Lithium sucks.

That’s the prevailing wisdom in the lithium space right now. Everyone has got the memo that lithium prices arw down, there’s been an oversupply, and even though we know we’r going to need loads of lithium for green energy and rechargeable battery needs in the future – right now, maybe we’re good.

A lot of the business media out there seems to agree on the theme.

Mining.com says:

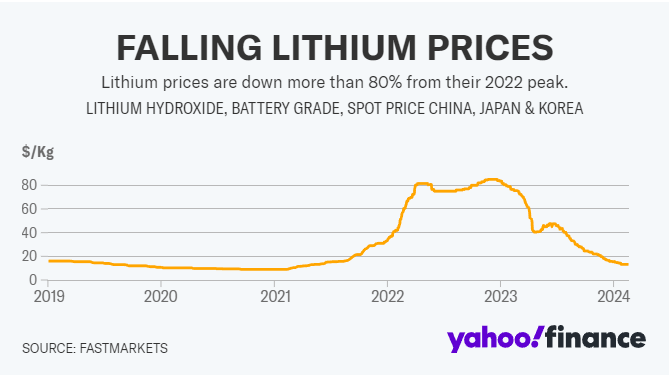

Low lithium prices are “unsustainable” and will have to rise in order to trigger the supply investments needed to meet long-term demand growth, according to Albemarle Corp., the world’s biggest producer. Lithium suppliers around the world are reining in spending and, in some cases, production after demand for the key component in electric-vehicle batteries slowed just as new mines started up, whiplashing the market from shortages to oversupply. One measure of prices has slumped more than 80% from record highs in late 2022.

CarbonCredits.com says:

Lithium carbonate prices have experienced a significant decline in China. They dropped from a record high of $81,360 per tonne in November 2022 to $20,782 per tonne in the current month. This marks the lowest level in two years, reflecting a 67% decrease year-on-year. In response to the plummeting prices, Chinese refining companies are taking measures such as cutting production or suspending operations.

Yahoo Finance says:

“We’re in another bear market,” Piedmont Lithium CEO Keith Phillips told Yahoo Finance. “I really think we went from euphoria two years ago to despair today. Someone described it…as peak pessimism.”

Well shit. That’s a lot of doom and gloom.

Anyone would think, after reading all that, that lithium is something you should keep away from.

But there are two important things to understand before you dismiss lithium investing outright.

First, there are a lot of investors out there who LOOK FOR this kind of commodity movement, because when a resource begins to fall off that much, either nobody needs it anymore (in which case, stay away), or it’s oversold (in which case, start buying).

Second, all of the articles I cited above are from a month ago. More recently, we’ve started to hear about positive price movement in China, which will take some time to make its away over here.

Here’s how prices have looked recently.

The time to go in on an inexpensive commodity, in my opinion, is when you feel like the belly of the plane is scraping the ground. If there’s no realistic place left to drop, that’s terrific, and even if you do get in a little early, chances are you’ve gone in near the low and can happily wait out the up-turn.

The graphic above shows, since December 2023, lithium prices have stayed level with the 52-week low. That’s intriguing.

Enter China:

Chinese lithium prices extend uptrend amid futures strength; other markets in stalemate.

Spot lithium prices in China’s domestic market remained on an uptrend in the week to Thursday March 14, following the strong futures market and rising spot offer prices, while market participants noted sporadic restocking activities.

Hmm. A one-off blip or the canary in the coalmine?

Financial Post suggests the latter:

Short bets worth billions of dollars against some of the world’s largest lithium producers are under threat as a supply glut shows signs of thinning.

UBS Group AG and Goldman Sachs Group Inc. have trimmed their 2024 supply estimates by 33 per cent and 26 per cent, respectively, while Morgan Stanley warned about the growing risk of lower inventories in China. The revisions come after lithium prices cratered last year as supply ran ahead of demand, with some producers cutting output.

Now, prices of the key material used to power electric vehicles are showing signs of a revival after the rout last year sent stocks spiralling and attracted short sellers. Bets against top producer Albemarle Corp. and Australian miner Pilbara Minerals Ltd. account for more than a fifth of their outstanding shares, or the equivalent of about US$5 billion, according to data compiled by Bloomberg.

Okay, so lithium might be about to have another moment.

So what next?

This is a page from the Beyond Lithium (BY.C) investor deck.

Everything in it is solid, from discoveries to milestones to the technical team and opportunities.

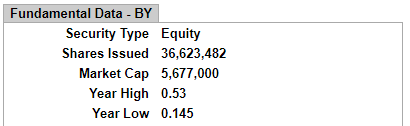

What ISN’T accurate is the market cap.

You thought it was tight with four active properties at a $13.5 million valuation? This is what it is now.

$5.6 million!

That’s almost a million bucks per active, discovery-hosted, being-worked project.

Now let’s add the other ++18++ projects the company has and you’re looking at just $250,000 of market cap per project.

Guys, that’s insane.

With lithium prices hinting that they’re swinging back up, market cap way down, and the number of projects bigger than any other Ontario explorer, you’ve got to think there’s grounds for coming in on BY.C at this price, especially given comparable explorers with JUST ONE PROJECT roll in at a $30m market cap..

Added to which, Peter Epstein, who we put a lot of belief in as a resource commentator, had this to say about Beyond recently:

Don’t overthink this, if one’s scared that Beyond Lithium’s share price at 15c might fall to 12c (yes, it could!), then one should not be investing in Li stocks or in junior mining stocks for that matter. The market cap is C$5M. The risk/reward is very compelling. The Company has 2 projects that should be drilled this year. Not many Li juniors in Canada will see 2 projects drilled. Many Li juniors will disappear this year and next, but there’s no reason for Beyond to fail. It has properties to farm out and up to 4 promising projects. There could be more projects as well. There are no large cash outlays hanging over management’s head. They are talking to MANY interested parties on a number of topics.

Eps knows what’s up.

This is a big company in its hibernation phase, dragged down by a sector that is in it’s hibernation phase and it’s time for the sunlight to roll in.

— Chris Parry

FULL DISCLOSURE: I own this stock and they’re a client, so don’t believe a word I say. Research it. Do the work. Figure it out so it makes sense to you, but here’s where you start.

Leave a Reply