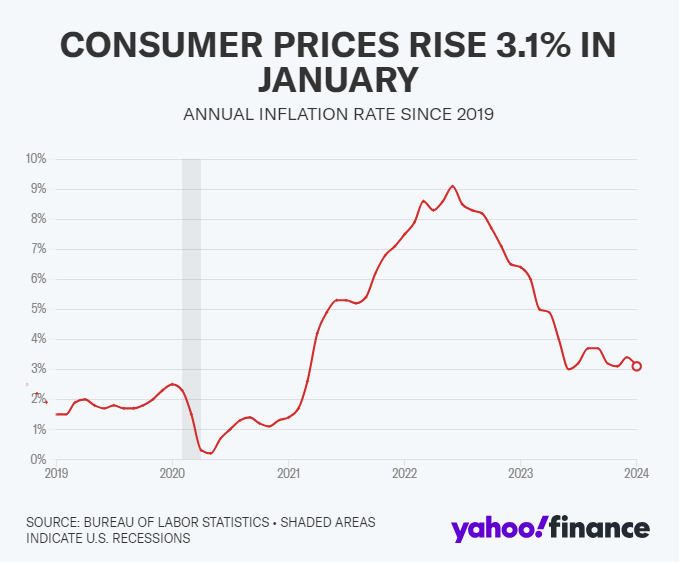

Inflation surprise! The contrarians are having their victory lap. With the markets expecting at least three 25 basis point rate cuts this year, the Fed recently disappointed some investors with a reinforcement of their “cautious approach”. Perhaps their slow approach to cutting rates is warranted. The battle against inflation isn’t done just yet.

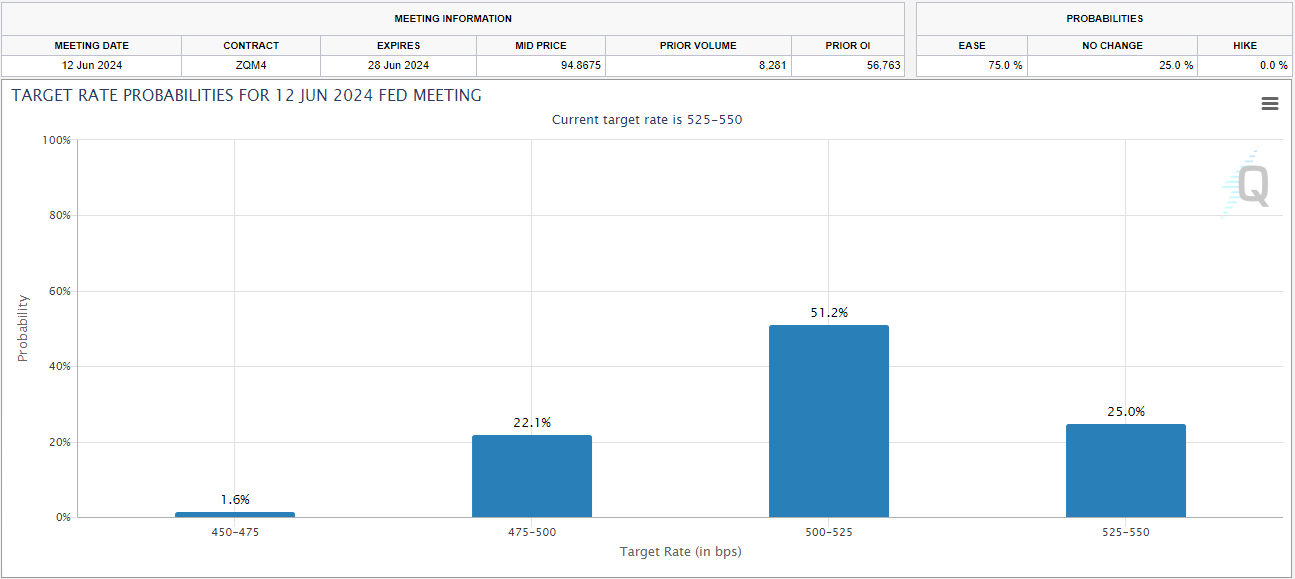

With no rate cut in March, today’s US CPI data likely means the first rate cut could come later than expected. Markets however are still pricing a 75% chance of a Fed cut in June.

In my previous article detailing Powell’s slow approach, I did mention that the Fed does not want to repeat the same mistake of the 70’s, where the Fed cut interest rates too soon and inflation spiked resulting in the raising of interest rates to 20% which killed demand sharply.

And I think this is a key point: the killing of demand and the slowing down of money velocity. This needs to happen and very likely means an economic slowdown. Although the Fed and other mainstream financial commentators believe the Fed can achieve a soft landing: raising interest rates to a level where inflation can fall and demand can fall without triggering an economic slowdown.

So back to the CPI number. US consumer prices rose more than expected for the month of January 2024. The Consumer Price Index (CPI) rose 0.3% over the previous month and 3.1% over the prior year in January, slightly higher than December’s 0.2% month-over-month increase but a deceleration from December’s 3.4% annual gain. On a “core” basis, which strips out the more volatile costs of food and gas, prices in January climbed 0.4% over the prior month and 3.9% over last year.

So is the Fed correct? Is it too early to declare victory over inflation? Investors are not expecting any rate cut in the May Fed meeting, but the market may now begin listening to the Fed and realize the slow and cautious approach may be the way to go.

As always, I look at the bond markets for clues on rates. And did we have quite the action after today’s CPI numbers:

Big moves in yields. They are all breaking out. The 10 year yield chart is definitely one many investors and traders have been watching since it has been testing a key resistance zone for sometime. Yields are spiking.

Again, this means that bonds are falling, or are being sold off. And this isn’t to do with a risk on environment as we are not seeing money leaving bonds for stocks.

I have covered the US Dollar chart many times in recent articles about markets and commodities. I warned the dollar was shifting trends as higher lows and higher highs were being printed. It looks like the dollar is likely to run up to the 106 zone.

Yes, US stock markets are falling today but I wouldn’t be too concerned just yet. Markets have not had a chance to pullback or correct after breaking into new all time record high territory. I actually have been waiting for markets to retest their breakout zones. Perhaps this will happen. If not, then this pullback just sets buyers up to form a higher low and continuation of the uptrend.

But the chart I am watching quite closely is that of oil.

The West Texas lower high came in around the $80 zone. You can see sellers piled in every time the price tested this resistance in recent months. We are making a run into this resistance again. If oil was to close above $80, we would break this lower high meaning the current downtrend is over.

Higher oil prices may lead to a shift in inflation expectations. And this could lead to the Fed having to be more pragmatic with the data.

Leave a Reply