Bloodbath. The markets are getting hit hard. An everything sell off triggered by Jerome Powell telling markets that interest rates will rise and remain high for longer which will cause “some pain” to the US economy.

Markets have quickly shifted back to the inflation narrative. The recession narrative was giving markets a boost as investors began betting on a Fed pivot. That interest rates were going to go down.

Now being a precious metal bull in this environment might be considered crazy. The US dollar is continuing the rise, and will likely continue to do so as money runs into cash and foreign money runs into the safety that is the US dollar. Gold and silver have a high negative inverse correlation with the US dollar. When the dollar rises, gold drops and vice versa.

If interest rates are heading higher, then gold will remain under pressure. However if rates are rising, would you still be buying bonds knowing that future bonds will yield more? Let’s not forget that in real terms, factoring inflation, you would still be losing money on bond yields.

In many articles on Equity Guru, I have said that gold goes up when there is a confidence crisis. When people begin to lose confidence in the government, in central banks and the fiat currency, money runs into gold. Gold has been money for thousands of years, and it doesn’t matter what happens to a country, be it war or a new regime, gold continues to be money in the new order.

Looking around the world, and I see many reasons why the theme should be wealth preservation. Geopolitics, inflation, the energy situation in Europe which will start making headlines in a few months, agriculture and drought, central banks breaking the system with rate hikes, a largely indebted consumer and middle class. The list goes on and on. The argument is that money will run into the US dollar, but I think there are issues with this.

Brent Johnson speaks about the Dollar Milkshake Theory and how a rising US dollar will wreak havoc around the world. You have seen this already with the Turkish Lira, the Japanese Yen… and possibly with the Hong Kong Dollar peg. If the dollar gets too strong, what will the rest of the world do? Especially those emerging markets with large dollar denominated debt. Debt that just got a whole lot expensive with the rising dollar. Bretton Woods/ Plaza Accord 2.0 anyone? The Fed and the US may be forced to devalue the dollar as a stronger dollar wreaks havoc, but this is something that isn’t going to happen tomorrow. This is just what I see playing out long term.

Betting on gold is betting on the system to come under strain. Might sound like the whims of a conspiracy theorist, but billionaire Ray Dalio has been warning us of this moment for sometime (crash is trash!). Central banks and fiat currency will be tested. Dalio is bullish gold.

When it comes to gold, I called the rejection at $1800 on August 17th. This was a major zone gold bulls wanted to see break. Unfortunately, the bears outnumbered bulls. The BIG zone is $1680. This has been held as support multiple times since 2020. If we break and close below $1680, then I may have to reassess my timeframes. This would be very bearish and I would expect to see much lower gold prices.

But we will deal with that if gold gets down to $1680. The US dollar is also testing resistance and could reverse or at least pullback, giving gold bulls some optimism.

There are some gold stocks holding up quite well given the carnage in markets. Gold juniors have smaller market caps, and all it takes is a press release for the stock to outperform.

