The nation of Japan has been making headlines recently. Unfortunately not for the best of reasons.

The world is still reeling from the assassination of former Prime Minister Shinzo Abe, just two days before the Japanese general election. In elections held on Sunday, the Liberal Democratic Party (the party Abe once led) and its ruling coalition partner extended their majority in the upper house of parliament.

Two of major ‘world changing’ events could come from Japan in the next few months. With the LDP victory on Sunday, the political forces supportive of revising Japan’s pacifist constitution – a long-held ambition of Abe – retain a two-third majority in the 248-member upper chamber. Prime Minister Fumio Kishida, an Abe protege, said late on Sunday that he would push ahead with plans to amend the constitution, which was imposed on Japan by the United States after World War II. China is the main fear, but this move would really shake up geopolitics in that part of the world.

Then there is the other reason Japan has been talked about. Funnily enough, it ties in with why you would want to hold gold. Equity Guru readers have been informed of this way back in April. The Bank of Japan is the most important central bank to watch. I don’t care what you invest in, be it stocks, bonds, real estate, commodities, or cryptocurrency. You must be paying attention to the Bank of Japan. This central bank is by itself, holding up this financial system. If it wasn’t for the Bank of Japan keeping interest rates low while the rest (well, most) of the world raises interest rates, global stock markets and other assets would be through the floor. Check out my articles detailing the reasons here and here. Or check out this video version:

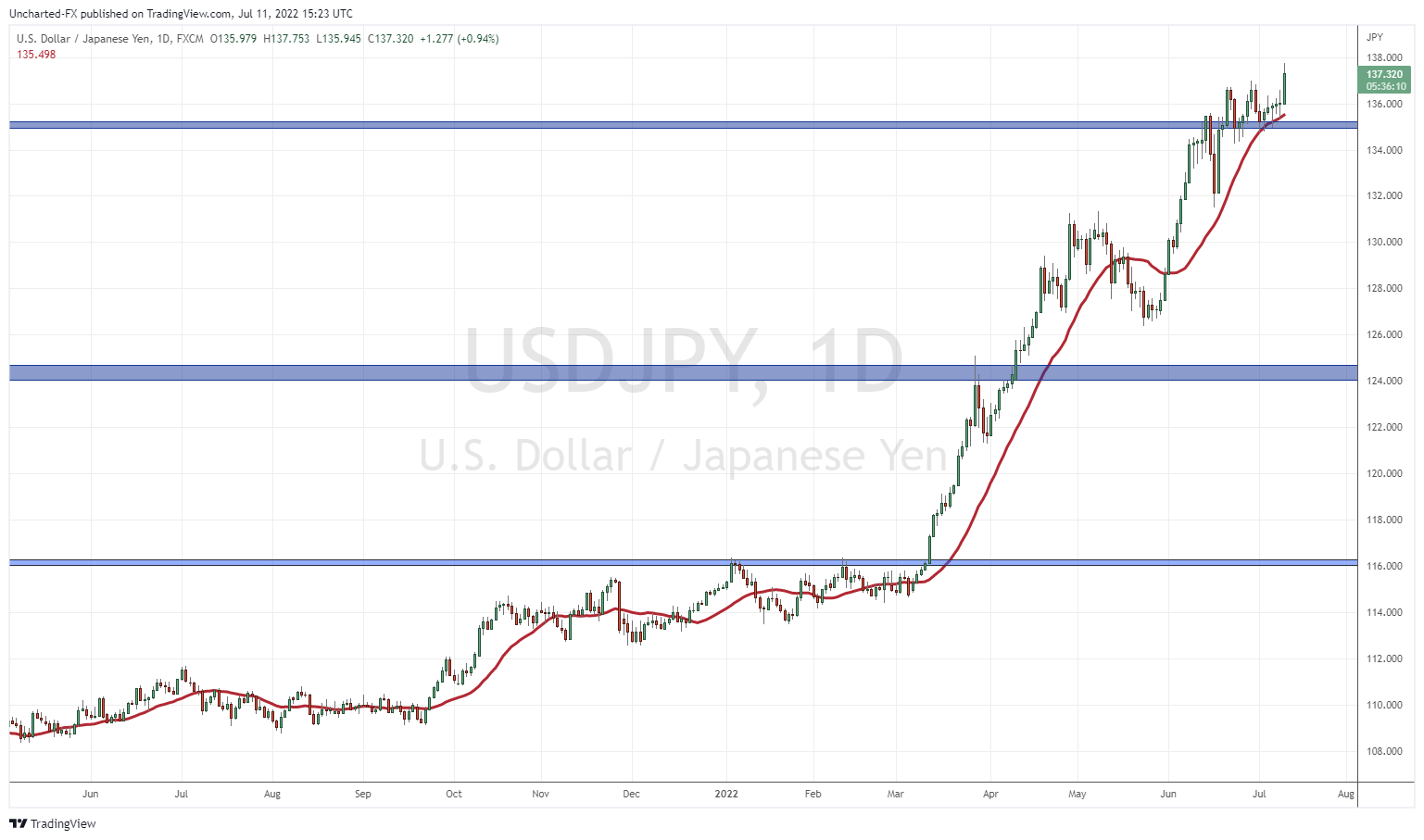

What am I referring to? The decline of the Japanese Yen which is the weakest it has been since 1998!

It could be getting worse as the USDJPY is breaking out as I type this article. The reason? Interest rate differentials. Money tends to flow to higher yielding currencies for yield. With Japan having low interest rates, and the rest of the world raising rates, the Yen is getting smashed not only against the US Dollar but against the Euro, the British Pound, the Canadian Loonie, the Australian Dollar, and the New Zealand Dollar just to name a few.

With the Yen weakening, here’s how Gold/JPY has been performing. As the Yen made lows not seen for decades, gold vs the Yen appreciated and began printing all time record highs! A record high of 254,259 Yen was printed on April 19th 2022. I would not be surprised if we take that out and print new all time record highs by the end of this year.

I am someone who is fascinated with Japan. I love the culture, the history, the language… and yes, the anime and kaiju’s. In all the time I have been fascinated with this country, never once have I heard the term ‘gold mining’ and ‘japan’ used until recently. Natural resources and Japan don’t really go together. However, you would be surprised that Japan has a rich mining history for a country that is known for its lack of resources.

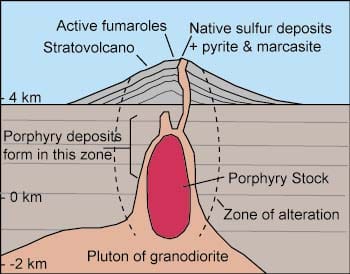

Some of you versed in geology might know that gold ore is formed in the rocks of active volcanoes as water thick with gold is heated by magma and forms deposits in volcanoes. Here’s an explanation from Oregon State University:

Gold and copper are found in ore bodies associated with porphry. Porphry is a general term applied to igneous rocks of any composition that contain conspicuous phenocrysts (crystals) in a fine-grained groundmass.

This type of deposit forms beneath stratovolcanoes and is associated with subduction zones. Erosion strips off overlying rocks to expose the mineralization. Gold and copper are found in sulfide minerals disseminated throughout the large volumes of intrusive rock (strictly speaking, this ore is associated with volcanic systems, usually not the volcanoes themselves).

For geology buffs, I am not even talking about epithermal gold deposits, but Japan has that too!

Epithermal gold and silver deposits are formed by volcanic activity accompanying plate subduction. In Japan there are many volcanic and hydrothermally active areas caused by plate subduction. Most epithermal gold deposits were formed by hot springs precipitating gold and ores are being formed in this way in Japan today.

Mount Fuji is perhaps the most famous volcano in Japan, but this is a country with a lot of volcanoes. Here is a map showing a list of Japan’s most prominent volcanoes:

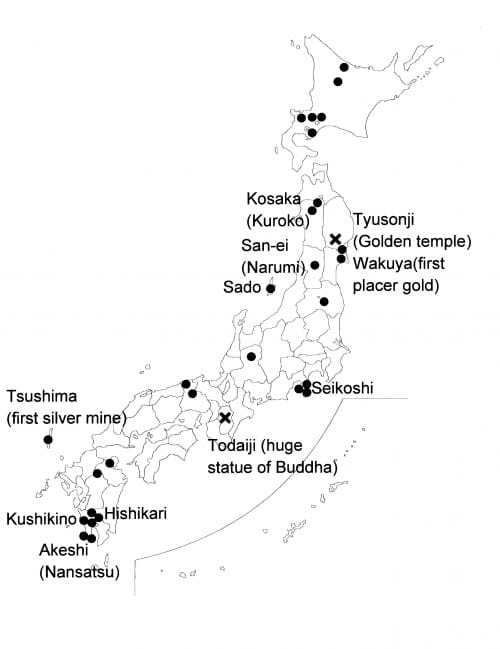

And here is a map showing Japan’s gold deposits:

I’m not here to make you a geology expert. The message I am trying to convey is that Japan has gold. And potentially a source of untapped and unexploited gold.

