I recently listened to a podcast episode of Search Engine with PJ Vogt, and I REALLY got into it. The episode was titled, “Why are drug dealers putting fentanyl in everything?” I’d asked myself the same question many times – why kill your customers?

I’d recommend you go listen because the answer is a lot deeper than you might think, but the TL/DR on it all is, fentanyl is really cheap and really addictive – so cheap and addictive that it’s beginning to replace the drugs it used to be slipped into.

This is driving governments in Canada bananas, because peeling bodies off the streets is bad for everyone, especially when those bodies are, increasingly, moms and pops and club kids and professionals and not the high risk methheads you might expect.

So safe supply has become an important thing. We’re moving away from ‘you shouldn’t use drugs, drugs bad, no drugs’ to ‘okay, what might it look like if the government allowed drugs to be used but ensured they were supplied in a safer way than legacy drug dealers?’

Tuesday October 3, 2023, saw ‘legal cocaine’ announced as a new public markets sub-sector when Safe Supply Streaming (SPLY.C, formerly Origin Therapeutics) landed on the CSE with a promise to invest in safer drug alternatives as they become legal. This brought about two immediate things, both entirely predictable; generalized confusion on what’s even legal anymore, and a significant stock price run.

We’ve been here before.

Long time readers may recall we saw similar happenings almost ten years ago, when resource company paperweight Satori Resources (BUD.V) announced in code it was switching from gold exploration to the cannabis game (and saw an ensuing 500% stock price increase), which preceded a tsunami of other similar resource shells all claiming the same thing over the following year, leading to a multi-year ‘green rush,’ before an ensuing multi-year capitulation that we’re still enduring.

It was back in 2015, as a professional marijuana pubco commentator at Stockhouse, that I wrote, mostly as a joke but also kind of not, “Medical Cannabis is officially a thing now – Next up, Medical Cocaine!” and, eight years later, here we are.

Fuckin’ Nostradamus, me.

Here’s a paragraph from one of my weed updates from 2014 – see if you can spot a single first mover that survived, let alone thrived:

Satori’s Stockhouse Bullboard has become a defacto weed clubhouse, where investors in 420 stock fling around rumors and pumps, and the stampede runs wherever the front of the herd is headed for that day. The market bears this out. Today, the big movers in weed at noon eastern were Seaway Energy (TSX:V.SEW – up 50%), Satori (up 43%), 88 Capital (TSX:V.EEC, up 40%), Alchemist Mining (TSX:V.AMS – up 32%), Senator Minerals (TSX:V.SNR – up 17.5%), and Thelon Capital – (TSX:V.THC), up 11.1%). None of those companies have any news that points to a solid marijuana-focused business, or the acquisition of grow licenses. And by the end of the day, a lot of that money had switched gears entirely. As an example, Seaway ended the day down 12.5%, a 62.5% swing from their noon high to the close of trading – on no news.

