Welcome to the latest edition of the all singing, all dancing, all set to take over humanity and bring about the singularity, AI Markets Update.

This week, we see one company ripping on the back of pioneering work, another rolling on the back of consistent B2B contracts, and another zeroing in on its core business by spinning out non-core items. Which is all much better than the ‘this is bullshit’ updates of the past few editions, I’ll tell you.

NEXTECH AR (NTAR.C) has made a bold decision to spin out its subsidiary Toggle3D.AI into a new IPO, bringing value to existing shareholders, as of June 13.

Toggle3D can be explained to the layman fairly simply; converting CAD (computer aided design) files into 3D models for things like e-commerce can be a tedious task, especially when some companies have literally thousands of them on file. Having a literal 360-degree viewable 3D image of a product is WAY more effective for driving e-commerce than a 2D image, as anyone who has ordered something off Amazon knows all too well.

But large retailers can have tens of thousands of SKUs in their catalogue, most of them with trash imagery that came from the supplier and, sometimes, can even be ineffective at showing the true product.

Compare that to a shiny, spinnable image of a product taken from the actual CAD file.

The problem with this has generally been you needed a designer to do the conversion, even with industry tools, one at a time. That’s been expensive.

But Toggle3D largely automates this process, using AI to do the conversion and making the files exportable in bulk. Now, a designer merely needs to check and approve each SKU rather than building each from scratch.

BUT DOES IT WORK?

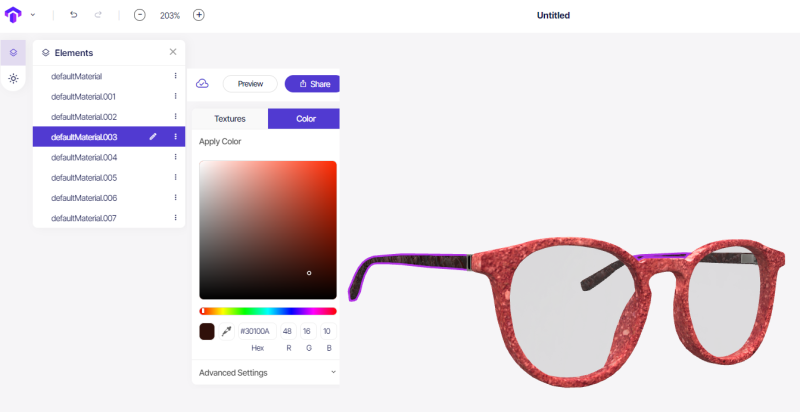

Hells yes. I did one. I made a pair of glasses with a chiseled granite look with the FREE account Toggle3D lets you set up.

Yeah – this isn’t one of those ‘call our sales guy to get a demo’ businesses, this is a legit tool that you, yourself, yes you can try for free and use from minute one.

Didn’t need a fat tutorial. Didn’t need a code background. Did it all in three minutes, soup to nuts.

Let’s just take a moment to respect THE SHIT out of this for a minute.

There are a lot of e-commerce B2B groups out there that will put up a website, make a lot of promises, and either keep the actual tool behind a fat subscription or account charge, or give you some hamstrung free version dependent on you putting in your credit card details with a view to getting chokeslammed by charges when you inevitably forget to cancel.

This is just a free version of the tool and it works as promised – except for the AI.

Now, if you’re Home Depot and you need 22,000 CADs converted, you’re going to need that AI tool to do the mass convert, and I’d be interested to see if the tool actually pulls off something close to 100% of the conversions without the help of a meat puppet, but if it does, this is a BIG DEAL.

