Our friends at Beyond Lithium (BY.C) went on an absolute spree over the last year, accruing more lithium projects in Ontario than any other explorer.

We asked repeatedly what they were going to do with all those projects, and they said repeatedly, “We’re going to explore them.”

No lithium project supermarket, no sit and wait for the neighbours to do the work; Beyond is determined to be the masters of their own destiny and actually DO THE WORK.

RESPECT THE WORKERS

We’ve heard that phrase before at Equity.Guru recently, when Defense Metals (DEFN.V) outlasted their heavily promoed but underworked neighbours long enough to see those investors change sides. The neighbours keep falling, while DEFN goes up every day on the back of actual work done and points on the scoreboard.

The sector there is rare earths, but the ‘respect the work’ mantra is also being chanted over in uranium country, where our friends Skyharbour Resources (SYH.V), Standard Uranium (STND.V), and Azincourt Energy (AAZ.V) are racking up similarly big stock wins on the back of news pointing to work getting done.

Over in lithium land, Beyond called their shot late last year when they said they’d be active on the exploration side, and the newsflow is showing that was no lie.

In the last six months they did the following:

- Submitted 290 project samples back in June

- Found LCT pegmatite at Cosgrave in August

- Sampled 2.075 ppm Li at Gathering South the same month

- Confirmed completed exploration on five projects in September

- Sampled 4.53% Li20 at Ear Falls later that month

- Grabbed two more projects and raised a million bucks while beginning stripping and drilling at Ear Falls in October

- Sampled more lithium at Cosgrave Lake in November

- Found 5.11% Li20 at Victory on the last day of November

- Submitted exploration permits for 30 drill sites in December

Now, cynics will point out it’s been a few weeks without anything new on the exploration front but, come on, give the guys Christmas off, it’s bloody cold out there in Ontario.

WE BURIED THE LEDE, THERE’S BIG NEWS

What Beyond have revealed is they’ve done a deal for their two most remote properties, at Borland East and North, which will bring back 1.1 million shares in Australia’s Patriot Lithium in the short term, and a $2.5 million cash payment should that company manage to put out a mineral resource estimate showing 20 million metric tonnes containing an average lithium grade of 1% or higher.

That deal is worth around 26% of Beyond’s current market cap should the resource estimate happen as planned, for a property so off radar, the company had no plans to drill it and hadn’t really listed it on their website.

It’s valuable to Patriot, however, as it lies near their existing property and could help make their holdings a much more attractive basket going forward.

For Beyond, that’s money for jam. It won’t blow the roof off, but it says ‘this is what our least attractive (to us) property was worth, now let’s get stuck into the properties we love.

That’s Ear Falls and Victory.

THE BIG BOYS

On Ear Falls, I spotted this note over on CEO.CA that summarizes my feelings:

“I have been to Ear Falls with the BY team. When we get what I expect to be great results next week, keep in mind that it’s only 15 minutes away from the town of Ear Falls and there is a three lane logging road going through the property and even over the pegmatites. 4.54 Li20 is on that peg, walking distance from road.. I was there.. Driving there we joked with Alain, did you prep infrastructure 10 years ago just for this discovery.. Hydro at at logging rd follows it, clear cut logging was done probably 15 years ago.. Maintained road.. It’s a dream come true to a company that wants to bring Ear Falls to production as fast as possible.”

For Ear Falls and Cosgrave, the company owes mid-5 figures in option fees this year, and the company Twitter feed shows they’re not sleeping on it.

Since our spodumene discovery in September at Ear Falls, our crew has been hard at work, uncovering more spodumene-bearing pegmatites in the northeastern extension with grades up to 1.0% Li2O and 107ppm Cs. The Wenasaga North Zone now stretches 50% more, from 1km to 1.5 km! 📈⛏️ pic.twitter.com/tLmWHKeHWd

— Beyond Lithium (@Beyond_Lithium) January 15, 2024

As for Victory Falls, that’s the prevailing ‘hot ticket’ in the Beyond Lithium camp, according to most with insight, and the option on that isn’t due for another year, with a full year of drilling expected on that rock in 2024.

