Einstein’s Theory of Relativity, first proposed in 1905, reshaped our understanding of the physical universe, not unlike the groundbreaking creation of the Logic Theorist in 1956 by Herbert Simon and Allen Newell which heralded in the age of artificial intelligence (AI). Both pivotal moments in scientific history brought forth dramatic shifts in their respective fields, ushering in advancements that have had profound impacts on the trajectory of human civilization.

It All Started With…

The Logic Theorist was developed to validate mathematical theorems like those articulated in Russell and Whitehead’s Principia Mathematica, it successfully proved 38 of the 52 theorems from the book’s second chapter, even providing more comprehensive proofs than the original authors.

Following the Logic Theorist, the journey of artificial intelligence faced many trials and tribulations. In the 1970s, Marvin Minsky optimistically projected that a machine with the average intelligence of a human would exist within a few years. However, the complexities of achieving natural language processing, abstract thinking, and self-recognition were not easily surmountable.

The road to advanced AI was littered with substantial obstacles. Chief among them was the lack of computational power; computers of the era simply could not store or process information quickly enough to exhibit intelligence. The intricacy of communication, with its requirement for understanding numerous words and their myriad combinations, proved too formidable for contemporary computers. Consequently, the pace of AI research slowed significantly for about a decade due to dwindling patience and funding.

Despite falling out of public favor for not living up to Minsky’s predictions, researchers continued to hone deep-learning techniques and expert systems in relative anonymity. Then in 1997, IBM’s Deep Blue, a chess-playing expert system run on a unique purpose-built IBM supercomputer, took world chess champion, Gary Kasparov, to the cleaners, marking the first time a computer had outwitted a human in a game of complex strategy.

AI Today

Moore’s Law pushed AI research even faster, bringing Turing’s dream of Natural Language Processing or Large Language Models (LLMs) to life in systems like Chat GPT. In fact, the latest version of Chat GPT, GPT-4 is arguably capable of passing the once impossible Turing test, convincing people, even if for a short time, that their conversation partner is human.

Chat GPT’s popularity has once again pointed the spotlight on artificial intelligence, and companies like Microsoft, who made significant investments in generative AI, are reporting record sales and profits. This AI boom has buoyed the public markets with the S&P 500 up 18.5% since the beginning of 2023 and the tech-laden Nasdaq pumping 35.7% during the same time.

It’s hard not to get excited about AI, the possibilities seem limitless. artificial intelligence doesn’t sleep or eat thus can be on the job 24/7 without holidays. It can avoid the mistakes you and I are prone to, complete repetitive jobs endlessly without losing productivity or quality. AI can plow through a problem in real time and define the right decision without the encumbrance and fallibility of emotions.

We are surrounded by AI in our daily lives. Siri and Alexa act as virtual butlers, answering our questions and controlling our home environments. We know where we are and where we are going thanks to Google Maps. We are driving more and more by auto pilot. We check our writing skills with digital editors like Grammarly. Researchers use AI to create new molecules, build new inventions and develop new drugs to fight disease. The military incorporates AI to minimize risk to soldiers either by providing them better tactical awareness or by replacing them entirely in certain battlefield scenarios.

