After reading many headlines to the tune of “inflation collapse/drop/peak will cause a market rally”, we can say that we aren’t just there yet. The markets have been pricing lower inflation the past few days. By looking at the chart, you can see what happens when the markets are wrong. We dump hard.

A sea of red on all the major US indices. We aren’t even close to the end of the trading day but so far we have already given up two green days.

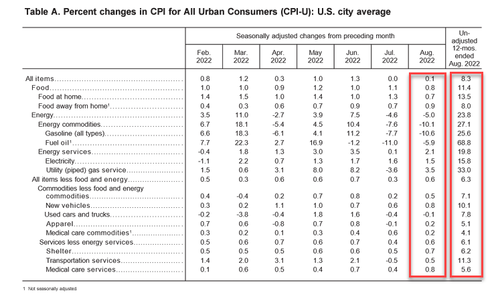

The consumer price index, which tracks a broad swath of goods and services, increased 0.1% for the month and 8.3% over the past year. Excluding volatile food and energy costs, CPI rose 0.6% from July and 6.3% from the same month in 2021.

Expectations were for headline inflation to fall 0.1% and core CPI to increase by 0.3%. The year-over-year forecasts were for 8% and 6% gains.

The decline of gasoline prices was providing optimism for a lower inflation print. Indeed, energy prices fell 5% for the month and was led by a 10.6% decline in the gasoline index. However, rising prices elsewhere offset the decline.

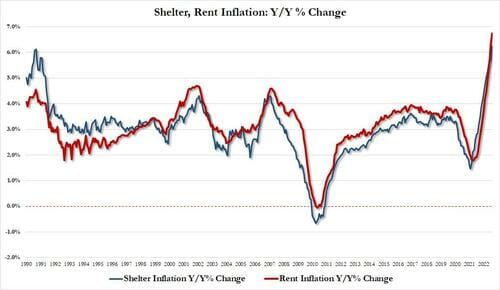

Food and shelter. The big shock was the food index which increased 11.4% over the last year, the largest 12-month increase since the period ending May 1979, while the food at home index rose 13.5% the largest 12-month increase since the period ending March 1979.

Medical care services also showed a big gain, rising 0.8% on the month and up 5.6% from August 2021. New vehicle prices also climbed, increasing 0.8% though used vehicles fell 0.1%.

“Today’s CPI reading is a stark reminder of the long road we have until inflation is back down to earth,” said Mike Loewengart, head of model portfolio construction for Morgan Stanley’s Global Investment Office. “Wishful expectations that we are on a downward trajectory and the Fed will lay off the gas may have been a bit premature.”

What does this mean for you an your money? In simple no nonsense terms: expect central banks to continue to raise interest rates. The reason why markets tumbled is because investors are now expecting a more aggressive Federal Reserve.

We will find out next week when the Fed raises interest rates by 0.75%. The important thing won’t be the rate hike itself, but the Powell press conference. Traders and investors will be tuning in and analyzing every word that comes out of his month. His tone and diction will be very important in gauging how hawkish and aggressive the Fed will be.

News

Russian forces have pulled back and Ukrainian strategists are worried about Moscow’s next move.

Large railroad labor unions in the US are moving closer to a strike with strike negotiations being held up by battle over sick time policies.

Peloton will be expanding their bike rental program nationally. The base-level Bike and subscription will cost customers $89 a month plus a $150 setup fee.

Citigroup is the latest company to announce a completely free college program for workers. Roughly 38,000 Citi front-line consumer banking employees will now be eligible for the expanded education benefits program.

Goldman Sachs is planning on cutting several hundred jobs this month making it the first major Wall Street firm to take steps to rein in expenses.

Canadian Market News

Go Metals Corp (GOCO.CN) intersects wide intervals of nickel and copper sulphides at its 100% owned HSP Nickel-Copper PGE project in Quebec, Canada. The stock is up 235% with over 1.4 million shares traded.

Silver Mountain Resources (AGMR.V) is up 15% with over 1.3 million shares traded. No news out today, but 5 days ago the company announced high-grade silver and gold sampling results.

TDG Gold Corp (TDG.V) provided an update on their exploration process at its Shasta project located in BC. A former gold-silver producing asset. The stock is up over 7% with over 695,000 shares traded.

Medical Facilities Corporation (DR.TO) announced a change in corporate strategy, changes to board of directors and an issuer bid for up to $34.5 million of its common shares. The stock is up 7% with 152,026 shares traded.

Calfrac Well Services (CFW.TO) provides an operational and financial update for Q3 2022. Calfrac’s management expects its third-quarter revenue from continuing operations in the United States, Canada, and Argentina to range between $400.0 million and $430.0 million. The stock is up over 5% with 41,954 shares traded.

Chart of the Day

Perhaps not a surprise given the CPI data, but the 10 year yield is what everyone should be watching. Yields continue to rise higher and we are now testing the previous highs set in mid June of this year. If we break this, then we are looking at yields not seen since 2011. The higher this jumps, the more rate hikes are expected by the Fed.

Leave a Reply