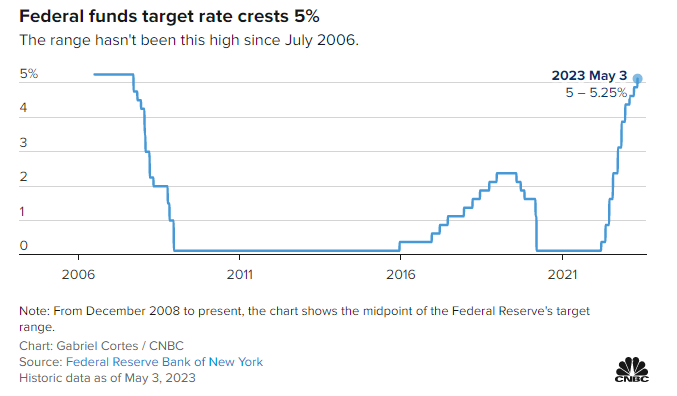

Well what developments in the past 24 hours. Investors and traders were anticipating the Federal Reserve meeting. A 25 basis point hike was expected along with some statement hinting at no more interest rate hikes.

Well, the market got the 25 basis point hike (the Fed’s 10th rate hike in a row), and some sort of hint at the Fed pausing, although it was not an actual pause. Financial media is calling this a ‘hawkish pause’.

Powell did say at the meeting that “a decision on a pause was not made today“, but traders took the changes in the statement language around future policy as a sign that the Fed might be done. The omission of the statement, “the Committee anticipates that some additional policy firming may be appropriate”, which has been in all the past Fed statements, has led to the idea that the Fed is pausing.

However the Fed did include in its statement that, “additional policy firming may be appropriate” and the Fed “will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Quite frustrating I know. And with the Reserve Bank of Australia doing a surprise interest rate hike this week when it paused, you just never know what central banks will do. All we know is that they will act on the data.

If you look at the Fed futures, a lot of investors are betting on rate cuts even as early as Q4 this year due to a recession. But the Fed did say that interest rates must remain higher for longer and they will not cut rates prematurely.

But perhaps recent banking events may get the Fed to cut earlier than expected. This week began with First Republic Bank being the third US bank failure since March 2023. Powell was asked about the banking system and he said that the US banking system remains “sound and resilient“.

What followed the meeting and post market was a huge plunge in regional banks with PacWest leading the way down:

I have been sounding the alarm bells on the banks in recent weeks. I even highlighted the chart of the US regional banks ETF ticker IAT. I warned that:

Individual regional bank stocks have the similar market structure to the US regional banks ETF, ticker IAT, which I have shown above. A major sell off and breakdown below support in early March due to the banking crisis headlines. Since then, regional banks have begun to range. A range generally is a sign of trend exhaustion, meaning in this case, the downside trend could be over. However, consolidation cannot be considered a bottoming until we see a breakout. Until then, the range could just be a pause in this downtrend.

This means that banking fears and more downside for US regional banks may not be over.

Well, we got the breakdown we were looking for, and the downtrend remains intact meaning more banking headlines are still to be expected.

The big question is if this becomes worse, will we see the Fed act to ease credit conditions? Or will they do nothing and allow the megabanks like JPMorgan to consolidate the regional banks into their clutches, making the mega banks even bigger in the process? My money is on the latter (unless we see a megabank fail!).

When it comes to the US markets, there isn’t really much to say. Our ranges are still in play, and we await a break in either direction to give us the signal for the next move. However, the longer this range persists, the more likely it is that we fall to the downside and move lower.

I also suggest following the price action in the Japanese Yen and the Swiss Franc. Both of these currencies see a bid when there is risk off. Some even consider these currencies a safe haven from the safe haven (the US Dollar). We are seeing big moves especially in the Swiss Franc.

But we are also seeing a major move in another safe haven.

Gold is making big moves.

I wrote an article stating that gold has made record highs against fiats such as the Australian Dollar, the New Zealand Dollar, the Japanese Yen, the British Pound, and the Indian Rupee. Well you can add the Hong Kong Dollar and the Canadian Loonie to the list.

Yes that is right folks, new all time highs against the Loonie.

When I see these moves in gold, I am looking at it more from a risk perspective rather than the financial media ‘gold will go higher when the Fed pauses’ move. When I look at other assets like the Swiss Franc and the Yen, something is up. Investors seem to be preparing for the worst, and it might have something to do with the banking headlines.

A lot of eyes will now be on Gold/USD. Seen as the anti-dollar, gold is testing previous all time highs against the US dollar. From here, we can either sell off and potentially forming a triple top pattern. This would lead to a move lower just as we have seen the past two times we have tested this zone.

Alternatively, we can keep this uptrend going on the daily chart with an eventual breakout into new record all time highs. The daily candle is showing a large wick indicating sellers are near this resistance zone, but the uptrend remains intact. The higher low we are working with comes in at the $1980 zone, however $2000 is a strong support zone going forward.

In summary, the Fed may be pausing but it is a hawkish pause. They have put themselves in a position where they can go either direction by still raising rates, or pausing given the data. Interest rates are likely to be higher for longer with no rate cuts coming soon. US regional banks continue to feel the pinch and will likely lead to the bigger banks consolidating the smaller ones. Price action in gold and other currencies indicate some fear.

Leave a Reply