When it comes to mining in Japan, there are two gold mines with a LONG history of mining. The Toi gold mine was operational from 1370-1965, and the Sado gold mine was operational between 1601-1989. Sado has been making headlines this year as Japan considers a bid for it to go on the World Heritage list. The headlines come from South Korea blasting the bid due to the mine being associated with forced Korean labour from 1910-1945.

There is currently only one gold mine in Japan in operation today. That is the Hishikari mine which has been producing gold since 1985. The mine is located in Northern Kagoshima prefecture (the southern part of Japan), and Hishikari is now one of the best gold mines in the world. The average grade is 20 grams of gold to one ton of ore. A profit can be made at 2 grams per ton, so the gold at Hishikari was certainly a major find. Pretty solid considering the average grade of major gold mines in the world is 3-5 grams. In the country’s long history of mining, there has never been a more productive gold mine, and never a mine yielding better quality gold.

For more info, I suggest visiting this page from the mine operators, Sumitomo metal mining. A very simple step-by-step explanation (with a lot of pictures!) on how gold is mined and refined from Hishikari.

The main question though is how much gold is left? The mine has been producing 7 to 10 tons of gold per year since 1985. If Japan is to keep its rich tradition of gold mining alive and well, it will need another major find. This is the opportunity, and where the 3 juniors listed below, step in.

Analyst Jayant Bhandari has said that Japan has a huge potential for mineral exploration. an expensive Japanese Yen at a time when gold prices were low deterred gold exploration. Not to mention that the Japanese government also didn’t make it easy.

“Remember, Japan was almost closed for mining for most of the last century. The reason was that the Japanese government did not necessarily give exploration licenses, but also the Japanese currency was extremely expensive,”

“Property prices were exploding in Japan, and … some of the people might recall that in the 1980s, just the grounds of the Imperial Palace in Tokyo were worth more than the real estate price of the whole of California. So it was very, very difficult to do any exploration work in Japan, but the yen has fallen and they have opened up the regime for exploration in Japan,”

But is that now all changing? And even more attractive given the weakness of the Japanese Yen and the fact the Japanese government may want to find another large reserve.

CEO of Japan Gold John Proust definitely thinks so. And he provides a very strong case:

“These days, it is increasingly rare to find projects available in politically safe jurisdictions with a history of gold mining that have received little to no modern exploration. Japan’s 76-plus past-producing gold mines, many of which were simply stopped in ore, have been in a sort of time capsule for over 30 years,”

Safe jurisdiction. Untapped gold potential. Little to no exploration. These are the reasons why Japan should be included in conversations about gold. Major gold producers are paying attention to this island nation. One similarity with all these companies listed below is that they have backing from major gold companies.

Japan Gold (JG.V)

