Agriculture was once making major headlines due to the war in Ukraine. It seems that those headlines have subsided, however food inflation remains to be a concerning topic for the middle class. A lot of this has to do with supply chains and the pressure on agriculture.

Agriculture doesn’t get much love from long term investors who are more focused on technology, AI, blockchain etc. But let’s think about this for a moment. Rising food prices. A growing human population. Unpredictable weather patterns either destroying crops or delaying the growing cycles. Damaged and depleted soil. Solar and wind energy having to be placed in certain areas to be effective and these areas traditionally being the best area for agriculture. Major moves in the potash and fertilizers market.

As you can see, investing in agriculture seems to be a no brainer. Technology investment thesis’ may confuse some investors with the jargon and complexity. Agriculture is something we can all understand… and feel the real effects when shopping at our local supermarkets.

As someone who follows (or at least tries to!) the moves in all markets, there have been some very interesting moves in the potash space. Before sharing some of these, let’s talk about potash.

Potash is the common name given to a group of minerals and chemicals that contain potassium (chemical symbol K), which is a basic nutrient for plants and an important ingredient in fertilizer. Most potash is produced as potassium chloride (KCl). However, we often measure and refer to it in terms of potassium oxide (K2O) equivalence for consistency because deposits can have different percentages of potassium.

Potash is used primarily in fertilizers (approximately 95%) to support plant growth, increase crop yield and disease resistance, and enhance water preservation. Small quantities are used in manufacturing potassium-bearing chemicals such as:

- detergents

- ceramics

- pharmaceuticals

- water conditioners

- alternatives to de-icing salt

Potassium is an essential element of the human diet, required for the growth and the maintenance of tissues, muscles and organs, as well as the electrical activity of the heart.

When it comes to Canada, we are the world’s largest producer and exporter of potash, with potash reserves coming in around 1.1 billion tonnes of potash. Canada is number 1, and the rest of the top 10 in 2023 compose of China, Russia, Belarus, Germany, Israel, Jordan, Chile, Laos and Spain.

