Samsung. Everybody knows that Company. The South Korean giant is often thought of as a competitor against Apple for smart phones in the West. But they are far more than smart phones.

This multinational conglomerate comprises numerous affiliated businesses, most of them united under the Samsung brand, and is the largest South Korean chaebol (business conglomerate). Some even call South Korea “The Republic of Samsung” given its power and influence.

It came to a bit of a surprise when the name Samsung appeared in junior mining headlines.

In February 2024, it was confirmed that Samsung SDI had completed its equity investment in Canada Nickel (CNC.V) for aggregate proceeds of US$18.5 million. Samsung SDI had subscribed for 15.6 million common shares of the Company at C$1.57 per share. Samsung SDI now holds 8.7% of the issued and outstanding common shares of the Company.

Now who is Samsung SDI? Think batteries.

Samsung SDI is a battery and electronic materials manufacturer operating in energy solutions and the electronic materials segment. Their focus has been to developing more efficient, high capacity energy solutions for leading automakers.

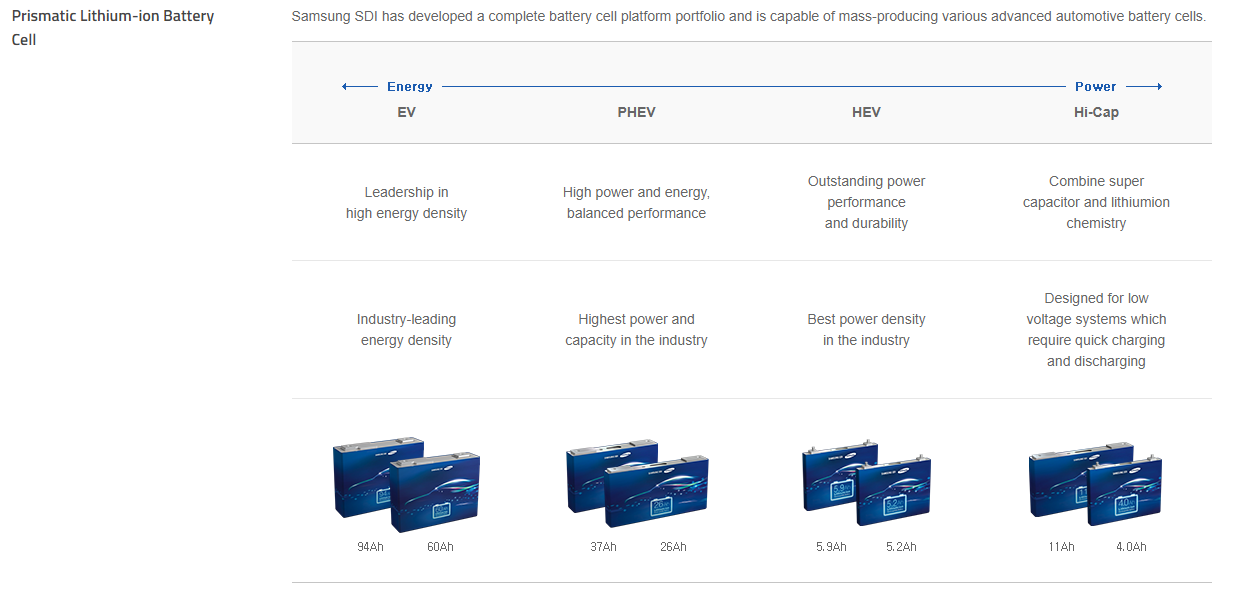

The Company has developed a complete battery cell platform portfolio and is capable of mass-producing various advanced automotive battery cells:

As many of you know, certain metals are required for said batteries. Lithium of course garners a lot of attention. Cobalt seems to always be the preferred way to play lithium battery tech. but nickel often goes under the radar.

Enter Canada Nickel.

Canada Nickel is advancing the next generation of high quality, high potential nickel projects to deliver the metals needed to power the electric vehicle revolution and feed the high growth stainless steel market.

Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Sulphide Project in the heart of the emerging Timmins Nickel District and is adjacent to major infrastructure.

