Why copper and why now? My readers know me as the commodity guy. My love for precious metals is not a secret. Just check out my gold vault on our Youtube shows. I can talk about gold and silver for hours. But let it be known from this day forward that I, Vishal Toora, am a copper bull.

I began my entry into copper investing doing it old school. Remember pennies? Those 1 cent coins that are now out of circulation. Recent pennies actually consisted of an alloy of 97.5% zinc and 2.5% copper. The price of copper moved up so much during the late 70’s that the US and other mints could not afford to use copper as the main base metal. Zinc was used as the major component post 1982. Any US pennies produced before 1982 were comprised of 95% copper and 5% zinc. Because copper prices have more than quadrupled over the past 10 years, the copper content in pennies is worth more than the 1 cent face value.

If you are Canadian, even better. Canadian pennies had a higher copper content of 98%, but they are lighter coins meaning it takes more Canadian pennies to equal 1 pound. Canadian pennies minted between 1982-1996 have high content of copper. No joke, but years ago I began searching through my change stash for these copper coins. We all have these stashes which we haven’t touched for years, even decades. Treasure stashes folks. I can proudly say I have quite a large container of high copper content pennies from Canada and the US. I mean this thing is heavy enough to be used as a weapon.

Nowadays you don’t need to do what I did. My way is more exciting, but you can now buy copper rounds just like you do with silver, gold, platinum and palladium:

Do I think this is the best way to invest in copper? Not really. In this article I will give a rundown on the copper fundamentals and why millennials should really consider copper as part of their portfolio. If you are a millennial and your only exposure and knowledge of copper is drinking Moscow Mules, read ahead!

For those who prefer video content, I got you covered. What I will talk about in this article is more or less covered in this video:

Let’s start with simple supply and demand. And for this, I will be using the powerpoint slides from Infinitum Copper.

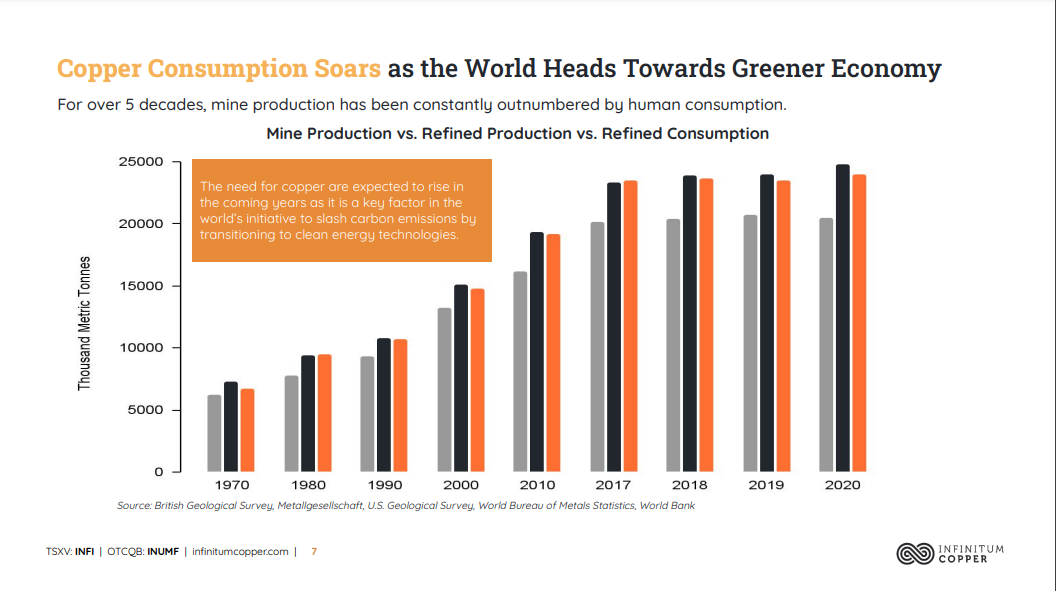

The demand for copper is growing and will continue to grow. If you believe the world will come together to tackle the climate crisis then copper is the metal for you. It is known as the green metal, but I will discuss this in more detail below.

