Well… it appears as if we are going full risk on. The US dollar is selling off and we are seeing a rise in metals, commodities, big potential breaks in the currency markets, and yes, a nice move in the stock markets. But can this move be sustained?

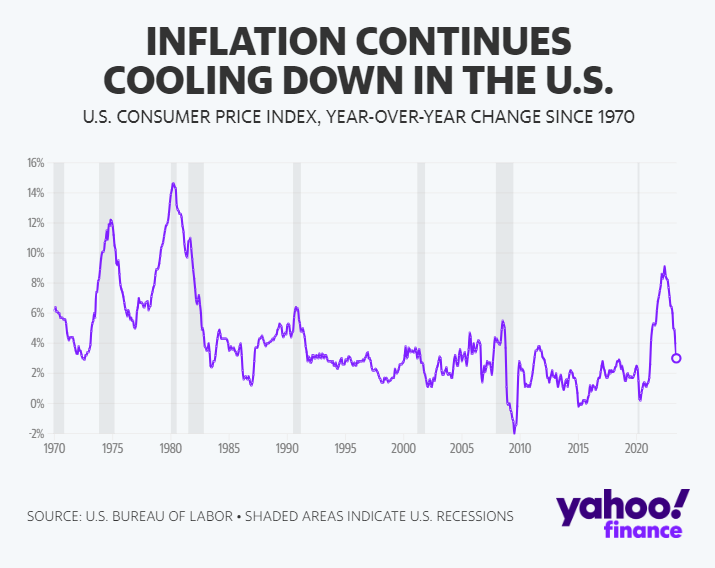

What was the trigger for these early gains? US CPI data is indicating that inflation is cooling. Consumer prices have risen at the slowest pace since March 2021 according to the data from the Bureau of Labor Statistics.

US CPI for the month of June rose 0.2% and 3% over the prior year. This is a slight acceleration from May’s 0.1% month over month increase but a slowdown when compared to the month’s 4% annual gain. Both of the data releases were slightly better than analyst forecasts of a 0.3% month over month increase and a 3.1% annual increase.

Core CPI, which does not include the volatile costs of food and gas, climbed 0.2% over the prior month and 4.8% over last year. Core CPI data was also better than analyst expectations. The monthly core CPI increase was the smallest one month increase since August 2021.

The index for rent and owners’ equivalent rent rose 0.5% and 0.4% as rent prices continue to surge. The shelter index jumped 7.8% annually and 0.4% between May and June was the largest factor in the monthly increase of core inflation.

The energy index decreased 16.7% for the 12 months ending in June, although prices increased 0.6% on a seasonally adjusted month-over-month basis.

The food index increased 5.7% over the last year with food prices rising 0.1% from May to June.

“Headline inflation is plunging for consumers,” Chris Rupkey, FWDBONDS chief economist, wrote in reaction to the data. “CPI inflation peaked at 9.1% year-on-year last June 2022 and today it is at a new low for the year at 3% year-on-year. The economy is on a safer path today as victory over inflation is in the air. Even core inflation is down in the dumps with a 0.2% rise which is the softest print since August 2021.”

Eugenio Aleman, chief economist at Raymond James, added: “June’s CPI report was better than what markets were expecting. …However, as the report indicates, shelter costs remained strong during the month and represented more than 70% of the increase in the monthly index. This means that if, as we expect, shelter costs start to weaken considerably during the second half of the year, the prospects for much lower inflation readings are looking promising. If we don’t have much lower readings for shelter cost and also base effects, we may see higher year-over-year inflation until the end of this year,” the economist continued.

