I was going to title this article “why millennials should pay attention to natural gas”. But it doesn’t matter what your age is. Moves in the natural gas markets will (and are already!) affecting you.

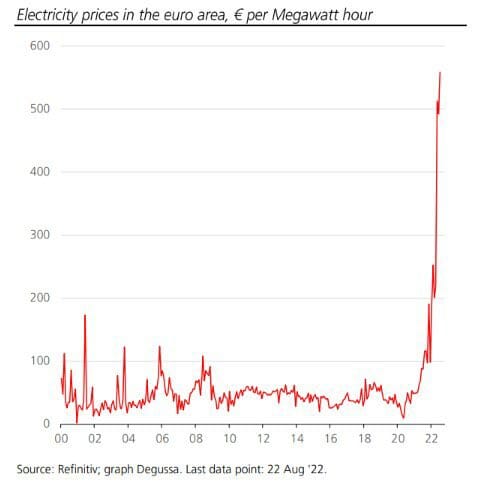

If you are a regular reader of Equity Guru then none of this comes as a surprise. Not only have we nailed the technical charts, but we warned that when the colder weather approaches, Europe is going to be in a lot of trouble. The Europeans are going to find out the hard way that they cannot wean off of Russian gas at the snap of a finger.

On the Russian side of things, natural gas behemoth and state owned Gazprom might be up to shenanigans. There was some drama over Nord Stream maintenance…which involved Siemens Germany having to get a turbine for the pipeline from Siemens Canada but was convoluted due to Canada not doing business with Russia. That was solved.

Now there is an unscheduled Nord Stream maintenance which will see gas to Europe being suspended between August 31st- September 2nd. European gas prices surged on this news. Many in Europe are saying that the Russians are using this as a geopolitical weapon against them as they attempt to exploit Europe’s dependence on Russian gas. I am just surprised that the boneheads in Europe didn’t figure this would happen months ago. Prudent politicians and strategists would have prepared for this before taking action, but I guess they did not anticipate Asian nations such as China and India coming in to make up for lost European demand. Now Europe will suffer. All is fair in war.

As the colder months approach, you will be hearing about problems in Europe. They are already starting, and rising energy prices and natural gas prices will keep inflation elevated in Europe. And the European Central Bank cannot do a darn thing about it.

You have probably already seen headlines of energy problems in Europe. Some parts of Germany are already rationing hot water and turning down heating in case Russia cuts off natural gas supplies. The European Union as a whole has struck a deal to ration natural gas for winter. But some countries like Poland do not want to play along.

It is going to be a tough Winter for Europe. I expect fuel and energy shortages. The UK are even planning organized blackouts to prepare for emergency power and gas cuts come January. The French are as well. I suspect Europe’s gas problems may occur way before January.