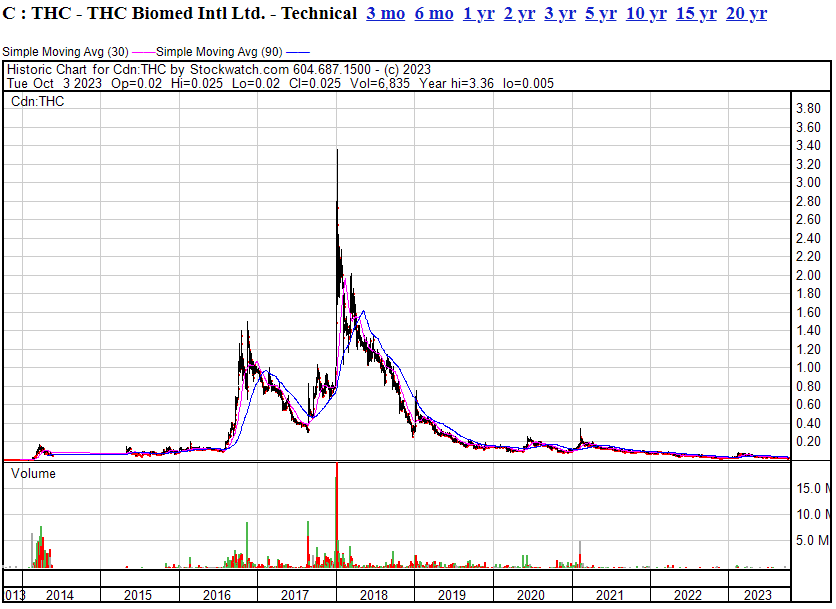

Thelon Capital, now THC Biomed, is still alive. Here’s what it looks like, if you’re wondering:

The major difference between the cannabis market debut then and the cocaine debut now is, nobody has had to go to court in Canada and win a case demanding the government supply cocaine to patients in order for it to no longer be an illegal thing. Rather, the government is openly telling us they’re listening for new ideas regarding what can be done around the safe supply of drugs to Canadians, which has brought about a growing movement of pubcos claiming that they can be the ones to make that happen. Heroin, cocaine, molly, LSD, licking toads, bloodletting in worship of the dark lords – all of it is seemingly on the table as long as fentanyl is infecting what used to be the nation’s ‘safe’ drug supply in increasingly lethal doses.

As recently as a year ago, fentanyl was perceived as a problem only for disposable hard drug addicts, not good old meemaw and papaw. Now that fentanyl has found its way into the ‘safe’ drug supply of normies, with the substance now being picked up even on testing of substances as harmless and routine as cannabis, there’s been a shift of intent from the federal and provincial governments.

Why is fentanyl a problem? Simply put, it’s dirt cheap (about 1/50th the price of morphine), easy to smuggle, the high is shorter than heroin, and it’s more addictive than most things.

Drug users knows fentanyl is terrible and will kill them, but they’re increasingly comfortable with the risk because it’s cheaper and more available than heroin et al. Drug dealers know it frequently kills their customers but they’re comfortable with that because it’s cheap and habit forming and easy to import. And now that Johnny Lunchpail knows an increasingly large number of normal folk, family and friends, that have been killed by it in non-traditional settings, there’s pressure on to do something about it all.

If you live in downtown Vancouver, you know what I’m talking about; the sound of sirens is non-stop. Traffic is routinely jammed as first responders deal with multiple people at a time overdosing and, more frequently now, those happenings are occuring further and further from the Downtown Eastside, as regular folks – those doing the occasional recreational drug, or using illegal stopgaps when they can’t access their regularly prescribed pain medications – find themselves on the receiving end.

When people die of anything in increasing numbers, governments look to act, and right now they’re looking hard at what can be done not to ban drugs (since that’s never worked), but to clean up their supply and limit the damage. Call it legalization through necessity rather than desire.

Though most drugs remain technically illegal, we’re already at the stage of ‘legalization through inaction’ where things are against the law but, like going 5kmh over the speed limit, you’ve got to really be an asshole to get pinged for it. Nobody is stealing your car stereo to do shrooms on Wreck Beach, or get baked after work, so the cops don’t care about mushrooms and weed. You can buy LSD and ketamine out in the open, from stores on East Hastings and Broadway here in Vancouver, and the increasing lineups of regular folks who do exactly that keeps the cops from wanting to kick the doors in. You can get acid and shrooms and weed delivered by mail order to your door, through Canada Post. Mine comes from a delivery service dude in a Tesla inside two hours. I think he also does Uber Eats.

Hell, I have 5 ‘party hits’ of LSD and a microdose dropper in my office drawer right now, along with some CBD oil, some gummies that I think are shrooms but it’s been a while since I bought them, a mostly finished bottle of Springbank Campbelltown Single Malt (like an angel crying on your tongue), and the fridge under my desk has six Little Victory weed bevvies chilling away, if you were thinking of dropping by and signing a market awareness deal, which I suggest you do immediately because them bastards is TASTY.