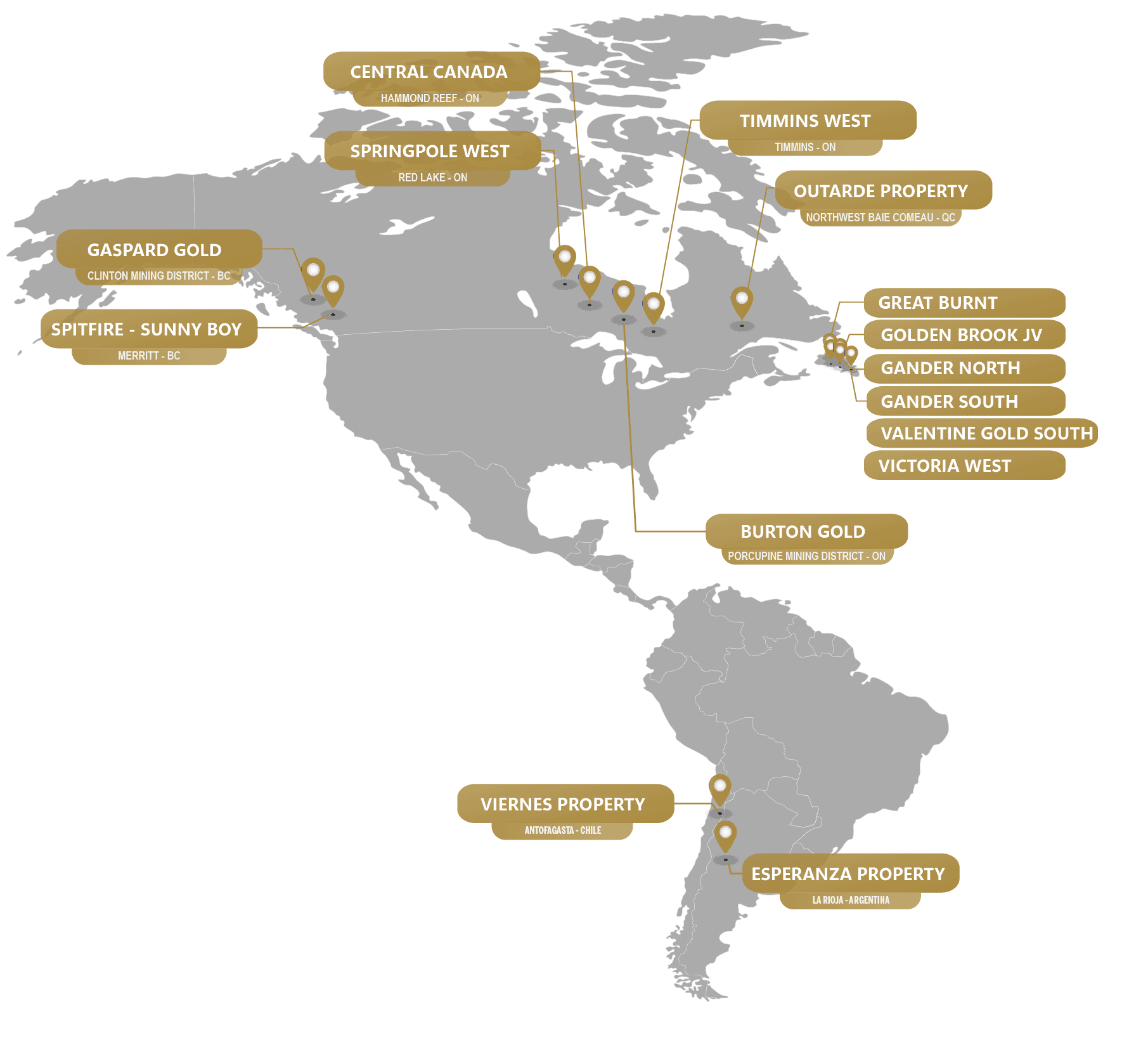

Falcon Gold (FG.V) is one I have on my radar. Falcon Gold is a junior explorer that acquires, explores, and advances quality mining projects in the Americas. Their assets are in Canada, Chile and Argentina with their flagship project being Central Canada and bordering Agnico Eagle Mines 4.6 million ounce Hammond Reef deposit.