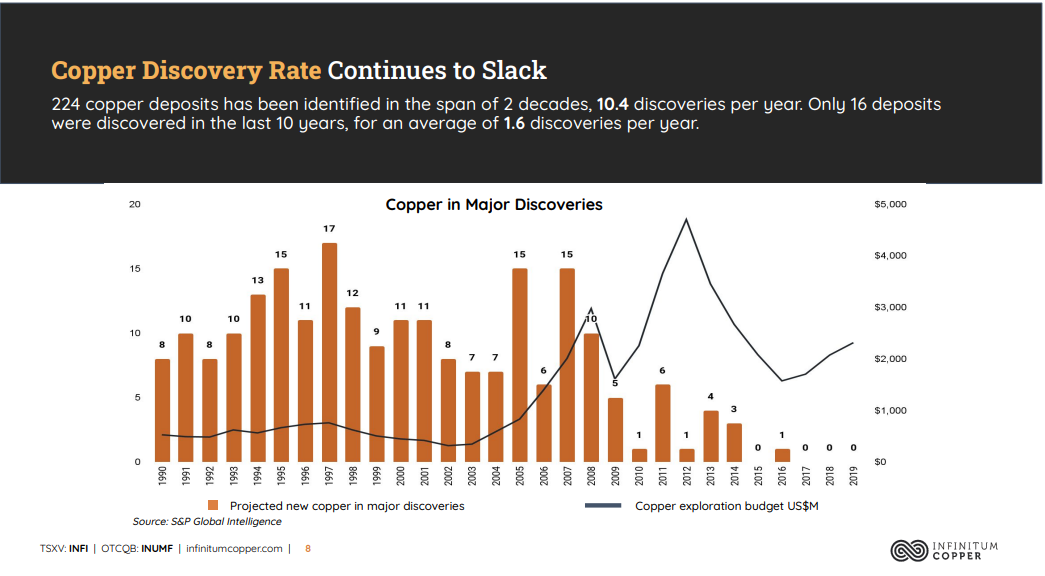

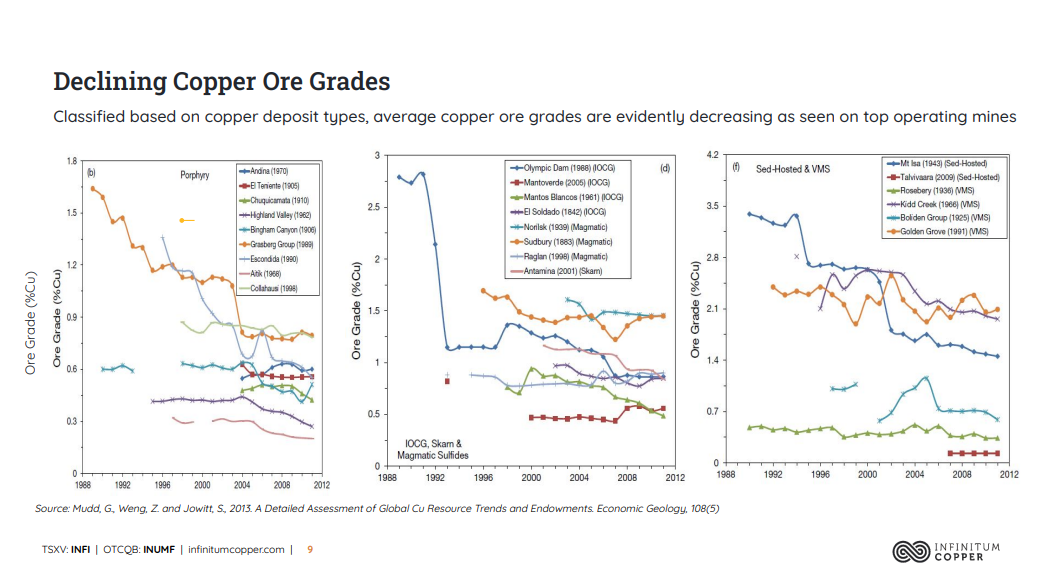

As demand increases, supply is shrinking. Not many new copper discoveries and mines are coming online. The largest copper mines that have been in production for decades, are now seeing declining copper ore grades. Essentially a lot of the good and economically feasible stuff has been mined. It now costs more to extract the lower grades.

In 2010 we saw the beginning of a commodity cycle which was due to China and their 6% growth rates. Major mining companies decided to expand real fast, by taking out more debt. When commodity prices fell, these major miners were left with lower revenues and a large amount of debt. Sound familiar? This is pretty much what also happened with the major oil companies. The thing is, these producers can’t just decide to halt or stop mining.

The consequence is that major mining companies have slacked on spending money for exploration and expanding their resource. This is where junior miners come in. They have stepped in to pick up assets close to producing mines. Their goal is to find and establish a resource, get the project de-risked and shovel ready in the hopes that a major producer will step in and buy them out because said majors are looking to expand their declining resources.

From a supply and demand point of view, things look really exciting for copper investors.

A quick note on geopolitics.