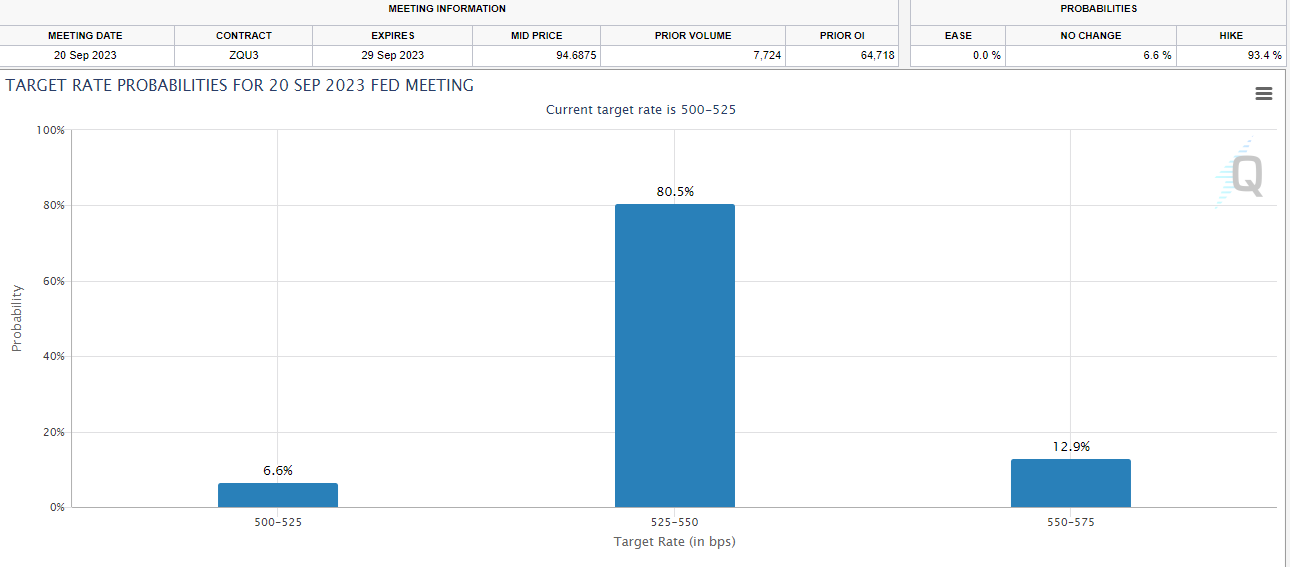

With a rate hike at the Fed’s July 26th meeting already priced in, all eyes now turn to the September Fed meeting. Will Powell continue to deliver a hawkish tone on July 26th, or will the Fed say that rate hikes are almost finished?

Current September data indicates a pause:

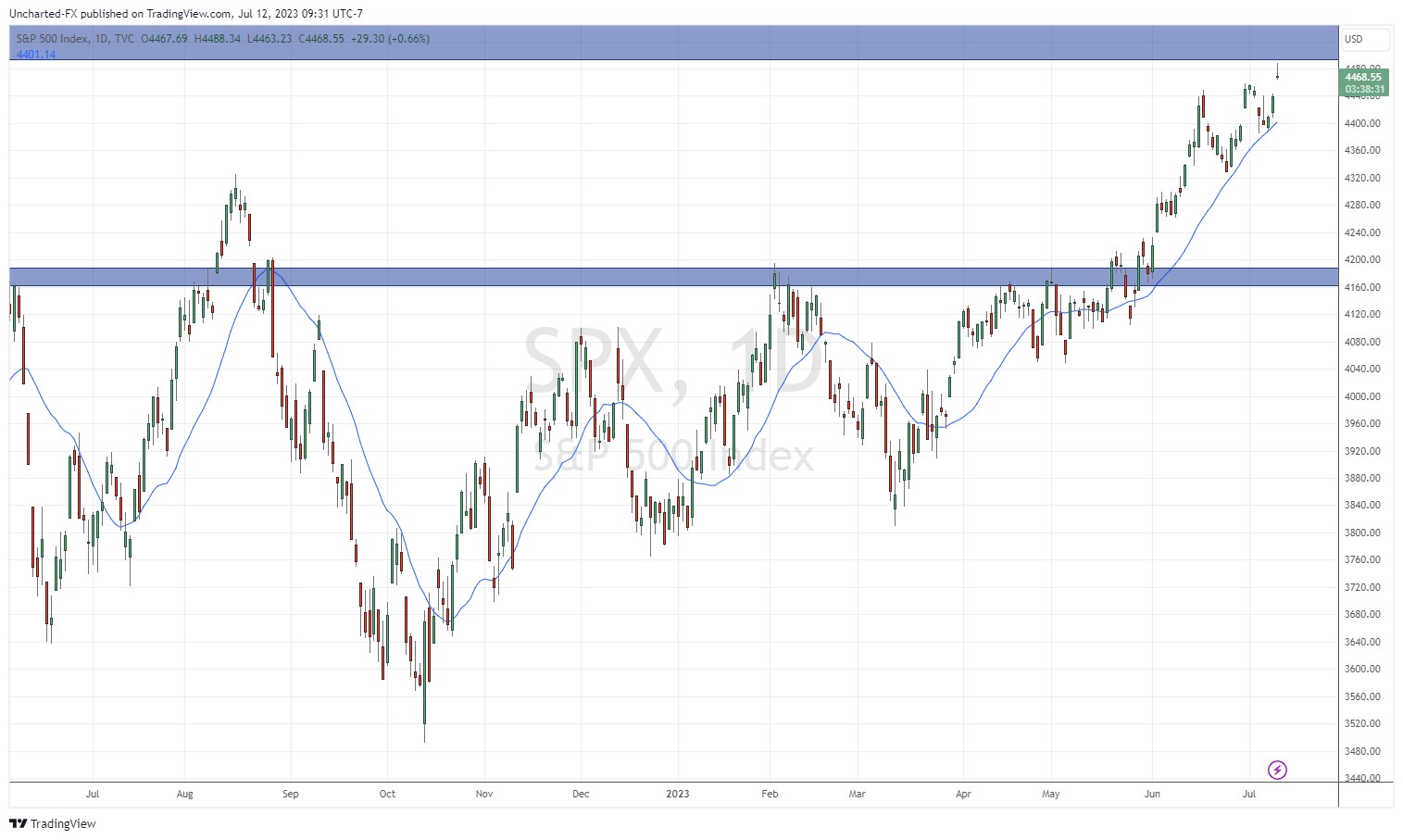

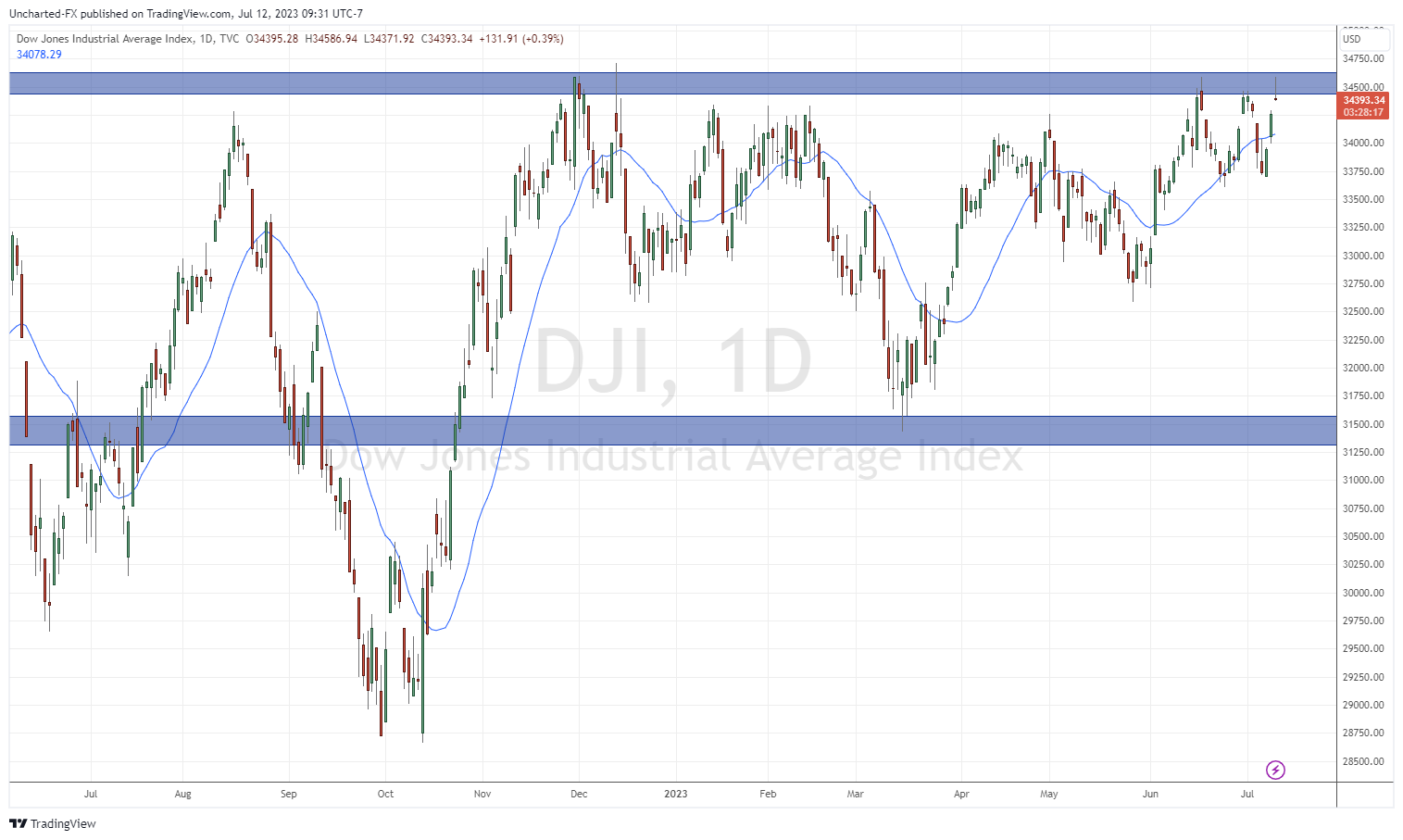

US stock markets made gains earlier in the day but have since given the majority of those gains back. From a technical analysis perspective, the markets are STILL seeing sellers step in at resistance. Readers may remember that I highlighted these resistance zones weeks ago in my article warning about a potential stock market reversal. This is still in play unless US stock markets can confirm a strong daily candle close above these resistance zones. So far, the sellers are jumping in. My analysis still stands going forward.

But the biggest move worth watching is coming from the currency market. The US dollar is puking. A major selloff following the breakdown of support around the 102 zone. The sell off momentum is strong and the US dollar index looks ready to test the major psychological zone of 100.

With this drop in the dollar, we are seeing some important moves in the currency markets.

The Euro is breaking out above a major resistance zone and is set to continue the momentum as long as 1.1050 is held.

The Loonie is set to reject 1.33 and appreciate with some help from the Bank of Canada rate hike.

A major technical move is occurring on gold, the anti dollar. The dollar puke is seeing gold break through some major resistance levels. We have climbed back above $1940 and are breaking out above the recent downtrend which is indicating the gold drop was just a correction. If gold can hold this momentum by the end of the day, and remain above $1940 on any pullback retests, we are likely to test the highs at $2060… and then from there, perhaps a breakout into new all time record highs depending on how the dollar reacts around 100.

In summary, a better than expected CPI data saw the markets pop on euphoria on the data release. But shelter and food prices continue to rise, which let’s face it, are quite the important categories when you consider the costs for the average person. Markets are now giving up their earlier gains which could see us continue the range rather than a technical breakout. All eyes and ears will not be focused on Powell on July 26th.

Leave a Reply