In late 2021, the team behind market awareness/online marketing group Native Ads ventured into their own e-sports deal through the creation of Good Gamer Entertainment (GOOD.C). It, well, wasn’t a smash.

To be fair, not many e-sports deals have been a smash. Most chased a sector everyone thought was going to be hot, but which struggled to monetize in a meaningful way, and has become a graveyard for well meaning deal guys and easily led investors who wondered ‘my kids watch Twitch all day, how do I make money out of this?’

Most of those vehicles quickly died and became shroom deals, or persisted through sideways pivots to betting and crypto, Good Gamer included.

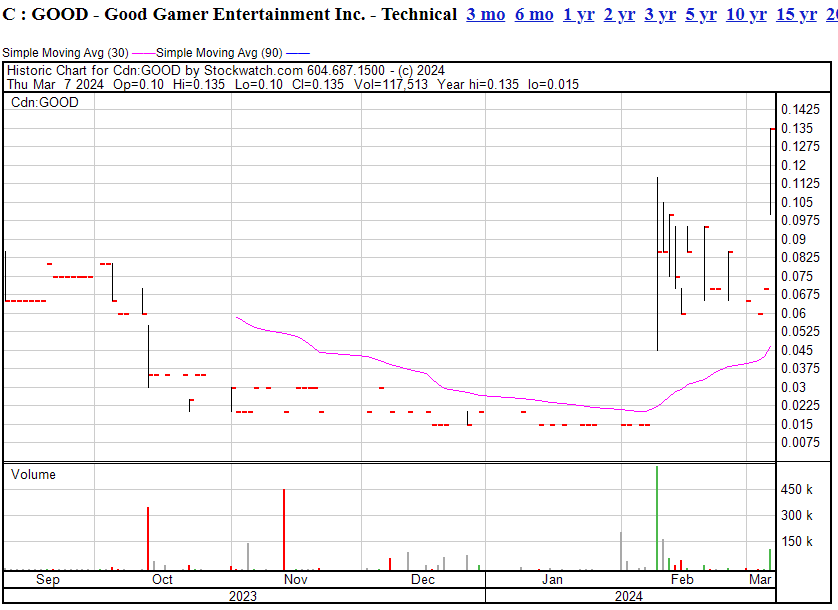

But news last month saw GOOD finally get some positive stock action as the company leapt off the bottom of the public market canyon and started climbing up the other side on the back of an announcement it would be ‘licensing’ the global rights to risk management software called software UrbanLogiq.

WHAT IS IT?

UL is a BC-based project that helps municipalities, first responders, and government departments bring a variety of datasets together, so they can be cross-referenced and more easily accessed in a variety of areas, such as traffic management, which is where the company focused upon launch.

It has a decent slate of current small govt clients, mostly around this province but also into the US, and the claim is it has earned $118k in revenue between September of last year and February 2024, which is fine. Not groundbreaking, but fine, considering government revenue tends to be paid on time and is usually periodically renewable unless you completely screw up.

The twist here is that, while that early section of UrbanLogiq’s business is a steady little earner, there’s other potential involved in the deal that’s hidden away until you dig in on the just announced transaction.

GOOD will pay $250k for the UrbanLogiq software, and 2.5 million shares of GOOD stock upon software development deliverables that would vastly open up the potential of the business.

Namely:

- Upon the company’s acceptance of the fire analysis and management platform, 833,333 common shares;

- Upon the company’s acceptance of crime analysis and modelling platform, 833,333 common shares;

- Upon the company’s acceptance of disaster analysis and modelling platform, 833,333 common shares

These are no doubt long planned additions to the platform, but ewach one would radically increase the addressable market to iunclude fire departments, police, and even the military.

At the time of the deal announcement, the stock payment to UrbanLogiq was worth, in its totality, $150,000 (at $0.06 per share).

A month later, and it’s now worth $337,000 (at $0.135 per share), so there’s plenty of incentive for the sellers to get busy and open this thing up – and to not go selling their paper down early.

STOCK ACTION

Since the announcment, the company has been on a quick rise. CEO Charlo Barbosa sold a chunk of his stock into that rise (credit where it’s due, he’d been holding it for a long time, and there’s a new financing afoot that he might want to roll his proceeds into), so there could be a lot more fuel left in the run going forward if he’s done loosening his position.

Most of the action came on the back of the announcement of the LOI and the subsequent announcement of the firming up of the deal, so it’s clear where the market is seeing value here.

WHERE TO NOW?

The GOOD market cap currently is tiny – $2.9 million – even after the big jump, and includes existing GOOD assets in the areas of pay-for-play gaming apps and NFT creation tools, neither of which I care about in the slightest, but are probably good for some couch cushion cash at some point.

The risk management platform is another thing entirely.

In fact, if I’m honest that’s a misnomer. It’s not risk management software as I see it, but ‘glue’ to help public servants get better use out of the wide array of data inputs they currently work with, so they can see threats, risks, opportunities, and dysfunction more clearly.

As an example, a municipal transportation department will have traffic cameras, speed cameras, road sensors, incident reports, citizen complaints, and online trip-time data to work with when figuring out whether to make changes to an intersection. Each of those lives in a different silo, but being able to overlay that data makes instant assessments a reality, making staffers more productive, problems more obvious, and outcomes more reliable.

I’m not seeing exactly where the AI element comes in yet, but I don’t really need to – $130k in revenues in its first quarter is a good look, conmsidering how long it usually takes government groups to lock in on a new supplier, and a $3m valuation for a compan that, right now, does $500k+ in annual revenue is just about right, even ignoring the potential to grow that number, and maybe cash out of some those other, earlier acquired assets.

I’ve got stock in GOOD from way back, so I don’t mind seeing it grow again, but my own personal question now is, do I take the chance to cash out on a price rise, or do I hang around for a bit and see where it goes?

Considering the group have announced a rollback to just 20 million shares out, which I don’t believe they’d have done if they didn’t have plans for something bigger out the other end, and the deal structure that rewards the expansion of the software into other sectors – and the ability of the Native Ads guys to really market a company on the exchange – I think I’m going to sit put and see what else is in the plans.

— Chris Parry

FULL DISCLOSURE: Not a client but, as mentioned, I’ve got skin in the game.

Leave a Reply