As we make the transition to green energy, uranium powers the best carbon-free option for producing base power. However, approximately 40% of the world’s uranium is produced far from North American shores in Kazakhstan.

With shifting geopolitics, resource security is vital and the storied Athabasca Basin spanning northern Saskatchewan and Alberta provides a world-leading high-grade domestic uranium option.

Skyharbour Resources (SYH.V), a Canadian-based uranium junior, knows the importance of the Athabasca Basin and has accumulated a highly prospective portfolio of 18 uranium exploration assets in the region covering over 460,000 hectares of mineral claims.

The uranium explorer is primed to benefit from an improving uranium market with its co-flagship Moore and Russell Lake uranium projects.

The 100%-owned Moore projects is located approximately 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of uranium major, Cameco’s McArthur River uranium mine.

Moore is advanced with high-grade uranium mineralization at the Maverick Zone including drill results that show 6.0% U3O8 over 5.9 metres.

Beside Moore is Skyharbour’s recently optioned Russell Lake uranium project. The company has the option to acquire an initial 51% and up to 100% of Rio Tinto’s 73,294-hectare property.

But what does all this mean to the average investor who isn’t familiar with mining, never mind exploration and development of uranium deposits?

Equity Guru’s own Gaalen Engen, sat down with Jordan Trimble, director, president CEO, as well as Christine McKechnie, Senior Project Geologist, of Skyharbour Resources to get a closer look at the uranium market, uranium mining, and how Skyharbour is developing uranium value for investors.

Equity Guru founder, Chris Parry, digs into uranium, how it is positioned to assist our green energy transition and how investors can take advantage of this renewable energy trend.

Now back to our story…

Skyharbour, under Trimble’s direction, is positioning itself as both an explorer and prospect generator in order to maximize the value of its growing portfolio

Currently, the company has seven project that have either been optioned by a third-party explorer or are part of a joint venture with another uranium miner.

These projects include:

Joint Ventures

- Preston with Orano Canada

- East Preston with Azincourt Energy

Option Agreements

- Hook Lake optioned by Valor Resources

- Mann Lake optioned by Basin Uranium

- Yurchison optioned by Medaro Mining

- Walle & Usam optioned by Yellow Rocks Energy

- South Falcon East optioned by Tisdale Clean Energy

The joint ventures and option agreements total $34.4 million CAD in exploration expenditures picked up by Skyharbour’s partners as well as $14.87 million in cash.

Trimble has masterfully leveraged these agreements for maximum shareholder value generation with just over $20 million worth of shares being distributed to service all the deals.

Skyharbour reported $4.61 million in cash as of December 31, 2022, with general and administrative expenses coming in at $909,268 for the quarter ending December 31, 2022. This gives the company a few months of financial wiggle room in its operations.

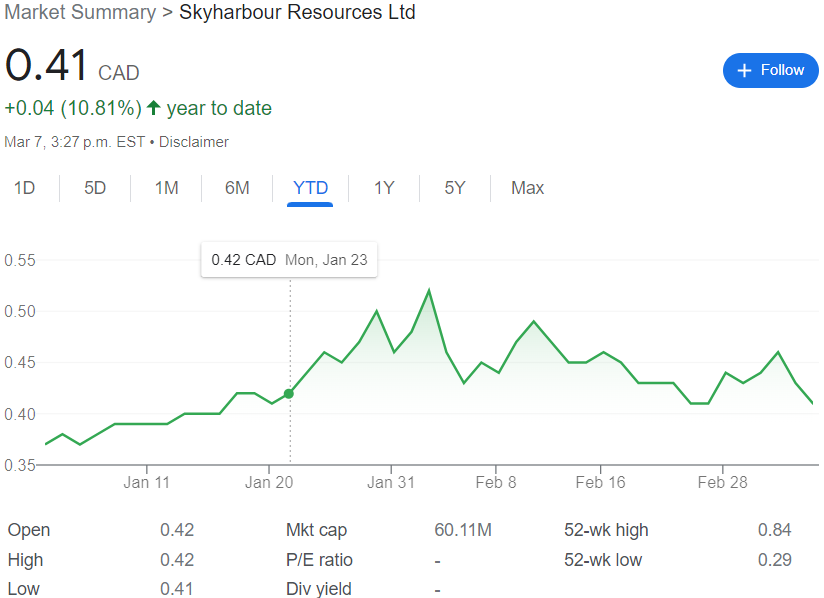

The company currently trades for $0.41 per share for a market cap of $60.11 million.

*Full disclosure: Skyharbour Resources is an Equity Guru marketing client.

Leave a Reply