This might be one of those “see we told you so” articles. While most investors are talking about Nvidia earnings and how it is holding up the US stock markets (S&P 500 and the Dow Jones have printed new all time record highs today with the Nasdaq not too far away), I think market news from the East is much more interesting.

The Japanese stock market, the Nikkei, has printed new all time record highs taking out 1989 highs. Yes folks you read that right. 1989. It took 34 years but Japan is back! Although many remain perplexed due to the country not really changing. Oh and the fact that Japan entered recession last week.

So why is money running into the Japanese stock market now? Very simply put: a weak Japanese Yen and rising corporate profits.

I discussed this in my most recent article on Japan titled, “Why I am Buying Japan“. And I do hope some of you joined me on this ride.

In that article I discuss a few reasons. One of them being a hunt for yield. This gets interesting now given the major three decade long plus breakout. More eyes will be looking at the Nikkei now and I expect the momentum to continue.

Some argue this is “animal spirits”.

Sure, you can argue that especially given that technical traders will be playing the breakout. But I do believe there is much more to this Japan trade.

I mean arguably the greatest investor of all time, Warren Buffett, sees something too given he has been buying big positions in Japan last year.

The move in the Nikkei can be explained by this:

The Japanese Yen has been getting smashed. Against most currencies. The reason has to do with interest rate differentials and overnight swaps. While most of the Western allied world began raising interest rates to tame inflation, Japan has kept rates unchanged at -0.1%. This means anyone who shorts the Yen through the foreign exchange market, or buys any other currency against the yen, makes a pretty penny just in holding overnight due to the interest rate differentials. You can see why many traders and funds who play forex would want to short the yen… and when we are talking tens or hundreds of millions of dollars, the overnight swap return provides a good return.

I have been long EURJPY for some time and the fees I have accumulated in swap differentials is astounding.

A weaker yen means Japanese exports look more appealing. And economic theory says that exports should increase. This is a good thing because Japan is an exporting powerhouse. And this is why many market analysts are bullish on Japan. They are attributing the Nikkei’s rise to strong earnings.

A weaker yen tends to help exporter shares as it increases the value of overseas profits in yen terms when companies repatriate them to Japan.

Corporate earnings have been stellar for Companies such as Shiseido, Asahi Group, Uniqlo brand owner Fast Retailing, Sumitomo, Panasonic, Honda, Nintendo just to name a few. Japan has always been seen as the place for value investing because these are good and strong companies which continue to make profits. I say value because Japanese companies tend to keep things the way they are, and rarely change. But with a weaker Yen, foreign money is bullish Japan.

But can the Yen continue to weaken? That depends on the Bank of Japan and if they want to normalize rates. Likely not now given the country has entered a recession. BUT if Japan were to normalize, which is something the new BoJ governor has been indicating he wants to do down the road, that would get a bid for the Yen.

But raising rates isn’t the only option. I am sure Japan has a vast amount of foreign reserves and they could intervene in open market operations to strengthen the Yen. Many traders believe the line in the sand for the BoJ is the 150-155 zone on USDJPY. And as you can see on the weekly chart I have posted above, the Yen does strengthen when it tests 152.

Back to the Nikkei: So with the weaker Yen, Japanese Companies are making big bucks. Their stocks are rising which is causing the Nikkei to rise. Got it? Good.

As discussed in my previous article, many state that this is more of an inflationary trade. That a weaker currency is causing the stock market to rise as domestic money looks to preserve purchasing power. They point out higher stock markets in hyperinflated nations such as Zimbabwe, Argentina and Venezuela. The truth is that equities tend to rise in periods of inflation because equities can bring in the highest rate of return which can keep up with inflation.

But this is not the case for Japan.

First off, Japanese companies are strong companies. I listed some earlier in this article and I am sure most of you have heard of these companies. These companies are seeing their profits rise due to exports. I don’t see the same for hyperinflated countries. I just see domestic money trying to make a yield and thus jumping in the stock market.