So while politics is stil a thing and the hand wringers who think everything should be banned are still out there whining, the government has enough voter support to think less about looking good to conservative snowflakes and more about BEING good, when it comes to establishing safe drug supply.

Canada isn’t a pariah here; globally, drug policy is shifting hard. MDMA and psilocybin are being rescheduled in Australia and some US states (trip to Oregon already scheduled). Switzerland is putting forth legal supply initiatives, the Dutch have long been okay with cannabis in a casual cafe setting and most of Europe is catching up there, the Portuguese stopped criminalizing drugs some time ago. Locally, British Columbia has shifted drug policy toward banning only the sellling of hard drugs while making the possessing of them legal, but if you do even the smallest amount of googling, you’ll find stores openly selling almost everything and no police or regulators bothering them because they’re too busy rescucitating Jeff outside the Dollarama for the third time this week.

SO WHAT NOW?

Let’s face it, you’re not about to stomp out casual drug use, because too many of us not just of voting age, but legislating age, are doing them.

Consider me. I’m 54, your standard middle-aged white guy. Job, kids, clean record, on the board of a few non-profits. I’ve also done, in the last few years (if I can remember it all) MDMA (aka ecstasy or molly), cannabis, ketamine, LSD, gas station Viagra, poppers, and a lot of shrooms, and I recommend all of it as an adult with the means to do so in a safe, controlled, quality-tested, and often clothing-free setting.

I’m not alone. A large number of the adults around me have shifted, rather quickly, over the last few years from bringing a six-pack and a cheeky sauvignon blanc to a Sunday family barbeque to now bringing cannabis beverages, shroom edibles, and adult brownies, marked appropriately so the kids don’t partake and dosed so that we’ll all be fine to drive by the time we’re finished kitchen clean up.

And much of that illicit drug use between consenting adults is therapeutic, not just for shits and giggles at the Third Beach drum circle. It’s microdosing, designed to spur creativity, chip away at anxiety, and work through emotional issues while leaving you capable of handling a last minute all-hands Zoom call. It’s therapeutic, done in conjunction with well-trained therapists who use the drugs to wipe away your ego so you can actually be honest with yourself about what ails you. They’re used to conjure up a good night’s sleep, or soothe a sore back, or maybe to regulate blood sugar.

Personally, I credit shrooms for making me finally aware of my shortcomings as a boyfriend, and helping me figure out a load of stuff that had tormented short term partners for decades.

I won’t claim any real expertise on cocaine, though will admit to once having done rails off the ass of an investor relations executive in the womens restroom at an investor conference.

Hey man, it was a bull run.

But I digress. My point here is the people who make the laws of the nation invariably use psilocybin on the weekends as marriage therapy and a treatment for depression and a better way to watch old Speed Racer episodes. We’re moving away from medications advertised on TV with two minutes of side effects and a dancing chorus of plus-sized seniors, and towards a quick inhaler shot of Golden Teacher before bed, a spritz of CBD, and shared strain recommendations during downtime at the kids’ Christmas concert.

