I have a confession to make. You see, I like silver stocks, but they’re very rarely cheap enough for me. More specifically, there’s one stock I’ve been eyeing for a number of months that is super interesting but isn’t yet (and maybe will never be) a screaming buy. Reason being, I like dirt cheap stocks whose charts look like they’ve been left for dead, and the market cap is dangerously low versus assets.

I have, however, just stumbled upon a neat way to play one of those target silver companies indirectly at an entry price that will make you fall off your chair.

Meet Northern Lights Resources (NLR.C), a company with a tiny market cap with two very interesting projects in the US exploring for gold and silver.

The first project is the 100% owned Secret Pass in Arizona. It’s 15 km north of the historic Oatman Gold Mining district that produced 2 million ounces of gold between 1892 and 1940 at an average gold grade of >15 g/t. Nice!

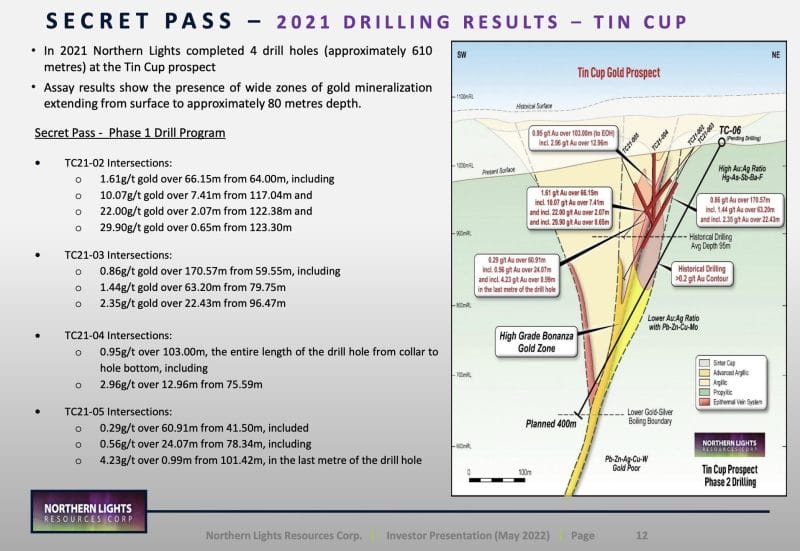

Drilling in 2021 has confirmed gold in their licenses as seen below:

The second project is Medicine Springs, and here is my “in” to play a silver company that’s too prospective to ignore. Medicine Springs is located in Nevada and has the potential to hold a Carbonate Replacement Deposit, which is geo-talk for juicy and large.

Reyna Silver, their JV partner, can earn up to 80% equity in the Medicine Springs project by spending a minimum of US$2.4 million plus other commitments plus a cash payment of US$1 million to Northern Lights by no later than December 31, 2023.

The 2022 exploration program at Medicine Springs will include a 5,000 to 7,000 metre drill program. Reyna Silver, if you don’t know, is a small silver junior that was spun-off MAG Silver, a 2b juggernaut producer.

This is what they have to say about this silver project:

“What we see at Medicine Springs includes 10 of the 13 major features we expect to see at the very top of a large CRD system… and we see these before drilling our first hole!” said Dr. Peter Megaw, Chief Exploration Advisor to Reyna Silver – who happens to be Chief Exploration Officer at MAG.

See the video below:

OK, so now let’s do some math.

Reyna Silver can own up to 80% of this project, which they seem super excited about (I should know, I’ve spoken to them personally) is sitting at a 38m market cap. Yes, they do hold other licenses and projects, but this seems to be their baby, and they’re putting money into this deal right now.

Northern Lights, who holds 20% of the project, is sitting at a ridiculous market cap of only 700k. Yes, you read that right, less than 1m CAD.

Now, nothing is guaranteed in the world of mining and there has been relentless selling of the stock this year, but this is a risk to reward ratio that I’d take all day long.

Drilling is ongoing and I’m watching this VERY closely. It’s very likely that by the time you read this, I’ll be starting a position. Fingers crossed!

Leave a Reply