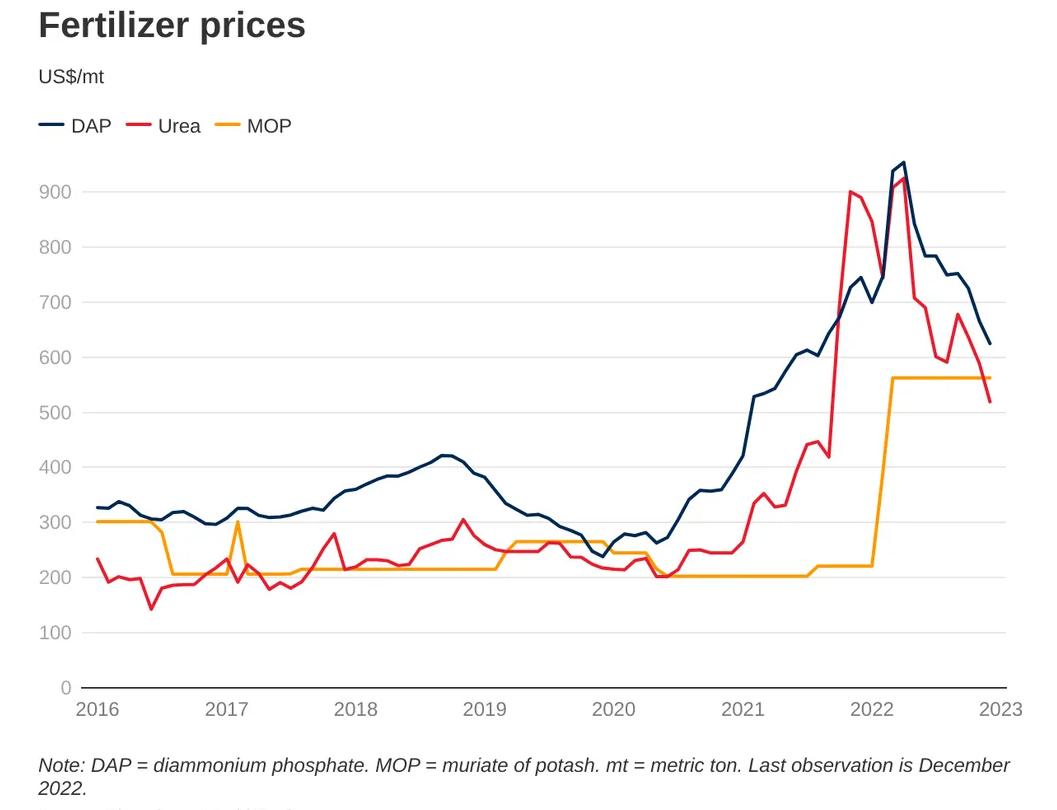

Fertilizer prices surged to new highs in 2022 continuing the trend from 2021 and influenced by war, rising gas costs, Chinese export issues and high crop prices. When it comes to Potash’s performance in 2022:

“In terms of production capacity, potash is certainly the most exposed to disruption from both Russia and Belarus when compared to other major fertilizers,” Humphrey Knight, potash principal analyst at CRU.

“Prior to 2022, the two countries accounted for around 40 percent of global supply. Although exports from both countries have faced disruption in 2022, particularly from Belarus, product has continued to flow to many downstream markets,” Knight said.

“The potash market certainly remains exposed to further disruption to production into 2023, and could see supply tighten quickly if demand recovers rapidly from its current lull,”

Even though potash prices are falling, largely due to the drop in natural gas and corn, any supply chain disruption will cause prices to rise. Some analysts believe higher potash prices will persist as the world scrambles to bring more production online amidst concerns of food security. Protectionism from some countries has been a wakeup call to the global community, spurring it to work towards ensuring food security needs are met amid a tightening of fertilizer supplies.

There are even headlines of POTASH WARS. Saskatchewan based Nutrien, the largest fertilizer company in the world, posted record earnings in 2022 when prices were rising. Nutrien plans to increase potash production from 12.5 million tonnes in 2022 to as much as 14.6 tonnes in 2023, to offset the decline in production in war-ravaged East-Europe.

But others want a piece of the potash pie. The largest mining company in the world, BHP Group, of Australia is building the largest potash mine in the world, in Nutrien’s backyard, just east of Saskatoon. Investing giant BlackRock is the largest shareholder of BHP with 7 percent of shares.

In summary, potash prices have been falling but supply disruptions remain a real possibility. When it comes to supply and demand, the long term outlook favors potash prices given protectionism and the world trying to get more potash production online.

When it comes to investing, Saskatchewan, Canada is where investors will want to look, as major moves are being made by the big boys in that area. And we believe we have found an upcoming gem.

Evolution Potash

Evolution Potash is a company run by a proven team who have worked at the executive and lead technical levels to develop 90% of Saskatchewan’s potash. The CEO is Bradley Fettis who has been involved in the potash and energy industry for over 30 years. He was the former COO of Rallyemont Energy, Vice President & Director at Athabasca Potash (BHP) and Management at PotashCorp (Nutrien).

This is a team with deep experience in the industry. Management is always key when it comes to investing in resource stocks. Having a team with experience and a strong record cannot be overlooked. I encourage readers to spend time reading about the experience on this executive team:

Now the exciting part.

