British Columbia (B.C.) is once again emerging as a hotspot for mining and mineral exploration, thanks to its rich geological potential, effective regulations, and strong mining ecosystem. With 326 active exploration projects, over 1.4 million meters of exploration drilling in 2021, and 17 operating metal and coal mines, the province is making its mark on the global mining stage.

In 2021, B.C. produced a diverse range of commodities, including gold, silver, copper, and other base and industrial metals. The province’s Golden Triangle, located in the northwestern region, contains some of the most important gold deposits in Canada, with minerals worth over $800 billion. British Columbia is also Canada’s leading producer of copper and steelmaking coal.

Australian-based Tempus Resources (TMRR.V) has positioned itself to take advantage of this thriving environment with the junior explorer’s flagship Elizabeth-Blackdome Projects.

What’s so special about Elizabeth-Blackdome?

President and CEO, Jason Bahnsen, commented, “There’s a number of other players around us. There’s Talisker Resources or Westhaven. They’re at a very similar sort of stage in the drilling or have just come out with a maiden resource. So, I think Tempus an attractive opportunity, especially when you look at the valuations of some of the other peer group companies, I’ve mentioned that are in the same area.”

That potential opportunity becomes even more apparent if you work in what sets the Elizabeth-Blackdome Projects apart from other projects in the region.

Bahnsen added, “The drilling is showing us that this [mineralization] extends much farther than we previously thought. So, we have veins. These are quartz veins. You can see the gold, visible gold in vertical quartz veins. We have a number of them that are close together.”

Exploration at Elizabeth pops with high-grade mineralization

- More than 9 known vein sets on the property with high potential for additional discoveries.

- SW Vein extended 150-200m below surface and 400m along strike.

- Newly discovered Blue Vein extends the high-grade gold zone to approximately 250 meters strike, remaining open along strike and at depth.

- Newly discovered No. 9 vein high-grade zone delineated over 150 meters strike, remaining open along strike and at depth.

- Total drilling by Tempus amounts to 80 drillholes. This together with data from an additional 49 drillholes completed in 2010/11, will be included in an updated JORC/NI43-101 resource estimate for the Elizabeth Project.

This accelerated exploration activity and planning is pushing a fast track to production at Elizabeth not to mention the junior contracting a mill restart study for completion in H1 2023. Then you have Tempus’ reduced capital requirements at Elizabeth which will most likely facilitate early monetization.

And there’s still so much more to come, with the project’s land package, covering a 315 square kilometer license area, there are considerable opportunities for new greenfield discoveries.

So, what’s all this about infrastructure?

The Elizabeth-Blackdome Projects benefit from existing site infrastructure, including a 200-tonnes-per-day permitted mill and tailings facility, an exploration camp at the Elizabeth Deposit, and plans for new haul roads and road upgrades.

Bahnsen continued, “Having these milling assets in place already, that are permitted, things are mitigated quite a bit from a risk viewpoint. The permitting risk is low. The infrastructure is already developed. We’re focusing on the resource.”

Elizabeth-Blackdome highlights

Elizabeth Gold Project

- High-grade mesothermal gold mineralization in wide (1.5-5m) vein sets.

- Potential for processing at Blackdome Mill with ~95% gold recovery using conventional methods.

- Drilling started in November 2020, with 80 holes and 19,500 meters completed to date.

- 2009 estimated 206k oz inferred resource at a grade of 12.3 g/t Au, targeting an updated “Maiden” resource in Q2 2023.

Blackdome Gold Mine

- High-grade epithermal gold mineralization and previous producer with ~230k oz at 22 g/t Au mill head grade.

- Tempus drilled 5,000 meters at Blackdome in 2020, completed an alteration study, and plans further drilling in 2022.

- Permitted 200 tpd capacity mill and tailings storage on site, suitable for processing Elizabeth and Blackdome ore.

- 2010 estimated 53k oz indicated resource at a grade of 11.3 g/t Au.

Blackdome Mill

- Restart study currently underway, led by JDS Mining.

- Blackdome Project is approximately 30 km north of the Elizabeth Project and connected via contiguous claims along an existing forestry track.

- The Blackdome Mine includes a 200-tonne/day conventional gravity separation and flotation mill and a permitted tailings storage facility.

- Metallurgical studies confirm 95% recovery for processing mineralization from Elizabeth.

- Existing infrastructure provides a path to a low-capital, fast-track restart.

Blackdome Mill – Historic Production

- Mining ceased in 1991 after 330,000 tonnes of ore had been milled at a grade of 21.9 g/t.

- Over the period from 1986 to 1991, 231,547 oz of gold and 564,300 oz silver were produced from the project.

Tempus’ strategic approach and extensive exploration activities have the potential to deliver significant value for its shareholders and contribute to the growth of the gold mining industry in British Columbia, but remember Tempus is international.

