It was eventful last week with the FOMC rate decision and US NFP (employment data). And I apologize, but once again this is all about the most important question and narrative driving financial markets: will the Fed cut rates soon?

Let’s start off with the FOMC meeting.

On May 1st 2024, the Fed kept rates unchanged as expected. But the markets wanted to hear his tone given the recent inflation data, and the path the Fed has set forth for interest rate cuts.

The Fed left rates unchanged saying there is a “lack of further progress” in getting inflation down to its 2% target. The takeaway? Those CPI numbers are still to be watched.

In terms of the road map ahead, Powell said:

“Inflation is still too high. Further progress in bringing it down is not assured and the path forward is uncertain,”

“So far this year, the data have not given us that greater confidence,”

“It is likely that gaining such greater confidence will take longer than previously expected. We are prepared to maintain the current target federal funds rate for as long as appropriate,”

With statements like this, the likelihood of rate cuts coming soon are low.

With inflation surprising to the upside, Powell did say it is unlikely the Fed’s next move will be a rate hike, but hey, if those inflation numbers continue to rise substantially, it would signal the Fed’s policy stance is not restrictive enough.

Powell also downplayed stagflation, when inflation in percentage terms rises faster than GDP growth.

Markets reacted positively to Powell, and turned their attention to NFP data. Some like Jim Caron, chief investment officer of the portfolio solutions group at Morgan Stanley Investment Management had this to say:

“The fly in the ointment is going to be the labor report. If the labor market starts to weaken, I think that advances the time scale for the Fed to start to cut earlier,” Caron said on CNBC’s “Power Lunch. “If the labor market stays strong, I think that they are going to stay on probably until December.”

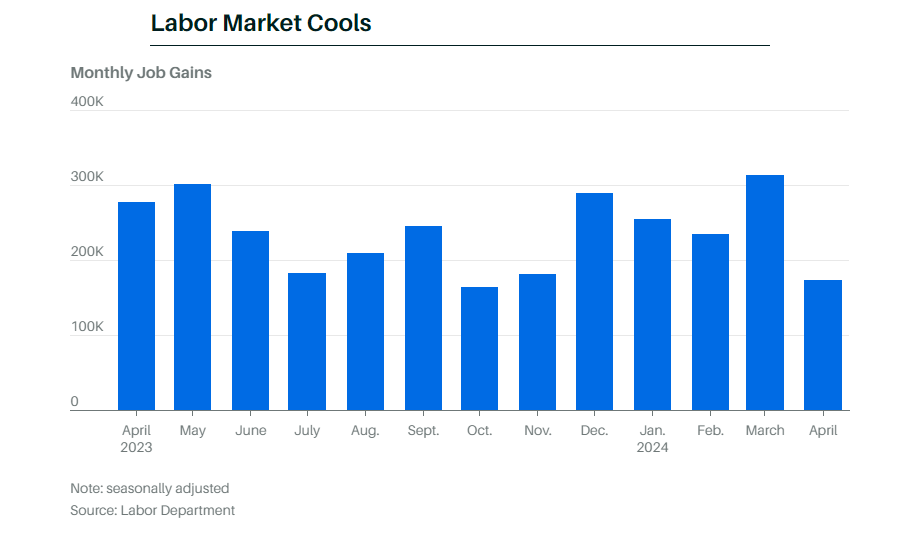

Here is how the jobs data for the month of April 2024 came out:

The US job market showed signs of cooling with 175,000 jobs added in April 2024. This is compared to 235,000 which was expected, and a dramatic slowdown from the blowout 315,000 jobs added data for the month of March 2024.

The unemployment rate ticked up to 3.9% in April.

New investors may be surprised with mainstream financial headlines stating how this weakness in the jobs data is good for the Fed… and for the markets. The markets did pop on this which again proves to you that there is a difference between the stock market and the real economy.

For the Fed to cut rates, they want signs of a weak economy which signals a drop in money velocity which would bring down inflation. The idea of a “soft landing” is that the Fed will be able to raise rates enough to slow things down without causing a recession in order to bring inflation back to its 2% gauge.

With stock markets being a place where money chases yield, and with the current narrative driving markets being interest rates, a sign of negative news for the real economy boosts the probabilities of a rate cut, which drives stock markets higher.

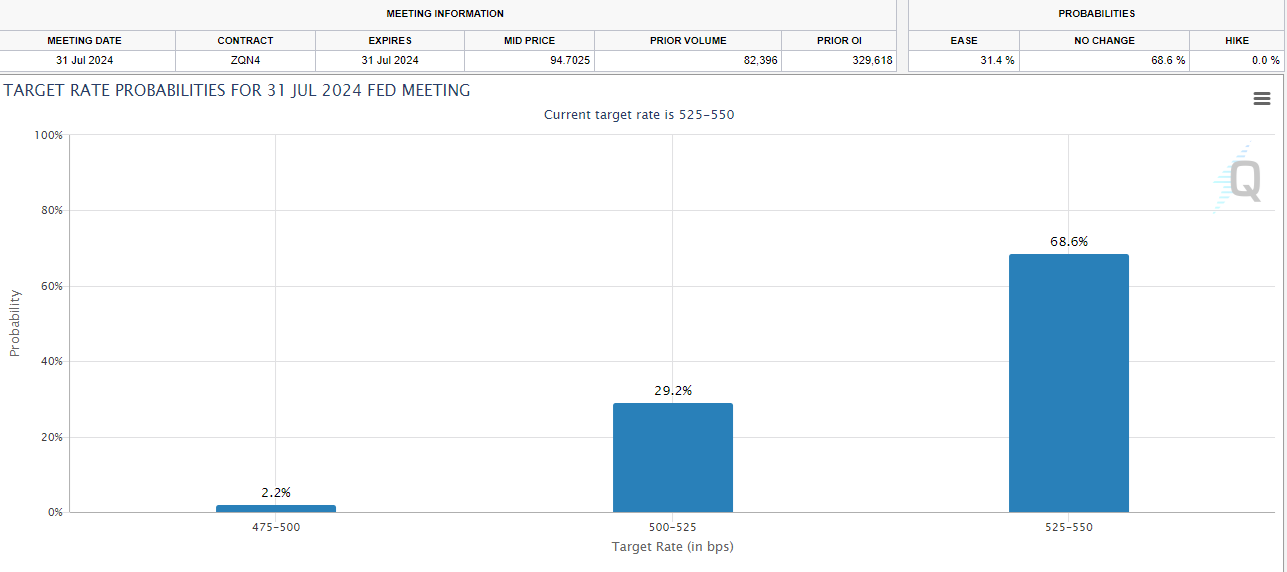

At time of writing, the probability of a rate cut in July is now 31%.

This can all change with upcoming inflation and labor market data.

In my opinion, the most important charts to watch are those of long term yields. Yields were rising as inflation data came out strong. There have been a few days of yields dropping post Fed and NFP data.

BUT in terms of the technicals, this can all still be seen as a pullback move in an uptrend. Until the support levels I have drawn with the horizontal black lines are taken out.

If yields decline, stock markets will move higher. But watch for that retest at support. If yields rise, then the continued uptrend means trouble for markets.

When it comes to the stock markets, they are recovering recent breakdowns. If today’s candles close above the horizontal black lines I have drawn, then the markets will continue their uptrend. Watch for recent record highs to be tested.

Happy Trading

Leave a Reply