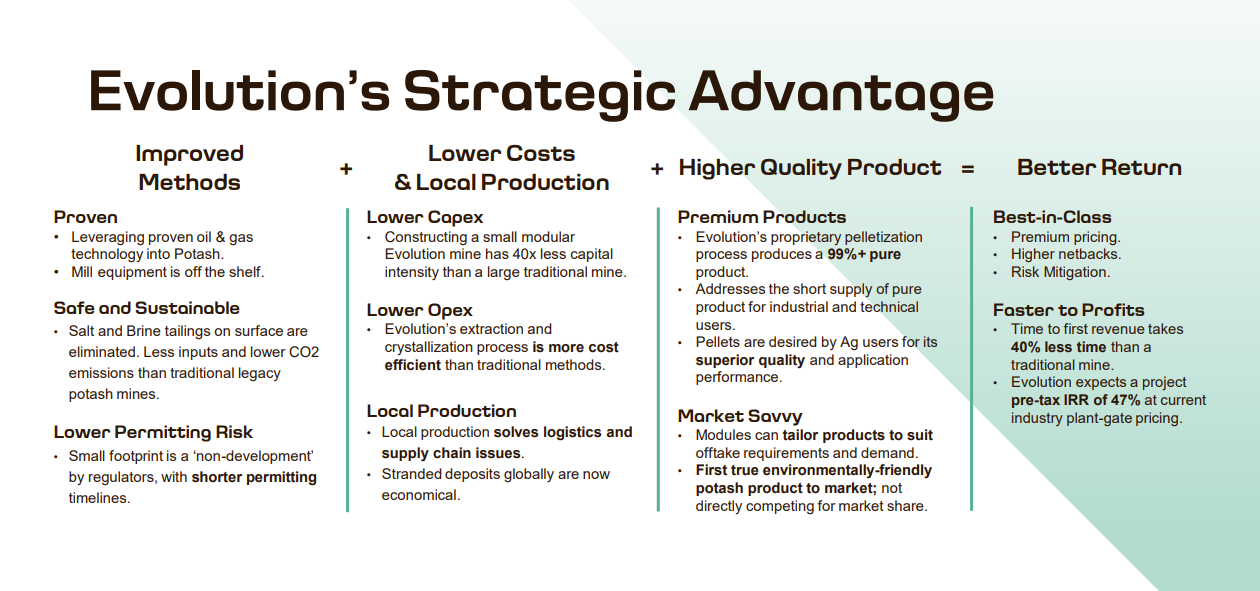

Big investing gains can be found in Company’s that do something the world needs but doing it better, cheaper and more effectively. In the commodity/resource landscape today, this also means accomplishing all of this in a way that is also minimizing the impact on the environment. When you have all of this in a Company, you truly have a disruptor. A dream for long term investors.

Evolution Potash is redefining the way potash is produced from start to finish. A better way to produce eco-friendly potash which will benefit shareholders, the industry, the customers and the communities.

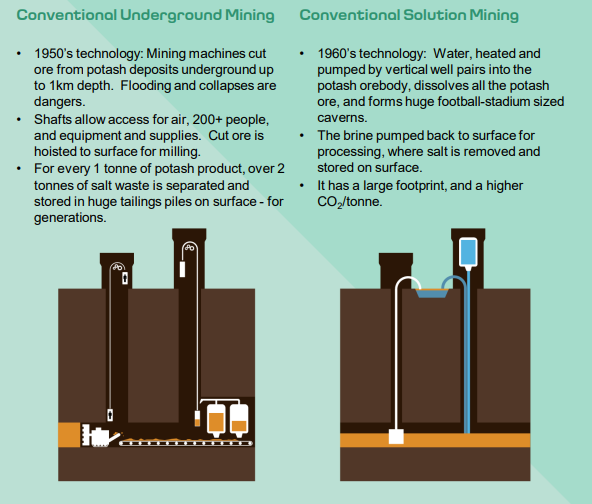

Traditional potash mining has a major environmental footprint and is impacted by high operational and capital costs. Here is the conventional way of mining:

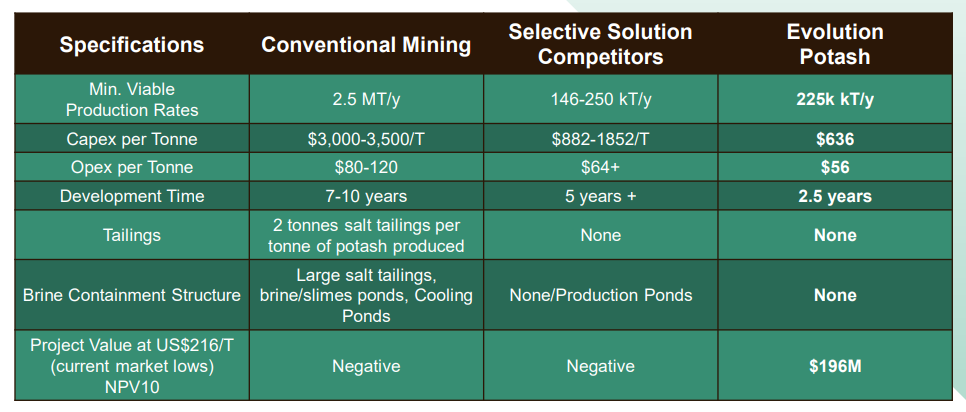

For new greenfield conventional mines, we are talking about capital costs between $5-13 billion. The environmental footprint is large due to huge sale waste piles and slimes as well as emissions. Not to mention the large surface and resource land base.

Evolution Potash is about to change this.

The Company has developed proprietary extraction and milling technologies that will enhance the economics and sustainability of selective potash production. This means:

- new generation of technologies

- high efficiency and purity

- environmentally friendly

- sustainable approach to food supply

- exceptional economics

- low cost structure

- premium product niche strategy

Evolution’s innovative technology and methods are expected to produce 225,000 tonnes of potash per year and substantially reduce the environmental impact of potash production with no tailings. The product will fill a market gap with premium industrial and food/feed grade, organic certifiable, and eco-labeled potash.

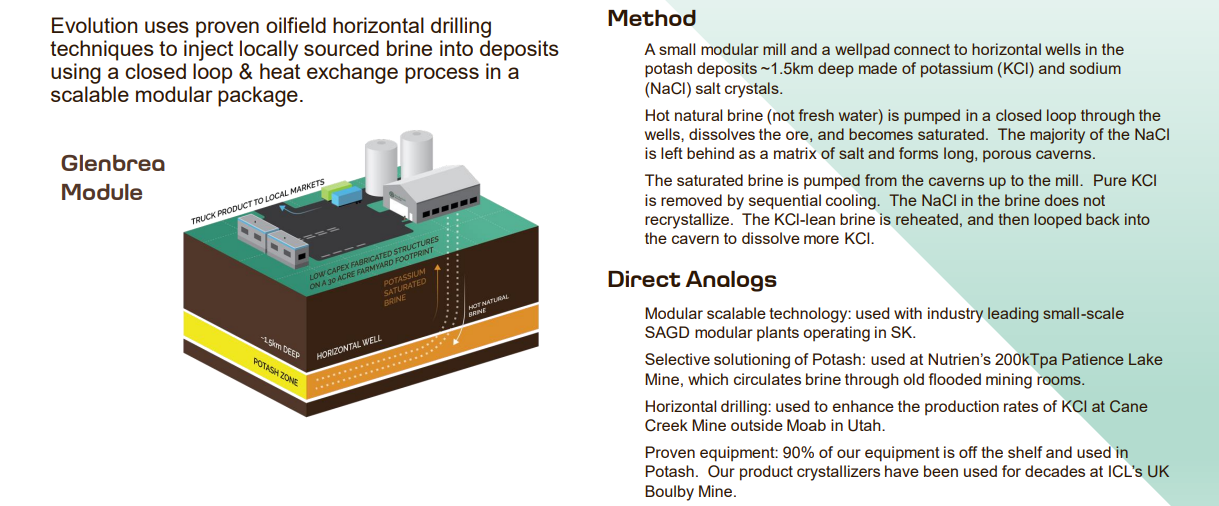

The Company does this by using oilfield horizontal drilling techniques to inject locally sourced brine into deposits. Here is a more detailed explanation:

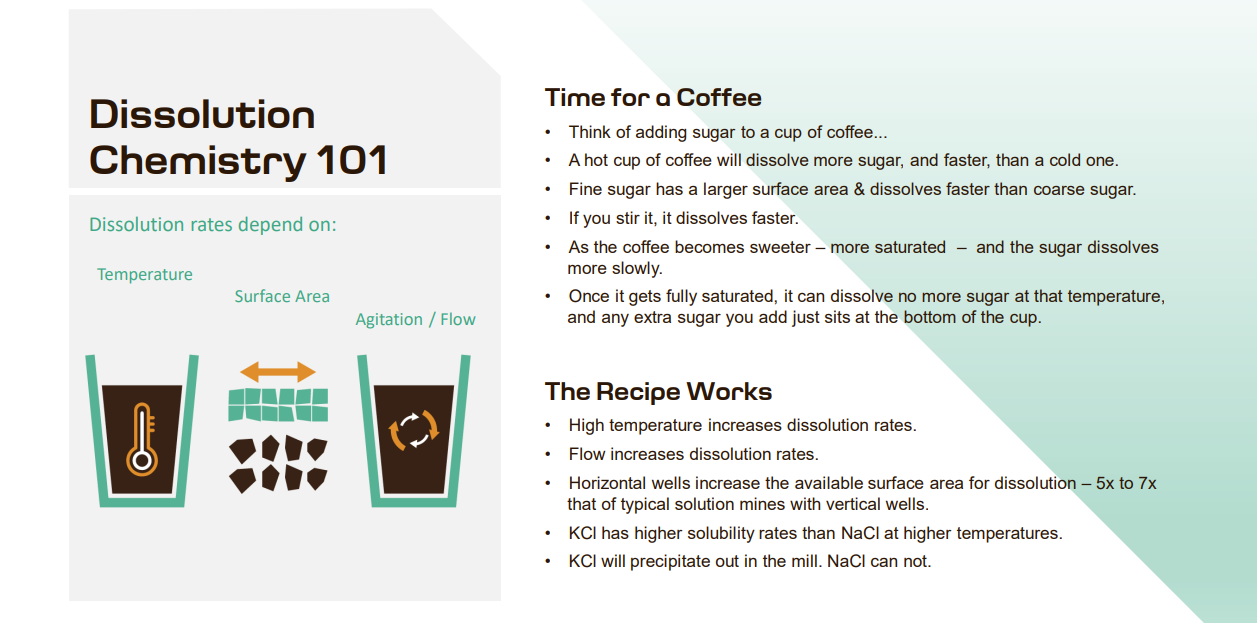

Too much mining jargon? Let’s simplify this with an example of basic dissolution from high school chemistry class:

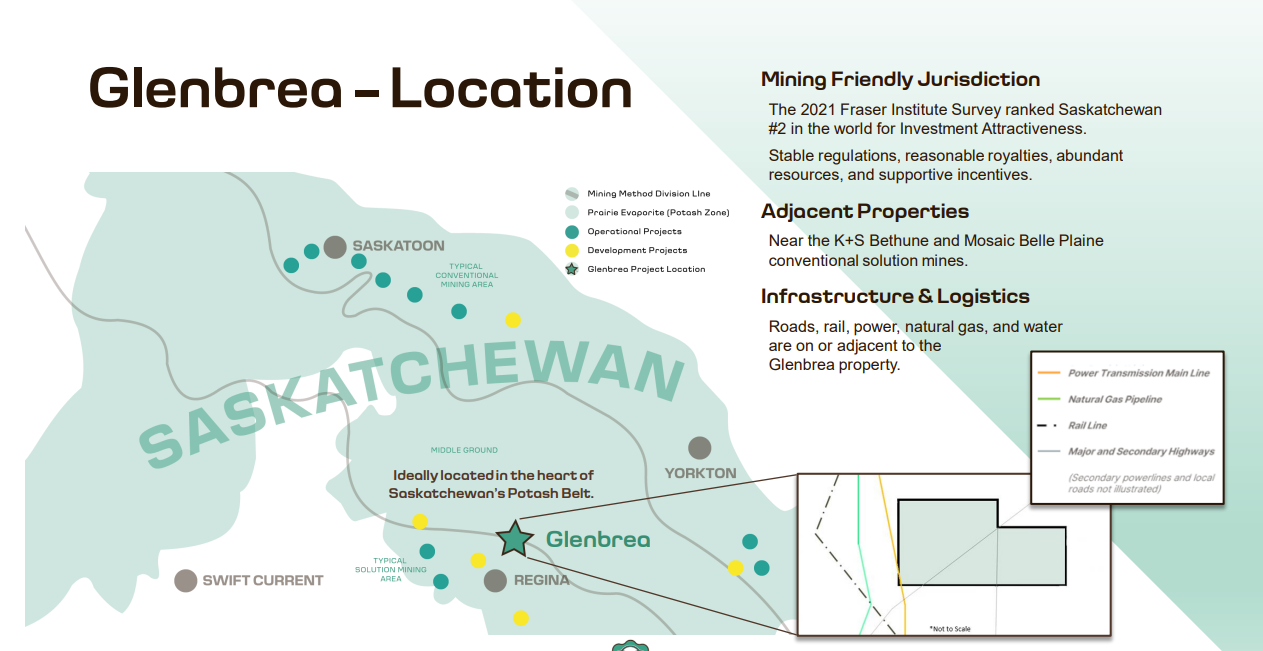

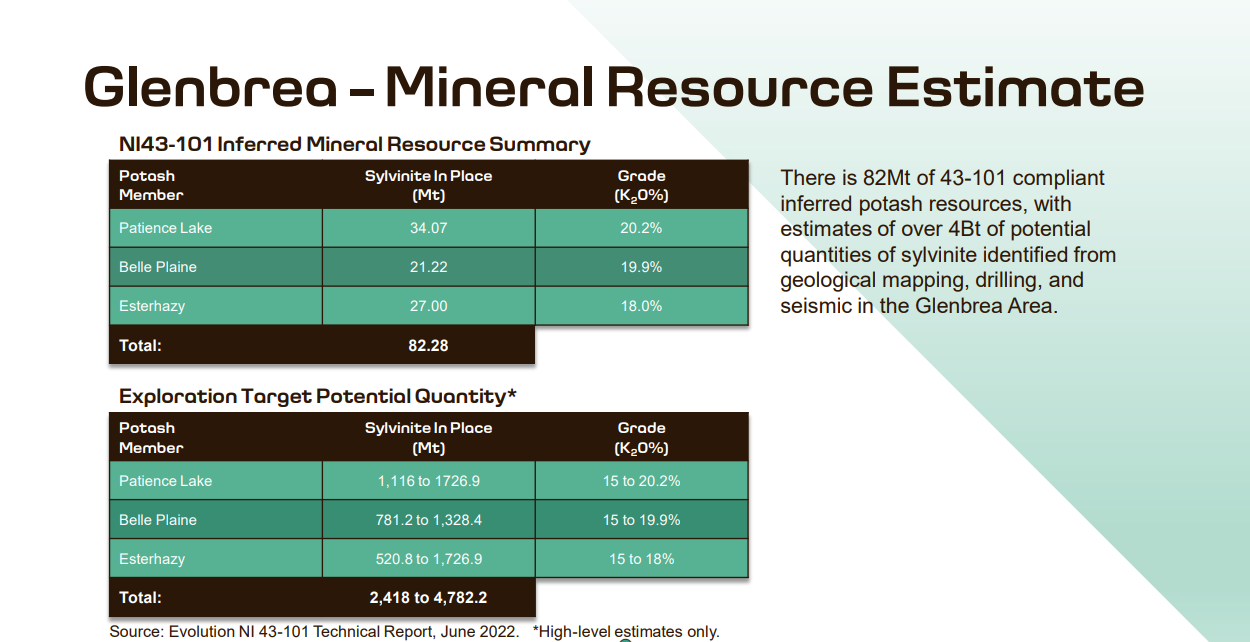

But what about the resource? Evolution’s Glenbrea project is located in the heart of Saskatchewan’s potash belt, and has access to roads, rail, power, natural gas, and water either being on or adjacent to the property.

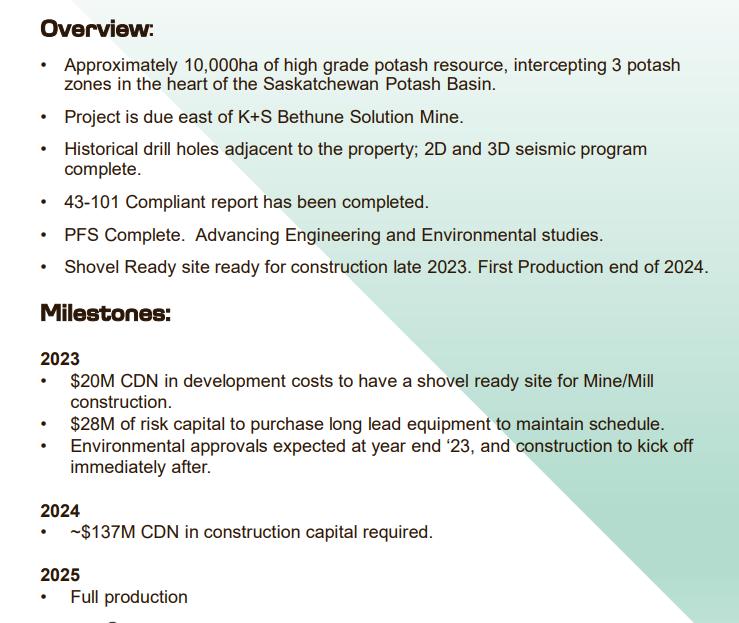