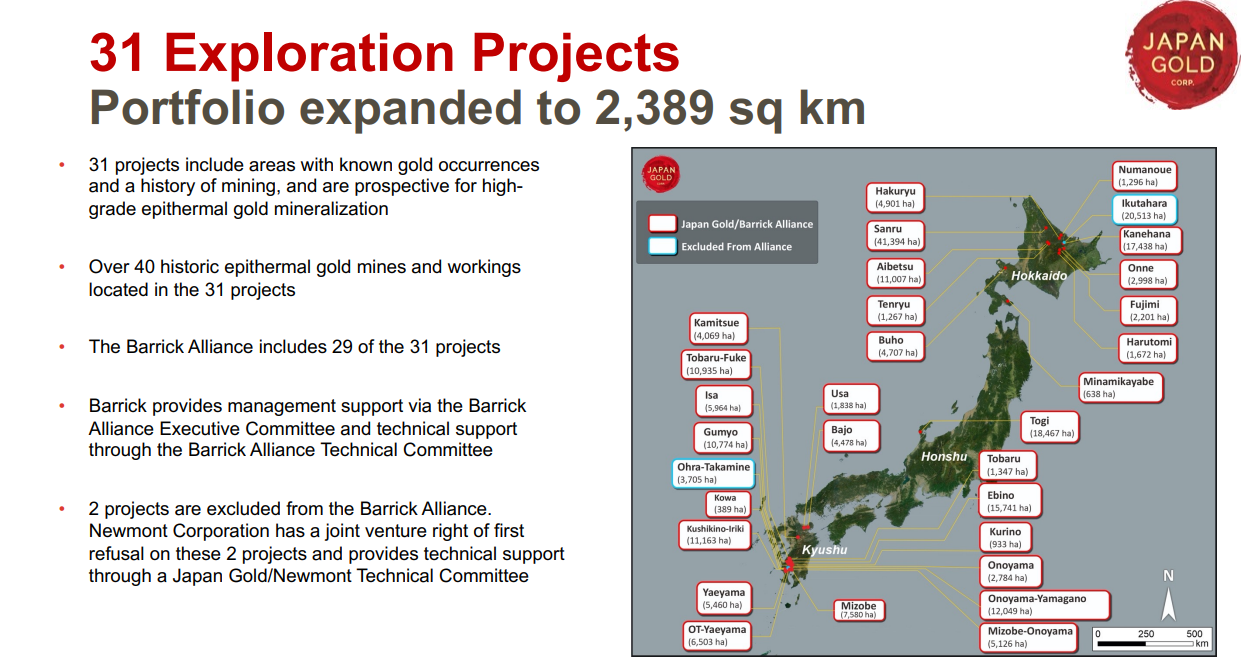

Japan Gold is one for the history books. The Canadian based company was the first foreign explorer to apply for and be granted prospecting rights as well as drilling permits under the 2012 amendments to the mining act. Historic, and a game changer. Proving it is possible for a foreign junior resource company to successfully work through the Japanese regulatory and permitting system. The first mover advantage.

Japan Gold holds a portfolio of 31 Gold Projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. To be exact, Japan Gold’s exploration licenses and applications cover at least 42 historically producing mines and workings.

Japan Gold’s two independent projects are located in Hokkaido and Kyushu. These are the Ikutahara and Ohra-Takamine projects, which are the most advanced projects in the Japan Gold portfolio.

We have major catalysts this year with Japan Gold being fully funded for 2022:

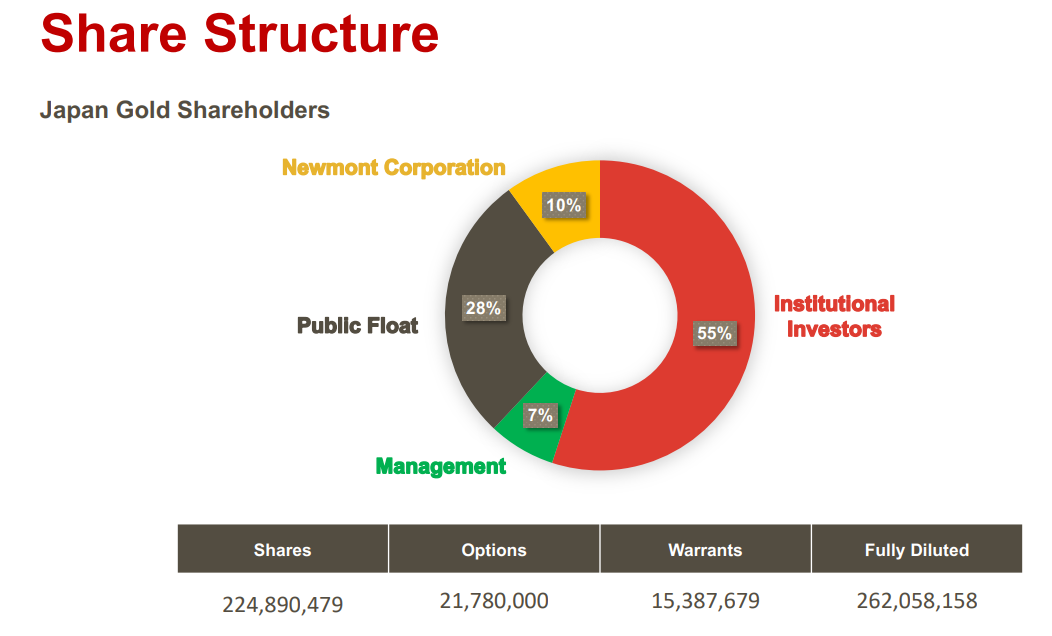

Remember I said that major mining companies are paying attention to Japan? When we speak about Japan Gold, we need to mention Barrick Gold ($30 Billion market cap major) and Newmont ($46 Billion market cap major). These are big players, and I am sure those who follow mining know about these companies.

