As May, 2022 rolls on, gold is looking like a pandemic-weary survivor.

The variants that were predicted to kill it (spiking interest rates) – failed to do so; the vaccines that were predicted to give benefit (high inflation) – provided little relief.

Gold is currently stumbling around in a face mask, humbled, immuno-compromised, lonely and disoriented – but experiencing rogue surges of energy and finding reasons to believe in a bright new future.

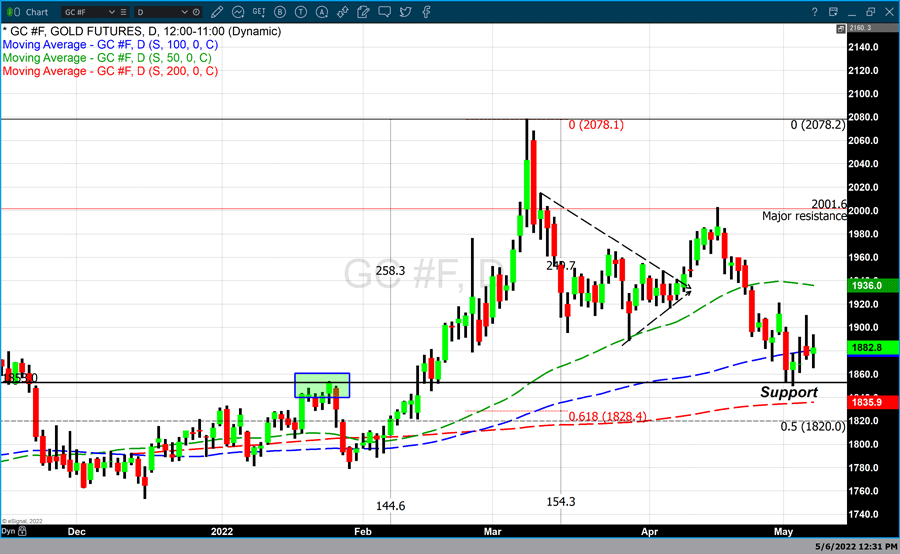

“This week the Federal Reserve addressed revisions to its monetary policy in its attempt to reduce the current levels of inflation to an acceptable target,” states Kitco News on May 7, 2022.

“The S&P 500, which gained almost 3% on Wednesday, declined by 3.56% on Thursday,” continued Kitco, “However it was gold that seemed to have price stability resulting in three consecutive days of higher pricing.”

“As of 6 PM EDT Friday, gold futures basis, the most active June 2021 contract is currently up to $7.10 or 0.38% and fixed at $1882.80.”

Image: courtesy of Kitco Gold

Falcon Gold (FG.V) and Kermode Resources (KLM.V) are two gold micro-caps with significant upside leverage to bullion prices.