The property is derisked with a 43-101 complaint report completed, a prefeasibility study (PFS) complete, and the project shovel ready for construction in late 2023.

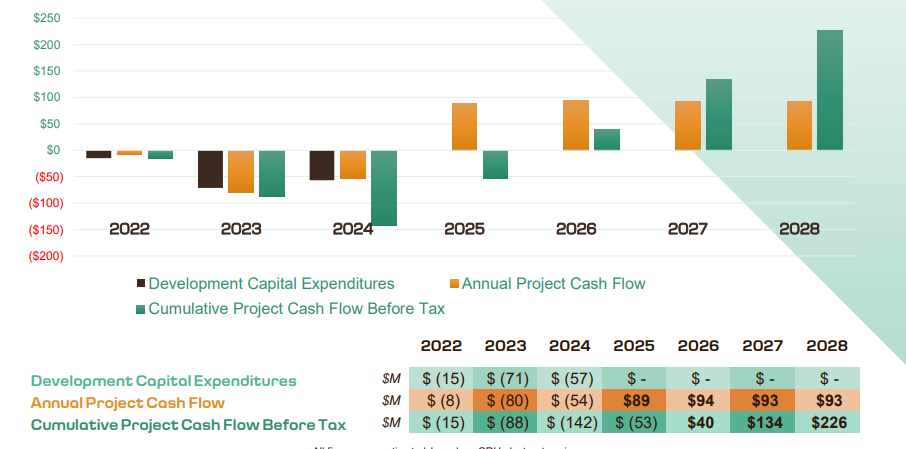

The economics is impressive with scalable growth. The project NPV is $533 million and has a project IRR of 47% at $543/tonne. The project has a low upfront capital cost of $143 million. The project has a pay back on development capital in less than 2 years!

