My followers know my love for silver. I am a silver bull. In fact, just this past weekend, I was ready to take my love for silver to new heights!

Tudor came out with a polarizing watch with the case entirely made out of 925 silver. The Tudor Black Bay 925. One of the first to do so. Back in the day, many pocket watches were made out of sterling silver, but steel has been preferred due to its hardness. And the fact it doesn’t tarnish. To me, nothing would say major silver bull than rocking the 925 Black Bay.

I found a great deal on a used watch at a watch store in downtown Vancouver. I went there with a friend this past weekend to pick it up. The result was cruel.

As I walked in, the owner said to wait a moment because he was on the phone finalizing a deal with a client. At first, nothing was off. But then I heard him mention the word “Tudor”, and when I looked in the case, the 925 watch was not there. My worst fear came true. The owner JUST sold the silver watch to his longtime client. If I was there just 5 minutes earlier, I would be rocking a 925 silver watch to VRIC 2023. I am sure it would have impressed silver company CEOs and the Wall Street Silver apes.

But perhaps this cruelty was a sign from the universe. Maybe I should be using that money to either load up on physical bullion and/or silver stocks.

Silver remains popular as it really is one of the cheapest hard assets there is. A hard asset which has a monetary past, and even though today has primarily industrial uses, it moves alongside the monetary metal gold, rather than the industrial metal copper.

When you look at the monetary set up in the world today with central banks, inflation, debt and interest rates, one can see a potential confidence crisis arising where people run into gold and silver to protect their wealth as they lose faith in the government, central banks, and the fiat money.

If you are big on the industrial uses for silver, then you should get excited about the increased demand for silver for solar panels. In fact, silver demand for solar panels is expected to grow by 15%. Just adding to the increased demand and likely deficit for the white metal.

I recently wrote an article about my silver 2023 outlook. The metal could provide high beta this year.

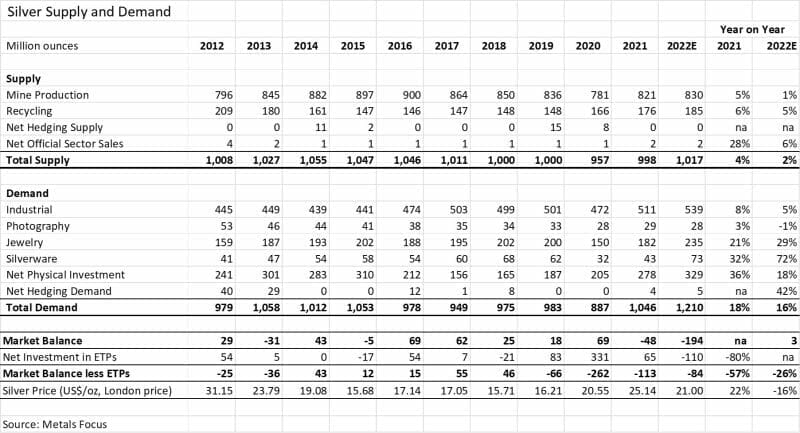

The Silver Institute has stated that silver demand is growing and set a demand record in 2022. For more info, read my silver outlook article linked above. Silver bulls have plenty of reasons to be excited for the long term.

Commodities have had a nice start to 2023. With the markets expecting a Fed pivot, the dollar has dropped which has been great for gold and silver. Other industrial metals such as copper, have had a bounce on the China reopening news.

Let’s take a look at silver:

Silver finished off 2022 very strong with price hitting highs of $24.28 in December. We kicked off the first day of 2023 trading with a breakout above recent highs and hitting prices of $24.55. However, the momentum did not hold and instead, silver sold off and created a pinbar candle.

As you can see from my daily chart, silver has just ranged between just under $23 and $24.40. We now await a break in either direction. A positive for silver bulls is that when the price fell below $23, it was bid up. We know there are buyers around that zone.

Some traders were expecting resistance here as we are close to the major psychological $25 zone. Some sellers are probably selling short contracts and placing their stop loss just above $25.

On the daily chart, I must admit that things look bearish. It looks likely that silver will break below $23 and then move lower. Perhaps the Fed and the Dollar can change this come the February Fed meeting.

But is this a major sell off? Or just a pull back? Let’s take a look at the longer term weekly chart.

Each weekly candle represents an entire week of trading. This chart above shows price action going back to 2019.

There are two things I want to point out. Firstly, the $18 zone was a major support level. In fact, this was my downside target which I gave to readers back in April 2022.

We have bounced at this zone which just validates the importance of this support. I was not ready to say a new uptrend had begun until silver took out the $22 zone.

$22 is a huge flip zone, meaning it has acted both as support and resistance in the past. When we broke below $22 in April 2022, it was a sign of bearishness. Because a major support which has held since 2020 finally broke. Note how the price pulled back above to retest $22 before selling off to hit $18.

This is key as pullbacks occur after a breakdown… or a breakout.

As you can see, the $22 zone was once again regained on the weekly November 28th 2022 candle. This is when I flipped back to being a silver bull for 2023. Silver is meeting some resistance now, but I do believe a pull back is coming. One that may see silver retest $22 but this time as a breakout retest, before seeing bulls jump in and take prices higher.

Something like this. If silver was to break back below $22, then it would not be a good sign for silver bulls.

I once again point to my 2023 Silver outlook article for more details. Looking forward to the Vancouver Resource Investment Conference, silver will be one of the hot commodities alongside uranium.

What are some companies I will be chatting with?

One of my favorites, Guanajuato Silver (GSVR.V) unfortunately won’t be there. But I like the current set up:

I love these types of basing charts because all that is required is a catalyst.

I like to talk with these companies regarding potential upcoming catalysts for the stock… and if they have the money to trigger the catalyst for the stock breakout.

Truth be told, MANY of the junior explorers have very nice technical setups heading into VRIC. Some have already broken out.

Tier One Silver (TSLV.V) is exploring Peru for high-grade silver. Samples have brought up 408.2 g/t.

Look at that chart. The stock is primed for a breakout. $0.375 is the key resistance zone that needs to be taken out.

Silver One Resources (SVE.V) is focused on the exploration and development of quality silver projects. The Company holds an option to acquire a 100%-interest in its flagship project, the past-producing Candelaria Mine located in Nevada.

The stock is also in a MAJOR range and recently saw a major 20% pop. A breakout in 2023 could be in the cards if we get the right catalyst.

Leave a Reply