Bitcoin bulls have been waiting for this news. The biggest catalyst touted by Bitcoin traders and investors was the SEC approving US Bitcoin ETFs. That day has come and US Bitcoin ETFs have begun trading today.

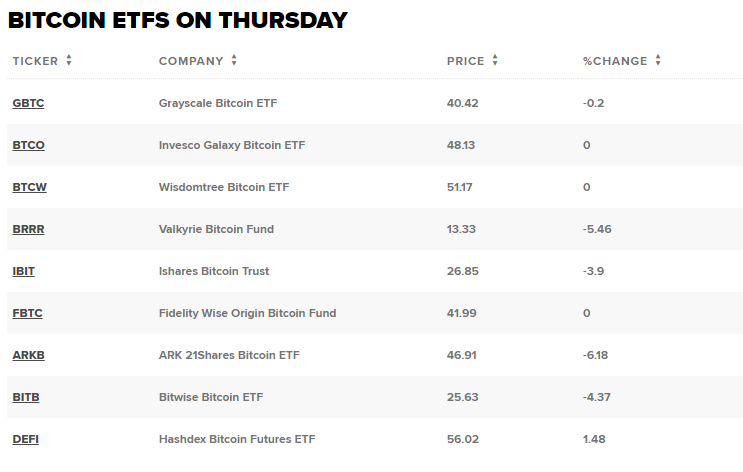

The SEC approved the first ever batch of Bitcoin ETFs to come out of the US with the green light given to sponsors of 10 ETFs including BlackRock, Invesco, Fidelity, Grayscale, and Ark Invest.

But as of right now, Bitcoin is not performing the way many Bitcoin bulls thought it would on the news. A typical ‘buy the rumour and sell the news‘ price action. The ETF news has been priced in which has caused Bitcoin to rise since October 2023.

BUT the trading of Bitcoin ETFs does mean a lot in the crypto space.

This increases the volume and interest as now a Bitcoin ETF provides investors a way to gain exposure to Bitcoin via holding existing and traditional financial instruments. A Bitcoin ETF gives investors exposure to the value of Bitcoin without directly owning it.

ETFs trade on traditional stock exchanges, and their value should rise when the underlying asset increases in price, or fall if it decreases.

So why the excitement from Bitcoin bulls? Well, CNBC had this nice comparison:

The total gold market capitalization was worth around $1 trillion to $2 trillion before the gold ETF was approved, and this subsequently ballooned to $16 trillion in a few years after, according to Vijay Ayyar, vice president of international markets for Indian crypto exchange CoinDCX.

With the modern world and a different breed of investors and traders, the Bitcoin market cap could accelerate and ‘moon’ faster. Especially with an increasing interest in cryptocurrency and it being seen as an asset class for a modern portfolio.

Bitcoin becomes ‘legit’ and loses that shady perception.

It really is all about that institutional crowd and how they will jump into Bitcoin given there is an easier and safer way to gain exposure. If this money flows in as Bitcoin and cryptocurrency emerges as an asset class, then the ride is just getting started.

Now I would be doing a disservice to my readers if I did not mention the ‘alternate/other’ viewpoint.

Many OG Bitcoin bulls and enthusiasts see Bitcoin as a decentralized asset which is supposed to be away from the hands of big government, big banks and wall street. With the adoption of Bitcoin ETFs, some see this as a way for Wall Street to get their dirty hands on.

They are asking the big question: “Is Wall Street Hijacking Bitcoin?“.

Take some time to consider that. Gold and Silver bulls talk about Wall Street repressing and muddling around with the price of metals. Wall Street can theoretically do the same with Bitcoin.

Now let’s get to the charts.

Starting with the weekly chart, the Bitcoin sell off happening right now is occurring at an expected zone. Bitcoin is testing major resistance around the $48,000 zone. There is a good chance that Bitcoin could correct and pullback here.

The daily chart shows some clearer levels for swing traders. The major higher low comes in at $41,000 meaning Bitcoin remains in an uptrend as long as price holds above this price zone. I would also watch the $44,000 zone. This is where a major range breakout occurred and price is seeing buyers there as evident by the large wicks. A daily and weekly candle close above $48,000 would be huge and extend the move. This would set up a move that could see $50,000 break.

For the sniper traders out there, take a look at the 4 hour chart. You can clearly see the current range Bitcoin is in between $45,530 and $47,000. Traders are waiting for the break.

Leave a Reply