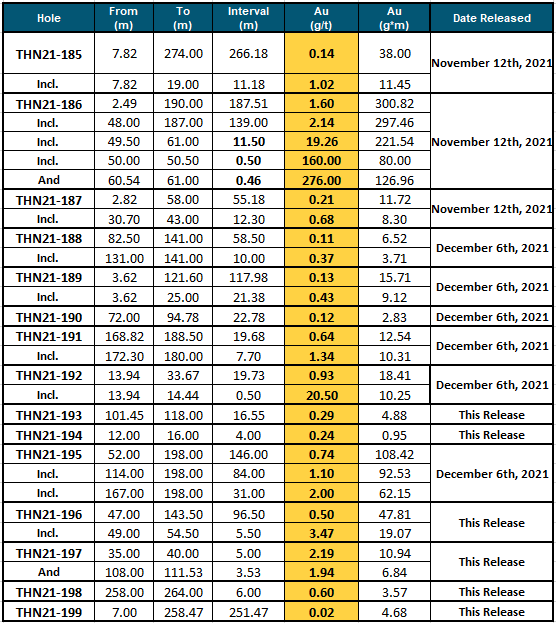

- Demonstrated gold endowment of the Trapper Target with drill hole THN21-186 yielding 139.00m of 2.14 g/t Au including 11.5m of 19.26 g/t Au including two highest grade intercepts to date of 0.46m of 276.0 g/t Au and 0.50m of 160 g/t Au. The target remains open along strike and at depth

- Collected and analyzed 417 rock samples and 607 soil samples which identified several new areas of interest for copper and gold mineralization and extended the gold geochemical footprint of the Trapper anomaly to 4km in length

- Completed 1072-line kilometers of Magnetic and Mobile MT geophysical surveys, structural mapping, geochronology and geochemistry supporting an emerging Triassic-Eocene porphyry Cu-Au-Ag-Mo belt with multiple porphyry centers

- Expanded and upgraded the Thorn camp capacity to host more than 50 people

Planned 2022 Thorn Program

- Drill up to 20,000 meters with a primary focus on the Camp Creek Cu-Au-Ag-Mo Porphyry Target and the Trapper Gold Target

- Secondary targets include drilling at the Outlaw Gold-Silver Target and potentially drilling at the Metla Copper-Gold Porphyry Target

- Conduct geophysical surveys over the Metla and Trapper Target areas

- Collect 3000 to 5000 soil-rock samples and geochemical modeling on new targets

- Collaboration with MDRU to improve our porphyry fertility understanding and porphyry vectoring techniques

“We are very excited about the new discoveries that were made at the Thorn Project in 2021,” stated Thompson, “This season is shaping up to be transformative for Brixton as we continue to demonstrate the potential of this emerging copper-gold porphyry belt within the 2600 square kilometer, wholly owned Thorn Project. We plan to be drilling multiple large-scale targets with a minimum of 2 drills turning all season.”

Camp Creek Copper Porphyry Target

Brixton Metals made significant progress in 2021 on the blind Camp Creek Copper Porphyry Target. A total of 2662.78m of core was drilled with THN21-183 being the deepest hole on the property.

The aim of the 2022 drilling at Camp Creek will be to test for the high-grade core of this copper dominant porphyry system with 4 to 6 deep holes with the aid of drill-wedges.

The Trapper Gold Target

The Trapper Gold Target was a major focus of the 2021 season.

Brixton drilled 15 holes for a total of 3107.34m. Standout holes include THN21-186 that reported 139.00m of 2.14 g/t Au including 11.5m of 19.25 g/t Au and THN21-195 with 84.00m of 1.1 g/t Au.

Trapper Gold Target Select Assay Intervals from 2021.

Outlaw Gold Target

The Central Outlaw Zone has seen most of the drilling to date providing a continuous strike of 600m with drill results up to 59m of 1.1 g/ Au. The highest surface rock grab sample was from the East Outlaw area returning 22.98 g/t Au.

The January 21, 2022 press release also provided exploration updates on Metla Copper-Gold Porphyry Target, Plum Copper Target, East Copper Porphyry Target, West Copper Porphyry Target and South Gold-Copper Target

In this March 22, 2022 video edition of the “The Gauntlet”, Equity Boss Chis Parry talks to the Brixton CEO, Gary R. Thompson about BBB’s business objectives.

“2015 was the bottom of the mining market,” recalled Thompson, “It was a long, deep downturn. What’s in front of us looks pretty good. You’ve got the decarbonisation and electrification of civilization, all those things are going to need metals, and a lot of them.”

“In 2020 more than $500 million was spent in exploration in BC, according to B.C.’s Association for Mineral Exploration (AME),” reports CBC, “In 2021, exploration expenditures grew to nearly $700 million.”

“We don’t have the metals we’re going to need in the next 100 years,” Thompson told Parry, “So we can’t drill these holes and build these mines fast enough. I think this is a good time for that rotation, out of big tech companies into raw material resource companies”.

Full Disclosure: Brixton Metals in an Equity Guru marketing client

Leave a Reply