Technically Speaking with Vishal Toora

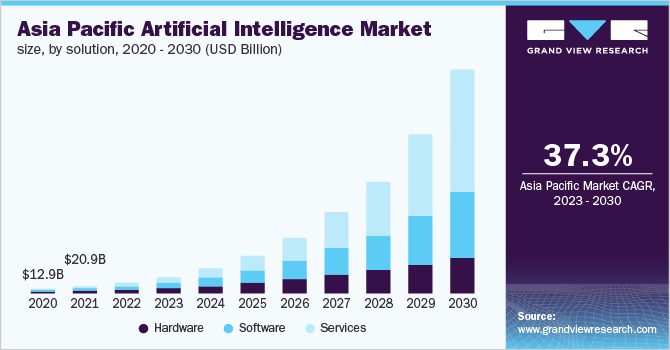

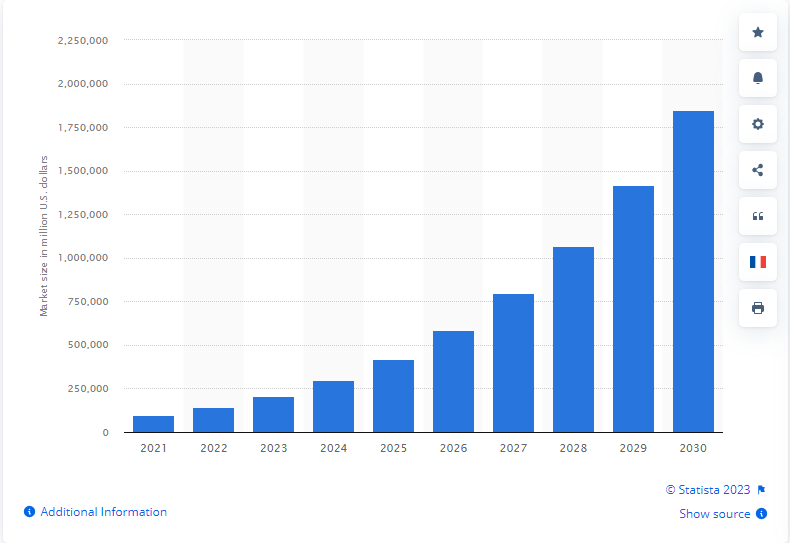

The AI market is one of the hottest investment trends currently. And with the AI market size expected to grow at a compound annual growth rate of 37.3% from 2023 to 2030. In terms of dollar amounts, this sector is expected to grow twentyfold by 2030, valuing up to two trillion US dollars. And with AI impacting and covering a number of fields such as supply chains, marketing, product making, research, analysis, and more, you can understand why investors want a piece of this pie.

And the major corporations are making big investments in AI. AI has the real potential to be the biggest technological impact on the world since the internet.

So how does one invest? There is the ETF approach with a plethora of ETFs having exposure to AI companies.

The Global X Artificial Intelligence & Technology ETF, AIQ, seeks to invest in companies that potentially stand to benefit from the further development and utilization of artificial intelligence (AI) technology in their products and services, as well as in companies that provide hardware facilitating the use of AI for the analysis of big data.

This ETF began in 2018 and has a net asset value of $481.02 million. Since inception, it has gained 13.83%.

This ETF has a wide variety of companies with exposure to multiple sectors including information technology, communication services, industrials, financials and health care. Investing in this ETF gives you exposure to companies such as Nvidia, Meta, Tesla, Microsoft, Apple, Salesforce, Amazon, Alphabet etc.

The ETF is in an uptrend with multiple higher lows and higher highs. This uptrend began back in January 2023 when the ETF confirmed the trigger of an inverse head and shoulders reversal pattern. As long as AIQ remains above the $27.10 zone, it will remain in an uptrend. The next major resistance zone comes in around $31.

Other ETFs worth a look are the Global X Robotics & Artificial Intelligence ETF (BOTZ), The Global Robotics & Automation Index ETF (ROBO), and iShares Robotics & Artificial Intelligence ETF (IRBO).

Notice something about all these charts? They all share the same market structure and therefore follow the trajectory of the AI space.

ETFs provide a convenient way to invest in any sector. For AI, it provides an investor with the opportunity to invest with the US big tech behemoths such as Alphabet, Meta and Microsoft who will be leaders in this space.

Canadian AI Players

Two Canadian companies seizing the rapidly emerging AI opportunity are Plurilock Security, Nextech.ai and Toggle3D.ai.

Plurilock Security (PLUR.V)

Plurilock Security Inc (PLUR.V) is a Canadian identity-centric AI cybersecurity solutions company. The cybersecurity company provides multi-factor authentication (MFA) solutions using behavioral-biometric, environmental, and contextual technologies.

The company has been putting out many AI headlines in recent days. On July 17th 2023, Plurilock announced a strategic company wide focus to address the growing AI cybersecurity threats leveraging its stable of industry-leading cybersecurity products and services.

Plurilock is focusing on generative AI, uses of this type of AI includes:

- Finance departments can use AI to rapidly produce financial reports, forecasts, and statements from raw data

- Human resources departments can use AI to rapidly generate performance reports, summarize personnel files, write termination letters and reprimands from raw data

- Engineering departments can use AI to rapidly write complex code, debug existing code, or develop integrations from raw data

- Physicians and other practitioners can use AI to rapidly propose differential diagnoses from complex case files provided as raw data

The risk is that this raw data that enables the AI to work is often confidential and sensitive data. This represents an immense flood of sensitive data leakage every day and an economy-wide data safety problem that spans the globe.

