In this summary report, we will take a quick look at the top 5 gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

FRX Innovations Inc. (FRXI.V)

Market Cap ~ $8 million

FRX Innovations Inc. is a leader in eco-friendly flame retardant solutions. The Company manufactures and sells flame-retardant polyphosphate polymers in Asia, Europe, and internationally. The company’s products including homopolymers used in carpets, textiles, connectors, wires and cables, transparent sheet products, and transparent blown films.

Today the stock is up 23% on no news, but recently announced the exploration of strategic alternatives.

The stock recently printed new all time record lows hitting $0.03. Since then an interim range has developed. $0.16 remains the key resistance and current lower high which keeps this downtrend intact.

Greenlane Renewables Inc (GRN.TO)

Market Cap ~ $33 million

Greenlane is driving change: accelerating the energy transition to a net-zero emissions economy. They are cleaning up two of the largest and most difficult to decarbonize sectors of the global energy system: the natural gas grid and commercial transportation. As a pioneer and leading specialist in biogas upgrading, they have been actively contributing to the decarbonization of our planet for over 35 years.

The stock is up 17.9% on the news the Company has been awarded a $35.3 million CAD contract by a leading environmental services company in Brazil that is investing in a portfolio of landfill assets across the country to produce biomethane.

After printing recent lows, the news has caused the stock to gap up and is now testing a key resistance zone at the psychological $0.25 zone. A close above would trigger a breakout. But the gap up is indicating strong bullish action.

Resouro Gold (RAU.V)

Market Cap ~ $32 million

Resouro is a Canadian-based mineral exploration and development company focused on the discovery and advancement of economic mineral projects in Brazil, including the Tiros Project in Minas Gerais and the Novo Mundo Gold Project in Mato Grosso.

The stock is up 13.9% on no news, but the Company recently released a 2023 exploration program progress for their rare earths and titanium project in Brazil.

The stock has recently broken above a resistance level at $0.33 and is thus in breakout mode. We have seen the retest of this zone and so far buyers are stepping in defending it. The momentum continues with a break above $0.57.

Sirios Resources (SOI.V)

Market Cap ~ $12 million

Sirios Resources is a Canadian-based mining exploration company focused on developing its portfolio of high-potential gold and lithium properties in the Eeyou Istchee James Bay region of Quebec.

The stock is up 12.5% on no news, however the most recent news on September 11th 2023 announced 160 additional claims on the Company’s Li-52 property.

After printing recent lows at $0.035, the stock could be turning with a close above the recent downtrend line. Bulls would want to see price take out resistance at $0.055 for more momentum.

Auxico Resources Canada Inc. (AUAG.C)

Market Cap ~ $14 million

Auxico is engaged in the acquisition, exploration and development of mineral properties in Colombia, Brazil, Mexico, Bolivia and the Democratic Republic of the Congo.

The stock is up 11.1% on no news, however yesterday, the Company announced that the Minastyc Project, a Company-controlled property, has received a Mining Registration Certificate from the National Mining Agency as it relates to the property mining title, which secures the Company’s rights to the exploration and exploitation of the property until 2040.

Another potential bottoming and turn here with the stock looking to build the momentum from an engulfing candle printed a few days earlier. A close above this trendline and the $0.20 resistance zone would be bullish.

