They call it Sun Dog, which is a misnomer in two parts. It’s colder than heck out there for a lot of the year, and it;s definitely no dog of a project.

Standard Uranium’s (STND.V) recent adventure at the Sun Dog Project, where they’ve joined forces with Aero Energy Ltd. to explore the atomic depths of the Canadian wilderness, is off to a fine start. They’re on a uranium treasure hunt in the Athabasca Basin, and they’re certainly not leaving anything to chance.

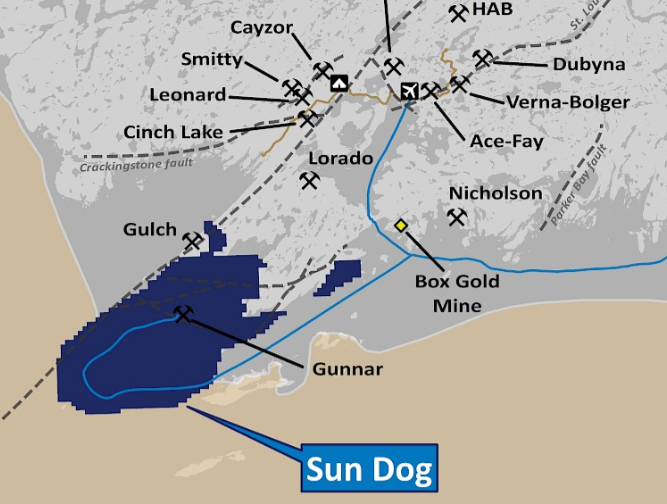

The Project covers an area of 48,443 acres in nine mining claims, located 15 km from Uranium City on the northern margin of the Athabasca Basin.

The Sun Dog Project is not just any plot of dirt and rock. It sits with historical gravitas, housing the old Gunnar Mine which, back in its heyday from 1953 to 1981, churned out a whopping 18 million pounds of uranium (U3O8).

At one time, it was the kingpin of uranium production worldwide.

Now, Standard Uranium and Aero Energy are scratching the surface once more, and perhaps a bit below, to see what high-grade uranium goodies might still be lurking there.

Of course, uranium doesn’t just pop up anywhere. It’s often found tucked away deep below what geologists call “the Unconformity” – that’s where the older basement rocks give way to newer sandstone. But at Sun Dog, the twist in the plot is that U308 is found both above and below this geological boundary.

Think of it as finding loose change both in your couch cushions AND under your couch.

These findings are not by sheer luck. The folks at Standard Uranium have been diligent, scouring the area with what’s called a VTEM™ Plus survey. It’s a fancy airborne electromagnetic tool that maps out where these elusive graphitic rocks—think of them as uranium’s favorite hiding spots—are located.

And it appears they’ve got quite the map drawn up, with over 40 kilometers of these conductive corridors laid out.

The next chapter of this saga will be the summer drilling program, when they’re going to make the earth shake starting in early June, hoping to hit the jackpot with high-grade uranium findings that’ll shine a new light on the old monster.

Jon Bey, the CEO of Standard Uranium, is understandably thrilled to be getting at it. He’s gearing up for an “exciting time for active exploration,” which puts the company in a category ahead of literally dozens of neighbours who won’t let the concept of actual work ruin a good story.

Not to be outdone by the Standard crew, Galen McNamara of Aero Energy is all in too. He’s eyeing the potential for shallow, high-grade uranium deposits which, until now, have been largely unexplored. The anticipation is palpable as they near the end of their surveys, poised to pinpoint where to drill come June.

Back in the day, producers were content with scraping the easy-to-get stuff off the surface, until low-priced uranium made things less economic. Back then, efforts were focused on what they call “Beaver lodge-style” deposits—which are lower-grade and easier to spot on the surface.

However, the real upside, especially nowadays, is in finding the hidden, high-grade stuff associated with these graphitic conductors. If you can find that, the surface level stuff is a bonus.

It won’t be easy. This isn’t just a simple dig-and-see operation. It’s a sophisticated dance of technology, geology, and hard-earned experience, with geophysical surveys revealing subtle clues about where the uranium might be. Recent discoveries and mapping have only added layers of anticipation to an already promising site.

Standard are, as ever, showing their cards by doing the work. This is no lifestyle explorer, they’re the blistered skin crew, and they believe they’re in the mix for something great.

That’s the plan – go massive or go home.

— Chris Parry

FULL DISCLOSURE: Standard is an Equity Guru marketing client, and we own stock, and we’ve been buying on dips.

Leave a Reply