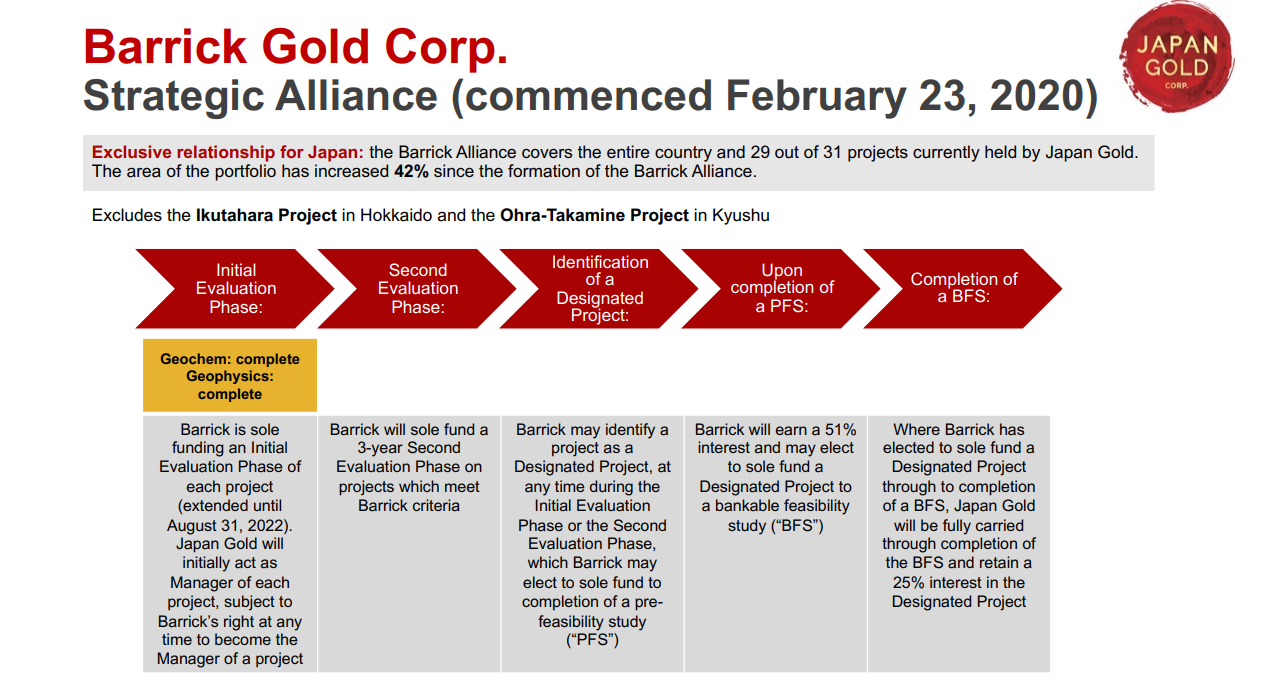

In 2020, Japan Gold formed a country-wide alliance with Barrick Gold (NYSE:GOLD, TSX:ABX) to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan. As part of the agreement Barrick agreed to sole fund a 2-year Initial Evaluation Phase of each project and sole fund a subsequent 3-year Second Evaluation Phase on projects which meet Barrick criteria. Barrick has spent US$5.6 million on the Initial Evaluation Phase from the formation of the Barrick Alliance to the end of 2021.

With travel restrictions still making it difficult to travel to and from Japan, Barrick has requested an extension of the two year Initial Evaluation Phase by 6 months to August 31, 2022.

The work so far has been promising. Work programs with Barrick have identified over 40 gold anomalies of high interest and this has driven the expansion of project areas. The final decisions have not yet been reached on all 29 project areas due to the 42% increase in the Alliance portfolio over the past 2 years. This significant expansion has resulted in pending sample assay-data for some areas, and a lack of sample coverage in more newly acquired areas, all of which are required for a proper evaluation.

Here is the road map of the next steps if Barrick continues with the Second Evaluation Phase:

The two projects that are excluded from this alliance are the ones I listed above, Ikutahara and Ohra-Takamine. When it comes to these projects, Newmont has been involved in providing significant technical support and has a joint venture right of first refusal on these two projects.