Top 5 losers

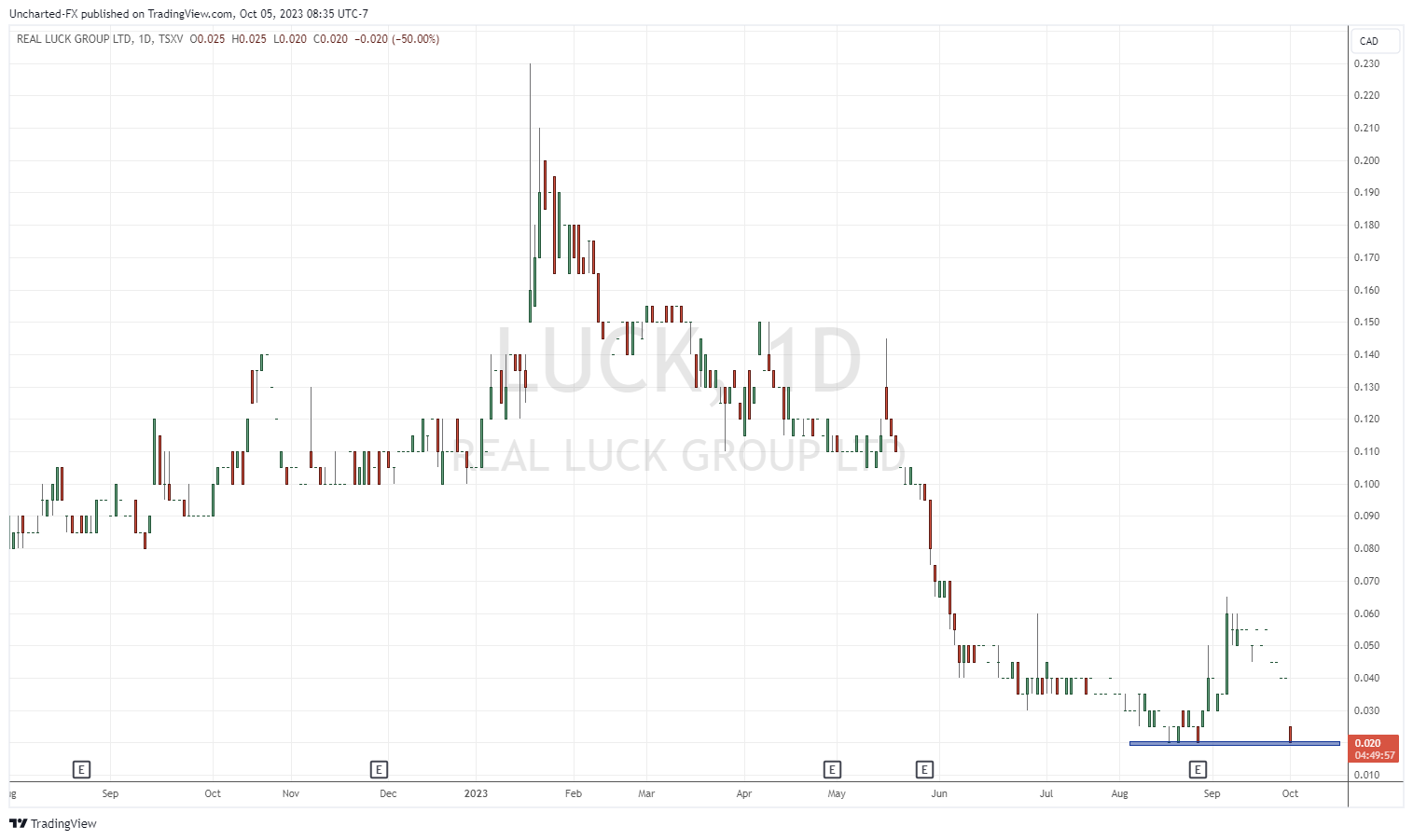

Real Luck Group Ltd. (LUCK.V)

Market Cap ~ $1.38 million

The Company is an award-winning betting company that offers legal, real-money betting, live streams, and statistics on all major esports and sports on desktop and mobile devices.

The stock is down 50% on news of a corporate update and an announcement of restructuring operations following the termination of a LOI as the Company determined the potential transactions under consideration are not viable and are not currently in the best interest of the Company and its shareholders.

The stock has gapped down to retest previous record lows around the $0.02 zone.