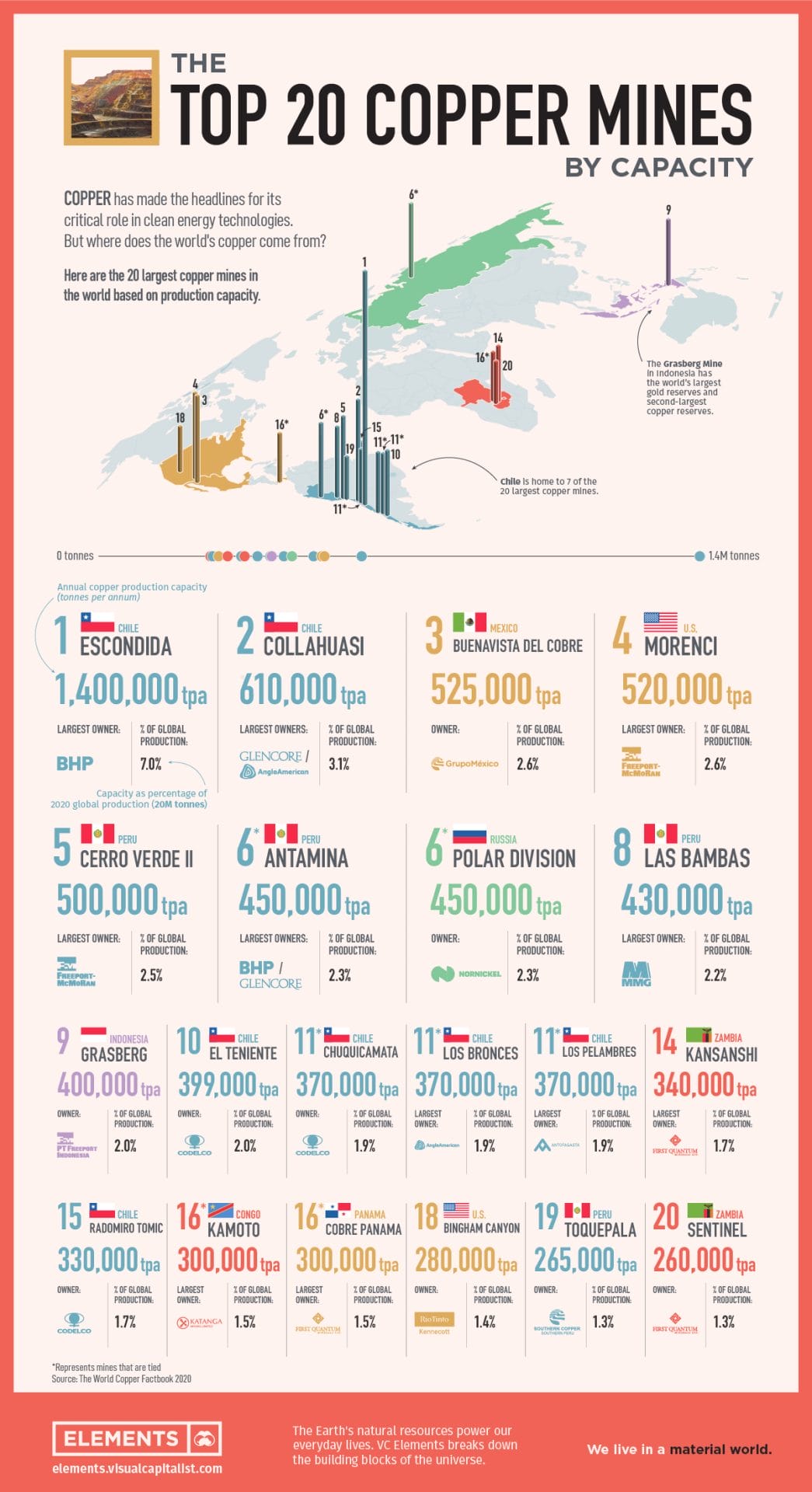

Chile is the largest copper producer in the world. In fact 7 of the 20 largest copper mines in the world are located in Chile.

The two mines that you will come across when you research copper are the Escondida mine in Chile and Grasberg in Indonesia. Escondida is operated by mining giant BHP, while Grasberg is operated by Freeport-McMoRan.

Both mines have made front page economic headlines in recent years.

Labor disputes saw miners threatening to walk off from the job, taking two large producers offline. The price of copper moved on these headlines. Labor disputes are over but you just never know when they will pop up again. If copper prices continue to rise, there is a higher chance labor disputes make headlines once again.

And then Grasberg. Indonesia has a bit of a bad rep when it comes to mining. Brie-X anyone? A Canadian mining company that went from pennies to hundreds of dollars because of a gold find in Indonesia. An epic decline to 0 when it came out that there was actually no gold, and assay results were being rigged. A lot of drama and even got a Hollywood adaptation. A movie titled “Gold” came out in 2016 and stars Matthew McConaughey and Bryce Dallas Howard. If you are interested in mining, I suggest you watch it. By the end of it you will be hooked to mining. I remember my flight to the largest mining conference in the world PDAC in Toronto. Everyone on the plane was watching this movie.

When it comes to mining, I prefer good jurisdictions. Marin Katusa refers to this as “non AK-47” countries. The danger is that governments may decide they want a bigger chunk of the profits from a mine operated in their country by a foreign company. Maybe even downright confiscation.

Alternatively, countries can change. Emerging market countries are quickly rising and will be the leader for growth in the future. Indonesia is one of them with a population of 273 million! If leaders want their countries to attract foreign investment and grow, then they will need to have a strong commitment to the law and free market principles.

Just something to keep in mind when looking at mining companies. If in doubt, invest in non AK-47 countries.

The Green Metal

I hinted at copper being the premier metal for combating climate change. The world is going green and green/clean infrastructure investment is set to increase. Copper is being touted as the green metal because you will require it for the green infrastructure. Solar panels, wind turbines, and even EV charging stations require copper. The concept of the “electrification of the economy” goes hand in hand with copper.

Gianna Kovacevic is the real life Dr. Copper. A very nice guy, and as you can tell, he is very bullish on copper. I had the opportunity to chat with him at a past Vancouver Resource Investment Conference years ago. I heard the term “electrification of the economy” for the first time from him. Mr. Kovacevic also says that in this new green world, copper will be the new oil.

He also has a great book titled, “My Electrician Drives a Porsche? Investing in the Rise of the New Spending Class“. Well worth the read if you want to understand how copper is going to be in high demand as we transition to new green infrastructure.

The electrification of the economy starts in your home. Instead of using natural gas to heat your home, a ductless mini-split heat pump would use electric resistance baseboards as their primary heating source. The heat from outside the home is transferred inside through a vapor-compression cycle commonly found in air conditioners and refrigerators. By moving heat, these systems can produce more heat energy than a home requires, as much as four times more. There are other examples such as geothermal heat pumps and electric water heaters.

The benefits of going electric are:

- It saves consumers money over the long term,

- Benefits the environment by reducing pollution

- Reduces greenhouse gas emissions, and

- Improves the overall efficiency of the grid.

The key takeaway is simple: As the most cost-effective conductive material, copper sits at the heart of capturing, storing and transporting these new sources of energy. Copper will be the new oil.

And it has already started. Nations are committing trillions for green infrastructure. President Biden unveiled his $2 trillion infrastructure bill last year. Some say it is dead, but I have another take.

It looks like a recession is coming either this year or 2023. What do governments tend to do to combat a recession? Spend money. Infrastructure spending is usually at the top of the list. They do so to try and spur the economy and create jobs. I see a recession as the trigger to unveil and initiate a MASSIVE green/clean infrastructure bill that has the potential to carry on for years as the US electrifies the economy. Think of it as the modern Roosevelt’s New Deal. Add in the climate crisis, and I think we may get a spending bill both parties can get behind in a recession.