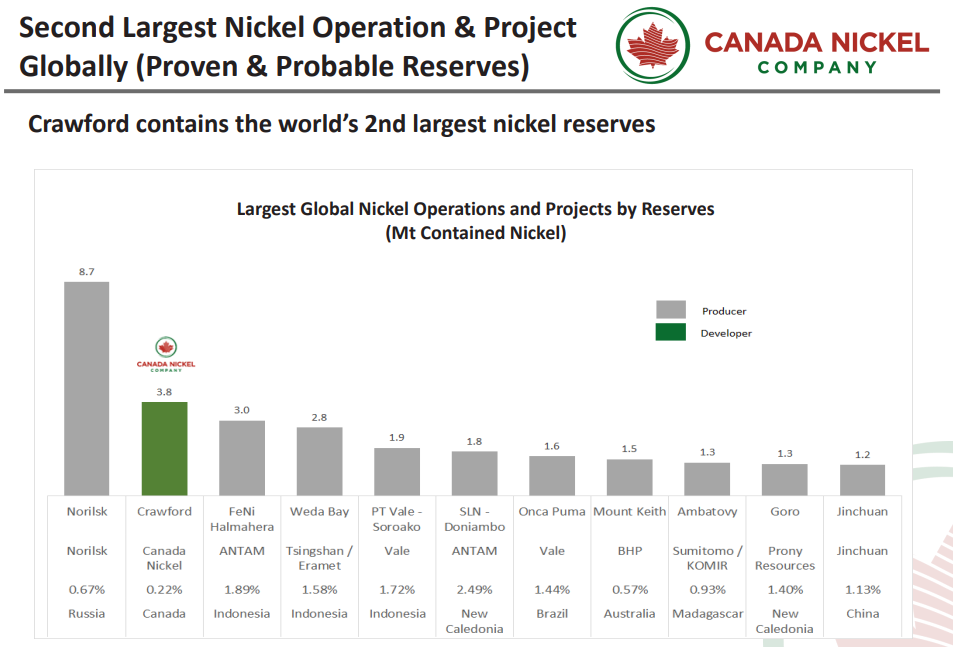

Here is the kicker: Crawford contains the world’s second largest nickel reserves in the world:

And if you look at number 1, 3-5, you can see why jurisdiction plays an important factor. Canada is a safe jurisdiction which abides by the rule of law. Not paying that premium for geopolitical risk.

It isn’t only Samsung SDI which has a position (8.7%), but so does Agnico Eagle (11%) and Anglo American (7.6%).