From the company, describing its patent-filed ‘FIXED POINT DIFFUSION OF 2D TO 3D MODEL CONVERSION’ process:

Diffusion models provide a solution for creating 3-D models from 2-D reference photos, either as a whole, or part by part by evolving differentiable, deformable templates to convert into 3-D parts, conditioned on one or more reference photos of the part. Fixed-point diffusion builds on that idea and ensures the resulting final mesh has clean, predictable quad topology suitable for further editing and rendering. As previously announced, over the past several years Nextech has been building tens of thousands of high-quality, fully textured, 4K photorealistic 3-D assets, with millions of individual parts. These 3-D parts get harvested into Nextech’s 3-D parts library, synthetically rendering them from random views, and using them to train new diffusion models that are able to autonomously reconstruct 3-D mesh parts from reference photos.

Now you add AI to this library of parts, and you can convert 3D models not just from CAD files, but from 2D photos. This changes EVERYTHING.

Mass retailers will flock to this software and service, and if the patents Nextech have filed are granted, they own the industry.

Four million shares of the company will go to NTAR shareholders on a pro-rata basis.

Meanwhile, NTAR will stick to its core business, which is for another day.

Real AI with a real tool that helps real companies, with a real business model. Love it.

PLURILOCK (PLUR.C) RUNS ITS REVENUES UP HARD

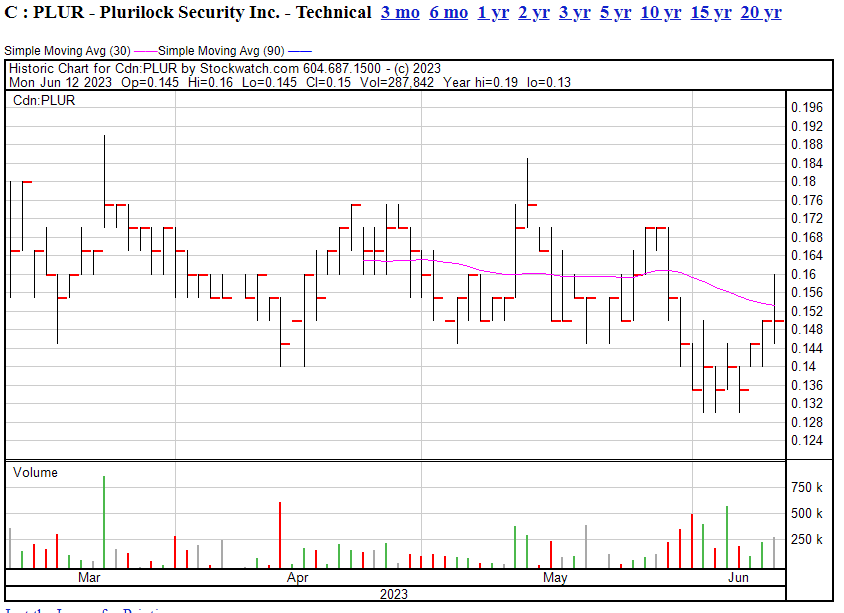

We told you computer security and ID verifier Plurilock (PLUR.C) was going to take a spell to show people how its revenues look without spending more money on acqusitions, and they did. What did it show?

- Quarterly revs of $15.8 milion, up from $7 million a year earlier

- Projected annual revs of $62.4 million, on a market cap of just $13.4 million

- Gross margins up more than double, from 6.6% to 13.6%

Still running at a loss, but that adjusted EBIDTA was down to under a million, as opposed to double that last year, and the company raised enough cash in the quarter to cover that.

Meanwhile:

- A total of 16 sale orders and contract renewals, including cross-sale purchase orders with two U.S. financial institutions for the company’s flagship AI-driven (artificial intelligence) technology offering were announced

This is all good stuff. Right now, the only thing keeping Plurilock’s stock from running hard is the number of investors on the fence, hoping it can continue to shave that narrow loss and remove a little more risk.

Maanwhile, the new AI product continues to sell.

Plurilock Security Inc. and related subsidiaries, has received a sale order for its flagship software platform, Plurilock AI with an overseas health care administrative services provider. The customer provides third party administration in health care services and has over 500 locations across 29 states. According to the terms of the contract, the customer will license the cloud security functionality of the Plurilock AI platform, which includes single sign-on, access control management, password policy and self-password reset.

