Endurance Gold (EDG.V) is a precious metals exploration and development company focused on acquiring, exploring and developing highly prospective North American mineral properties that management believes have the potential to become world class deposits.

The company has multiple projects, mostly focused on gold, but there is a project dealing with rare earth and niobium-tantalum. Here is a visual of all the projects and their locations:

For those playing the junior mining space, jurisdiction is key. We look for companies which have assets in stable countries which respect the rule of law. Some third world nations have prospective geology for major discoveries, but there is always the risk that the government decides to take the mine over, or even change their minds about profit sharing when the asset is in production.

Marin Katusa says that investing in good jurisdictions is key. Investing in ‘non AK-47″ countries. Canada and the US definitely fit the bill, and I think junior metal investors and investors in general, need to factor the jurisdiction when making investing decisions.

Endurance Gold has many assets, but the current focus for advancing is the Reliance Gold Project.

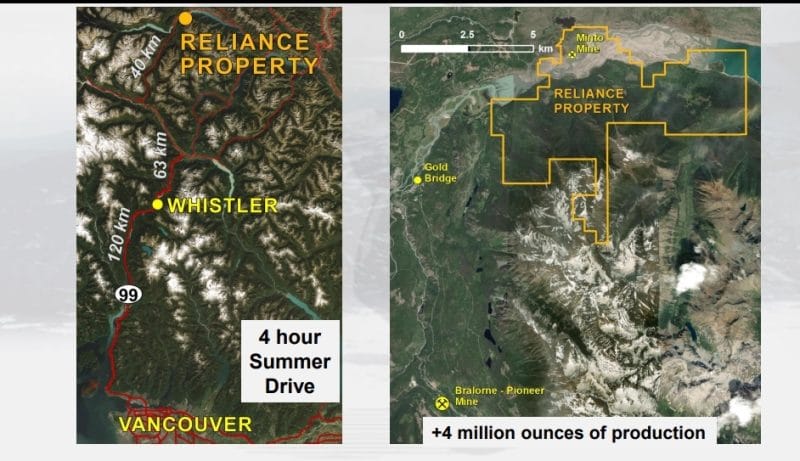

The Reliance Project is located 4 km east of the village of Gold Bridge, and 10 km north of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold, making the camp British Columbia’s largest historic multi-million-ounce gold producer. From Vancouver, the drive to the project will take 4 hours on a nice Summer day.

