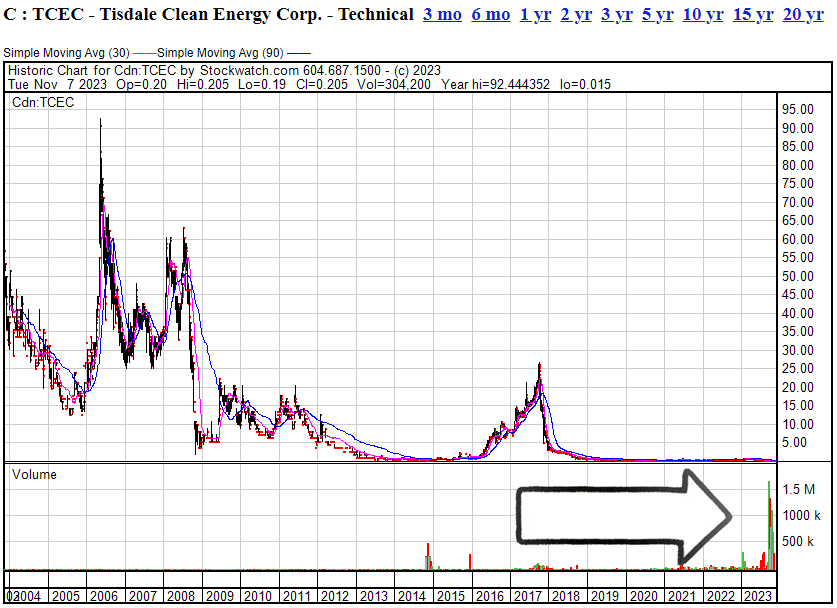

If you factor in all the rollbacks and the sell-offs and the flat years and the crashes, the downturns and boardroom battles and pivots and losses, Tisdale Clean Energy Corp (TCEC.C) has been a decades-long garbage disposal for investor dollars.

- In 2006, TCEC stock was priced at $93 per share (taking subsequent rollbacks into account).

- In 2008, it was $60.

- In 2011, $20.

- Today: $0.20.

But a funny thing has been happening in the last month, since Vancouver mining guy Alex Klenman came in to take the wheel of a company that hadn’t been doing, well, anything for much of the last year, and not a whole lot for the several years prior.

The stock chart since 2004 looks like a journey to Mordor.

Thar be monsters here.

But do you see that fat arrow on the bottom right of the stock chart?

That’s pointing to an EXPLOSION of trading activity the likes of which haven’t been seen on this stock in over 20 years.

All the way back to the early oughts, there hasn’t been a single day where more than 500k shares of TCEC were traded, until just this last few months, where there have been four days of over 1 million daily volume.

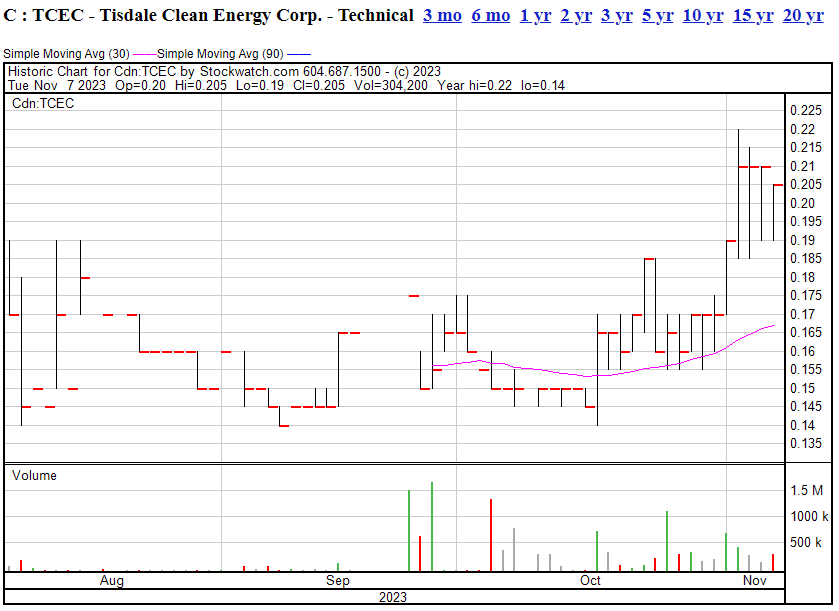

All of that activity has seen the stock move up 30% since September, even at a time when resource juniors WITHOUT poor historic track records struggle to get lift.

Nobody knows the Tisdale story, nobody is promoting it, it’s not being bandied about social media and Discord and Telegraph, and yet it’s flying.

Why?

Look at that thing – that’s consistent trading volume every day.

- Is the pump in play? Nope, no marketing being done.

- Is the sector blowing up? Nope, no rising tides here.

- Is someone accruing on the open market? Maybe.

Either way, bro, something’s going on at Tisdale.

