Chip designer Arm (ARM:Nasdaq) launched its initial public offering today (September 14th 2023). The ARM IPO priced 95.5 million shares at $51 per share at a valuation of $54.5 billion on a fully diluted basis. This $51 was the high end of the expected range of $47-$51.

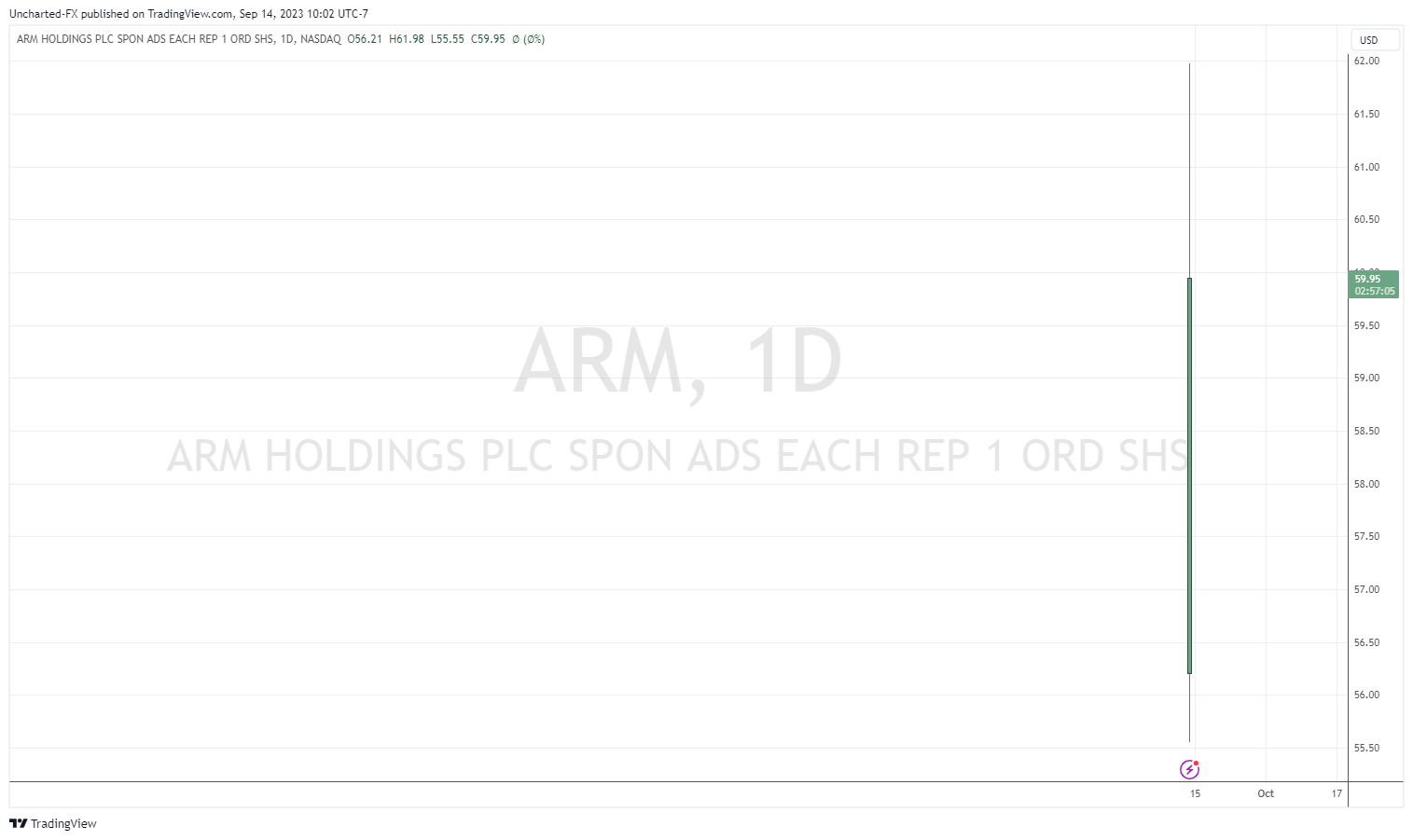

Arm came out swinging. The open price was 10% above the IPO price with the stock opening at $56.21.

Arm is a UK based chip company which provides chip designs to a range of semiconductor manufacturers, including the processor designs used in essentially every current smartphone. Arm doesn’t manufacture chips. Its chip designs are used by every major semiconductor designer including Apple, AMD, Qualcomm, Nvidia and many more. Arm now gets 63% of its revenue from royalties and 37% from licensing. Royalties enable Arm to get a payment per chip sold. Licensing involves giving customers access to its portfolio of intellectual property for developing Arm-based processors.