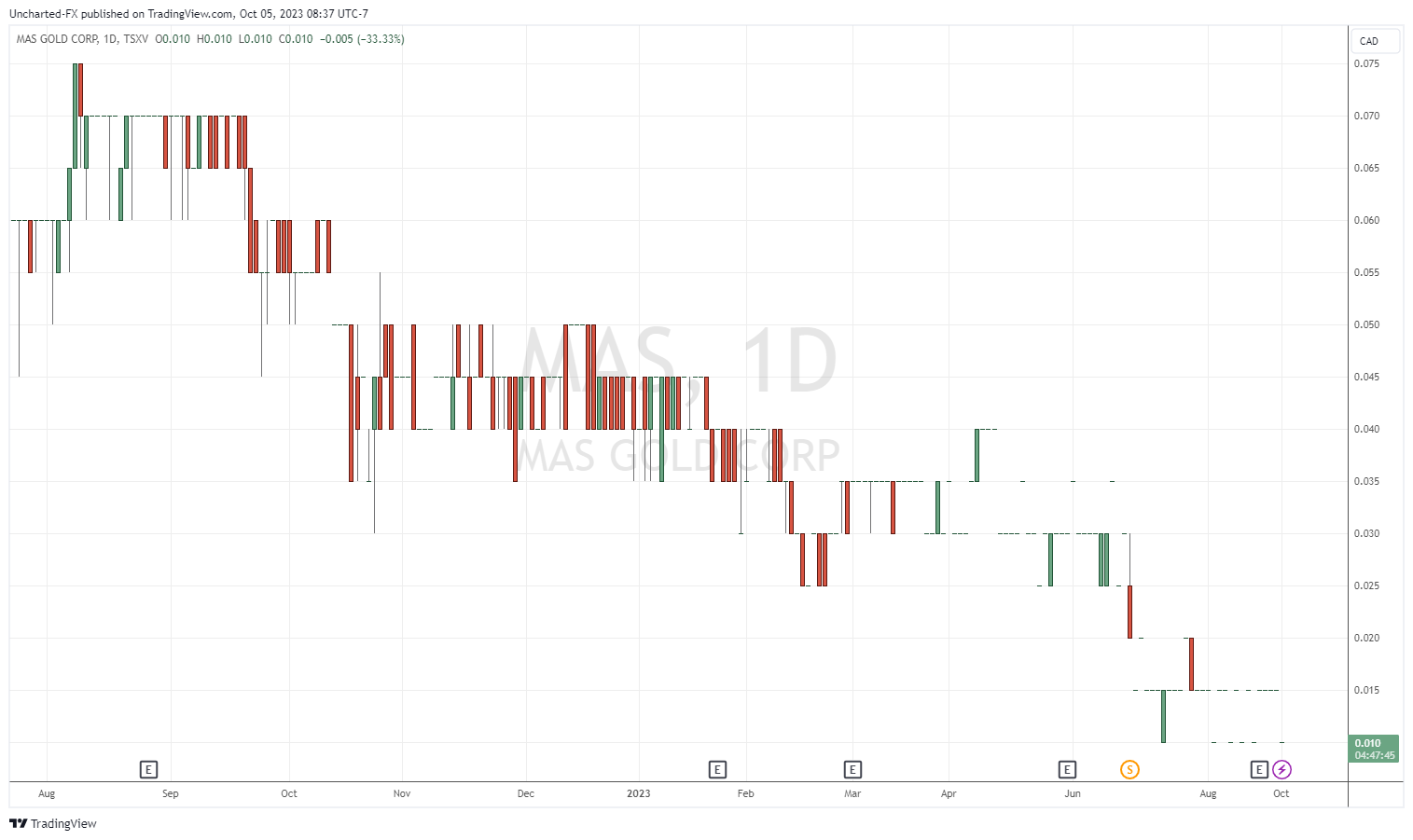

Mas Gold Corp. (MAS.V)

Market Cap ~ $ 3.8 million

MAS Gold Corp. is a Canadian mineral exploration company focused on advancing its gold exploration projects in the prospective La Ronge Gold Belt of Saskatchewan. MAS Gold is exploring on four properties in the belt, including the Preview-North, Greywacke Lake, Elizabeth Lake and Henry Lake Properties totalling 35,175.6 hectares (86,920.8 acres).

The stock is down 33.3% on no news.

The stock is once again retesting all time record lows at $0.01.

Horizonte Minerals (HZM.TO)

Market Cap ~ $96 million

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two 100%-owned, Tier 1 projects in Pará state, Brazil – the Araguaia Nickel Project and the Vermelho Nickel-Cobalt Project. Both projects are high-grade, low-cost, with low carbon emission intensities and are scalable.

The stock is down 22.6% on the announcement of holdings in the Company.

A major gap down and the stock printed new 52 week lows hitting $0.27. New record lows could be in the cards with today’s sell off.