China Growth…or not

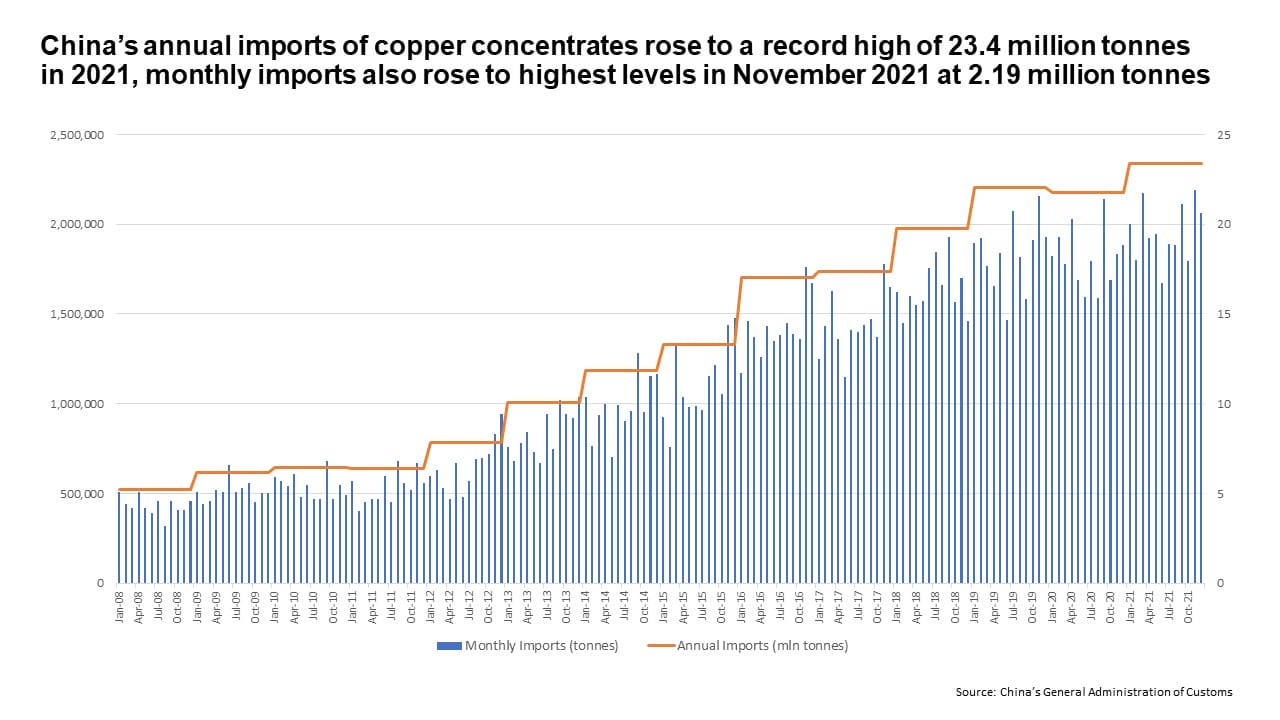

China’s rapid growth spurred a commodity cycle during the 2000s. We saw annual growth levels which sometimes exceeded 10% per annum! This caught the commodity world by surprise and producers struggled to keep up with Chinese demand. Investors had their eyes on China and all the commodities it was sucking up. Copper was one of them.

A lot of people count China out, but their copper demand keeps on increasing.

We have spoken about copper in green infrastructure but copper is required in even basic infrastructure. We are talking plumbing, buildings, homes etc. Copper is referred to as Dr. Copper because it can be used to gauge the health of the economy. If copper prices are going up, then that means demand is high and therefore, the economy is doing well as things are being built and economies are expanding. Although, inflation and supply chain disruptions today make it a bit difficult to use copper as a thermometer for the world economy.

Chinese GDP numbers are not the epic growth numbers we have seen in the past, and it is still to be seen how fast China recovers from Covid lockdowns. The People’s Bank of China is actually cutting interest rates and is accommodative compared to the Fed and other western central banks. China is trying to spur growth… or they are dealing with a large credit and real estate issue.

If Chinese growth drops does copper demand go with it? I would say no. I think the global push for green/clean infrastructure will keep demand high for copper. Secondly, perhaps another nation could pick up China’s slack:

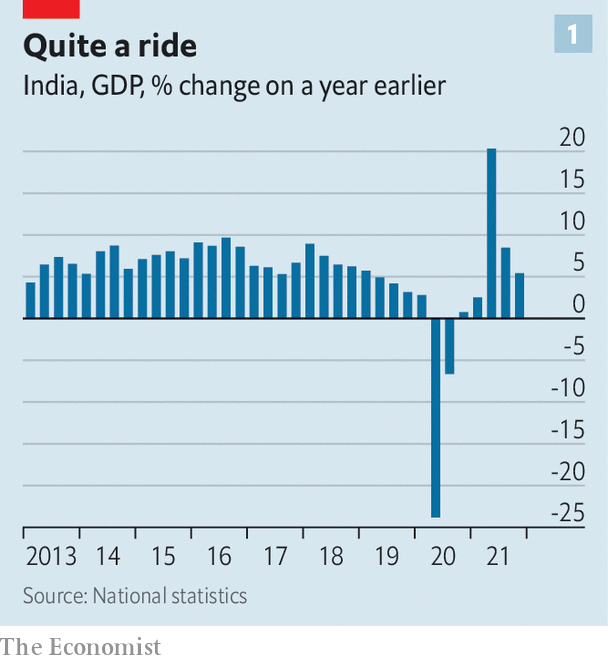

India is likely to be the world’s fastest growing economy this year, says The Economist.

Since the election of Prime Minister Narendra Modi in 2014, India’s economy grew by 40%. Only China did better in this time period with a growth of 53%.