Mining in Ecuador

Ecuador, with its abundant gold, silver, and copper deposits, has emerged as a prime location for mining explorers seeking to develop mineral resources in Latin America. The country’s innate geological potential, encouraging exploration results, and a supportive legal framework for mining have made it an ideal destination for business development in the sector.

Ecuador is considered one of the best places in the world for making significant new mineral discoveries. The country shares similar geological and metallogenic potential with its southern neighbors, Chile and Peru, which contribute 25% and 15% of the annual world copper production, respectively.

Tempus Resources is capitalizing on opportunities in Ecuador with its Zamora Projects, comprising the Rio Zarza and Valle del Tigre projects. These projects are located in southeast Ecuador, with the Rio Zarza project being adjacent to Lundin Gold’s Fruta del Norte project. Meanwhile, the Valle del Tigre project is undergoing a sampling program to develop anomalies identified through geophysical work.

Valle Del Tigre Project:

The Valle del Tigre project is an early-stage exploration project in the highly prospective Cordillera del Condor mineral belt of southeast Ecuador. The project is situated near Lundin Mining’s Fruta del Norte gold-silver mine and CRCC-Tongguan Investment Co.’s Mirador copper-gold porphyry deposit. In 2019, Tempus conducted a ZTEM, Magnetics, and Radiometrics helicopter-borne geophysical survey over the area, which highlighted two zones of anomalous copper and gold values. This project shows potential for both copper and gold mineralization.

Rio Zarza Project:

Rio Zarza comprises two concessions covering approximately 1,000 hectares, directly adjacent to the west of Fruta del Norte. Previous exploration on the property was carried out from 2008 to 2012 and included surface magnetics, induced polarization (IP), gravity surveying, soil/stream sediment sampling, mapping, and limited diamond drilling. Tempus has completed additional sampling and mapping and has permits in place to drill the down fault extension targets associated with the Fruta del Norte deposit.

Tempus Resources is well-positioned to capitalize on the promising mining market in Ecuador, thanks to its experienced management and board of directors. With a diverse range of skills and experience in mining, resource investment banking, and corporate governance, the leadership team is well-equipped to navigate the complex landscape of sustainable mine development and drive the company forward in Ecuador and beyond.

