As a marketing provider to public companies, I see a wide variety of deals of all shapes and sizes and intents.

Some are monsters, with massive acreage, million of dollars in the ground, big staff rosters, and NI 43-101’s and PEA’s and financings stacked to the ceiling.

Others are just straight promotes, with little intention to get past the first three months of heavily promoted life on the exchange, just long enough for those behind the scenes to exit their heavily cheap-papered positions.

And then there’s, well, Ashley Gold (ASHL.C).

To be clear, Ashley was previously a client of mine, loing enough for me to understand the CEO and Chairman, Darcy Christian, as the type of resource explorer you’d wish there was more of.

Darcy isn’t a mining giant. He’s just a good guy. He wants to do the work. He wants to reward his investors’ faith. He spends money on little else.

If there’s a rock to be lifted, he’ll put on gloves and lift it.

If there’s a business lunch to be had, he’ll order the burger and a glass of water.

And if there’s a financing to be done, the most he’ll spend on himself is what he needs to pay for his apartment, from where he’ll do most of his work – at least that work that doesn’t require being in mud.

Also though, on a literal shoestring, he’s managed to do this:

Ashley has acquired:

- 100 per cent of the Tabor Lake lease subject to a 1.5-per-cent royalty

- 100 per cent of the Santa Maria project subject to a 1.75-per-cent royalty,

- 100-per-cent interest in the Howie Lake project subject to a 0.5-per-cent royalty

- 100-per-cent interest in the Alto-Gardnar project subject to a 0.5-per-cent royalty

- 100-per-cent interest in the Burnthut property subject to a 1.5-per-cent NSR

- An option to earn 100 per cent of the Sakoose claims subject to a 1.5-per-cent NSR

- An option agreement to earn 100 per cent of the Sahara uranium-vanadium property in Emery county, Utah, subject to a 2-per-cent NSR

Seven projects – count em – seven projects.

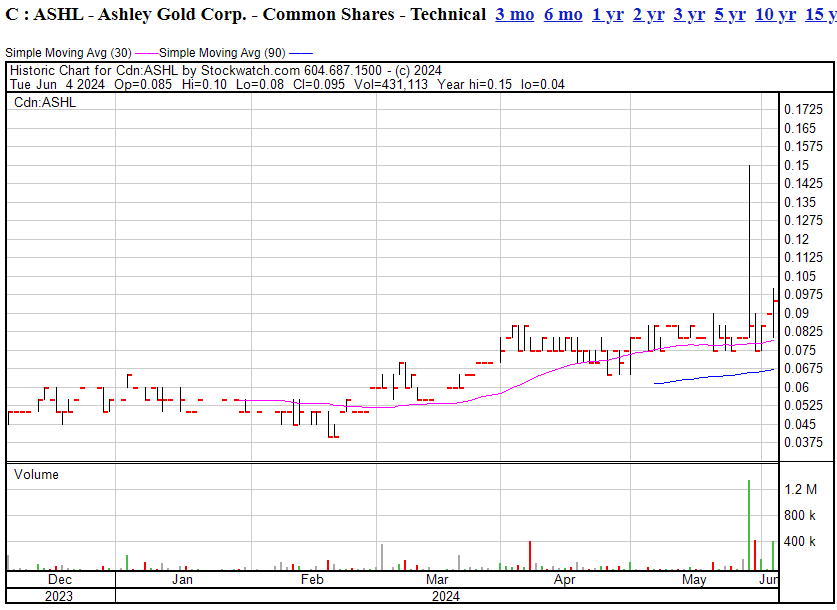

And though his story is still fairly unknown, he’s managed to hold the line in a down market.

That’s a double since February.

And that’s why I’m still talking about Ashley Gold, long after my marketing contract has ended and knowing the company is unlikely to be doing another with me for a while.

Because it’s REAL.

Christian is real. The properties are real. And if there’s any karmic resonance in the mining space, where people who really get out there and give ‘er are rewarded with discoveries and reputation and eventual riches, ASHL is due.

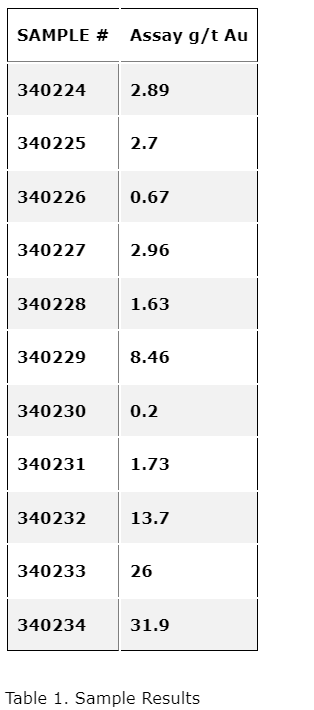

And, what do you know – maybe that karma is landing… ASHL just announced, “New discovery Oro-Grande West grading up to 31.9 grams per tonne gold.”

Ashley Gold Corp. is continuing to advance its properties with the discovery of a parallel deformation zone west to the 2023 initial Oro-Grande discovery in addition to extending the Oro-Grande zone an additional 200 metres.

Darcy Christian, chief executive officer of Ashley, comments: “Our team continues to show how prospective our acreage is with another amazing result on our Burnthut project. Not only have we significantly extended the strike potential of the 2023 Oro-Grande discovery, we have confirmed the stacked mineralized potential of the area with the new definition of the Oro-Grande West. Burnthut is evolving into a fantastic drill project with the opportunity to open massive new upside for Ashley. We are excited to get the drill turning this summer.”

Attaboy, Darc’.

Let’s be clear, they didn’t open up the strike by drilling, because that costs money and raising at a pre-story exposure share price doesn’t do his long term investors much good, but you can get a lot done by putting boots on the ground.

Prospecting has discovered an inland extension to the Main Oro Grande zone. Approximately 200 m inland, well-mineralized, pyritic quartz veins quartz veins up to 0.15 m in width occur in a poorly exposed deformation zone. Rocks in this area display strong iron carbonate alteration. Much of the inland extension is covered by overburden. Four random grab samples from quartz veins and host rock were sampled returning up to 2.96 g/t Au.

They’re getting into the thickets and pulling up stumps, looking in places where it’s difficult.

Close examination has identified an 80 m wide corridor area which is marked by competent mafic flows which are subsequently separated by rubble filled areas representing less competent rocks. Inland trends of these rubble-filled shoreline areas are marked by linear overburden filled gullies. This 80 m wide zone has the potential to host additional high-grade gold veins in a stacked setting. None of these high-grade gold veins situated in this 80 m wide mineralized corridor has ever been tested by diamond drilling.

Yet.

But here’s what they grabbed by hand.

Saving the best for last!

This isn’t the first chunky sample the company has grabbed, they pulled an 80+ gram p/t sample at a different project last week.

Ashley Gold, with money in pocket, would be a lovely thing to see. Right now, they’re just going to keep sweating, slashing overburden, picking up rocks and seeing how far this thing can go, and I appreciate that kind of workflow.

Not a client, but an interested spectator and friend to those who get shit done.

— Chris Parry

FULL DISCLOSURE: I own a small amount of stock and may buy more.

Leave a Reply