BUY THE WORLD A COKE

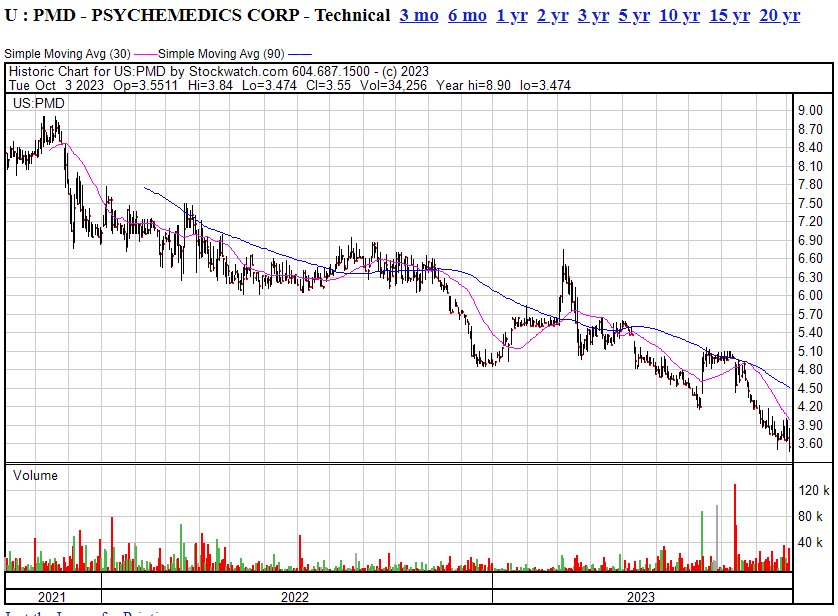

Perhaps a notable sign in the shift away from criminalizing cocaine is in the stock performance of Psychemedics Group (PMD.Q), which sells hair testing drug kits for illegal drugs. Their share price is sliding off a long, greasy cliff as drug laws liberalize and regular citizens work within the legal system to get what used to be forbidden.

So it stands to reason we’d start seeing public companies emerge who are unafraid to use the word cocaine in their press releases.

Well, maybe a little afraid.

Safe Supply Streaming Co. Ltd. started trading on the Canadian Securities Exchange (CSE) as of today, under the trading symbol SPLY. CEO Bill Panagiotakopoulos emphasizes that the safe supply ecosystem is ‘not just a business but a movement, in response to the global shift of accepting and embracing all drugs, due to the failure of existing prohibition policies.’ He says Safe Supply is positioned strategically to act swiftly on initiatives, focusing on impact and building a future that is profitable, sustainable, and responsible due to its robust financial footing and experienced leadership team. He wants his company to to be a steadfast voice and champion in the sector, utilizing the leadership team’s expertise to be a first mover in the emerging global opportunities within the safe supply ecosystem. He says SPLY’s mission revolves around contributing responsibly to ending the war on drugs and is investing in and incubating companies leading the third wave of drug policy reform, and they’re developing facilities to analyze, manufacture, and distribute psychoactive compounds (including from the coca plant), investing in research and innovation to maximize potential and minimize harm from these medicines, and constructing clinical infrastructure to ensure safe, responsible access and treatment.

All of the above, the whole entire paragraph there, that’s code for ‘we’re going to do medical cocaine.’

They don’t say the word because they’re scared of what people will say in response to it, but ‘including from the coca plant‘ is the tell. We are exactly where we were with Satori Resources back in the day, when they claimed to be ‘exploring opportunities in the science, wellness, mining, healthcare, recreation, and pharmaceutical’ industries but couldn’t bring themselves to say ‘weed’ (though the BUD ticker symbol was a bit of a billboard of their intent).

Other companies have been less frightened of their intentions in the new cocaine economy, like the rarely traded former-Vic Neufeld joint, HYTN Innovations (HYTN.C), stating clearly earlier in the year they’re hoping for a Health Canada license adjustment that would bring them the ability to trade in MDMA, LSD, ketamine, and cocaine. That announcement came in March, shortly before former Aphria (TLRY.T) honcho Neufeld walked the plank, so who’s to say if they ever get what they were asking for. It could be the de-Vic’ing was required by Health Canada to move forward, or it could be a sign that license isn’t coming and VN saw no reason to continue the ruse.

Currently, HYTN do run the gamut of the usual cannabis licenses, and put out some fine products in that sphere, but it’s clear they REALLY see other drugs as their path forward and a quick look at their finances show they had $80k in cash left and $140k in accounts receivable at the end of June, with a $400k operating loss per quarter. They’re trying to raise a million bucks at $0.10 per share, while the stock is selling at $0.085 on the open market. Unless I’m missing something, it looks ‘grym’ for HYTN.

Pharmadrug (PHRX.C) would love to be in the cocaine space, at least in terms of synthesizing the stuff, but its efforts to commercialize DMT through research and clinical trials have hit a financial dead end, and it can barely get its stock over half a cent as it actively ‘assesses strategic alternatives.’