Plurilock is positioning its customers to succeed in the new AI landscape by being a one-stop AI consultancy that:

- Assists customers with AI deployment and sound data management

- Provides expert planning and guidance for AI adoption strategy

- Works with customers to develop internal AI governance for safe use

And then on July 25th 2023, Plurilock announced its Plurilock AI ranked first among leading software solutions including Microsoft Defender for Cloud Apps, Prisma Cloud, Cisco Cloudlock and Oracle Cloud Access Security Broker.

After bouncing at the major support zone at $0.125, Plurilock gained strength and momentum backed on the news that the Company is announcing a strategic focus on addressing the growing AI cybersecurity threats on July 18th 2023. Further momentum followed with a major 15% green day on July 19th 2023.

The stock saw a technical pattern breakout confirmed with a close above a downtrend line on July 20th 2023, the day when Plurilock announced its new SaaS product, PromptGuard. The stock recently hit highs just above $0.16 before selling off.

Currently, the stock is in a corrective pullback phase. This tends to occur on major technical breakouts. Price retreats, or corrects, to retest a breakout zone. This provides another entry point for those who missed out on the initial breakout and momentum. Plurilock stock tested the broken trendline and has closed below it. The buyers did not step in to validate this breakout technical pattern. This now sets us up for a retest of the major support zone at $0.125. A zone the stock has held and seen buyers step in all throughout 2023.

Nextech3D.ai (NTAR.C) & Toggle3D.ai (TGGL.C)

Nextech3D.ai (NTAR.C) is a diversified augmented reality, AI technology company that leverages proprietary artificial intelligence (AI) to create 3D experiences for the metaverse. Its main businesses are creating 3D WebAR photorealistic models for the Prime Ecommerce Marketplace as well as many other online retailers. Nextech is a generative AI-powered 3D model supplier for Amazon, Kohls, P&G and other major e-commerce retailers. The Company develops or acquires disruptive technologies and once commercialized, spins them out as stand-alone public Companies issuing a stock dividend to shareholders while retaining a significant ownership stake in the public spin-out.

Nextech3D.ai has spun out ARway.ai (ARWY.C) as a stand alone company, and most recently, Toggle3D.ai (TGGL.C).

Nextech3D.ai announced that a large enterprise customer that is part of the Wesfarmers (WFAFY), one of Australia’s largest listed companies whose business include Bunnings, Kmart Group, Officeworks and others, has renewed and expanded its contract for over 1,000+ 3D models.

This comes after the renewal and expansion contract with a major ecommerce brand for 3000 3D models, and an enterprise contract with an S&P 400 company for over 5000 3D models.

Nextech3D.ai believes these renewal contracts, in addition to its multi-year supply agreement with Amazon, will strengthen its position in the 3D models for the ecommerce industry.

The company recently announced a major expansion into the gaming and manufacturing industries. This strategic move leverages the company’s state-of-the-art generative AI technology to meet the growing demands for efficient, high-quality 3D model production.

This expansion of business just isn’t stopping, in fact, Nextech is seeing an uptick in demand from its top customer, Amazon. The surge in 3D model orders translates into an additional $2.2 million in revenue for Nextech, with the firm’s profit margins seeing a considerable expansion. This growth is largely credited to the productivity enhancements driven by the company’s innovative generative AI technology, allowing it to edge closer to positive cash flow.

The bolstered contract with Amazon underscores the transformative power of Nextech’s Generative AI technology, effectively setting Nextech3D.ai as the unrivaled AI solution for scaling up the production of 3D models globally. This technology is proving integral not just to the burgeoning e-commerce industry but also in the gaming and manufacturing sectors.

According to Nextech3D.ai’s CEO, Evan Gappelberg, the significant increase in 3D model demand from Amazon from Q3, 2023, testifies to the proficiency of the company’s team and their AI’s scalability. He anticipates the transition from 2D photos to 3D models in e-commerce and various other sectors to become the standard, mirroring the shift from Kodak film to digital photos in the 1990s.

Nextech’s growth journey includes a recent capital raise of $2.5 million, positioning the company for potential exponential revenue growth from Amazon’s millions of merchants. Having already supplied over 25,000+ 3D models to Amazon in the past year, Nextech stands at the cusp of this emerging technological wave, driving innovation in the 3D modeling industry.