So things are looking good, right? Management turning stuff from the bottom drawer into money, showing that even their B-list is worth money, and CEO Al Frame points out that on the strength of the deal just done, if they applied it to everything they own, without any further exploration, that’d put the company at a value of $33 million.

Right now the market cap is under $10 million.

Minions, this one isn’t so much a speculator as an arbitrage. The market has cooled for the minute on lithium while folks play with uranium’s run, but we know lithium will have more runs in 2024 as it did in 2023, and 2022, and 2021… so the weak hands have tossed you an opportunity.

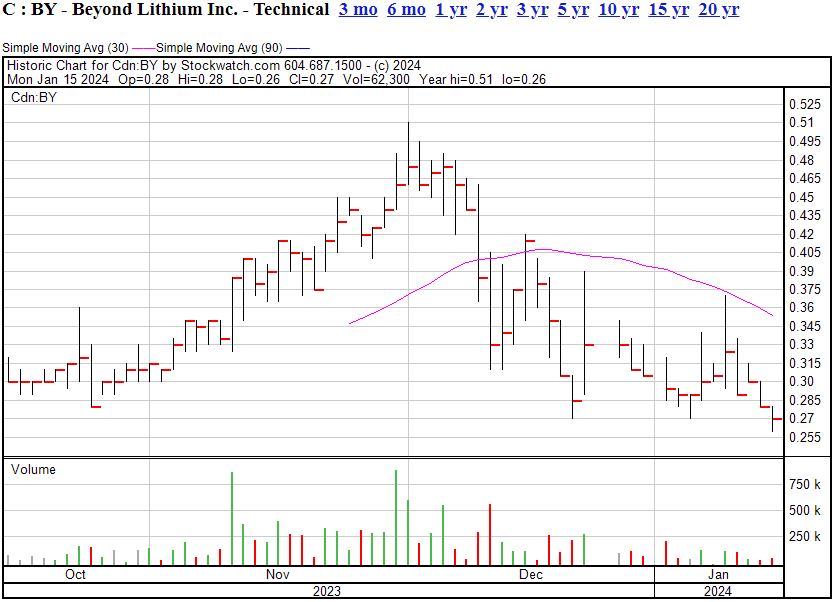

Yep, that’s a $0.51 to $0.27 fall-off in six weeks, while the company is crapping out real news weekly, doing on the ground work constantly, monetizing some of it’;s 60+ properties, facing precious little headwinds, and with drill data likely being released this week before the Vancouver Resource Investment Conference.

COME SEE ME TALK

Speaking of VRIC, I’ll be there doing a keynote for the first time in a few years on January 21 and 22 at the Vancouver Convention Centre West, and the Beyond Lithium team will reportedly all be there, so I assume they have news to bring.

If you’ve never been to an investment conference before, I heartily encourage you to get out there. Besides me, you’ll get to hear Rick Rule, Tommy Humphreys, our own uranium bug Fabi Lara, Ross Beaty, Gwen Preston, Nick Hodge, Jeff Clark, Brent Cook, Jamie Keech, Kai Hoffman, and a hundred or so others. If you’re a resource investor from way back or a total noob lookng for ideas, I can’t recomment it enough.

See you there: https://cambridgehouse.com/vancouver-resource-investment-conference/

— Chris Parry

FULL DISCLOSURE: All the companies mentioned in this piece are clients of ours, and chances are we own stock in them at the time of writing. I heartily recommend them not because they do business with my company, though you should assume that’s the case and not take my word for it – but because I genuinely believe in these management teams, they’ve shown their work over a loing period, and they continue to have support among people I respect in the business. Always talk to an investment advisor before buying any stock, but add these guys to your watchlist.

Leave a Reply