Building on yesterdays report, we will take a quick look at todays top 5 stock gainers and losers up or down double digits on the Canadian stock markets.

Here is a summary of the intraday action of assets:

Top 5 Gainers

Jade Power Trust (JPWR.H)

Market Cap ~ $2.67 million

Jade Power Trust is a renewable energy company that relies on wind, solar, and hydropower generation assets.

The stock is up 200% on no news. The company announced two days ago that the final amount of €3.0 million held in escrow pursuant to the closing of the Trust’s sale of all its renewable energy operating assets to Enery Power Holding GmbH and its affiliate has been released from escrow.

Since the calamitous drop at the end of last year, the company has ranged well below its support level. The powerful green candle today with an uncharacteristic increase in volume doesn’t necessarily indicate a reversal and may still drop back down to range once more.

Pampa Metals (PM.C)

Market Cap ~ $5.78 million

Pampa Metals is listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE: FIRA), and OTC (OTCQB: PMMCD) exchanges, and wholly owns a portfolio of projects highly prospective for copper, molybdenum, and gold along proven and highly productive mineral belts in Chile, the world’s largest copper producer.

The stock is up 180% after the company announced yesterday that it had optioned a copper-gold project along San Juan Porphyry Belt.

The sustained downtrend reveals an overarching bearish sentiment, even though buyers have stepped in periodically in larger volumes. The news-driven green candle at the end is singular and doesn’t necessarily indicate a reversal pattern.

Stroud Resources (SDR.V)

Market Cap ~ $4.32 million

Stroud Resources Ltd. is a Canadian generating shareholder value through the exploration and discovery of precious metal deposits. It has previously focused on an easily accessible, epithermal gold and silver projects in Mexico and Archean gold deposits in Canada.

The stock is up 87.5% on no news. Back at the end of November the company announced a 71% increase in measured and indicated resources at Santo Domingo, Mexico.

This stock has been ranging below support levels for the past few months with a couple instances of strong buying volume. As described, today’s spike is backed by volume which may indicate a potential reversal or a short term rally.

Bravada Gold Corporation (BVA.V)

Market Cap ~ $8.84 million

Bravada Gold Corporation is a Nevada-focused exploration and development company, exploring for precious metals in well-established gold trends in one of the world’s best gold jurisdictions. The Company has a large portfolio of high-quality properties covering a range of development stages from early-stage exploration to advanced-stage exploration and pre-development.

The stock is up 62.5% on no news. The company released its annual MD&A at the end of November.

The falling wedge from March 2023 onward shows a solid break above the $0.04 resistance level with the latest green candle. If it can close above resistance, there may be a reversal in the offing.

Willow Biosciences (WLLW.T)

Market Cap ~ $12.42 million

Willow Biosciences is a biotechnology company focused on the development of a disruptive bio-based process for the production of high purity cannabinoids.

The stock is up 42.9% on no news. Insiders have increased ownership in the latter part of November with the exercising of options and an acquisition on the public market.

A falling wedge combined with a possible double bottom indicates the potential for a reversal of the downward trend.

Top 5 Losers

Copper Road Resources (CRD.V)

Market Cap ~ $4.69 million

Copper Road Resources is a Canadian company exploring for copper-dominant polymetallic deposits at its 24,000-hectare project near Batchewana Bay, Ontario. The Project is located within the eastern extension of the Mid-Continent Rift within the Proterozoic Keweenawan Group, approximately 85 km north of Sault St. Marie, Ontario.

The stock is down 29.2% on no news. The company announced yesterday that it had intersected 50 metres of 1.00% Cu Eq at the Richards Breccia.

Even though there was a lot of buyer volume on November 30, sellers took out any gains made with no indication that this falling wedge would experience a break out.