The Board of Directors is assessing strategic alternatives to be able to yield maximum shareholder value for its cepharanthine and N,N-Dimethyltryptamine (DMT) programs which management believes is being significantly undervalued by the markets at this current time. Possible avenues include potential entries into joint ventures in order to add intellectual bench strength, scientific program synergies and short to mid term financial flexibility. Management has already begun discussions with several companies, although there is no guarantee an agreement will be reached. PharmaDrug’s intention is to keep operational control of its cepharanthine and DMT programs.

Though clinical trials are going ahead, they’re being performed by another company that picked up a controlling interest in the subsidiary holding the asset, for $300k. Former Aurora Cannabis boss Terry Booth is an advisor, though he doesn’t appear to have brought them any market weight.

Elsewhere, I’ve been hearing a steady drumbeat from private companies that are talking about getting into the cocaine space as soon as retail investors get a bit less frightened of their own shadow, but the kicker here is, all of these companies – every single one of them – is late to the game.

WHO’S ON FIRST

While Safe Supply is looked at by many as being the first through the wall, another pubco touched on the cocaine space long before Safe Supply, when it press released that it had received a Health Canada dealers license for – wait for it – cocaine. Adastra Holdings (XTRX.C) got itself in talk radio trouble earlier in 2023 when it accurately reported the government had allowed it to hold, process, and supply (to hospitals and research institutions, not the general public) 250 grams of cocaine, and the news media immediately ran to the most extreme translation of that information; that cocaine was a legal business now, that the company was dealing, and that dogs and cats were living together.

Adastra boss Mike Forbes put out a news release in February that stated, “Adastra Holdings Ltd.’s Adastra Labs Inc. received approval from Health Canada on Feb. 17, 2023, for its amendment to include cocaine as a substance that the company can legally possess, produce, sell and distribute.” The release would go on to state that the “amended licence allows Adastra to interact with up to 250 grams of cocaine and to import coca leaves to manufacture and synthesize the substance,” but didn’t specifically point out that the license was for interacting with research institutions, hospitals, and the like, as opposed to shifting grams of coke to the general public.

Thus began a round of weirdness where politicians started blaming each other for a thing that wasn’t actually happening, and the tossing about of terms like ‘pump and dump’ and ‘lawsuit’ while plumbers and stay-at-home moms told talkback radio hosts about the downfall of civilization. The company clarified some days later that they weren’t actually a Mexican drug cartel, but rather a properly licensed research company, already doing a roaring trade in weed and very open to using other substances for proper future research, synthesis, compounding, and therapeutic ends in an effort to create a safe supply, but the media cycle already had its meat and the company stock dived.

Here’s the thing: When a new drug sector emerges, the usual gang of corporate suspects always jump aboard, papering the room with cheap stock of whatever shell they have lying around and claiming their market heft will bring about success. They did it with weed. The same people – Linton, Booth, Neufeld – did it with psychedelics, and now cocaine.

But Michael Forbes is one of those guys who has actually had real skin in the game from the outset. He piloted a needle exchange for the Centres of Disease Conrol and Prevention back in 2010. He’s a pharmacist who started and operated a chain of successful methadone clinics, so he’s seen addiction treatment up very close. In addition, he’s recently started a chain of longevity clinics, which is (trust me on this) the next big thing in the wellness space, and drawing big money clientele all over North America to clinics charging as much as $80k for services annually. His Ageless Living group has multiple bricks and mortar locations that I (did I mention I’m a 54 year old middle-aged grey-hair?) have seen first hand.

Forbes isn’t a markets player, rather he’s the kind of dude the government agencies LEAN ON, because he’s got first hand knowledge of addiction, addiction treatment, pharmaceutical development, and he’s clean skinned enough that he’s qualified for his weed licenses but ALSO a current cocaine ‘dealers license,’ which all of these other companies are hoping to get.