When it comes to the stock chart, Japan Gold has been doing what many junior miners have been doing. Selling off. With this sell off comes the opportunity to pick up cheap juniors. Remember, there is always risk with juniors. However, we look at things such as jurisdiction, management etc to assess whether the risk will pay off. With Barrick and Newmont, two major gold miners, involved with Japan Gold, I think the risk is really worth considering. Obviously the geology team of those major mining companies see something of interest. It is worth noting that Newmont themselves own 10% of the shares.

The major upcoming catalyst will be Barrick and their choice on projects for the second evaluation phase. This means more money and drilling which translates to more catalysts for shareholders. With Japan Gold approaching a major support zone at $0.20, I will be watching to see if buyers jump in here. This is a major support which has been held since 2019. I expect buyers to put up a fight defending it. If we break below, the next support level comes in around $0.15.

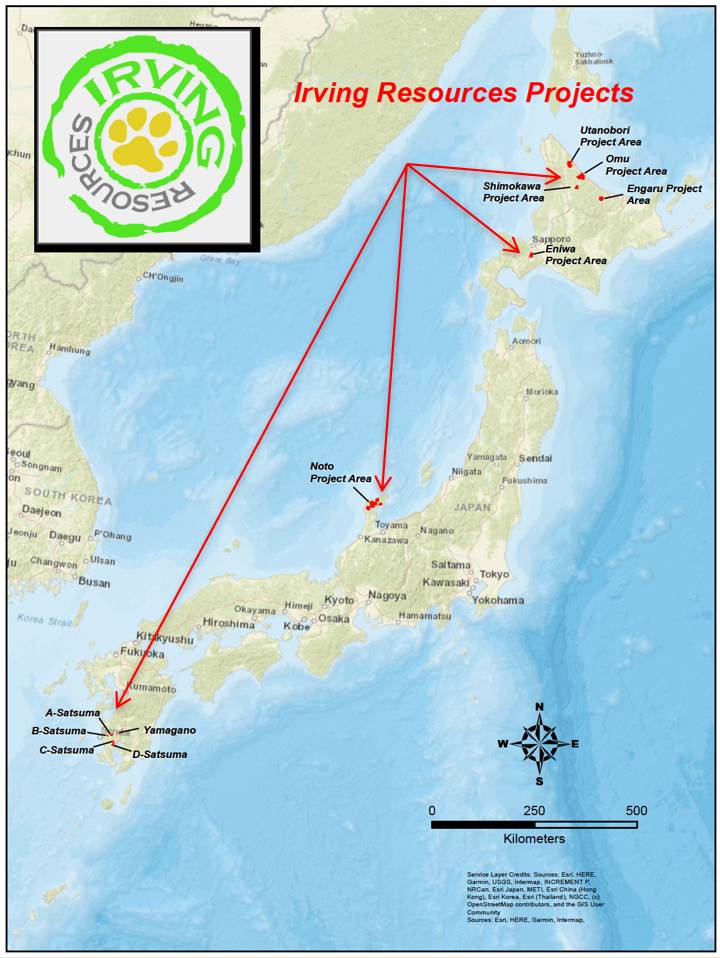

Irving Resources (IRV.CN)

Irving Resources is another Canadian junior miner with a focus on Japan. Since 2016, Irving has been acquiring gold projects in Japan. The company has a unique strategy: to explore for and mine high-silica, high-grade epithermal gold and silver veins. Such ore has the potential to be suitable for use as smelter flux in the many operating base metal smelters throughout Japan. What does this all boil down to in simple terms? Irving’s strategy could translate to simple, low cost mines. Other positives include:

- Deposits with low sulfur and deleterious elements including As, Sb and Hg, thus making them environmentally friendly and suitable as smelter flux.

- Deposits that will have a small surface footprint when mined.

- Ideally near shipping facilities enabling easy transport to Japanese smelters.

- Low impact on communities, cultural heritage and environmentally sensitive

areas.

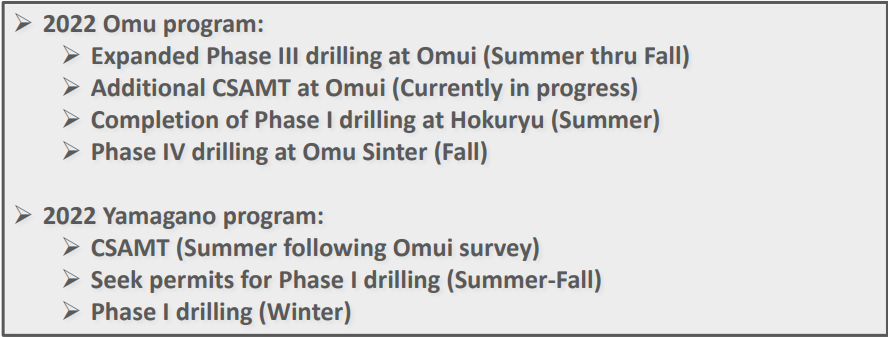

In 2022, Irving Resources is focusing on the Omu project in Hokkaido (three project areas are Omui, Hokuryu and Omu Sinter) and the Yamagano projects which is approximately 11km southwest of the Hishikari gold mine. Yamagano is the nearest past producer neighbor to the Hishikari mine.