India’s projected full year 2022 growth is projected to be 8.7%, making it the world’s fastest growing large economy this year. The World Bank recently downgraded India’s economic forecast for full year 2023 down to 7.5%.

“In India, growth is forecast to edge down to 7.5 percent in the fiscal year 2022/23, with headwinds from rising inflation, supply chain disruptions, and geopolitical tensions offsetting buoyancy in the recovery of services consumption from the pandemic,” the World Bank said in its latest issue of the Global Economic Prospects.

As someone who is East Indian, I can say that India needs a large infrastructure overhaul. There are still people who don’t have flushing toilets and deal with regular power outages in many parts of the country. A large infrastructure project would transform the Indian economy, create more jobs, and make India one of, if not the fastest growing economy in the world.

In my opinion, copper holds attractive future demand prospects in the country of my parents and grandparents.

How to invest in copper?

There are many ways to invest in copper for the long term. An ETF is an option. The global copper miners ETF is traded under the ticker: COPX.

This ETF gives investors an opportunity to achieve exposure to copper without encountering the nuances of a futures-based strategy. For investors looking to bet on increased demand for a raw material used widely in various applications, COPX is a nice option. COPX often trades as a leveraged play on the underlying natural resources, meaning that this fund can experience significant volatility but be a powerful tool for profiting from a surge in commodity prices.

Here are the funds largest holdings:

A nice mix of major producers of copper from around the world.

Above is the weekly time frame chart of COPX. A major run beginning in April 2020 hitting highs of $47.23 on April 4th 2022. The ETF also pays out a current dividend yield of 1.34%.

Another option for long term investors is a major producer. I prefer Freeport McMoran, the operators of Grasberg in Indonesia:

This stock was making headlines as copper prices surged post pandemic lockdowns. We went from lows at $4.82 in March 2020 to highs at $51.99 in March 2022! A 962% rise in two years! The stock currently pays a dividend yield of 0.76%.

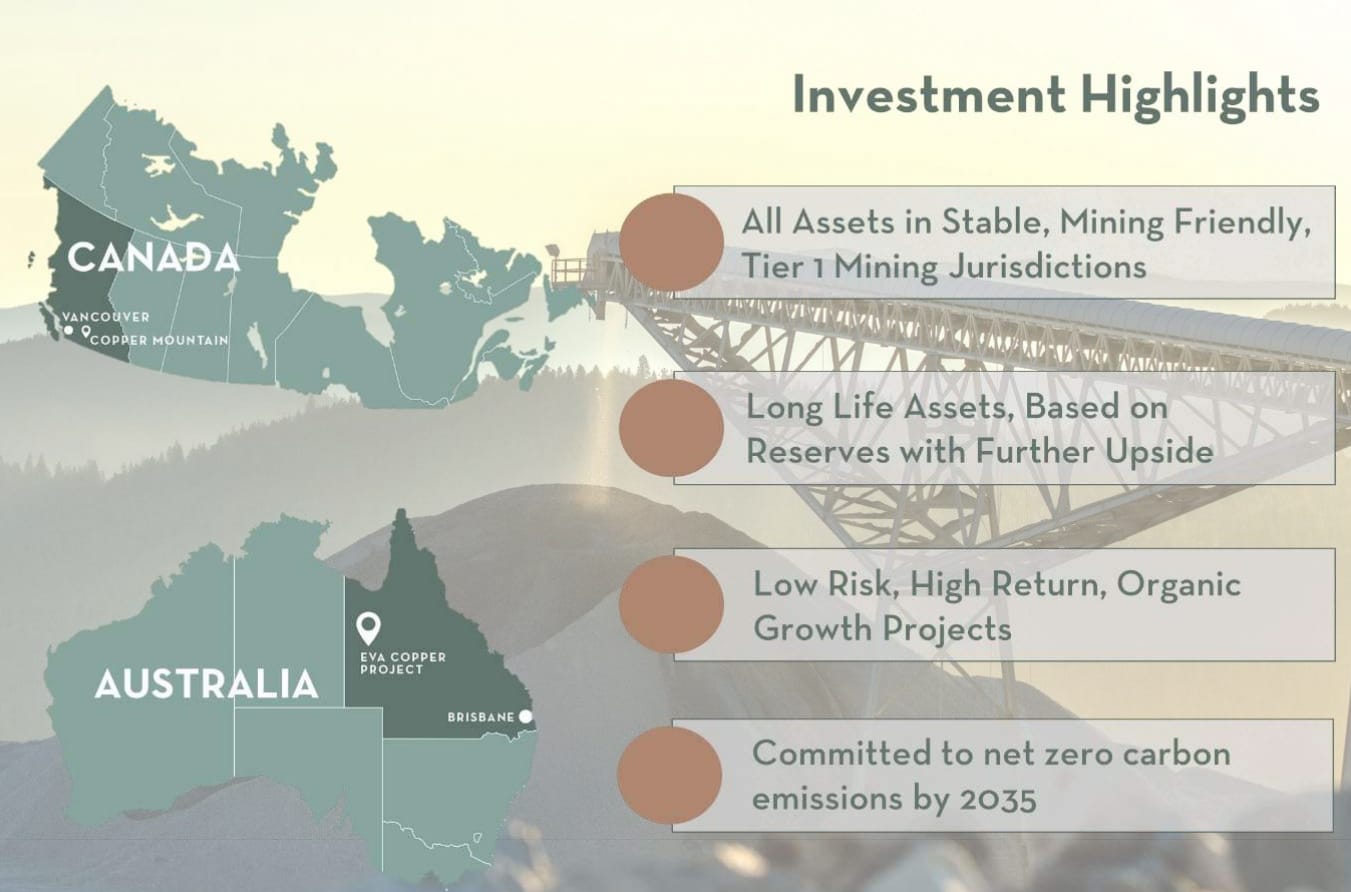

Copper Mountain Mining (CMMC.TO)

Market Cap ~$ 589 Million

Copper Mountain Mining operates a copper mine just east of Vancouver, BC. The mine is located south of Penticton. The mine produces approximately 100 million pounds of copper equivalent per year. The company is planning on increasing investment in the asset with a mill expansion which would increase the amount mined. Copper Mountain also has another project located in Australia which is development ready and will add approximately 100 million pounds of copper equivalent per year on average over its 15 year mine life.

