Uranium – The Rocket Has Been Launched

As we have been harping on for months HERE and HERE, pointing out the inevitability of a uranium price move upwards, we can finally say: it’s arrived. Technical analysts can pull out their crayons and draw lines to confirm the obvious: if demand is growing faster than supply, at some point, the price moves. And move it did, reaching a high of $81 this past week in the thinly traded spot market.

With this, one might be inclined to assume they’ve missed the move and should sit this one out unless a short-term correction makes the commodity relatively cheap again.

Not so fast.

I’d like to point out an intriguing opportunity in this market, after putting some capital at risk in this thesis since 2014. Losing some, winning lots.

Look, I am not going to lie, the run from $18/ lb of U3O8 to $80/ lb has been the sweetest form of vindication for the small retail investor who has made a bold bet by going long uranium.

For years, experts and fuel buyers have sat on their pretty little butts (some not so little, others not so pretty) and expected business-as-usual as their industry forecasters gave them a nod and did not warn them of the impending bottlenecks they would soon be facing to source uranium.

Financial buyers such as SPUT (Sprott Physical Uranium Trust), ANU Energy, Zuri-Invest’s Swiss fund and others have found the gap in the supply and demand models, marketed the opportunity to wealthy investors, and have been buying up pounds of yellowcake quietly. Fuel buyers have maintained their no-longer-existing market-coloured-glasses on and expected suppliers to bow to their demands.

Case in point, an RFP (request for proposal) went out by a well-known utility from South Korea a number of weeks ago. The request determined a floor that was below market prices then, with a ceiling barely $10 what we are already seeing this week. This was for a contract for delivery from 2026 to 2030. Suppliers all rejected this proposal and the RFP went “no-bid”. The Korean utility, once so used to getting its own way that it would put non-compliant suppliers in a so-called “blacklist”, may be forced to put (checks notes) ALL market suppliers on the blacklist. Cute.

However, the opportunity lies in the fact the price of uranium has not yet caused a massive spike in stocks.

Why?

Canadian stocks are losers

Well, Canadian stocks in general have done very poorly. After many years of losses in junior miners across the board, there aren’t many new investors interested in losing money in a market that’s gone down for so long.

If you take a look at the TSX.V index, which hosts most junior mining stocks in Canada, you see a painful pattern. You would have lost money on the market as a whole in the last 12 months, and the last 5 years, and also since inception. At some point, the players in the casino run out of cash to buy chips. Investing in Canadian companies is a contrarian sport. By definition the market is against you, but if you time it correctly and study the right thesis, you can multiply your initial capital again and again.

TSX Venture Composite Index

Risk-off + Investor Demographics

Another factor is that as inflation has gone up in the last two years, interest rates have been hiked to put out this fire – and bonds have shown to be a credible alternative to riskier assets. This bodes well for the typical mining investor in Canadian ventures – who are often older and therefore would have a natural tendency to move to risk-off instruments when the payout is favourable. Let’s be honest, even the most degenerate of us might choose something more conservative in our 60s, 70s and beyond.

Many Speculators Left Too Early

Since the peak of uranium juniors in November 2021, as evidenced by the ETF URNM, many retail speculators have thrown in the towel. The reason was simple: the underlying market fundamentals were working their way throught the market slowly, and like a 15th century conquistador looking at the stars to adjust his direction, analysts could see the market tightening well before it actually happened, stocks ran hot too quickly, and subsequently cooled off as participants waited for the price of the commodity to catch up to the excitement.

The fact is, during that 2021 peak, the spot uranium price was pierced through $50/lb and hovered below it for quite some time before breaking out this of 2023 summer and reaching the low $80s, where we sit now.

With this massive discrepancy between spot price movements and a recent timid response by juniors, the savvy amongst us are absolutely salivating and building / rebuilding their positions.

And if you’re looking for ideas of companies in this area, let me mention two interesting companies with a tiny market cap, or what I like to call nanocaps for maximum risk and torque.

Standard Uranium

A long-time partner of Equity Guru, Standard Uranium (STND.V), a Canadian junior uranium exploration company, has established a strong presence in the Athabasca Basin region of northern Saskatchewan, Canada, known for its high-grade uranium deposits.

Standard Uranium’s portfolio comprises of seven high-quality uranium exploration projects across over 187,542 acres in the Athabasca Basin. These include the eastern Athabasca uranium district’s five projects – Atlantic, Canary, Ascent, Rocas, and Corvo projects, each in proximity to significant uranium discoveries like IsoEnergy’s Hurricane deposit and 92 Energy’s Gemini uranium discovery. Additionally, the Sun Dog project in the northwestern edge of the Basin adds to the company’s diverse exploration front.

The company’s new approach has been strategically capital efficient, engaging joint venture partners for the development of its land package while retaining upside exposure to any discoveries. This model of project generation allows Standard Uranium to leverage its exploration expertise while managing capital requirements effectively.

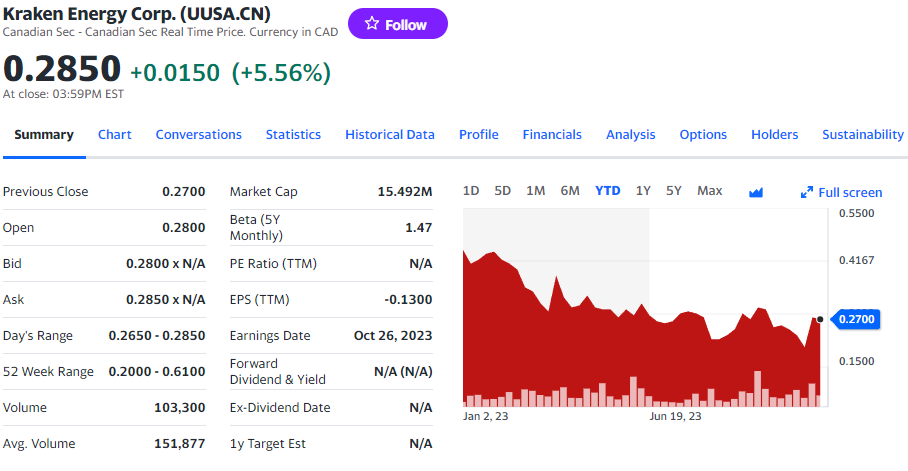

Kraken Energy

Kraken Energy (UUSA.C) is engaged in uranium exploration and development in the USA. They control four projects, including the Apex Uranium Mine in Nevada, a significant historical producer of uranium in the region. With a possible American-sourced uranium renaissance with bi-partisan support, their strategy has been centered around higher-grade projects (such as 0.25% U308 and surface samples reaching up to 6.0% U₃O) for the region. The idea is they may come back into production more quickly than their lower-grade counter-parts. The Apex Project features a notable 14.5 km strike of uranium showings, so lots of potential for more modern-day exploration methods.

Located near infrastructure like roads and power supplies, the company’s projects are well-positioned for future mining operations. Kraken Energy is led by a team with experience and great success in uranium exploration in the Athabasca Basin.

————————————————————————————————————————–

Having a portfolio that extends the whole spectrum of companies of nanocaps to producers has proven to be a winner in this market (just look at Cameco!), and we want to hear from you – what uranium companies do you think the market is sleeping on?

Happy speculating,

Fabi Lara

Leave a Reply