Technical analysis

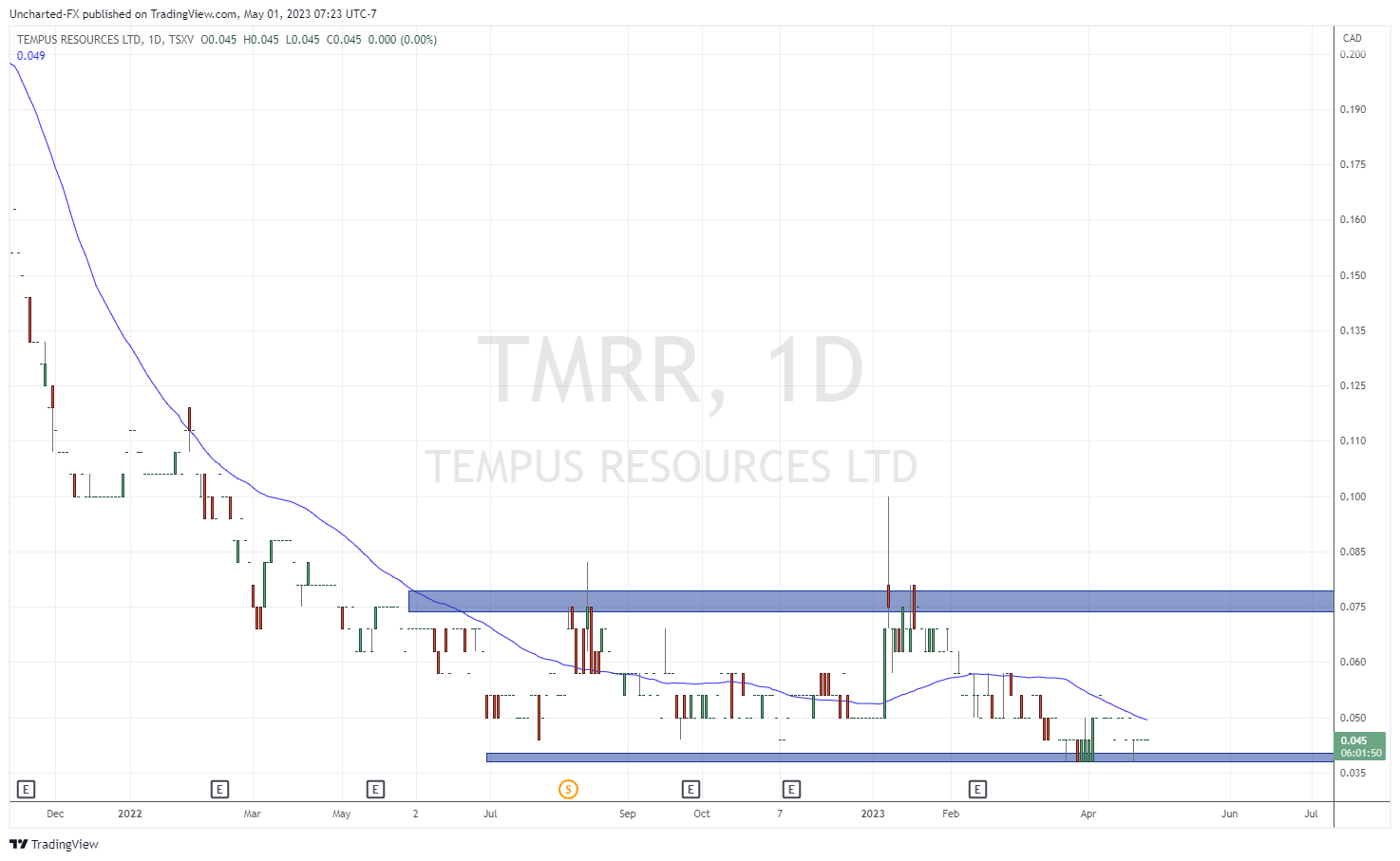

When it comes to the chart, Tempus Resources is in the consolidation or range phase of market structure. This phase is the ‘in between’ phase and generally represents the exhaustion of one trend and thus, the beginning of a new trend. In the case of Tempus Resources, since the range has printed after a long downtrend, this range indicates the selling pressure exhaustion and the potential for a new uptrend to begin.

A range has two levels: support and resistance. Resistance is the price ceiling. It is an area where we expect sellers to be, or where range traders take their profits. For a stock to start a new uptrend, this range must be broken which means price must close above resistance. The new uptrend trigger on Tempus Resources would be a break and candle close above the $0.075 resistance level. You can see the last two times the stock tested resistance, the sellers came stepped in. Perhaps the third time will be the charm.

When we talk about recent price action, Tempus Resources is testing support, or price floor. This is an area where we expect buyers to be, or where range trader short sellers take their profits. Looking at the recent price action, we can tell there is a strong presence of buyers around the $0.04 support zone. On April 5th 2023, we printed one of the strongest single price action candles there is known as the engulfing candle. A very strong sign that buyers are here in strength.

Then on April 25th 2023, a candle stick with a large wick was printed at support. This weird looking candle is known as a dragonfly doji. Both of these types of candlesticks signal a potential reversal. We have had both printed at the $0.04 support zone which signals the importance of this zone, and the fact there are many buyers here.

This zone is also a previous all time record low for the stock, which tends to be another strong confluence for support and potential bottoming and reversal. With strong bullish candlestick patterns, investors should next watch for the volume profiles to increase which would give a stronger bounce higher from this important technical zone.

A strong team

At Tempus Resources, the exceptional management and board of directors play a crucial role in the company’s success. With a diverse range of skills and experience in mining, resource investment banking, and corporate governance, the leadership team is well-equipped to navigate the complex landscape of sustainable mine development and drive the company forward.

Jason Bahnsen, president and CEO, has over 30 years of experience in natural resources finance and operations. His background in corporate executive roles and mining engineering roles in the resources industry make him an invaluable asset to Tempus Resources.

Alexander Molyneux, the Non-Executive Chairman, brings over 25 years of experience in corporate executive roles in mining and resource investment banking. His knowledge and connections in the industry have helped to shape Tempus Resources’ strategic direction.

Jonathan Shellabear, a Non-Executive Director, has an impressive 30 years of experience in the mining and financial services industries. His extensive capital markets and advisory experience, along with his technical, commercial, and financial expertise, contribute significantly to the company’s growth.

Colin Russell, another Non-Executive Director, is a professional geologist with 40 years of experience in mining and geology. His work on projects ranging from grassroots through to feasibility in various locations worldwide provides essential insights for Tempus Resources’ exploration endeavors.

Sonny Bernales, the Exploration Manager, has over 35 years of experience working on projects across a wide range of deposit types and commodities, primarily in gold and copper. His expertise in various geologist roles for mining companies around the world strengthens Tempus Resources’ exploration capabilities.

So what’s ahead?

Investors can look forward to a strong news flow in 2023, with up to 10,000 meters of drilling planned, targeting the No.9/Blue Vein intersection area and expanding newly discovered veins. The Q2 2023 updated resource estimate will incorporate approximately 129 new drill holes, further emphasizing the company’s progress.

The upcoming JDS study on plant restart highlights low capex restart options, while additional engineering work planned for 2023, including preliminary mine planning and haul road design, will pave the way for a comprehensive PEA/Pre Feasibility study.

Moreover, Tempus Resources offers exciting upside potential with its copper/gold projects in Southeast Ecuador, diversifying its portfolio and providing exposure to multiple commodities.

With an attractive valuation and a strategic focus on resource expansion, fast-track development, and near-term production potential, Tempus Resources is well-positioned to capitalize on the opportunities in the gold mining sector, delivering significant value to its shareholders and contributing to the industry’s growth.

Leave a Reply