Recent news details results of drilling at the Omui mine site. High-grade veins were encountered:

- 7.39 gpt Au and 10.07 gpt Ag (7.52 gpt Au eq) over 8.58m within 4.44 gpt Au and 14.97 gpt Ag (4.63 gpt Au eq) over 15.25m, and a second interval of 7.55 gpt Au and 155.00 gpt Ag (9.49 gpt Au eq) over 0.79m in hole 22OMI-001

- 9.60 gpt Au and 63.30 gpt Ag (10.39 gpt Au eq) over 0.71m, a second intercept of 13.75 gpt Au and 23.13 gpt Ag (14.04 gpt Au eq) over 1.07m, and a third intercept of 12.50 gpt Au and 8.34 gpt Ag (12.60 gpt Au eq) over 1.00m in hole 22OMI-002

Newmont has also shown interest in Irving’s projects. In 2019, Irving Resources announced a non-brokered private placement with strategic investor, Newmont Goldcorp Corporation. Newmont owns about 14% of the shares:

Irving Resources looks very appealing in the eyes of a technical analyst. I like the price action I am seeing. Right off the bat, we had a nice pop on July 8th 2022. Why a 13% plus pop you ask? This is the market reacting to the drill results which were released. Very positive price action and the story just gets more exciting. There will be quite the anticipation for future drill results there.

The stock recently bounced above a major support zone at $0.875. The buyers defended it and we had a nice catalyst to ensure further strength. My technical analysis eyes are lighting up because I see signs of a reversal pattern in development. We have met the criteria of bouncing at support and crossing over my moving average. The last thing I am looking for is a close above $1.18. This would ensure the current downtrend is now over and confirm a reversal pattern known around the trading world as the inverse head and shoulders pattern.

BeMetals (BMET.V)