This is a play for someone looking for a mid tier producer which has room for growth and expansion.

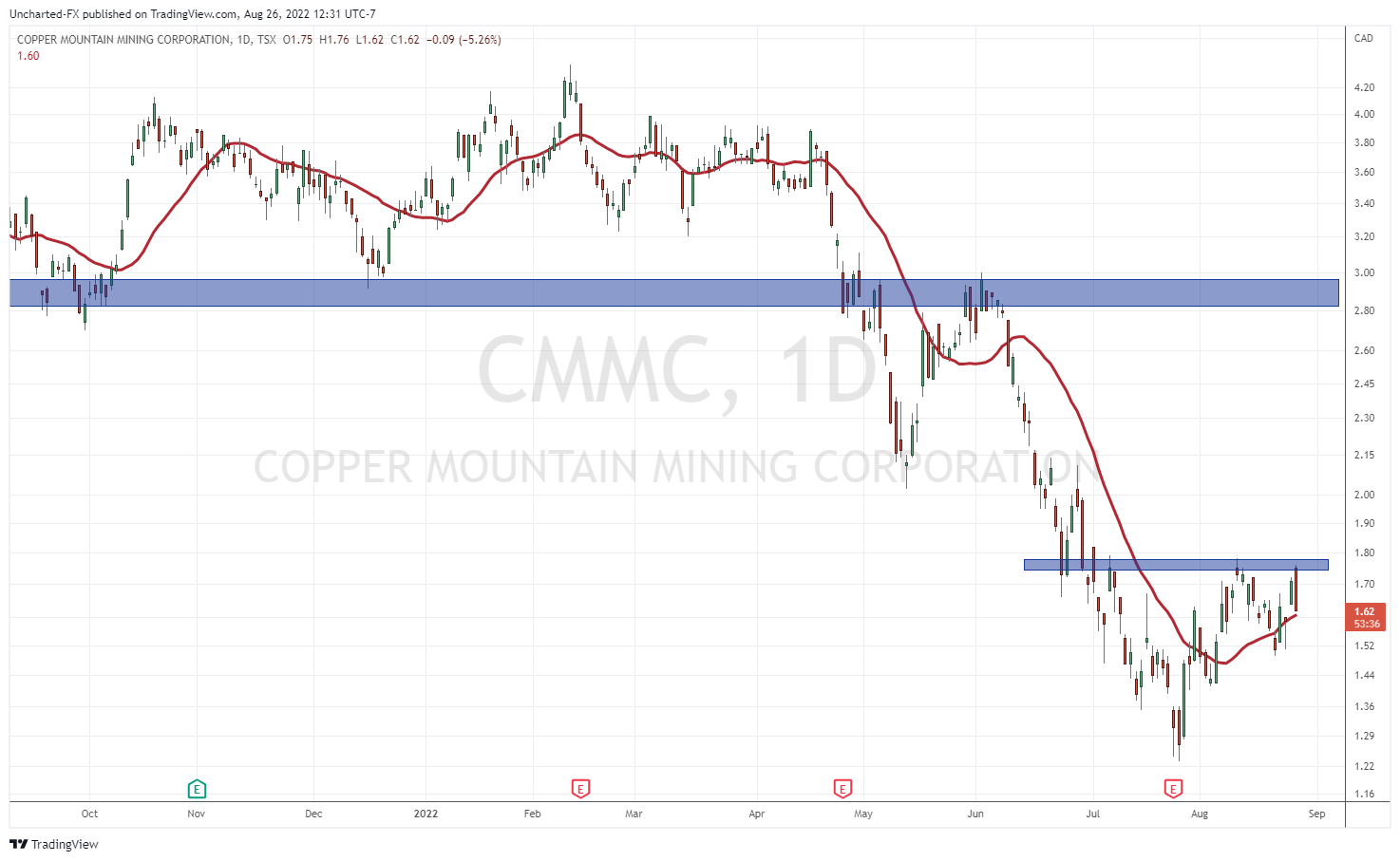

At time of writing, the stock has a very nice looking reversal pattern which requires a break above $1.80 to trigger.

Perhaps you want to speculate a little bit and make big gains. Then you will have to look at some junior miners. There are quite a few copper miners that I am keeping my eye on.

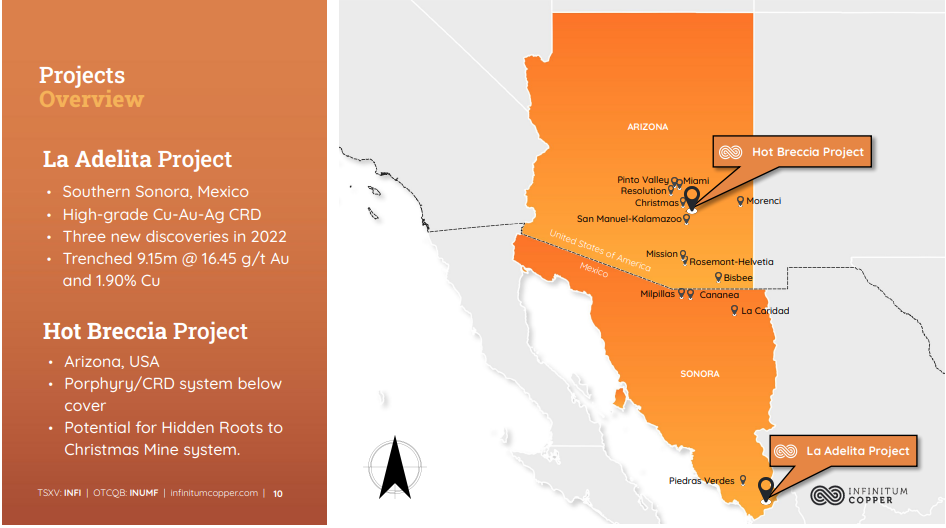

Infinitum Copper (INFI.V)