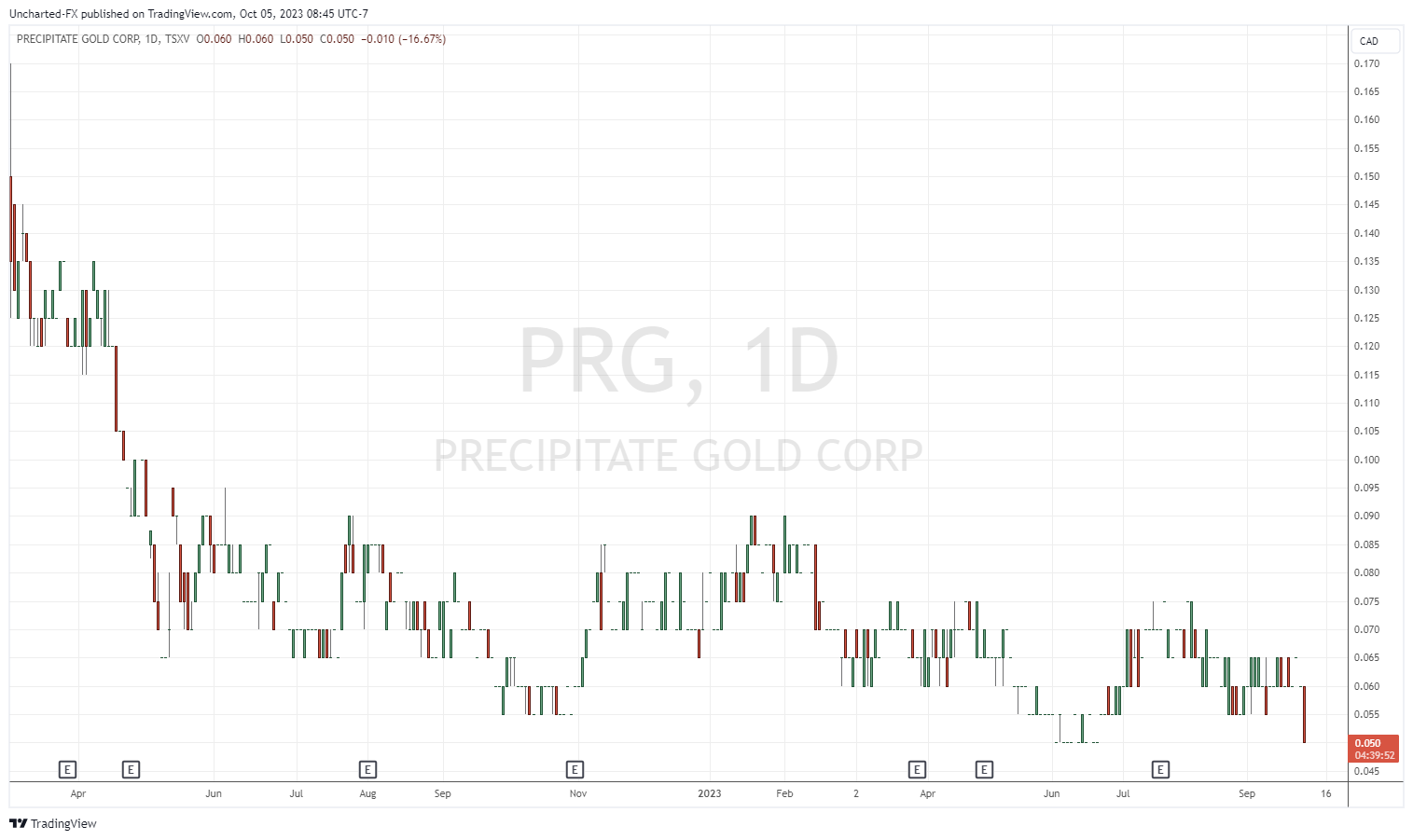

Precipitate Gold Corp. (PRG.V)

Market Cap ~ $6.5 million

Precipitate Gold Corp. engages in the acquisition and exploration, exploitation, and development of mineral resources in Canada and the Dominican Republic. The company primarily explores for gold and base metal deposits.

The stock is down 16.7% on no news.

A major support zone is being tested at $0.05. A breakdown could be in the cards.