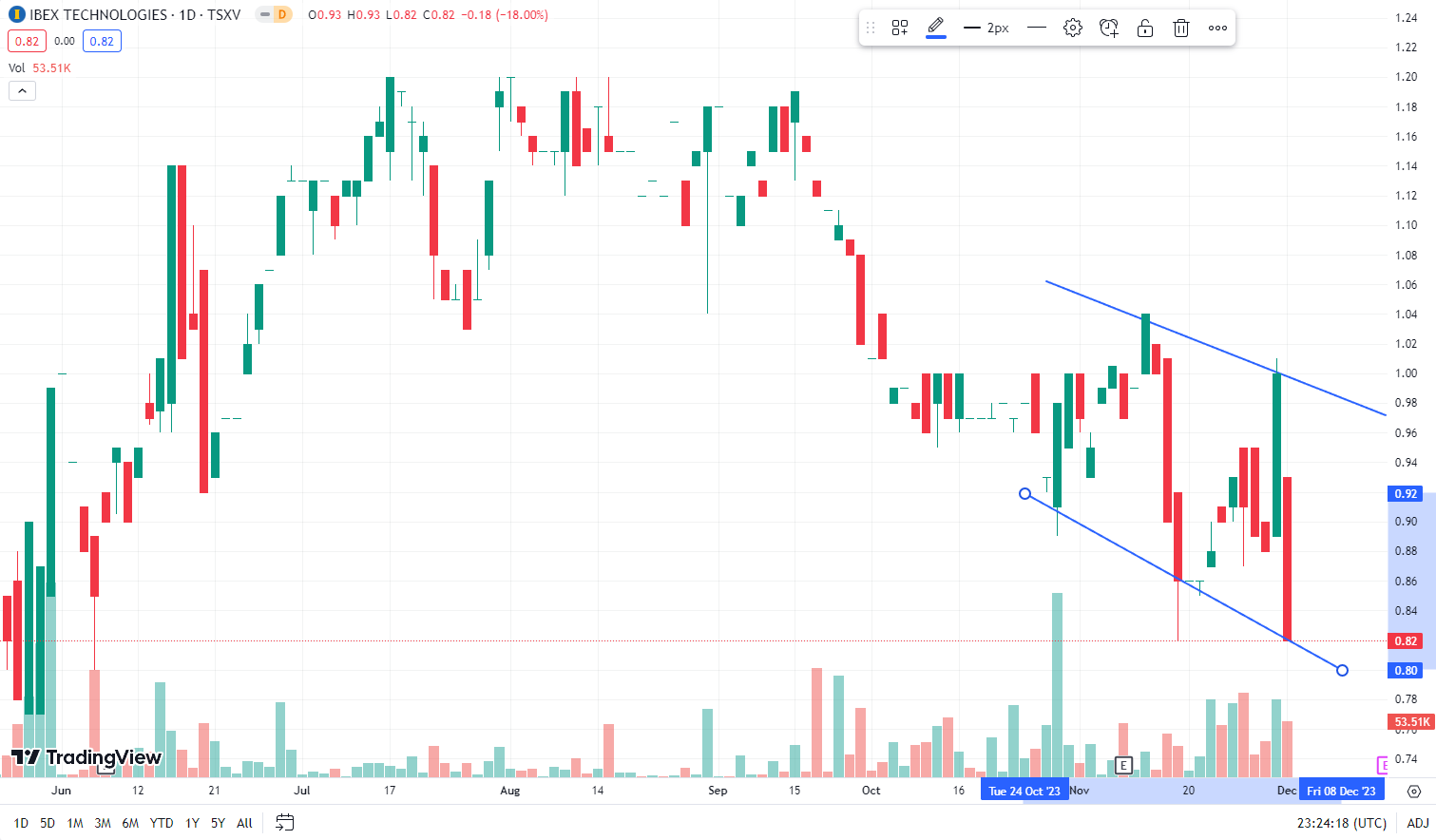

IBEX Technologies (IBT.V)

Market Cap ~ $20.32 million

IBEX manufactures enzymes for medical use as well as filling and the lyophilization of medical device components.

The stock is down 18% on no news.

The downward trend shows no indication of a reversal.

Adventus Mining Corp (ADZN.V)

Market Cap ~ $53.89 million

Adventus Mining is a unique public company focused on copper-gold project development and exploration in Ecuador. Adventus Mining also owns a portfolio of exploration projects in Ireland.

The stock is down 16.7% on no news.

SP dropped below support at the beginning of October with a meteoric breakout during the first part of November. The proposed merger cooled sentiment and the strong bearish push indicates that it will probably drop further at least to the $0.28 support level.

Regenx Tech Corp (RGX.C)

Market Cap ~ $17.36 million

Regenx provides a new clean-tech solution for the recovery of precious metals from end of life materials.

The stock is down 16.7% on no news.

This stock shows no sign of reversal and looks to be on its way to drop at least to $0.04.

Gold Bull Resources (GBRC.V)

Market Cap ~ $4.72 million.

Gold Bull Resources is a US gold focused, exploration and development company, led by a team of experienced industry professionals with expertise in exploration, corporate finance, and mine development.

The stock is down 15.8% on no news.

There is an upward trajectory with a large price correction but the selling pressure did not push past support levels, so not an indication of a break down.

Leave a Reply