In the world of mineral exploration and resource development, it’s not uncommon for companies to possess significant potential yet struggle to gain recognition and investment. Rockridge Resources (TSXV: ROCK) is one such company that seems to have fallen under the radar, despite holding two highly promising assets in Canada. In this article, we’ll delve into the insights shared by Jonathan Wiesblatt, CEO of Rockridge Resources, during a recent video interview with Equity Guru. We explored the company’s assets, market sentiment, and the potential for a turnaround in its stock valuation.

Assets

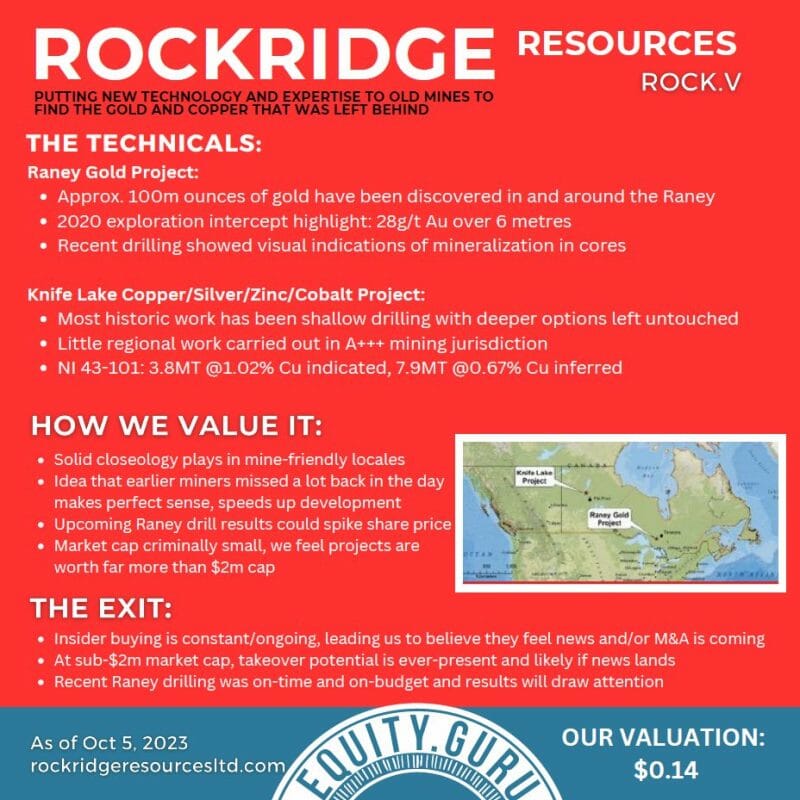

Rockridge Resources is a junior exploration company with two flagship properties—one in Saskatchewan and the other in Ontario.

The Saskatchewan property is a VMS copper play with a substantial resource of over 200 million pounds of copper at surface, along with promising grades and good infrastructure. The company owns 100% of this property. In Ontario, Rockridge is exploring the Raney Gold Project, located approximately 150 kilometers southwest of Timmins. This gold exploration property has seen recent drilling activity, aimed at evaluating its potential for high-grade gold mineralization.

Market Sentiment and Challenges

The current market sentiment, particularly in the junior commodity sector has always been skewed toward the commodity itself while gold equities and related securities languish in the dark just outside of investor’s attention.

Understanding the Market Sentiment

To understand this market sentiment, it’s essential to consider the broader market dynamics. In recent years, the S&P 500 has been driven to new heights, primarily by mega-cap technology stocks. These few giants have dominated the market, leaving many smaller stocks, especially in the resource sector, struggling for attention. The prevalence of technology-driven growth has overshadowed investments in hard assets like gold and base metals.

Wiesblatt pointed out that the volumes in various resource sectors, such as the TSX Venture Exchange, have reached multi-year lows. Apathy seems to be high, and desirability for these resource stocks is low as well.

Potential Catalysts for Rockridge Resources

Despite these challenges, Rockridge Resources has several factors working in its favor. The company’s CEO emphasized that there is an extreme disconnect between the value of the assets held by Rockridge and its market valuation. This disconnect suggests that the market may not fully grasp the potential that these assets represent.

Furthermore, insiders at Rockridge Resources have been actively acquiring shares, indicating their confidence in the company’s future. The CEO himself recently purchased a significant block of stock, and other key figures within the company have done the same.

Looking Ahead for Rockridge Resources

As Rockridge Resources awaits assay results from its recent drilling activities at the Raney Gold Project, there’s a sense that the company may be on the cusp of a significant turning point. The potential for positive news flow and the alignment of insider interests with shareholders’ interests make this a compelling time to consider Rockridge Resources as a potential investment opportunity.

While market sentiment may have temporarily overlooked companies like Rockridge Resources, it’s essential for investors to recognize the value in these undervalued assets and remain patient as the market dynamics evolve. In the resource sector, as in many others, opportunities often arise when least expected. Rockridge Resources could well be one such opportunity waiting to be recognized by a broader audience of investors.

Our Analysis

Leave a Reply