So this is it, we’ve finally started to see what’s been brewing in the long-term uranium market for a while, finally reaching the spot market, as the price is breaking out and reached $57.65 USD/lb very recently, and it looks like it’s stabilizing around the $56-57 range.

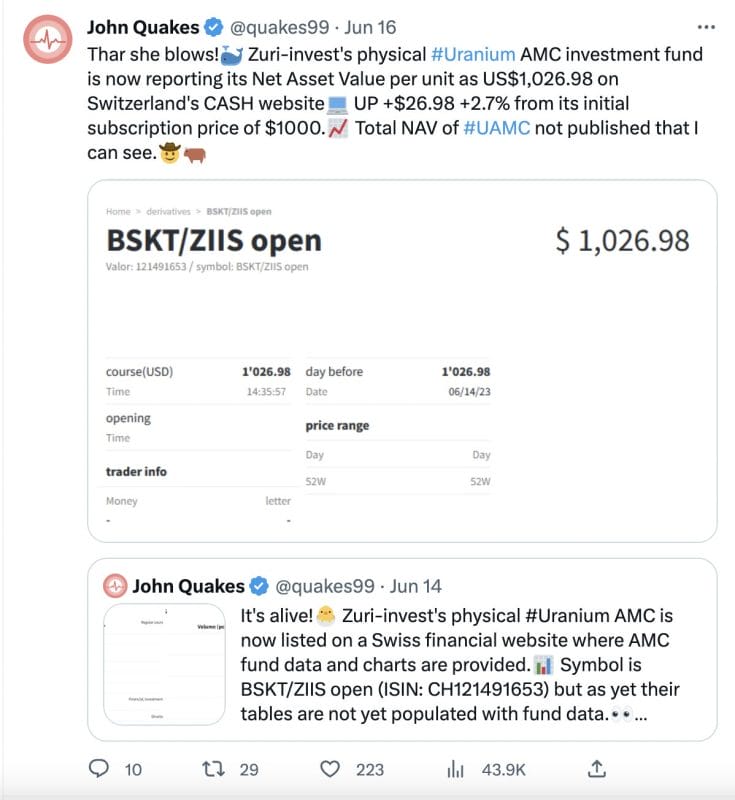

As previously mentioned here, the Swiss vehicle, Zuri-invest Uranium AMC has raised their millions and started to buy uranium in the spot market.

In what would otherwise be a quiet period of the year for nuclear utilities to come and sign their long-term contracts with the miners, it seems like the financial vehicles are filling in the gap and bringing excitement to the market.

And it couldn’t be any other way – a $3 move happened with only 1m lbs bought, and in a market where approximately 180-200m lbs are consumed annually. Rumour has it an RFP for 2 million for processed uranium (UF6/ EUP) received only three proposals for less than 50% of the amount sought. The spot market is tighter than tight.

It seems like the much-awaited inflection point is here, and the stocks are lagging painfully behind the commodity, which is precisely where the opportunity lies, unless you like overpaying for things.

In the chart below you’ll see the massive disparity between the price of spot U3O8 in orange versus the Global X Uranium ETF, in blue. A timid 69% gain compared to 173.01% from actual yellow cake.

Knowing the junior mining game, you already know that the leverage is in the miners, over and above gains and losses are typically made by betting on the stocks rather than the underlying metal. So for this, a good portfolio structure is needed.

The producers are a small handful: Cameco Corporation (Canada), Kazatomprom (Kazahkstan) are the major investable ones. Looking at the developers, there are a handful available to North American investors. Some to consider are: Nexgen Energy, Fission Uranium Corp, Global Atomic and Encore Energy. In the exploration stage, there are many options, but we’ll focus today on companies with multiple projects in the Athabasca Basin.

Athabasca Basin Players

The Athabasca is called the Saudi Arabia of uranium for good reason. While uranium can be mined with a grade as low as 0.05% (or lower if selling price is high enough). In the Athabasca Basin, it’s not uncommon to see deposits of 1% or higher. That is 20 times the grade of other deposits so naturally explorers are attracted to the region. Let’s focus on three of our current or past partners that operate in the area:

- Standard Uranium (STND.V): This company probably did the best all-around job promoting themselves within the retail crowd since inception, which is exactly what’s needed in an early-stage exploration company that needs to constantly raise money in order to go out and drill. And drill they did! After a few campaigns, focussing on their flagship project Davidson River int he southwest of the basin and finding smoke but no fire, they’ve recently pivoted to a project generator model. By doing this, they can hold onto their cash and dilluite less frequently. This may prove to be the right move at the right time as the share price has recently suffered and it seems like the speculators who wanted to throw in the towel, have already done it. The move will free them up to negotiate more projects and as uranium becomes the flavour of the year again, they might get lucky since they currently hold not one but six projects totalling 65,205 hectares. A project generator in the Athabasca Basin for C$5m does not seem expensive, in fact, quite the contrary. And you know that when all sellers are gone, there’s only one way to go.