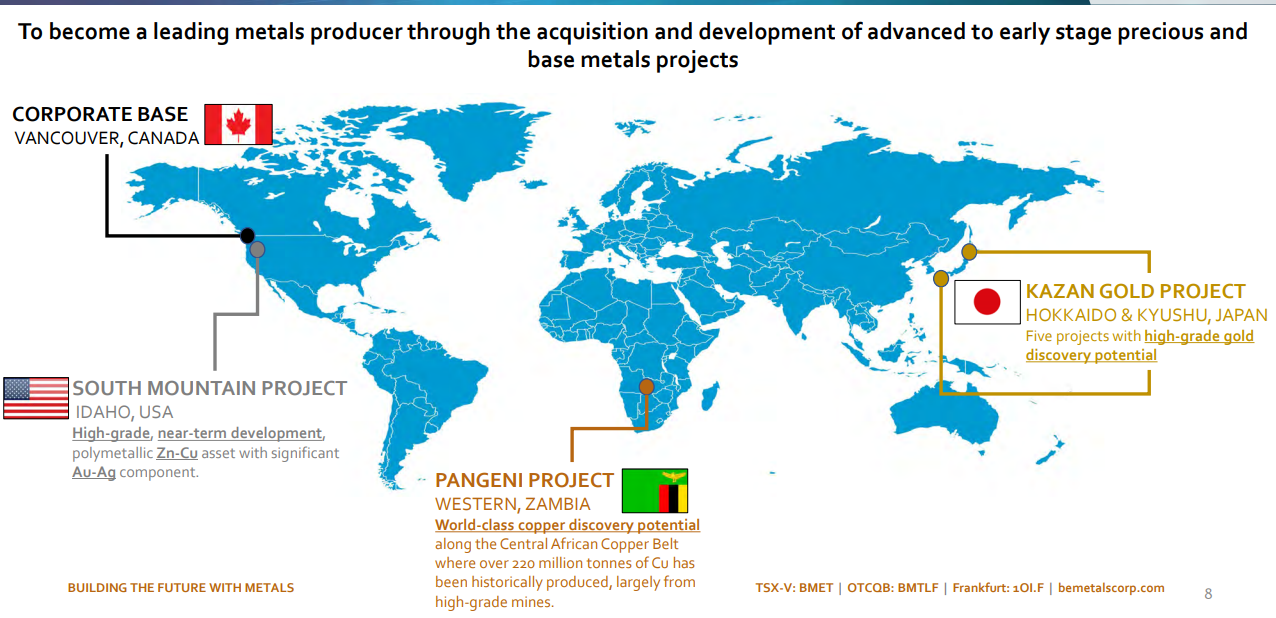

BeMetals is a little different than the first two companies. The strategy here is to generate significant value for shareholders by incrementally growing into a leading diversified metal producer through prudent acquisitions and development of quality exploration, development and production stage mineral projects. BeMetals deals with zinc, copper, gold and silver.

The company has assets in the US, Zambia, and the country we are interested in, Japan.

BeMetals is currently focused on advancing commencing exploration at its compelling new Kazan Gold Project in Japan and is continuing to advance both its high-grade South Mountain Zinc-Silver-Gold-Copper Project in Idaho and its Pangeni Copper Project on the Zambian Copperbelt.

The Kazan Gold Project is a package of 5 exploration licenses in prospective areas of Japan. The reasons why BeMetals is bullish on Japan are the reasons I included at the beginning of this article. Underexplored and untapped gold potential.

The Kato project is getting some major attention. There were some initial drilling phases which included these highlights:

Follow up drilling commenced in April 2022. The focus will be on targeting an area of historical Japanese state agency drilling that included drill hole 5MAHB-2 which intersected 17.5 metres (m) grading 8.15 grams per tonne (g/t) gold (Au) and hole 7MAHB-1 that intersected 18.65 m grading 5.01 g/t Au.

John Wilton, President and CEO of BeMetals stated, “We are very excited to have commenced our exploration drilling at the Kato Project in a relatively remote but easily accessible area of Hokkaido in Japan. The Company and its advisors regard the Kato Project as demonstrating many geological and gold mineralization features often associated with significant, high-grade, epithermal gold deposits in Japan. Our technical team has selected a number of high priority drilling targets at Kato for this initial phase of exploration. The primary objective for this phase will be to test target gold zones and their continuity based on historical intersections made by the Japanese state entity Metals Mining Agency of Japan (“MMAJ”) during the 1990s.

The drill results from this will be a major catalyst. Keep in mind, BeMetals has other projects outside of Japan that are also undergoing drilling, such as the Pangeni copper project in Zambia. The Japan results are what I will be watching given the previous drilling by the Japanese state agency.

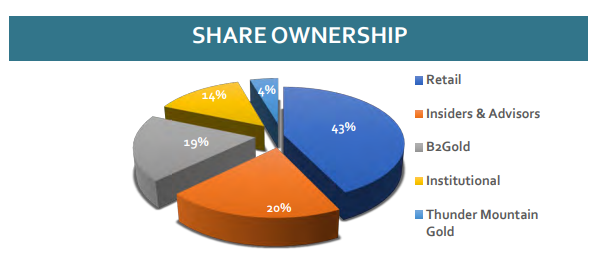

When it comes to major gold producer support, BeMetals has the support of B2Gold (BTO.TO and a market cap of $4.5 Billion). BMET through B2Gold and its advisors have intimate knowledge of the geology prospective for gold.

Through the acquisition of Kazan Resources, and a $7.5 million investment, B2Gold is now a 19% major shareholder in BeMetals. For BeMetals it validates management’s strategy while providing financial and technical support. For B2Gold, they gain exposure to exploration projects which may not initially meet their criteria, and allows them to unlock the potential value in Japan just as Newmont and Barrick are.

When it comes to the stock price, BeMetals is also sliding down with this broader market sell off. A major support zone is approaching at $0.125 and we shall see if buyers will be able to hold the line. Plenty of catalysts with drilling in Japan and Zambia. As a technical analyst, I would watch to see if these catalysts will be enough to see us break above the downtrend line I have drawn. Sometimes technicals and trends become as simple as following the slope of trendlines. A break above this would begin to show me signs of a potential bottoming and reversal.

So there you have it, three junior mining companies with a focus on Japan. With the country now opening up again post Covid, we should expect to see more investment money flowing to the resource exploration going on there. Likely a lot of tourist money as well. Count me in!

Leave a Reply