One day.

Maybe.

Safe Supply has positioned itself to brag that it will, one day, work within the law when the laws become available to work within, but Adastra is there right now. Forbes is respected enough by Health Canada that they already gave his company a license the other guys hope to get over the next year plus.

No, that license doesn’t let him sell eight balls to brokers (which is, let’s face it, where the real money will be), but it does let his company begin formulating compounds that can be put forward as a responsible forward movement in the suddenly very fucking important quest for safe supply.

Cocaine, back in the 70’s and 80’s, didn’t ruin lives because it was super profitable in its pure form and, though definitely habit forming, at least wasn’t stepped on with a variety of household bleaches and rat killers for added profitability. As a legitimate medical treatment, it was, for a long time, way back in the day, the go-to. But the realities of modern illegal drug dealing mean the stuff that most users partake in today is an absolute mess of filler, much of which is toxic, and an increasing amount of which is fentanyl.

If we’re moving toward a future where the government can make available a safer, less addictive, inexpensive alternative to cocaine and other drugs, including those doled out with a prescription, it’s going to be guys like Forbes that provide the framework to do it.

To quote him, in that infamous press release last February, “Harm reduction is a critically important and mainstream topic, and we are staying at the forefront of drug regulations across the board. [..] We pro-actively pursued the amendment to our dealer’s licence to include cocaine back in December, 2022. We will evaluate how the commercialization of this substance fits in with our business model at Adastra in an effort to position ourselves to support the demand for a safe supply of cocaine.”

I’d like to quote him more directly, but when I called and asked if he could talk to me about cocaine, he said only, “I talk to Health Canada about cocaine. I talk to the government about cocaine. I talk to researchers about cocaine. I don’t talk to journalists about cocaine because it’s a nuanced business that, as things stand currently, kills way too many people precisely because of small mindedness and sensationalism getting in the way of harm reduction. If it’s going to ever be better, it won’t be from people talking up how they’re getting into the cocaine business, but from people quietly and legally doing the work of harm reduction and safe supply, and I’d tell anyone looking to back that goal with their hard earned money to look very deeply at the track records and licensing of those involved.”

Hot damn.

Big talk, but do the numbers back him up?

Actually, yeah, kinda. From their last financials:

- Revenue of $10.9-million in Q2 2023, compared with $3.6-million in Q2 2022, representing an increase of 205 per cent;

- Revenue experienced a 15-per-cent increase from Q1 2023 to Q2 2023;

- Gross profit of $2.6-million in Q2 2023, compared with $1.1-million in Q2 2022, representing an increase of 135 per cent.

- Operating expenses as a percentage of revenue decreased from 42 per cent in Q2 2022 to 21 per cent in Q2 2023;

- Cash position as at June 30, 2023, increased to $2-million, an increase of $103,000 from March 31, 2023.

On the shelf:

- In-house brand Endgame ranked No. 1, No. 3, No. 4 and No. 5 of the best-selling concentrates in Alberta.

- In-house brand Endgame ranked No. 2 and No. 3 of the best-selling concentrates in British Columbia.

- In-house brand Endgame ranked the third-best-selling vapour pens in Ontario.

- In Q2 2023, 15 new SKUs for in-house brands were accepted for listing across Ontario, Alberta, and Newfoundland.

And, the kicker of the entire fucking story:

- On Aug. 1, 2023, Health Canada issued a renewal of the company’s controlled drugs and substances dealer’s licence No. 6-1360, which remains valid for the period from Aug. 1, 2023, to July 31, 2026.

Yeah. That’s right. That cocaine dealer’s license, that all the others want to get for the first time, and that he doesn’t want to brag about, has been renewed for three years.

Public company cocaine is here. It’s a thing. But only one company has it, and it’s the one company that doesn’t feel the need to brag about it.

— Chris Parry

FULL DISCLOSURE: No companies mentioned in this article have commercial agreements with Equity.Guru, and we own no stock in the companies mentioned.

Leave a Reply