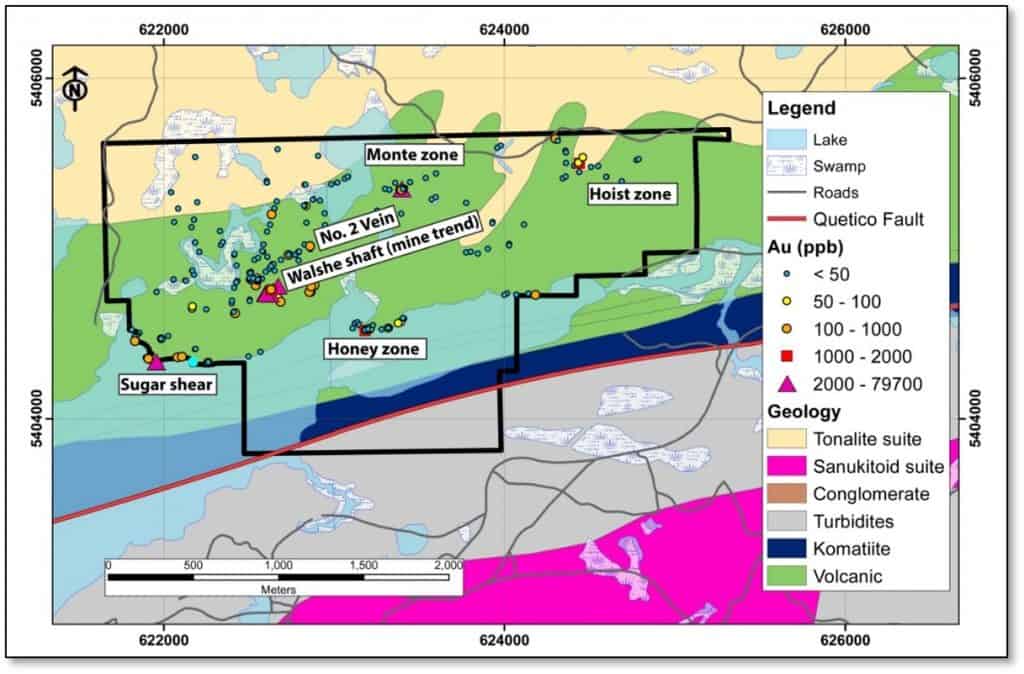

Falcon Gold’s flagship asset is its Central Canada Gold Project (CCGP), located 160 kilometers west of Thunder Bay Ontario (in proximity to Aginco Eagle’s Hammond Reef deposit).

Falcon’s Other Mineral Assets:

- The Esperanza Gold/Silver/Copper mineral concessions located in La Rioja Province, Argentina.

- Viernes Property, Antofagasta, Chile

- The Springpole West Property in the world-renowned Red Lake mining camp

- a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario

- The Spitfire-Sunny Boy, Gaspard Gold claims in BC

- The Great Burnt, Hope Brook, and Baie Verte acquisitions adjacent to First Mining, Matador Benton-Sokoman’s JV

- Marvel Discovery, Valentine Lake in Central Newfoundland

Central Canada Gold Mine History:

- 1901 to 1907 – Shaft constructed to a depth of 12m and 27 oz of gold from 18 tons using a stamp mill.

- 1930 to 1934 – Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December, 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

- 1935 – With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840m in which a 3.8 ft intersection showed 30.0 g/t Au.

- 2010 to 2012 – TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

On April 6, 2022 FG reported its upcoming Phase III drill program will be increased from 1,000 meters to 2,000 meters at the historic Central Canada Mine Project.

To date, Falcon has completed 17 diamond drill holes totaling 2942.5 meters since 2020. A portion of the Phase III drilling will include 3 holes totaling approximately 1,000m targeting the J.J Walshe Zone (Central Canada Mine Trend) at vertical depths between 200 and 300m. This will potentially extend the gold bearing zones beyond the current drilled depth of 160m.

“Our drilling campaigns have now intersected gold mineralization at the Central Canada Mine Trend (CCMT) to 200m vertically,” stated Karim Rayani, Falcon’s CEO, “We look forward to extending this trend at depth below any historical drilling by previous operators.”

On April 26, 2022, Equity Guru’s Jody Vance sat down with Karim Rayani, CEO & director of Falcon Gold, to get a closer look at the value proposition for FG’s portfolio of mineral assets.

“We’re doing a spin out of two of our holdings in Latin America,” explained Rayani, “We’re doing this because Falcon has a lot of projects, and we want to keep our focus on Canada.”

In the new company called Landmark Resources, the shareholders will receive a share dividend. The share structure is still being determined, but it is likely on a 5-1 basis.

“For every five shares of Falcon, you’ll likely get one share in the new company,” explained Rayani, “We’re quite excited about this. The project in Chile tied to BHP Rio Tinto, and the Argentina high grade gold epithermal system. We believe bundling the assets in the Latin America, and keeping the Canadian assets separate is the way to go.”

Kermode Resources (KLM.V) is a junior mining company hunting for exploration opportunities around the world

On April 10, 2022 Equity Guru’s Jody Vance spoke with Peter Bell, the President and CEO of Kermode Resources (KLM.V) about the company’s business objectives.