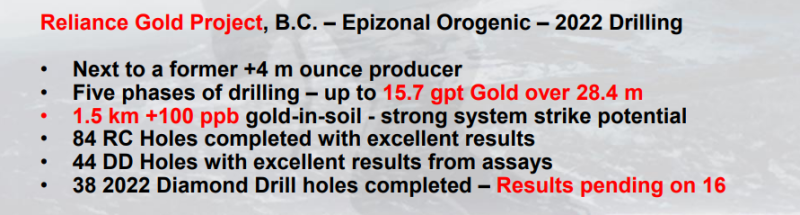

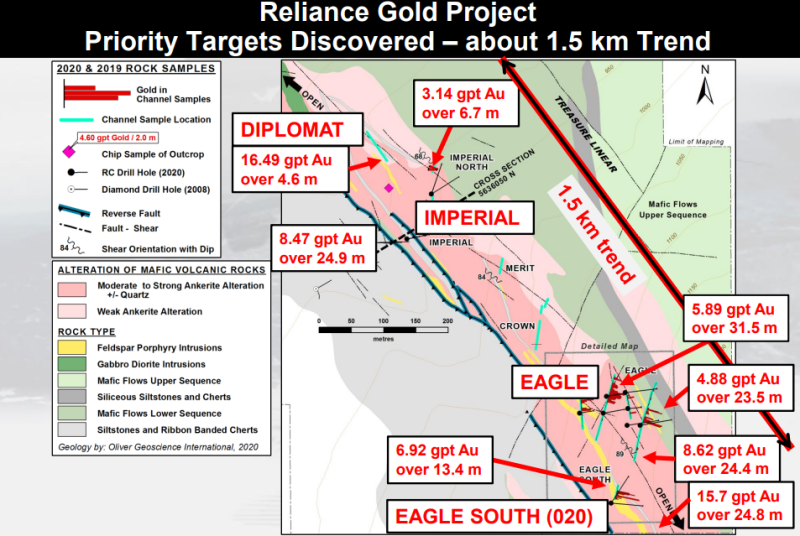

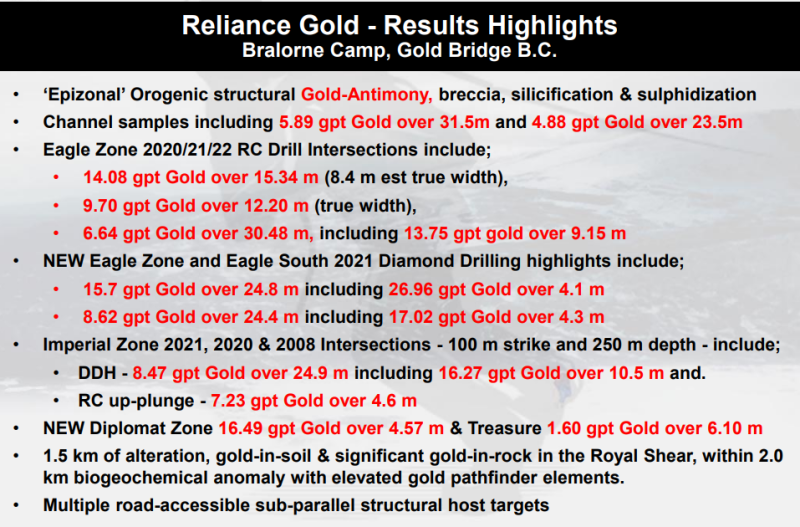

The Property hosts an “Epizonal” Orogenic gold system, within a compressional structural setting, that extends over at least 1,500 metres of strike and 600 m vertically. The results from the exploration programs completed to date indicate very encouraging mineralized potential for about 2 km of trend associated with a major relatively unexplored shear zone complex that is subparallel to the structural trend that hosts the former producing Bralorne-Pioneer mine. The Property warrants continued systematic exploration through drilling to expand the gold system.

The Property consists of two separate option deals, the original Reliance Option was acquired in 2019 and the Olympic Option acquired in 2022 which collectively encompass about 2,475 hectares in mineral rights. The Olympic Option was originally explored with minor pre-World War II gold production of about 17,500 ounces from the Minto Mine. In addition, numerous short gold exploration adits are documented on at least five other prospects on the Property.

Before the 2019 acquisition by Endurance Gold, the Imperial zone was last drilled in 2008 and returned a highlight drill of 13.30 grams per tonne (“gpt”) gold over 4.20 m (est 1.8 m true width), 7.05 gpt gold over 5.06 m (est 2.05 m true width), 5.70 gpt gold over 12.05 m (est 9.5 m true width), 5.43 gpt gold over 15.35 m (est 10 m true width) and 2.16 gpt gold over 12.13 m (est 6.5 m true width), in five (5) of an eight (8) hole drilling campaign.

Endurance Gold began systematic exploration which included airborne and ground magnetic surveys, an airborne LiDAR survey, a ground 3DIP survey, geological mapping, alteration mapping, talus fine/soil sampling, biogeochemical sampling, rock sampling, systematic channel sampling, three RC drill programs with a total of 84 RC drill holes, a 2021 diamond drilling program that completed 22 drill holes. A current 2022 diamond drill program was recently completed, and results are pending catalysts for the stock.

Before we look at recent assays, here are highlights from Endurance Gold’s drilling and exploration:

Recent news on November 14th 2022 saw Endurance Gold report assay results from the completed 2022 drill program at Reliance. The objective was to extend the strike of the mineralized system and to test the extent of mineralized feeder structures below the shallow-dipping, near-surface Eagle Zone.

The 2022 drill program consisted of 38 diamond drill holes for 8,274 metres and 33 reverse circulation holes for 2,455 metres. Too technical? The key takeaway is that this was a large drill program and assays are the catalyst for the stock. Currently, assays are still pending for 16 diamond drill holes.