Here is how Evolution compares with other potash producers showing that sustainable potash production is possible and the Company having the lowest full cycle development costs in the industry:

Here is an overview and summary of the project, as well as what comes next:

So to put it all together: a proven and experienced team. A project in a great jurisdiction and de-risked. Innovative potash production technology to produce more efficiently while reducing the environmental impact. Premium markets products with eco-labeled potash filling in a market gap. And finally, strong economics with a low upfront capital cost and a payback period of less than 2 years.

All of this occurring at the right time with positive long term fundamentals for potash and agriculture.

Evolution Potash is about to IPO and I am looking forward to seeing the price action. The agriculture sector may not be as exciting as it was last year, but this means there is a great opportunity to buy agriculture stocks at a good price as long term fundamentals suggest higher prices.

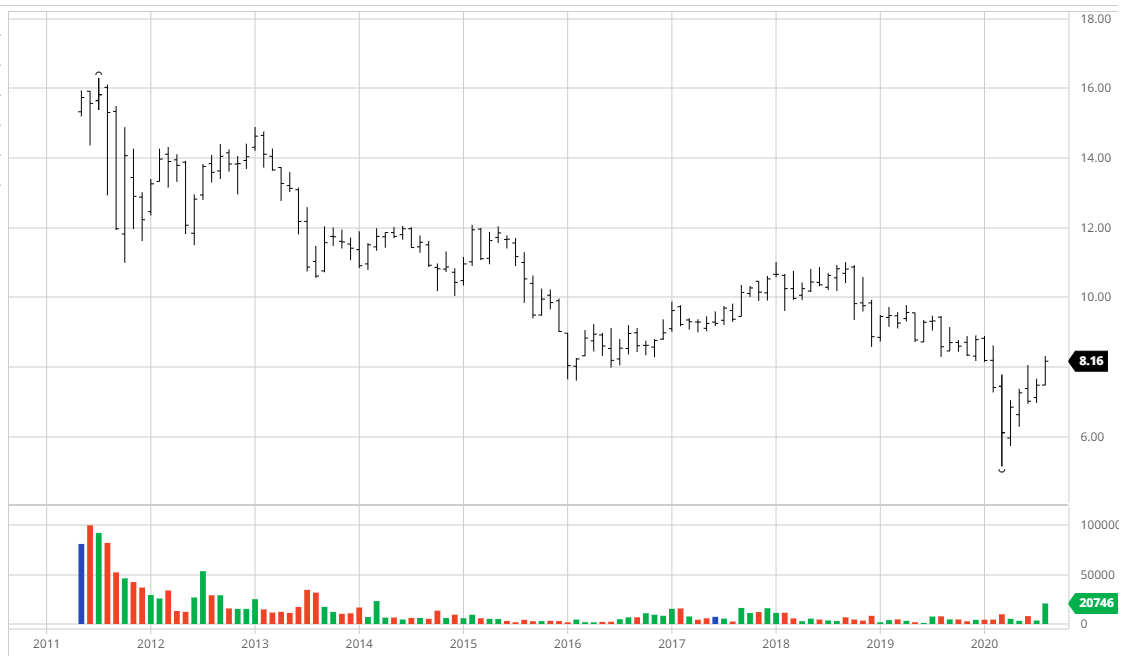

Above is the chart of the Global X fertilizers and potash ETF SOIL. It has been in a long downtrend with this chart going back to 2012. However, the recent price action is worth noting. What was resistance at the $8.00 zone is now being nullified. We are getting a nice breakout, but the most exciting part is the volume. You can see this by comparing the size of the green bar at the bottom of the chart with all those previously. You would have to go back to 2018 to see this kind of volume.

When we get a technical breakout, we want to see it accompanied with big volume. We have that here which tells me that a new uptrend in fertilizers and potash could be on the way.

Leave a Reply