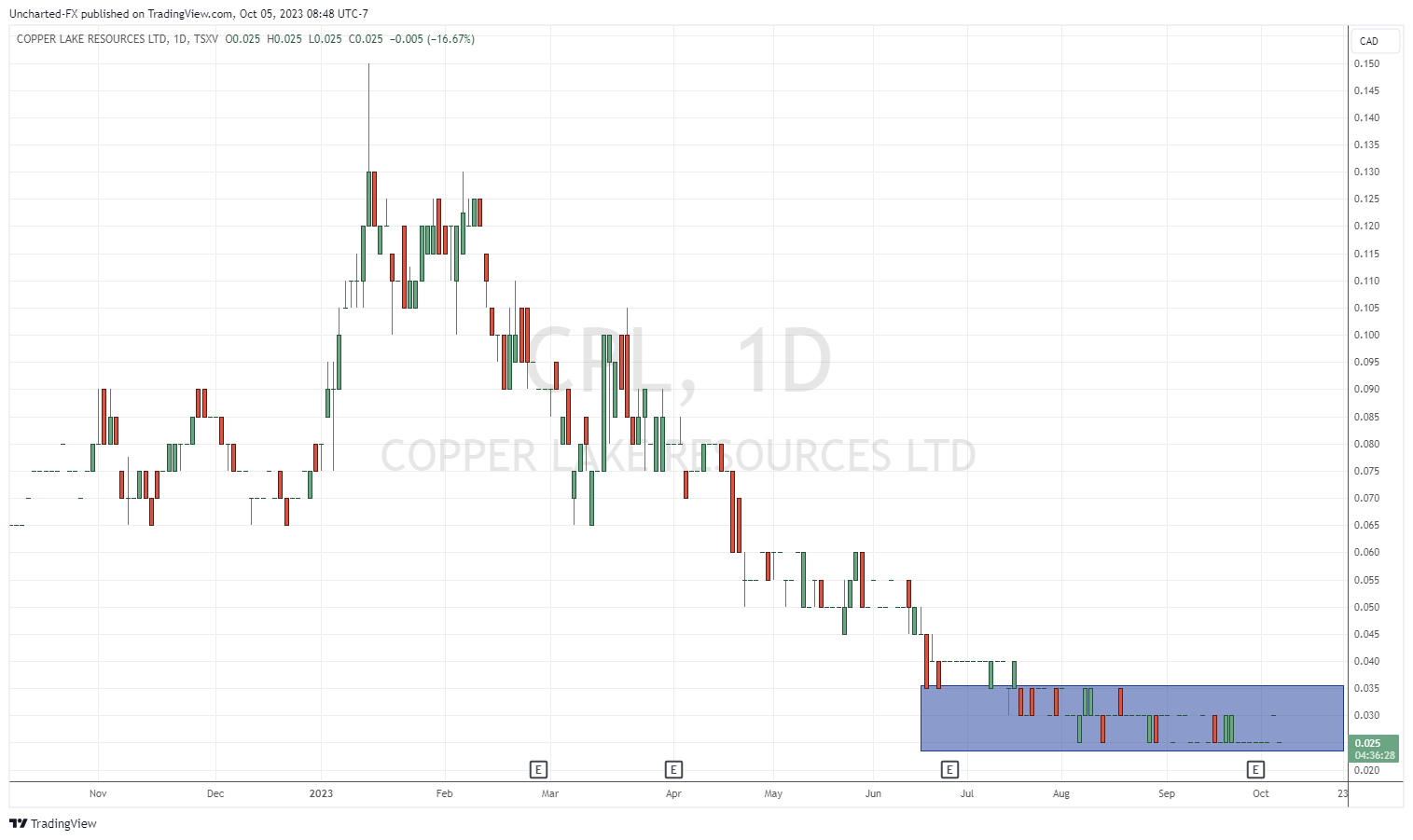

Copper Lake Resources (CPL.V)

Market Cap ~ $5.9 million

Copper Lake Resources Ltd. is a Canadian mineral exploration and development company with interests in two projects both located in Ontario.

The stock is down 16.7% on no news, however just two days ago, the Company released a filing of a NI 43-101 Technical Report and Updated Mineral Resource Estimate for the Norton Lake Nickel-Copper-Cobalt-Pge Deposit, in Northwestern Ontario.

The drop means the stock is once again retesting the support portion of this range which also coincides with 52 week lows at $0.025.

Leave a Reply