While many traders and investors wake up early on the West Coast to open charts of the stock markets, the very first markets I look at before my morning cup of coffee are the debt markets. Of course if you are a regular reader of my work then you know why I do this, and how we have been able to use the debt markets to make calls about the stock markets.

Well this morning, the debt markets definitely took some by surprise.

The two year yield is breaking out above recent highs.

The longer term 10 and 30 year have also jumped higher and have bounced from my highlighted blue zone which highlights the current higher low. According to market structure, as long as the current higher low remains intact, the uptrend is still in motion. This means that there is a real chance for a move higher in yields.

So what was the big fundamental factor? It comes down to the Federal Reserve and interest rate expectations. In an ironic way, bad economic data has been celebrated because it means the Fed is likely to stop hiking interest rates. Remember, to tame inflation the Fed does want to slow money velocity which means the economy would have to slow down. Many are under the impression that the Fed’s “soft landing” where the Fed can take rates to a high level to tame inflation back down to 2% without causing a recession, is not a realistic scenario.

So what have been the major fundamental data points the markets have been focusing on to gauge the strength of the economy? Labor data and retail sales. The health of the consumer is pivotal in economic strength.

Today’s retail sales data for the month of September came in much higher than expected. Retail sales rose 0.7% on the month, well above the 0.3% Dow Jones estimate. Excluding autos, sales were up 0.6%, also well ahead of the forecast for just 0.2%.

“The U.S. consumer cannot stop spending,” said David Russell, global head of market strategy at TradeStation. “All three retail sales reports for Q3 were above estimates, which puts us on track for a strong GDP number later this month. It also gives the Fed zero reason to loosen policy, which keeps the 10-year Treasury yield pushing toward 5%.”

The implied probability for a December hike moved up to about 43% after the release, compared with 34% on Monday, according to the CME Group’s gauge of futures market pricing.

“I see an economy that is much further along the path to demand normalization than much of the data would tell you. But the path for inflation isn’t yet clear,” Barkin, a nonvoting member this year on the Fed’s rate-setting committee, told a group of real estate professionals. “We have time to see if we have done enough, or whether there’s more work to do.”

In the end just more confusion and uncertainty. Inflation numbers will be closely watched given the recent bump up:

More uncertainty is added given the geopolitical event going on in the Middle East. If things escalate, it has the potential to cause oil prices to surge, which would add to inflationary pressures. Which would mean the Fed either having to raise rates higher if CPI numbers continue to climb, or keep rates higher for much longer.

The US Dollar however did not climb with yields today and remains above the retest zone of 105.50. Some have attributed the move in the dollar for safety rather than pricing in higher interest rates.

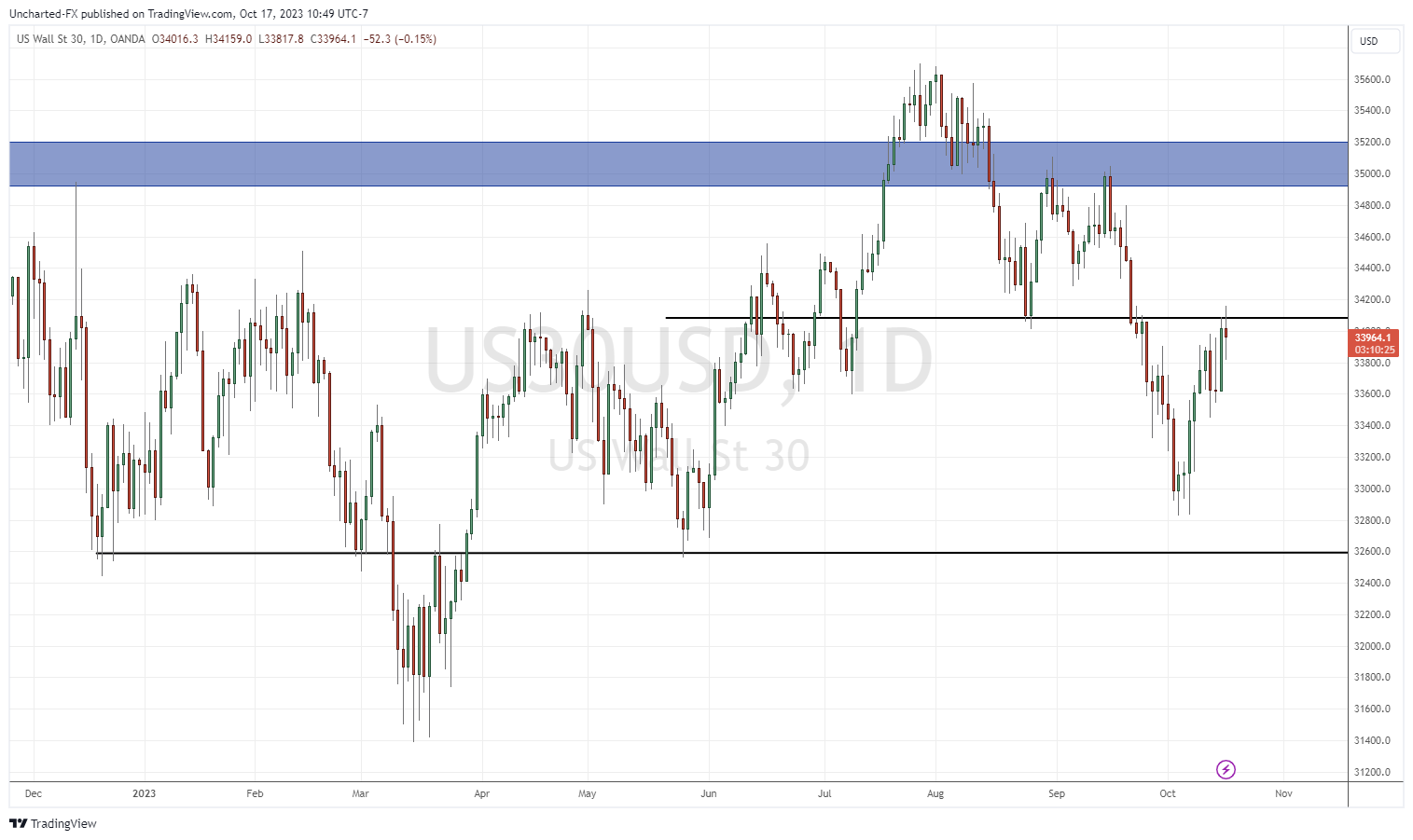

The stock markets continue to be held below resistance zones or the current lower high level. If yields drop, the markets will breakout above and then we will hear more talks of markets taking out previous record highs. The move higher in markets actually occurred when yields corrected to test their current higher low. If we see yields breakout higher, then it would give more strength to the sellers to pile in at these key resistance levels. Technically, the downtrend is the current path of least resistance. But let’s see who wins this battle. The daily candle closes will give us our signal.

Leave a Reply