And money flows are very important. Japan is a well developed nation. Heck, it has the 3rd/4th largest economy in the world and its financial markets are well developed. You are seeing foreign money run into the Japanese stock market because of fundamentals. You are not seeing foreign money running into the hyperinflated nations for many obvious reasons but a large part is the fact they know the financial markets and regulations in those countries are poor or sub standard. You can get your money out of Japan.

This is key because I think we will see even more foreign money run into Japan.

One interesting thing to note is that a lot of domestic Japanese money has been buying up foreign bonds, thereby capping rates. Japan and not China is the largest holder of US debt. There are some that say that if the BoJ does normalize, Japanese money will sell off foreign bonds and return to invest in Japan. This would require quite the move by the BoJ in normalizing which I don’t think would be enough to persuade Japanese money to return to Japanese debt markets. BUT this breakout in the Nikkei may spur a return of money to invest in the domestic stock market. I will be watching those US yields carefully.

So how can one play this trade?

You can play the Nikkei through futures, or through CFDs (one way I am playing it) in certain parts of the world. As a Canadian, I can trade CFDs.

If you are Canadian you can also bet on the Nikkei through a Canadian hedged ETF. The second way I am betting on Japan.

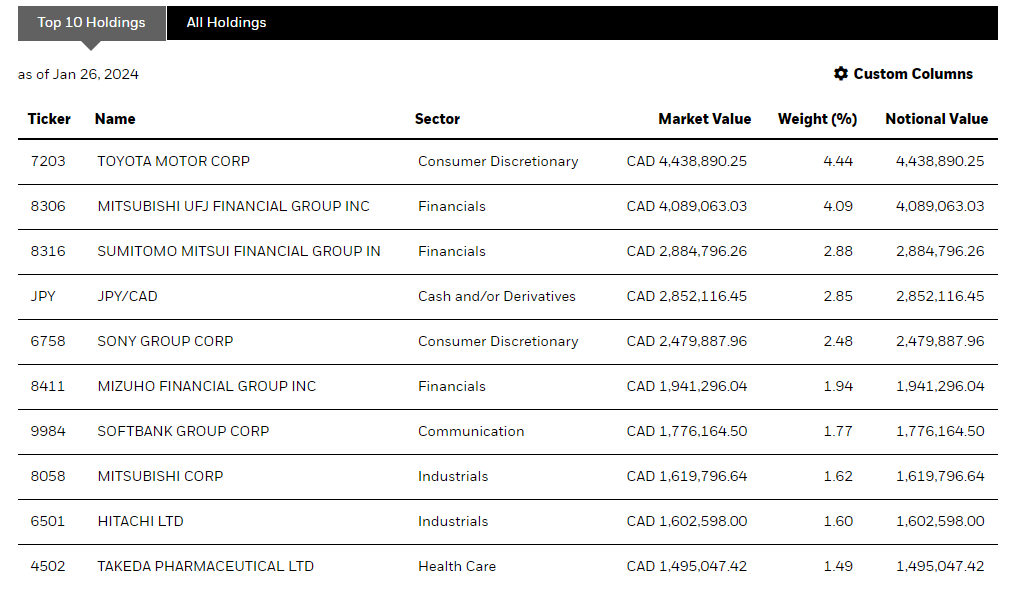

BlackRock has the iShares Japan Fundamental Index ETF traded on Canadian Markets through the ticker CJP.NE. You can read more about the ETF here.

The ETF is printing new all time record highs as the Nikkei does.

With that said, I hope I have laid out a good case on why I am betting on Japan. The key takeaway is that a weaker Yen is causing Japanese corporate earnings to rise. This is garnering the attention of Warren Buffett and many other foreign investors. This move on the Nikkei is due to this and is not similar to hyperinflated stock markets like Argentina etc.

And just for fun, I want to remind readers of the fibonacci targets I laid out in the previous article:

Happy Investing.

Leave a Reply