On September 19th 2023, I published an article titled “The moment of truth for silver!“. I really meant it. The price of silver was contained between two major trendlines and technical traders were waiting for the break.

What got me worried was the fact that everyone’s favorite white precious metal had retraced hard after briefly touching $25… and bounced off of a support level around $22.30. What also got me worried was the actions in OTHER markets which have a huge influence on silver and gold.

Here is the chart I laid out on that article:

Note the support and trendline.

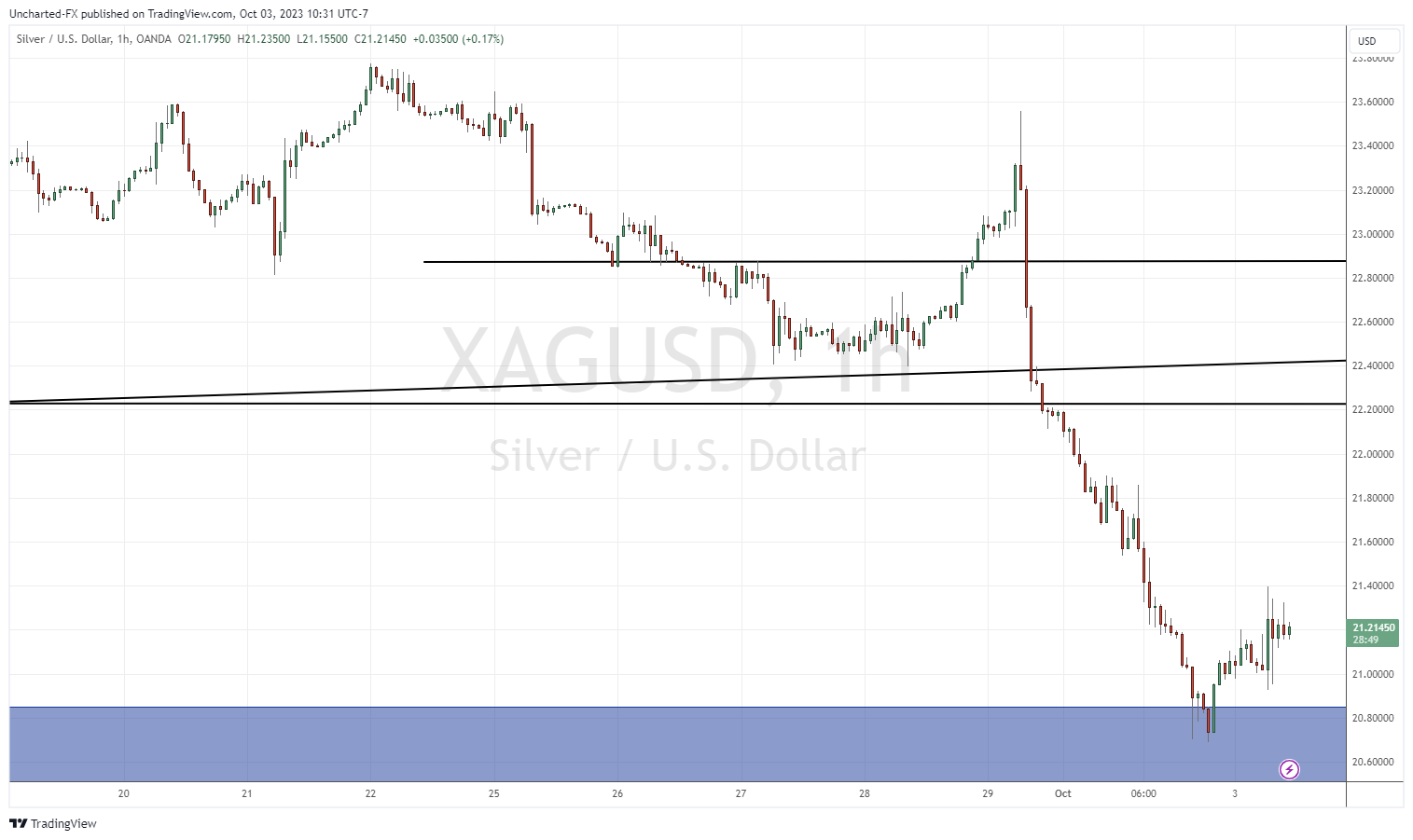

Here is what has happened to silver now:

Silver bulls have got wrecked. The brief bounce at support had no momentum and the sellers forced a break below support AND the trendline on Friday September 29th 2023. After seeing this break, I knew silver was in for a rough week. And clearly other traders saw the same break as Monday saw shorts pile in with silver dropping over 5% for the day!

Now silver is testing a support zone, which is the first target for shorts. The bounce here is most likely bears taking profits (sell orders become buy orders to take profits). But $20.50 is a key support zone which may entice bulls to jump in. Watch for major wick candles here to indicate the bulls are putting on a fight.

However, silver needs to put in some work to regain bullish momentum. Ideally, we would need to see a close back above the $22.50 zone.

And for more unfortunate news for silver bulls, this relief could just be a dead cat bounce. On the intraday chart, we are seeing evidence of sellers jumping back in as evident by wicks above the candles.

How would I play a sell resumption? Wait for the intraday higher low to be taken out. In this case this would be $21. But silver could see some more recovery which would alter the intraday higher low.

I see more selling resumption due to what I am seeing in other markets. But before I jump on those charts, let’s look at gold since it will also be affected by action in those other markets.

Gold failed to climb above the previous lower high level at $1940 which was the bullish signal I gave to readers and followers. This failure also coincided with a rejection of the trendline, or the upper portion of a wedge/triangle pattern. To add to the weakness, gold closed below interim support at $1900, which was the major sell entry for traders. And then the pattern breakdown.

Gold broke below the lower portion of the triangle pattern. The retest saw sellers pile in as evident from the daily wick candle. And then gold tanked and is also testing a key support zone around $1820.

The market structure is similar to that of silver. A lot of work has to be done for bulls to regain control. A move higher is likely to be met with sellers. Just a correction in this new downtrend.

Action in two other markets are leading me to believe more downside is coming for silver and gold.

Bond yields in the US and other parts of the world continue to climb HIGHER, leading to many analysts now accepting that interest rates will be higher for longer. The move in the 30 year yield is quite record breaking as the 30 year yield is at its highest level since 2007.

CNBC bond expert Rick Santelli mentioned that the 10 year treasury yield could hit as high as 13%!

Something will probably break if we hit double digit interest rates, but I tend to agree that interest rates are heading higher. I posted this weekly chart in 2022 which shows that the 40 year bond bull market is over. This means that rates are heading higher.

Because gold does not yield anything, when rates move higher, the price of gold takes a hit. And yes, I mean REAL yields with inflation factored. With the government data showing inflation levels below the current yield on bond yields, the real rate is positive. If yields continue to run higher, this will put more pressure on gold and silver.

The chart of the US Dollar (DXY) is also worrying for precious metal bulls since the dollar has an inverse correlation with metals. With yields rising, the US Dollar is also climbing. A major resistance zone at the 106 zone was broken and the retest is showing buyers stepping in. The Dollar uptrend continues, and as long as DXY remains above 105.60, the uptrend will continue. The next major resistance zone for the Dollar comes in around the 109-110 zone.

In summary: unless we see a reversal in yields and the US Dollar, gold and silver are likely to break below current support and head lower. This would mean silver below $20, with the next major support coming in at $18. And gold below $1800 with the next major support coming in at around $1700.

Leave a Reply