In 2016, SoftBank Group bought Arm for $36 billion. SoftBank tried to sell Arm to Nvidia in 2022 for $40 billion in cash and stock but this did not go through due to regulatory opposition. Now after this IPO, SoftBank will control around 90% of Arm’s shares outstanding.

It is definitely quite the premium at a $54 billion valuation. This means Arm’s price-to-earnings multiple would be about 104 based on the most recent fiscal year profit. That’s comparable to Nvidia’s valuation, which trades at 108 times earnings, but without Nvidia’s 170% current-quarter growth forecast.

The stock markets are celebrating the successful IPO, but there are already questions on the valuation.

Arm had revenue for its March 2023 fiscal year of $2.679 billion, down a hair from $2.703 billion, amid a soft market for smartphones, which account for the bulk of the company’s royalty revenue. Net income for the year was $524 million, down from $549 million in fiscal 2022. However some analysts such as Barron’s Arm Chief Financial Officer Jason Child said that the flat revenue last fiscal year was no surprise, and followed outsize growth a year earlier when some customers accelerated their licensing activity when it appeared Arm would be acquired by Nvidia. He said that it makes more sense to look at the company’s three-year average revenue growth—around 15%—as a better rough measure of Arm’s likely growth rate going forward.

Others still question the initial valuation which comes in 36% higher than what Nvidia offered to pay for the company last year.

“It’s hard to convince the market to pay such huge premiums when you’re not growing as a company,” said Daniel Newman, chief executive of research and advisory firm Futurum Group.

Research firm New Constructs said the Arm stock valuation is “based more on SoftBank’s self-dealing in private markets to manipulate the valuation higher than the fundamentals of the company.” The research firm also stated that, “We believe investors should avoid this IPO, as we see very limited upside ahead, as there are plenty of other companies in the tech sector that offer investors growth, but at a reasonable valuation,”.

Paul Meeks, tech fund manager with Independent Solutions Wealth Management said that he thinks the valuation of Arm shares seems “badly stretched” at about 20 times trailing annual sales and nearly 100 times trailing profits. He says that valuation is unusually aggressive for a company that showed no growth in its latest fiscal year, and also sees risk in the company’s exposure to China which accounts for about a quarter of the company’s revenue.

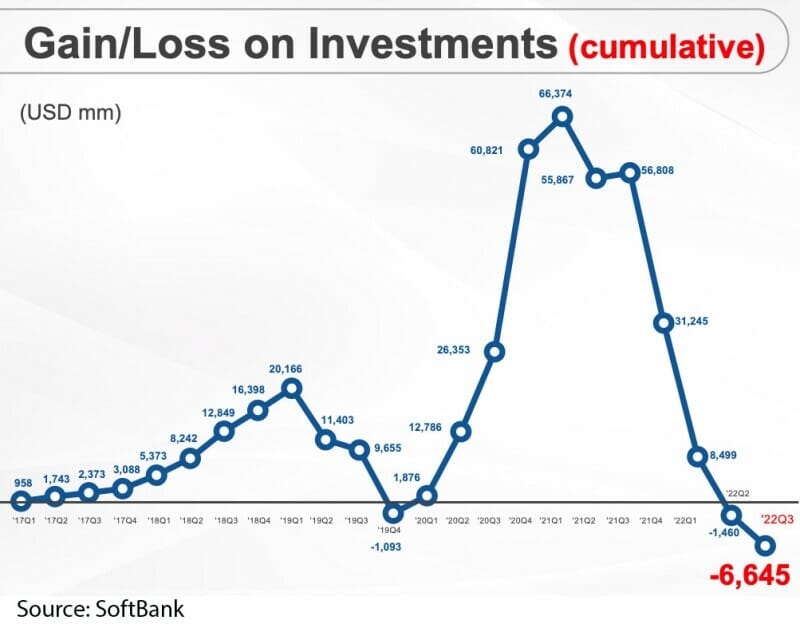

What most analysts can agree on is that this IPO is a big win for SoftBank Group. The Investment holding company has struggled in recent quarters with losses in its Vision Fund venture capital portfolio. Founder and CEO Masayoshi Son has recently said the company intends to get aggressive on investments in AI. Perhaps this is how SoftBank plans to spend the proceeds from the Arm IPO.

SoftBank’s large position in the stock could become an overhang on the Arm share price if the market begins to worry about the company liquidating its Arm stake. However, SoftBank has not made comments on how long it will hold the position of whether it would sell to reduce its position. But SoftBank has a long history of slowly and gradually reducing its position in slices of its large investments. One such example is how it gradually reduced its outsized position in Alibaba.