- Skyharbour Resources (SYH.V): Skyharbour is a uranium exploration company with an extensive portfolio of projects in Canada’s Athabasca Basin. They own twenty-four projects covering over 500,000 hectares, with ten of them being drill-ready. The Moore Uranium Project, acquired from Denison Mines, is an advanced-stage exploration property located near other major uranium projects. It has shown high-grade uranium mineralization in the Maverick Zone. Skyharbour also holds the option to acquire a majority stake in the Russell Lake Uranium Project, which has historical high-grade drill intercepts and significant exploration potential. Partner companies can earn ownership interests by funding exploration and making payments to Skyharbour. The company has multiple joint ventures ongoing. Collectively, these partnerships have brought in substantial exploration expenditures, share issuances, and potential cash payments to Skyharbour. The company also owns thirteen 100% owned projects in the Athabasca Basin. With a strong team with many successes under their belt, Skyharbour is a must-watch stock for anyone with exposure to the Athabasca Basin.

- Azincourt Energy Corp (AAZ.V) is focused on exploration and development projects in the clean energy sector. As such, they have their eyes and ears open to other opportunities in other minerals such as lithium. The company has acquired a promising lithium project in Newfoundland to ensure year-round news flow and add exposure to the metal as a complementary project to its uranium program. The project is located just south of the Kraken discovery by Sokoman and Benton, which showed high-grade lithium in multiple holes. When it comes to uranium, Azincourt has a project portfolio that includes the East Preston Project in Saskatchewan, Canada, and the Hatchet Lake Uranium Project. East Preston shows some interesting alterations zone and the hunt for high-grade uranium continues as the company drills during the winter. With Hatchet Lake, optioned from Val’Ore Metals Corp. for up to 75% ownership we see some interesting previous work: total sampling includes 1583 soil, 2404 bio-geochemical, and 24 radioactive rock samples returning assay results up to 2.43% U3O8. It would be very exciting to see what Azincourt can do with this project, which, being in the east of the Basin, is not far from all the current uranium mines in Saskatchewan.

Technically Speaking with Vishal Toora

In the past few months, I was a bit hesitant on the price of uranium based on the technicals. But the fundamentals have led to a rip roaring spot uranium market price action!

To refresh readers memories, this is how spot uranium looked in mid May:

I highlighted the $50 dollar zone as an important psychological level, which saw the bulls enter on a retracement. Now we know that this move down was a corrective pullback in an uptrend. But, note that uranium price was still holding a range. In mid May, spot uranium was retesting the upper portion of this range. We needed a fundamental catalyst to get the breakout, which did occur.

Other charts I use to assess where the uranium market is going such as URA and U.UN were showing some promising signs after a major drop. Major support was held and a basing pattern was potentially in play. Here is how the charts looked then:

I actually did highlight the technicals on the Sprott Physical Uranium Trust (U.UN) after it closed back above the head and shoulders neckline which meant that the downtrend reversal had been nullified.

Let’s take a look at the charts now.

Spot uranium is on a tear, breaking above the upper portion of the range at $54 and confirming a major breakout.

Zooming out, you can see the range breakout more clearer and why bulls are excited. The uranium market has broken out above the recent resistance, or price ceiling. This means the next target is now the 2022 highs at around $65. With the $53.30 zone now being support in case of a pullback or retracement.

The Global X Uranium ETF has closed above the $21.50 zone which was the neckline resistance of the triggered head and shoulders breakdown pattern. In simple terms, because URA closed above $21.50, the bearish head and shoulders pattern has been nullified. URA now remains contained in a broad range as you can see with my highlighted blue zones. The next zone to the upside is $24. If we take that out, then the breakout would be very bullish for the uranium market.

The Sprott Physical Uranium Trust (U.UN) is actually testing a major resistance zone right now. In recent days, the stock has been testing the $17.90-18.00 zone. We aren’t seeing enough buying pressure to confirm a breakout just yet, but a battle between the bulls and the bears is in the process. If the bears step in, a pullback could be in store. If the bulls win, it would set up a move to the $20 zone, and be very bullish for the uranium market.

So what is the fundamental catalyst for the soaring spot uranium price? According to trading economics:

Uranium prices soared to $57.75 per pound in June, the highest in 14 months, amid increasing concerns that the current capacity of producers throughout the cycle is not fit to meet bullish long-term demand. Major economies continue to announce plans to increase nuclear power capacity to strengthen energy security and lower carbon emissions, solidifying expectations of strong uranium buying activity for decades to come. In the meantime, two bills to ban the import of Russian uranium were approved by US government committees, aligning with many European utilities that have voluntarily shunned Russian supplies. The developments pressed imports from one of the top producers of enriched nuclear fuel, placing pressure on the capacity of scarce Western converters and enrichers. Supply concerns were exacerbated by Russian firms winning contracts to mine uranium in Kazakhstan, threatening the neutrality from the world’s top uranium miner and increasing purchasing competition from China.

Supply is the key word.

This current rise in the uranium spot price has caused excitement in the uranium space. The uranium sector as a whole benefits from the uranium fundamentals as more supply will need to come from somewhere. This sets up an exciting time for juniors that are de-risking projects.