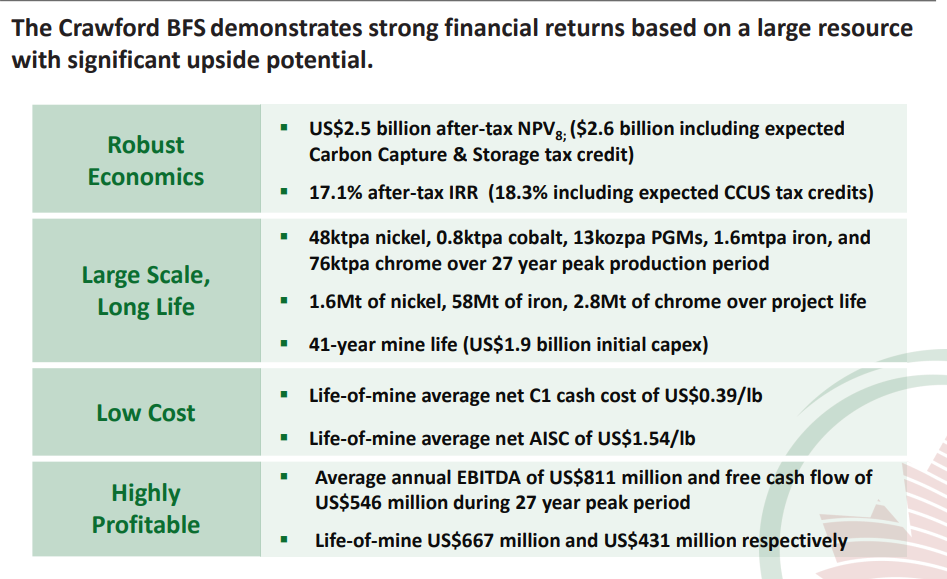

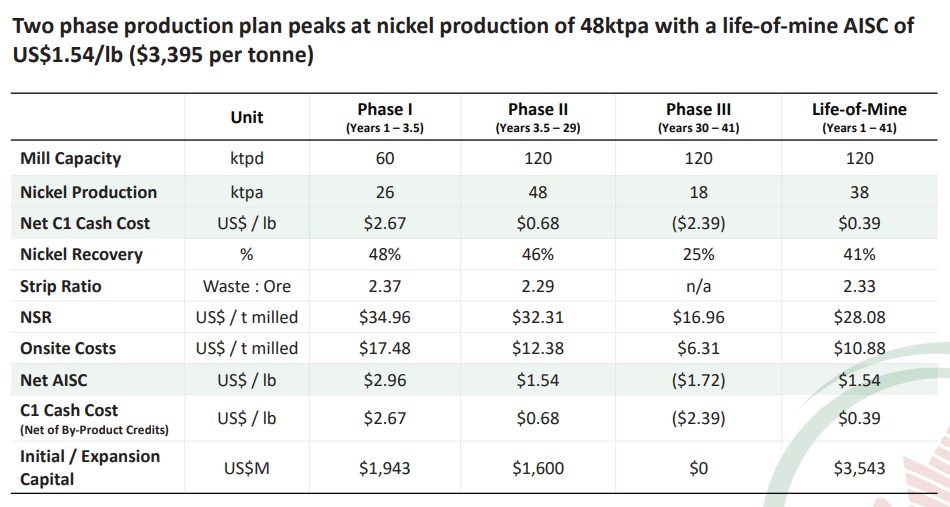

But it is also because of the positive economics:

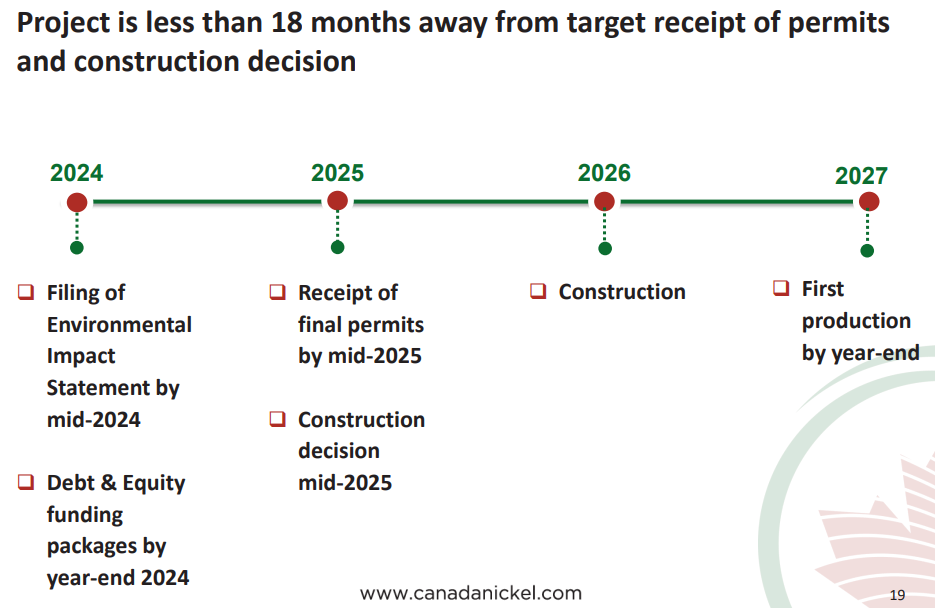

Is there still some de-risking to go? Yes.

The most recent press release announced positive initial assay results from its 2024 exploration program including the first two holes at the Company’s Newmarket property and results from the first hole from its Reid property, which delivered the best drill results to date from Reid.

A total of six holes have been completed at Reid and seventeen holes have also been completed at Crawford as part of a program to delineate an initial palladium-platinum (PGM) resource for which assays are pending. Four drill rigs are currently operating, and a fifth drill rig is expected to begin on April 1st. As outlined in a conference call held on February 23, 2024, the Company’s 2024 exploration program is targeting delivery of seven additional resources by Q2-2025 and six further discoveries.

Mark Selby, CEO of Canada Nickel said, “Our 2024 exploration program has started very strongly with the best drill interval to date at Reid and a new discovery at Newmarket. The long drill interval of higher-grade material at Reid is very encouraging and the first section delineating an over 800 metre width of target ultramafic sequence – nearly 2 times thicker than Crawford – highlights the very large-scale potential of this property”.

The stock has been in a range with support at $1.30 and resistance at $1.60. This has happened after a major run up with the breakout above $1.20 propelled by the Samsung SDI news.

Traders and investors are waiting for the confirmed breakout in either direction.

But as this article’s title suggests, you can enter at a better price than Samsung SDI.

Samsung SDI got in at $1.57 per share. The stock is currently trading at $1.44 at time of writing. Now is your chance to begin dabbing in and entering at a better price than Samsung SDI.

Just remember, mines take some time to be built and de-risked. This is a long term investment. But major companies have stakes in this project. They have obviously done their due diligence.

Leave a Reply