Above is the summary of the diamond drill holes (DDH). Highlights from 6 assay include:

- DDH22-044 returned 4.95 grams per tonne (“gpt”) gold over 12.1 m including 12.55 gpt gold over 4.3 m. The hole also returned 3.52 gpt gold over 4.0 m from a second deeper structure.

- DDH22-042 returned 2.99 gpt gold over 12.0 m including 7.35 gpt gold over 4.3 m from an Eagle South Feeder structure in a 250 m step-out to the northwest from hole DDH21-020 which previously reported 15.7 gpt gold over 24.8 m

- Other intersections within the northwest extension of the Eagle South Feeder Zone include:

- DDH22-040 with 2.08 gpt gold over 13.3 m including 8.85 gpt gold over 2.6 m.

- DDH22-039 with two significant intersections of 1.58 gpt gold over 13.3m including 6.37 gpt gold over 1.5 m and a deeper intersection of 0.78 gpt gold over 15.1 m.

- The Eagle South Feeder Zone continues to be open along strike and to depth.

“Results reported to date from the 2021 and 2022 diamond drill holes continue to deliver over seventy-five percent of drill holes returning significant gold intersections,” commented Robert T. Boyd, CEO of Endurance Gold. “As previously reported, drilling has confirmed that the near surface shallow dipping Eagle Zone extends over a 500 metre strike. In addition, a total of nineteen significant intersections along a 400 m trend are now confirmed in the Eagle South Feeder Zone, which remains open to expansion along strike and to depth.“

- New Eagle Zone feeder structures discovered this season have potential to dramatically expand the gold endowment at depth.

- 75% of all Diamond Drill holes (with assay results reported in 2021 and 2022) have returned significant gold intersections with >10 gram-meter and 22% of these with excellent intersections of >100 gram-meter.

There is a good chance of a major discovery here and if future exploration and drilling results in a multi-million ounce gold resource, Endurance Gold stock and market cap will significantly increase from these levels.

Management is key in this sector. You want to look for a team with experience and a history of success. CEO and President Robert Boyd, has over 38 years of experience in exploration, executive-level management, corporate finance and corporate governance. His resume includes Lead Director for Peregrine Diamonds Limited (which was acquired by De Beers in 2018), President, CEO and Director of Athabasca Potash Corporation (acquired by BHP), and President, CEO and Director of Ashton Mining of Canada Inc (acquired by Stornoway Diamonds). Mr. Boyd is a well respected geologist and gemmologist and is currently also serving as a Director of Peru-focused Condor Resources Inc., the Prospectors and Developers Association of Canada and the Canadian Mining Hall of Fame.

Not only this, but Endurance Gold has already sold pre-existing projects for cash, shares and/or royalties including the sale of Rattlesnake Hills Gold Project to GFG Resources (GFG.V) and the sale of the Pardo Paleoplacer Gold Project to Inventus Mining (IVS.V).

Management has extensive experience and has a track record of success.

Technically, the stock could be poised for a large move. Currently, Endurance Gold shares are ranging within a wedge/flag pattern. The trendlines show that the price is respecting and reacting at these levels. A breakout of the wedge would be a major technical event.

There are also areas of support and resistance that investors should be aware of. The $0.325 zone is a major price floor, and I expect there to be a wall of buyers there. If the stock were to break below, then it would be bearish.

Onto the better news, price ceiling, or resistance, comes in at $0.425. A breakout above the trendline AND a break and close above $0.425 would be a major bullish catalyst. We would then be on the way to test previous record all time highs printed in July of 2022, and likely take that level out into new all time record highs.

Upcoming assay results are a catalyst for Endurance Gold, but gold stocks tend to move with the price of gold as well. They are leveraged to the price of gold.

Gold recently closed back above the very crucial $1720 zone nullifying a long term downtrend. This is a reason to get bullish on gold, and as long as price remains above $1720 and remains above it on a weekly basis, gold will be in a new uptrend with new recent highs upcoming. Currently, the US dollar is getting a bid from uncertainty in China which is seeing gold drop down retest $1720.

Retests are normal and there is no reason to be bearish just yet. Again, $1720 is key. Perhaps the next leg up on gold begins post Fed meeting on December 14th 2022. This move, alongside potential release of drill results, will be a key catalysts for Endurance Gold stock to breakout.

Leave a Reply