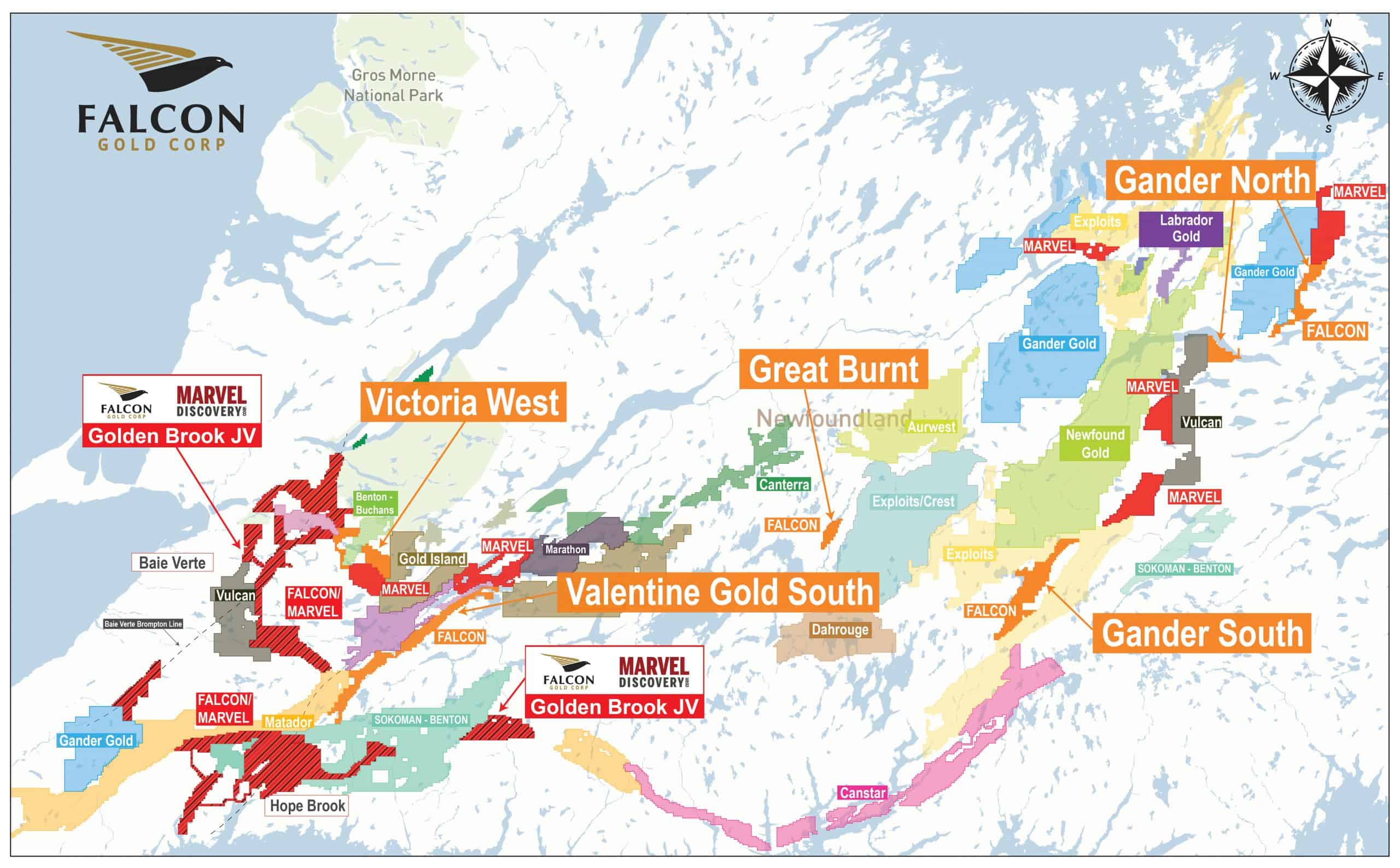

The company has recently been focusing on Newfoundland.

Falcon’s Newfoundland property portfolio (shown above) is immense. Falcon has acquired and currently holds over 140,000 hectares of ground in Central Newfoundland tied on to Major Structures. This puts Falcon Gold in the top 8% for landholders in the Province. Most of their assets in Newfoundland are owned 100% with no property payments or net smelter royalties. This puts Falcon in a prime position to succeed as new discoveries are made.

We have used the term “close-ology”. With Falcon’s holdings near major structures (and even producing or past producing mines in other Provinces), the chances of discovery are higher as the vein could extend into Falcon’s land holdings. It is up to Falcon to drill, discover, de-risk and then find a buyer.