..and more:

Plurilock Security Inc. has received a sale order for its flagship software platform, Plurilock AI, with an overseas utility infrastructure developer. The Customer’s portfolio which includes projects that are completed and under development, covers over 10,000 kilometres of power transmission lines across two countries. According to the terms of the contract, the Customer will license the cloud security functionality of the Plurilock AI platform

I continue to believe in Plurilock as a company that has shown its work, again and again, as a valued developer and distrobutor of uniquie identifying software that only becomes more valuable with every pssing month and announcement by big companies that computer security is getting harder, not easier.

Between August and September, as President Vladimir Putin indicated Russia would be willing to use nuclear weapons to defend its territory, [russian hackers] Cold River targeted the Brookhaven (BNL), Argonne (ANL) and Lawrence Livermore National Laboratories (LLNL) [nuclear facilities], according to internet records that showed the hackers creating fake login pages for each institution and emailing nuclear scientists in a bid to make them reveal their passwords.

With both infosec and AI being hot industries with investors, Plurilock has the tiger by the tail and, as evidenced by growing trading volume, the markets are starting to figure it out.

VERSES (VERS.T) TO THE MOON? SPATIAL INTERNET HEATS UP WITH APPLE ANNOUNCEMENT

When Mark Zuckerberg announced he was sinking many billions into the metaverse, the markets took his alien-being ass out behind the woodshed and tanned his behind for his sheer stupidity in doing so without a clear reason to bother.

Sure, those of us who saw Ready Player One at the movies like the idea of the ‘next internet’ that will have not only the bandwidth but the user tools and hardware needed for us to all ‘plug in’ to the internet in a 3D, all engaging way, but we’re also not dumb enough to think the first outfit that sets out to build that is going to actually be able to. Come see us in a decade. First through the wall, sore head and all that.

So when Apple CEO Tim Cook announced the new Apple Vision Pro (was ther a Vision Amateur we didn’t hear about?) would be a VR headset that looks mildly like Wall-E and costs around $4k after taxes and foreign exchange rates, most appeared to write the gadget off.

I mean, sure, it’d be great to watch a movie on a massive virtual big screen – if you don’t already have a real big screen on your wall, and if you don’t mind watching movies by yourself, and if you’re not bothered about wearing giant goggles for two-plus hours, and if you don’t mind having to be plugged into a power bar because the battery life dies at two hours…

Basically, this ain’t it, and the fact that Tim Cook didn’t wear one at the reveal tells you he knows.

If I wake up Thursday and absolutely need to look like a villain from a 1980’s ski hill sex romp movie, I know where to go.

Anyways, so why do I bring this up?

Because Apple is going heavy on some terminology that we’ve been talking about for a while, that it seems the world is catching up to; the Spatial Internet.