Let’s take a look at the price action of a few.

Standard Uranium (STND.V)

Standard Uranium is an exploration stage company, that acquires, evaluates, and develops uranium properties in Canada. Its flagship property is the Davidson River Project, which comprise 21 mineral claims covering an area of approximately 25,886 hectares located in the southwest part of the Athabasca Basin.

Recently, the company announced it is amplifying its growth strategy. Transitioning from its original exploration-only business model, the company has embraced a wider project generator model. This evolution will enable Standard Uranium to achieve capital efficiency and speed up the development of its exploration projects through joint-venture collaborations, while ensuring upside potential from any new discoveries.

This new trajectory allows Standard Uranium to diversify and bolster its portfolio. Now holding ownership interests in six projects spanning over 65,205 hectares across the uranium-laden Athabasca basin, the company has positioned itself to capitalize on the richness of the region’s resources. With the most recent acquisition of the Rocas project in Northern Saskatchewan, the company is inviting strategic partners to further accelerate progress across its asset portfolio.

A bottom picker play with the stock hitting and consolidating at record lows of $0.025. Standard Uranium is showing signs of a market structure switch and eventual reversal. All markets move in three ways: a downtrend, a range and an uptrend. The downtrend has been in play, and the stock has begun ranging. A range tends to occur after a downtrend as it indicates selling exhaustion and the end of the downtrend. A breakout of the range to the upside also tends to signal the beginning of a new uptrend.

The range is in play and the breakout trigger will be a close above the upper portion of the range at $0.04. A breakout sets a move to the $0.065 and then eventually the $0.10 zone.

Skyharbour Resources (SYH.V)

Skyharbour Resources is a uranium exploration company with prime assets in the Athabasca Basin, is poised to capitalize on the anticipated resurgence in the uranium market. The company’s extensive portfolio of uranium exploration projects and strategic joint ventures with industry leaders make it a wise investment for those seeking to benefit from the rising demand for nuclear power. With twenty-four projects covering over 504,000 hectares of mineral claims, Skyharbour is well-positioned to become a major player in the uranium mining industry.

Recently, the company announced it had completed the 100% acquisition of the South Dufferin Uranium Project from Denison Mines through a share and cash deal. The project is drill ready with numerous prospective targets.

The South Dufferin Uranium Project is located on the southern edge of the basin west of Skyharbour’s other core Russell Lake Uranium Project. South Dufferin totals 12,282 hectares in nine claims.

The property covers the southern extension of the Virgin River Shear Zone, which hosts known high-grade uranium mineralization at Cameco’s Dufferin Lake zone approximately 13 kilometres to the north.

South Dufferin has the potential for basement-hosted uranium mineralization associated with the Dufferin Lake fault and parallel faults within the Virgin Lake Shear Zone.

Skyharbour Resources is holding up well and remains contained in a range. The stock is attempting to breakout above resistance at the $0.43 zone. Support comes in at $0.35. A breakout above $0.43 would set up a move to the psychological important $0.50 zone and eventually a retest of the major flip zone at $0.55.

Azincourt Energy

Azincourt Energy is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. Their core projects are in the clean energy space, with uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru.

Recently, Azincourt announced it had completed the 2023 exploration program at the East Preston Uranium Project. For more information on this, check out this article. The company considers the drilling results to date to be significant, as major uranium discoveries in the Athabasca Basin such as McArthur River, Key Lake, and Millennium were primarily the result of drill testing of strong alteration zones related to conductor features.

Azincourt also announced that it has entered into a definitive property option agreement with Atlantis Battery Metals, to which it has been granted the option to acquire up to a 75% interest in three exploration licenses covering 300 contiguous mineral claims located in the Province of Newfoundland and collectively known as the Big Hill Lithium Project.

The stock has recently broken down and retested previous all time lows tested in 2020 hitting $0.04. In doing so, we have broken below this support which has been holding since 2022 at $0.045. The stock developed a range which saw an intraday break hitting new all time record lows at $0.035.

For bulls of Azincourt, they would want to see a strong candle close back above this support level ($0.045) to confirm a false breakdown. The fundamental catalyst which could see momentum carry through would be drill results.

Conclusion

The surge in uranium prices, catalyzed by a confluence of market dynamics, presents an unprecedented opportunity for investors looking for exposure to the uranium mining sector. With the spot uranium market getting tighter, uranium stocks appear to be the next promising frontier. The diverse offerings of companies like Cameco Corporation, Kazatomprom, Nexgen Energy, Fission Uranium Corp, Global Atomic, Encore Energy, Standard Uranium, Skyharbour Resources, and Azincourt Energy Corp, each bring unique value to the table. Moreover, the Athabasca Basin continues to be a hotbed for high-grade deposits, offering massive potential for uranium explorers. As the financial vehicles fill the market gaps and rising global demand for clean, nuclear energy drives the uranium market, the opportunities in uranium stocks are set to reach new heights. It’s not just about jumping on the bandwagon, but understanding the mechanics of the uranium market and leveraging them to your advantage.

Leave a Reply