So I called Alex Klenman, because he always answers the phone, is always good for a quote, and I figured maybe there’d come a point where he does want to promote his deal and, you know, that’s how I make my living. I wasn’t wrong on any of the three counts.

THE STORY:

“Back in February of this year, things were definitely in play at Tisdale,” he told me. “There was some promotion happening, folks were jostling each other for a piece, I was in the background helping raise money, and then it just seemed that everyone on the boat stood around and looked at each other as it sank around them.”

The market wasn’t being kind, reasoned Klenman who also runs uranium play Azincourt Energy (AAZ.V), but that wasn’t the reason for a $0.70 to $0.15 fall-off.

“It was just… nobody did anything,” he explained. “So, you know me, I’m a sucker for a deal that’s cheap for reasons other than what’s in the ground, so I took the wheel.”

When you volunteer to be CEO and nobody at the company resists, you know there’s work ahead of you, but Klenman isn’t afraid of that. In fact, taking out a lease on a burning building is kind of his MO.

Klenman’s first move was to call long term investors in his other deals who know from prior experience that he punches above his weight class, and stays around through the hard stuff.

“They know this is a turnaround story,” he said, “and they know I work for fun, so if it doesn’t play out at Tisdale, it won’t be due to executive inaction. For people who know me, that’s enough to take a position.”

And in the junior mining space, that’s a large part of the de-risking needed to find success. A junior mining explorer can be successful with an average property and great management, but rarely will things work the other way around.

“I know this is a good property,” says Klenman. “It’s really going to come down to doing the work, and I’m rich in the ability and drive to make work happen.”

He aint lying. As an example, Klenman is determined not to change the name of Tisdale, despite it’s long history of having had carnal relations with the canine.

“I’m not someone to take the easy path,” he says. “I’d rather be known for fixing this thing and revealing its potential than dodging that history and pretending it never happened. This is Tisdale Clean Energy Corp. I’m not here to apologize for what happened before me, or make excuses, or hide. Judge me on what’s happened since I showed up.”

If that’s going to be the metric, he’s off to a blindingly good start, but it’s the technicals that will fuel things from here.

THE TECHNICALS:

Tisdale’s exploration property is the South Falcon East project, and it’s a uranium play in the uranium hub of Canada.

- Strategic Location and Accessibility: The South Falcon East property is situated in a prime location, approximately 18 kilometers outside the southeast portion of the Athabasca Basin and 55 kilometers east of the Key Lake Mine. It benefits from proximity to all-weather northern highways and grid power, enhancing its accessibility and reducing potential infrastructure costs.

- Significant Historical Resource Estimates: The property boasts substantial historical resource estimates, including 6,960,681 pounds of Uranium (U3O8) and 5,339,219 pounds of Thorium (ThO2) inferred at average grades of 0.03% U3O8 and 0.023% ThO2 within 10,354,926 tonnes. These figures suggest a strong potential for future resource expansion.

- High-Grade Mineralization and Expansion Potential: Initial drilling programs have intersected high-grade mineralization, with one such intersection yielding 0.172% U3O8 and 0.112% ThO2 over 2.5 meters. The Fraser Lakes Zone B area within the property presents exceptional exploration potential, including the possibility of expanding the resource along strike and at depth.

- Favorable Geological Features: The property exhibits geological and geochemical characteristics similar to high-grade basement-hosted deposits in the Athabasca Basin. Such similarities to renowned deposits like Eagle Point, Millennium P-Patch, and Roughrider may indicate the potential for significant uranium discoveries.

Tisdale has an earn-in option to acquire up to a 75% interest in the property, which could significantly increase the company’s asset base and provide leverage for future development and exploration activities. That said, it’ll cost them around $20 million over five years in cash, shares, and work done, to maintain that interest.

For a $3.3 million market cap company today, that’s going to make it necessary to drive the share price hard before kicking in a whole lot of financing or loans down the road.

“There’s only 16 million shares out now,” says Klenman, “so we have plenty of opportunity to raise money before anyone worries about too much dilution.”

I know from talking to other junior explorers in the Basin, that there’s more than a little intrigue going on with geologists who have uranium experience right now. There’s been a lot of headhunting and, at times, a lack of respect regarding existing contracts. Doing the work requires more than just funds, it requires experienced bodies.

Klenman says that side of things is well sorted.

“Oh yeah, look, if you treat people right they’ll ccome work for you,” he says. “I’ve been working in uranium exploration for some time and I feel like I’ve got a good reputation for treating people right, which is why I’m still in the game.”

It’s also why he has solid partners, including Skyharbour Resources (SYH.V), one of our favourite clients and widely considered the company most likely to level up in the Athabasca this year. Being able to trust that your partners will stay in business is an important asset. Being able to trust that your partners do things the right way is the icing on top.

— Chris Parry

FULL DISCLOSURE: Tisdale Clean Energy is, as of now, an Equity.Guru marketing client

Leave a Reply