Some of you might ask why Newfoundland? The Canadian province has been attracting mining magnates. One such magnate is billionaire investor Eric Sprott, founder of Sprott Asset Management. Sprott has since invested heavily in Central Newfoundland holding over 125.9 million shares of New Found Gold alone, Sprott has invested over $200 million into New Found Gold Corp. bringing his total stake to over 30%. This is his biggest bet yet and he believes Newfoundland could hold the “greatest gold discovery in the history of Canada“.

Falcon Gold’s crews are mobilized on multiple projects in Newfoundland. The first phase of exploration at Gander North has been completed which included base line prospecting, soil sampling, and trenching. News on exploration progress is an upcoming catalyst for the stock. Falcon recently closed a $300,000 CAD financing. Proceeds will be used for general working capital and will be deployed into the ground for exploration.

I think one very interesting project is the Central Canada project. In terms of ‘close-ology’, it is near Agnico Eagle’s Hammond Reef project. Drilling has been done and Falcon Gold has found gold. More drilling is required to expand and find a discovery, and I think it would be great if Falcon could do a drill program here or even a joint venture. But perhaps this is for the future with the focus on Newfoundland.

And what about the South American properties? On August 2nd 2022, Falcon Gold provided a corporate update and CEO Karim Rayani, reaffirmed his focus on creating value for shareholders. One thing which will be beneficial for shareholders is the plan of a spin out. Falcon Gold intends to spin-out its rights, obligations and interest in the Esperanza Gold project in Argentina to Falcon’s wholly owned subsidiary Latamark Resources Corp.

The transaction is being completed by way of a plan of arrangement. Pursuant to the arrangement shareholders of Falcon will be entitled to receive one common share in Latamark for 5.8 shares held in the company as of the effective date of the arrangement. The record date is estimated for early September 2022.

The benefits? It protects share capitalization, and protects capital expenditures needed allowing Falcon Gold to focus on Canadian operations while Latamark would focus on opportunities and projects outside of North America.

Karim Rayani also highlighted all the other big news in a busy Summer for the company including the June 6th 2022 acquisition of Green Metals, which gives Falcon two battery metal focused projects in Canada, and updates on the Viernes project in Northern Chile.

From a technical perspective, Falcon Gold had a nice bounce at the $0.075 zone. What I loved was the break of the wedge pattern which I have drawn out. We got an explosive move after the break. The large wick candle you see is the market reaction to the Falcon corporate update press release on August 2nd 2022. The market liked the contents and liked the spin off news. The news was received with large volume. 640,000 shares traded, which is the most we have seen since March 31st 2022.

The major resistance zone (price ceiling) comes in at $0.125. We actually broke above it on August 2nd 2022 but failed to close above it. If we did, it would have been a very important and bullish technical event. The stock has remained below this level after attempting to break above it multiple times back in June and Summer 2021. For the long term, this is the break we want to see, and it would mean a technical ramp up to $0.25.

What about currently? Well the markets are dropping and gold is under some pressure with a stronger dollar. As mentioned before, the dollar could be reversing as it is finding some resistance. If this happens, gold can get a bounce and Falcon Gold will too. But will it be enough to close above $0.125? I think we would need either a major press release catalyst from Falcon Gold or gold climbing back above $1800 for sustained momentum above $0.125.

If market and gold weakness continues, it is very reasonable to say we will see price fall back to the $0.075 zone. Major support tested once again and I expect buyers will be lining up to pick up shares. But that remains to be seen. Even with current market and metals weakness, Falcon Gold is holding up well, ranging between $0.095 and $0.11.

With a market cap currently at $11.07 million, Falcon Gold has big upside potential considering the fundamentals and the technicals.

Full Disclosure: Falcon Gold is an Equity.Guru marketing client.

Leave a Reply