Market Cap ~ $12.1 Million

Infinitum Copper is a premier copper explorer. Their flagship asset is the highly prospective La Adelita copper project in Sonora State, Mexico. This project is known to host high grade copper mineralization. It is also adjacent to the ex-producing Alamo Dorado silver mine.

Recent drill results from April 13th 2022 returned drill results including 9.15 metres (m) averaging 16.45 grams per tonne (g/t) gold, 1.90% copper and 3.50 g/t silver. Three new discoveries of high grade mineralization were also made. Further drilling is planned for this year.

There is also an asset in Arizona. Arizona is important for copper investors because it accounts for 65% of the copper produced in the United States. One of the largest copper mines, the Morenci mine, owned by Freeport-McMoran is located in Arizona. A state that is a top jurisdiction for mining.

Keep in mind this is an early stage explorer company. More drilling is required to confirm a resource, but the prospects look great. If copper prices rise, not only will these juniors rise with them (keep in mind they have a small market cap!), but the higher the potential for a buyout or a joint venture if they have a resource.

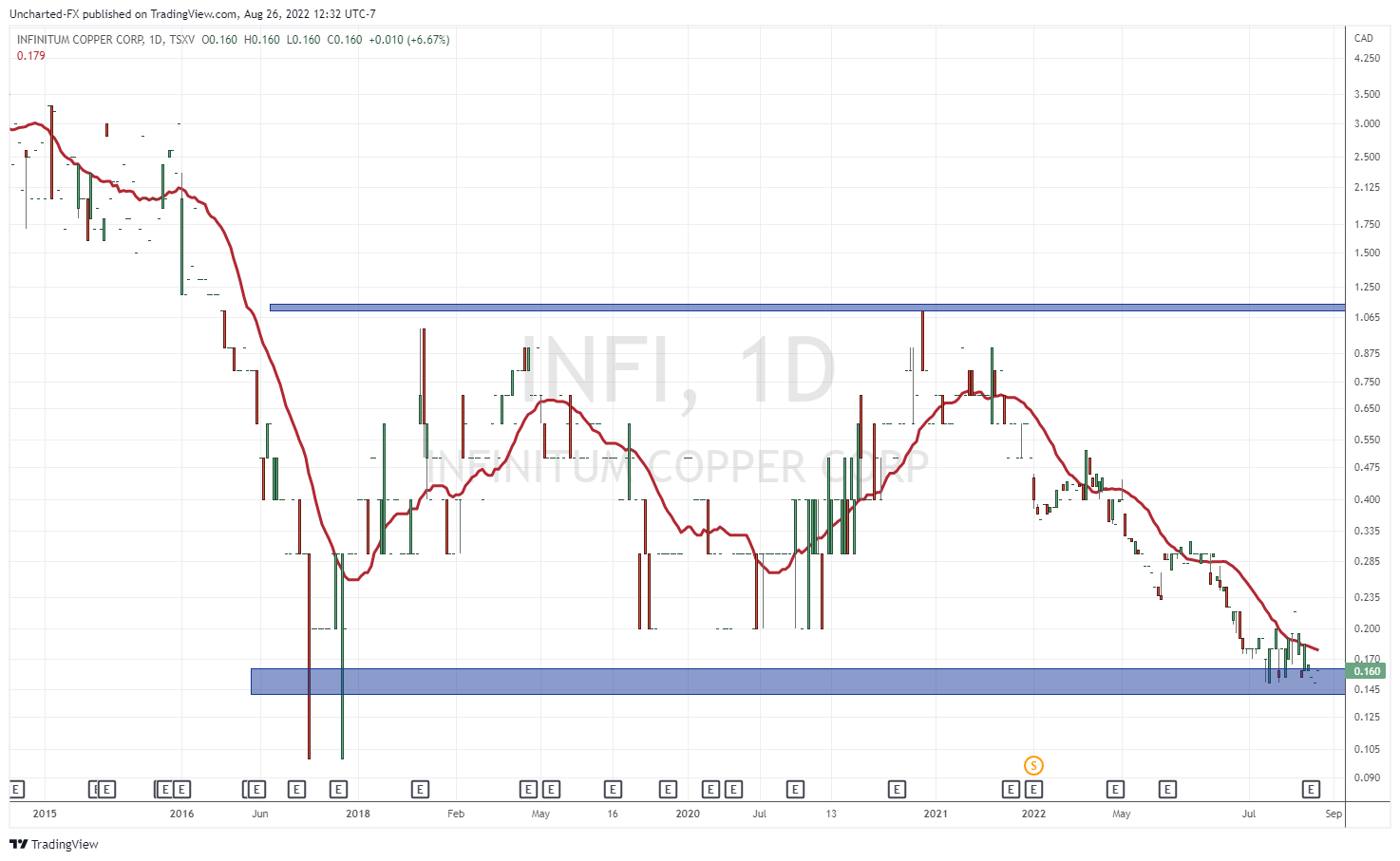

The stock has been basing for years, but these are the types of long term setups that catch my eye. I won’t make this into a price action/market structure. You can just read my Market Moment articles for more details on this. Suffice to say that when a range/base breaks after many years, it leads to an explosive run higher. The stock still has a long way to go before confirming that major break, but looks supportive here at major support.