“One of the things I say about this business is not buy and hold,” explained Bell, “It’s buy and keep buying. I have put that into practice myself with the shell that became Kermode.”

“When I joined the company, I didn’t own any shares. And I didn’t buy any shares until the first financing. I typically don’t like to buy shares in the market because that’s going into somebody’s pocket. I want to put the money into the company’s treasury.

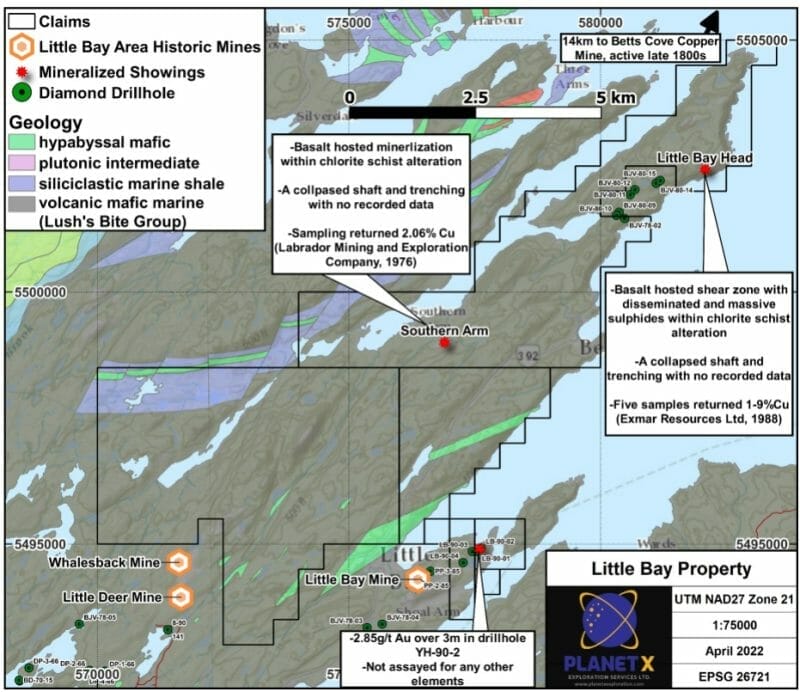

Kermode announced on April 26, 2022, that it has received approval from the TSXV exchange for the Mineral Property Purchase Agreement to acquire the Little Bay copper project from Grassroots Prospecting Group in Newfoundland,” reported EG’s Kieran Robertson on April 29, 2022.

All shares issued are subject to resale restrictions under applicable securities registration and the rules of the TSXV. No finder’s fees were paid in connection with this transaction.

“This is an aggressive deal with bullish partners. When I first joined the Board of Directors of Kermode in January 2020, I attempted to do a deal with the prospectors behind this Little Bay Copper deal but it didn’t happen,” stated Bell.

“I am grateful that I can now do my first deal as CEO of Kermode with this crew. Our plans include an immediate campaign of prospecting with marketing videos showing selective sampling as we hunt for high-grade copper at the known mineral occurrences on the project.”

Although the Fed is raising interest rates, with inflation running hot at 7.9% real rates are negative (investors buying bonds are guaranteed to lose purchasing power) – a positive environment for gold.

With $30 trillion of U.S. government debt, a single percentage point rise in interest rates adds $305 billion in debt servicing costs.

“As the Treasury debt rolls over—especially T-bills and 2-year notes—the average carry cost of the public debt will rise sharply,” projects the Brownstone Institute.

“By FY 2024 that rise could easily be 200 basis points, meaning a weighted average debt service cost of 3.75% on $26 trillion of projected publicly-held debt. In turn, that implies $975 billion of annual net interest expense or more than double the current fiscal year estimate”. That’s $200 billion more than the U.S. currently spends on Medicare. A big ticket item that will trigger more money printing.

If fiat currency is debased and investors flee to gold, aggressive little explorers like Falcon Gold (FG.V) and Kermode Resources (KLM.V) will benefit from this mass migration of wealth.

Full Disclosure: Falcon Gold and Kermode Resources are Equity Guru marketing clients.

Leave a Reply