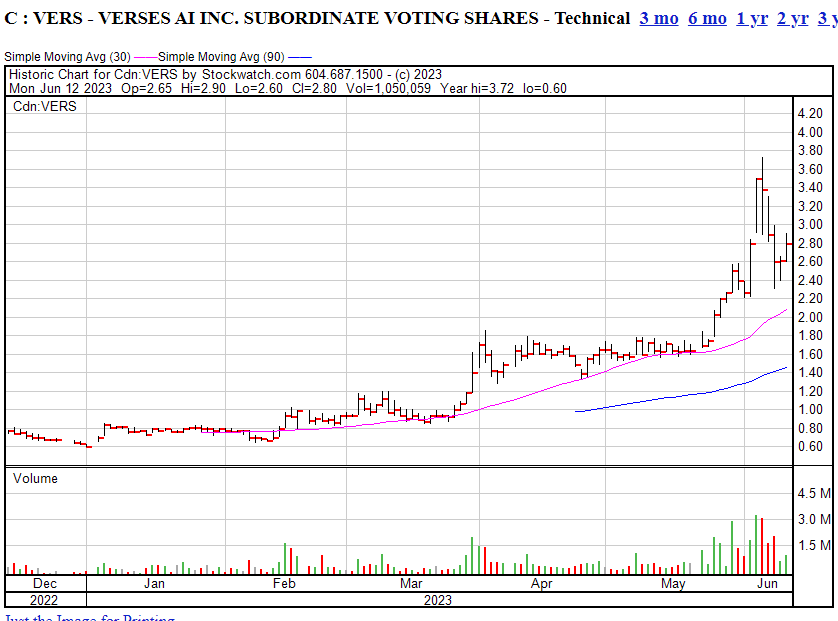

Our former client, Verses (VERS.T), has been on an absolute charge for a few months as their early work pioneering the spatial internet is starting to bear fruit with the big boys.

For mine, the guts of the Vision Pro annuncement is less about the product being advertised and more about the technology behind it. No VR headset is going to sell like hotcakes because so many of us are concerned about being kicked in the nuts or falling down stairs or cricking our neck or looking like a nerd when we put them on.

But that will change in time, when someone upgrades this mess of cameras and sensors and wiring into a simple set of glasses that contain all the hardware and software necessary.

That’s not now. That’s for later, and Apple knows it. In the meantime, it will serve as a dvelopment space for spatial internet content, and THAT is where Verses is going to fly.

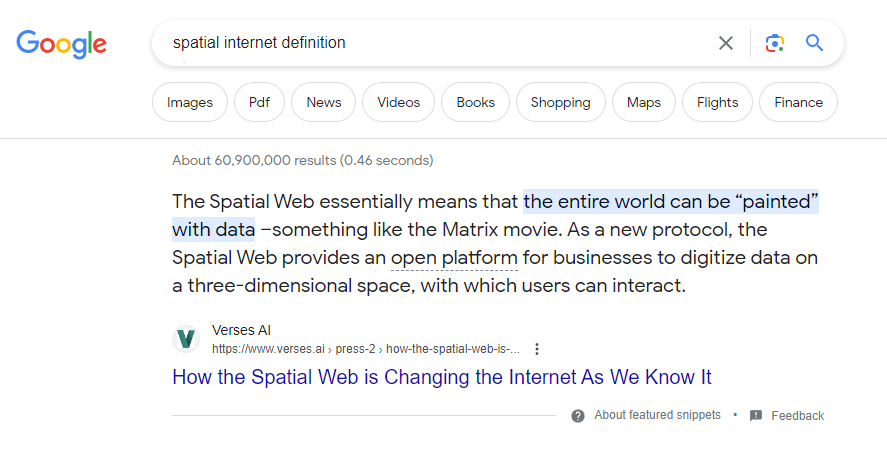

I went to Google to find an easy layman’s translation of what the Spatial Internet is, and it delivered as you can see below.. but what’s really important is what Google considered the ultimate authority on the Spatial Internet… Verses itself.

Interesting! So here’s Apple going all in on the Spatial Internet, and everyone who googles that term is brought to Verses to explain it for them.

Why? Because they wrote the fucking rules on the Spatial Internet. Like, the actual protocols.

Imagine if you could invest in a company, in 1993, that wrote HTML, the language the entire internet has been built on. Verses is that, but for what’s next.

They also just brought in $7m in stock options and warrant cash, and they’ve just published a paper on Explainable AI, in case you’re wondering if they know their way around the artificial inelligence space. Then, the patents..

Verses AI Inc. has filed a patent application covering a milestone invention for automating the generation of intelligent software agents directly from data sets that can interact with both software and hardware systems, such as robots, drones, sensors and actuators.

We spend a lot of time pricking the balloons of bullshit AI companies spinning mindless word drivel in an attempt to show you they have an actual business where they don’t.

Verses is the opposite of that. Try to keep up.