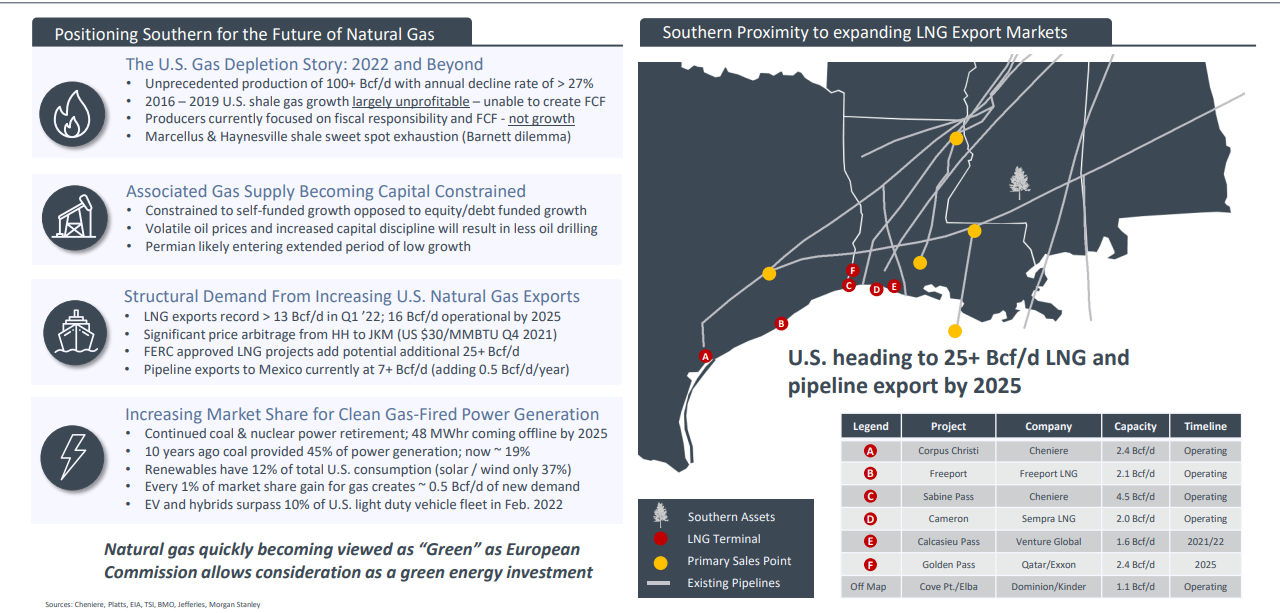

I know this may sound negative, but there is an opportunity. In order to wean off of Russian gas, Europe will look to North America and other parts of the world. In the future, Europe will import more liquified natural gas (LNG) from the US. The opportunity? Natural Gas companies in North America that can sell LNG to Europe, or plays that are near LNG terminals. Just last week, I spoke of one such company. Southern Energy (SOU.V) is a company that is in a prime position to benefit from this European demand as their primary sales points are near LNG terminals.

Okay I said this would be a positive but I need to address one negative. Russian gas in pipelines is cheap for Europe. LNG will not be cheap due to transportation costs. You need to freeze natural gas into a solid state, load it in a specialized ship, and send it across the sea to an LNG terminal in Europe. This means that Europe and European citizens will be paying more for their gas and heating. Not going to help bring down those inflation numbers which could be problematic for the central bank.

Geopolitics and supply chains? Check. Europe turning to North America? Check? Ah. The green movement.

As you can see from the above Southern Energy slide, natural gas is becoming viewed as a green investment. Many think that you can shift from fossil fuels to green energy just like that. Ain’t gonna happen. Instead, I and many others believe that natural gas and nuclear energy could be the intermediary between fossil fuels to green (solar and wind etc). Natural gas is the cleanest fossil fuel and is considered by many to be a key ingredient as the world transitions to a cleaner future. The key word is ‘fossil fuel’. Yes, natural gas is still a fossil fuel and some of the green purists are already ticked off that the EU and other nations consider natural gas green. Perhaps “transitional” would be the better term.

But whether these purists like it or not, the EU and other nations will need natural gas and nuclear power to keep on running when they deal with their energy crisis. The green purists should be happy since some European countries like Germany are already reverting back to opening coal power plants which emits much more CO2 than natural gas. Germany is going to coal as a way to save natural gas supplies to last through winter, taking a drastic U-turn from their climate goals.

When it comes to energy, oil is what a lot of people talk about. Oil makes the headlines. Oil prices look ready to turn around and head higher. The technicals hint at a breakout while on the fundamentals, the Saudi’s may decrease output.

But natural gas has been making headlines and I am sure more headlines are to come. Since the lows on July 1st 2022, natural gas has rallied 88% to its recent highs. Natural gas tends to be seasonal and performs well in the colder months, but I believe many investors and traders are already pricing in the disruptions, and quite frankly, the shortages Europe will have.

If natural gas prices breakout and head higher from here, we are poised to make highs not seen since 2005!

In summary, if you are a young investor or a veteran, it is time to pay attention to natural gas. In the short – medium term, the major catalyst is going to be Europe and its gas problems. As the world realigns geopolitically, the opportunity will be LNG from the US and other parts of the world. Finally, the transition to green clean energy will see natural gas play a part.

Leave a Reply