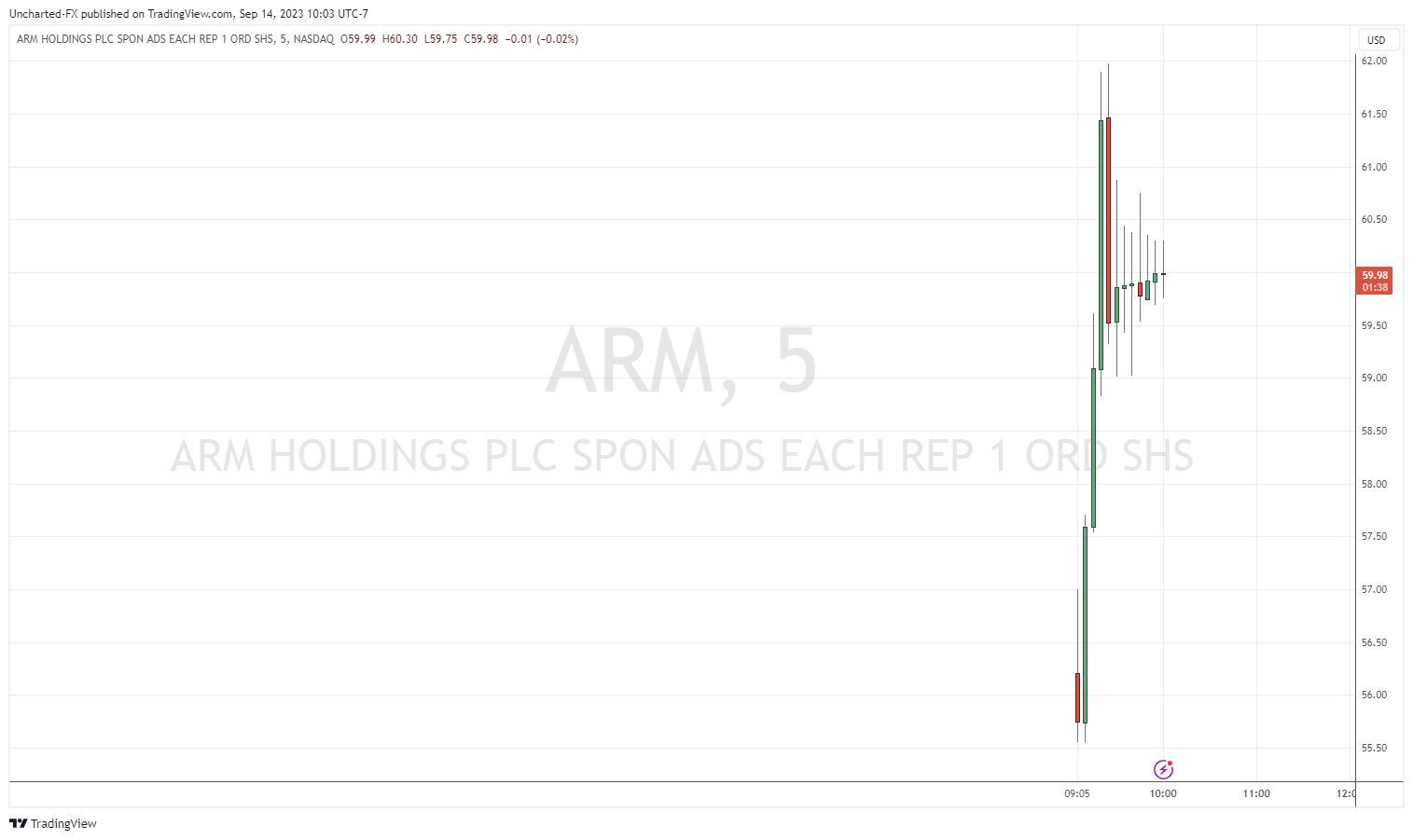

The first chart is the daily chart of ARM. The stock hit all time highs hitting $61.98 and is now pulling back. The second chart is an intraday 5 minute chart and can tell us that there are some profits being taken around the $60.50 zone.

We do not have enough information to denote major support and resistance levels on the daily chart, except the opening price the daily low and daily high (for breakdowns and breakouts), but the intraday is beginning to provide some levels that will provide more help to day traders than long term investors.

However, if the momentum continues in the next few trading days, this IPO could be a good thermometer in telling us the current risk sentiment and where US stock markets are heading. Currently, all the major US stock markets continue to battle at major resistance levels.

Leave a Reply