Evan Gappelberg spoke with Equity Guru founder, Chris Parry, to further illustrate the company’s progress:

In addition, Nextech3D.ai’s Generative AI technology has been a key catalyst in extending the company’s profit margins. The company has filed a provisional patent titled “Generative AI for 3D Model Creation from 2D Photos using Stable Diffusion with Deformable Template Conditioning,” adding to its existing patent portfolio.

An integral part of the company’s growth strategy is the development of a substantial library of 3D models. By amassing millions of unique parts, Nextech3D.ai can expedite 3D model creation by leveraging these existing parts, thereby significantly slashing creation times and fostering continued innovation in the industry.

Nextech stock rejected a major resistance zone at $0.81 and then broke below a trendline triggering a downside move. The stock actually retested this trendline on July 14th 2023 which saw a huge influx of sellers. The stock then broke below the $0.50 zone and gapped down. Now, the stock is about to retest a major support zone at $0.36. It is definitely a zone to watch for buyers. Signs of selling exhaustion would be a range and large green candles. A break below this support would mean Nextech could head down to the $0.25 zone.

Toggle3D.ai (TGGL.CN), a groundbreaking SaaS solution that utilizes generative AI to convert CAD files, apply stunning 4K texturing, and enable seamless publishing of high-quality 3D models, has unveiled a new AI photo segmentation algorithm for the Toggle3D web application.

This revolutionary AI-algo is poised to redefine the boundaries of image analysis and 3D texturing, unlocking a multitude of opportunities by attracting new customers. The new feature uses AI-powered tools to save time and money for individual users and design teams while adding efficiency and speed to the 3D texturing creative workflow. This is just one of the many in suite AI-powered tools being released on the platform for Platform Pro users.

How does the algo work? When users upload a 3D model and a 2D reference image, the AI segments the 2D reference into parts, which users can select directly in the platform. The technology then takes a patch from the part and searches that texture patch against the pre-existing material library, automating the matching process from the 2D photo to the 3D material.

From a market structure perspective, this stock looks very intriguing. We are clearly in a range phase with the stock bouncing between $0.85 and $1.30. The trigger for momentum would be a breakout above $1.30. It would be a strong breakout which could potentially see the stock fill the gap up to $2.00 which would result in an even bullish melt up.

The breakout remains the trigger, but the stock is above the psychologically important $1.00 price level. If the stock remains above this price, there is a real possibility for a range breakout.

Back to the sector…

AI, like the Theory of Relativity, will change the world and our way of life so much, there is no way to predict who and how we will be as a planet when it truly takes hold. Therefore, it is imperative to consider both sides of the AI coin, because, let’s face it, Einstein’s intellectual baby also brought us the atom bomb.

One of the most notable concerns surrounding AI is the potential for job displacement. As AI and automation technologies become increasingly advanced, they could potentially replace human workers in various sectors, from manufacturing to customer service. This can lead to increased unemployment and social inequality if those displaced are not provided with adequate opportunities for re-skilling or transitioning to new roles.

Privacy is another critical issue with artificial intelligence. Machine learning algorithms, a key component of AI, often require vast amounts of data for training. This data frequently includes personal information about individuals. Misuse or mishandling of this data can lead to significant privacy breaches. AI technologies can also be used for surveillance and potentially infringe on individuals’ privacy rights, as seen in the use of facial recognition software.

AI also raises ethical and bias concerns. AI systems are trained on data generated by humans, and as such, can unintentionally learn and replicate the biases present in that data. This has led to instances where AI systems have been found to demonstrate biases against certain racial or social groups, which can perpetuate harmful stereotypes and discrimination.

Additionally, the decision-making process of AI systems can be a black box, meaning it’s often not clear how the system arrived at a specific decision or prediction. This lack of transparency, or “explainability,” can make it difficult to hold AI systems accountable for their actions or to correct their behavior.

Finally, there’s the concern about AI potentially becoming too powerful or intelligent. Some people, including high-profile figures in science and technology, have expressed worries about the possibility of a “superintelligent” AI system that could become uncontrollable or pose a threat to humanity.

So, What Do We Do?

Unfortunately, there is no way to put the genie back in the bottle. Like the Theory of Relativity, AI is here to stay. However, as long as we address these issues and manage the development and deployment of these technologies in a responsible and ethical manner, we may be able to avoid the creation of a digital Fat Man and Little Boy while companies like Plurilock and Nextech build an artificially intelligent bridge to a better tomorrow.

Leave a Reply