Lastly, let’s close out with a company that is very much in the AI space, but has struggled to get the message out.

AMPD Technologies (AMPD.C) – a venture I’ve been invested in since its market inception, is struggling this week after its interim CEO ‘lost sight of the northern star’ and bailed on his job at the absolute worst time for market confidence.

AMPD had recently lost former CEO Anthony Brown after a corporate reshuffle insisted on by potential new investors. But the replacement, James Hursthouse, posted one corporate upodate webinar which gave the stock a boost, then stepped down two months later after the potential new investor dipped.

For mine, it’s okay for a company not to pull off its business plan without mistakes and hiccups. That happens at nearly every company, and sometimes how you deal with those issues makes your company stronger as a result. The best of intentions aren’t always enough to make a venture a big success but the thing that, to me, is most important is whether you fight for investors when it’s easier not to do so. Because when you show up at your next venture, people will remember less that the last one didn’t come off and more that you stood with them and fought for their money.

Brown had absolutely no responsibility to come back to his old role, just weeks after being asked to stand down, and to take on the task of finishing a clean up someone else started. But that’s what he’s done because, if he didn’t fight for investors, nobody else was going to.

As for how it’s going – he’s got several irons in the fire and discussions continue on what might be the best path (or paths) forward to take proper ongoing advantage of what’s been built, but credit to Brown for committing to the cause. Regardless of whether AMPD comes out of this process better or for the worse, he’s shown that his primary responsibility is to investors, not himself, which is a rarity in this business and will see me trust him with my dough again, at AMPD or somewhere else.

THE RECAPS: The latest news from previous AI update targets:

Bluesky Digital BTC.C:

We said: “I have no freaking idea what the hell Bluesky Digital does, how it does it, what it owns, and what the hell is even happening here because either the management team are ESL students with bad translation software or they’re deliberately obfuscating for as long as they can in the hope people will just surrender to frustration and stop asking what they do.”

Since: BTC is writing off hundreds of thousands in debt by issuing stock at $0.03-0.05. It’s selling equipment. It doesn’t mine crypto anymore. It loses $1 million per quarter and has $50k on hand. It’s toast.

Our advice: Burn it with fire.

Energy Plug (PLUG.C)/VPN TECHNOLOGIES (VPN.C):

We said: “VPN Technologies put out a news release in February that it was announcing a “new AI business division.” Cool. I’m announcing that I’m qualifying for the Olympics as a 6’2″ 20-year-old Dutch skier.”

Since: VPN was such a wasteland of failure and overhyped terminology, they changed their name and went all in on AI. They describe themselves as “a software development company encompassing cutting-edge artificial intelligence (AI) and machine learning capabilities, complementing its existing suite of software development activities, including developing software technology utilizing advanced algorithms and real-time data analysis to monitor electric vehicle (EV) charging stations, as well as AI-enhanced software development services and intelligent networking solutions for the virtual private network (VPN) sector targeting retail and SME (small-to-medium-sized enterprise) markets.”

Let’s be clear; none of that is real. Regardless, it went from 2c to 17c.

Our advice: Don’t even go near this thing, it will give you AIDS.

Alpha Metaverse Technologies (ALPA.C):

We said: “E-sports. Crypto. NFTs. Metaverse. It’s like a murderer’s row of disappointing tech shifts. If they could figure out a place to fit ChatRouelete and MySpace, you’d have the full tech failure Yahtzee.”

Since: ALPA managed to bring in some dough on a metaverse build that got their financials off the floor, so props to them. The stock has gone on an AI spike, which was starting to happen when we first shone a light on the company and hasn’t stopped since, though it took them a while after months of hypey AI news releases brought the opposite stock effect to what they were hoping for.

Our advice: I still don’t think there’s any real AI there, and there’s some serious promo being applied to it in the usual places, but the market is giving it enough respect that it may well raise enough money to get real at some point.

Leave a Reply