I know it has been a long article, and I thank you for sticking with me until the end. Before I let you go, let’s take a look at copper prices.

The weekly chart of copper looks very similar to the ETF and some of the producers I shared above. On March 6th 2022, Copper prices made new all time record highs hitting US $5.02 per pound. Fears of supply chain disruptions and historically low stockpiles amid rising copper demand drove prices higher. If everything I mentioned above comes into play, then new record highs are very likely in the future. Demand will grow for the new green/clean infrastructure and the growth of emerging markets such as India. Supply will need to catch up which gives us a great opportunity as long term investors.

Short to medium term we can expect lower prices on the economic slowdown. Copper is in a bear market and is known as Dr. Copper as it predicts recessions. Central banks are set to raise rates higher even when the economy is weak. As mentioned earlier, the next ‘New Deal’ that government is likely to introduce will be a large green infrastructure project.

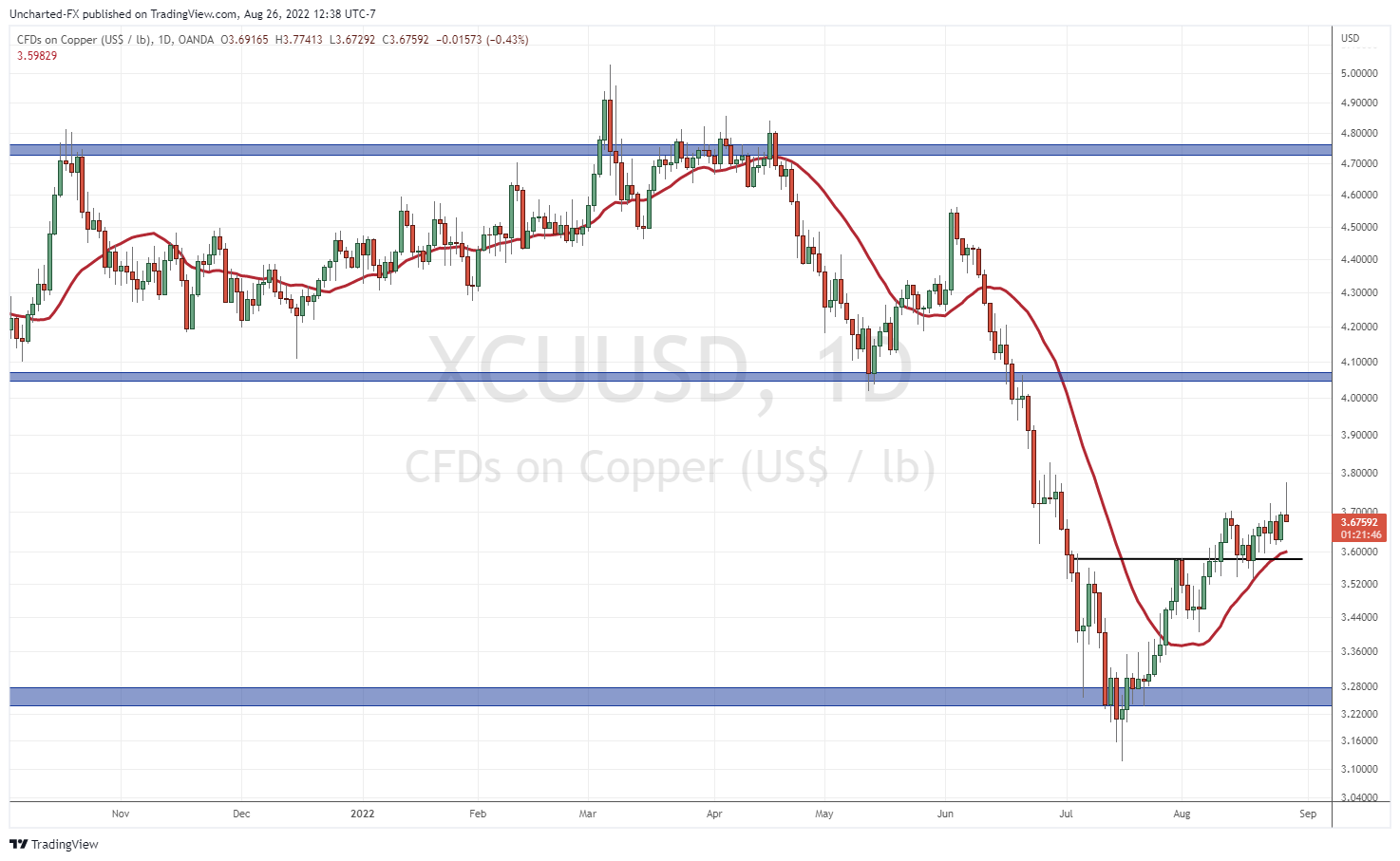

On the daily chart, we have an interesting technical breakout. Copper formed a cup and handle pattern and saw a breakout above $3.58. But as you can see, not much momentum taking prices higher. Not a strong sign. Central bank news got the Dollar popping and will weigh in on copper and other commodities. If we close back below $3.58, then we can expect another lower leg breaking below recent lows at $3.28.

What would it take to change my bullish case in the short to medium term? Copper will need to close above $4.00.

This has been the millennial guide for investing in copper. The fundamentals are great and I really do believe copper should be a part of the millennial portfolio. If you believe in green and clean energy and the world combatting the climate crisis, copper is THE green metal. So what say you? Are you bullish on the base metal? Let me know by reaching out on Twitter.

Leave a Reply