NOTE TO READER: This is an article about a mining exploration company and I know that’s going to make half of you cross your eyes in expectation of weird terminology and technical talk. I hear you, so here’s my commitment to you; take the time to read and I promise you I’ll explain things in a way you’ll understand AND toss in a bit of humour AND by the end you’ll have a deep understanding of what you’re about to see.

NOTE TO READER: This is an article about a mining exploration company and I know that’s going to make half of you cross your eyes in expectation of weird terminology and technical talk. I hear you, so here’s my commitment to you; take the time to read and I promise you I’ll explain things in a way you’ll understand AND toss in a bit of humour AND by the end you’ll have a deep understanding of what you’re about to see.

I’ll colour any layman’s explanation of terms in green, like this, so you can skip them if you’re a techie, and dive in if not.

Worst case scenario, you’ll learn some things.

Let’s go.

You’re a smart investor; you don’t need me to tell you the green energy sector is big and getting exponentially bigger.

If you’re environmentally focused, the switch from fossil fuels to green energy has to be front of mind, because who wants to live in a post-apocalyptic hellscape?

But if environmental concerns aren’t exactly your thing; if you think you’ll look great driving around in road leathers, wearing a necklace made of of human teeth, and using the head of your enemy as a hood ornament as you traverse the gang-swarmed desert highways in search of ‘guzzoline,’ green energy investing should STILL be attractive to you because, hey, profits.

Global investments in clean energy technologies and infrastructure are expected to exceed USD 2 trillion in 2024 alone.

This surge in investment comes on the heels of the urgent need to transition away from fossil fuels to more sustainable energy sources, such as solar and wind power, which are projected to grow significantly. Solar photovoltaic (PV) technology investment, for example, is expected to top USD 500 billion in 2024, surpassing all other generation sources combined (IEA).

Moreover, renewable energy is set to make up more than one-third of the world’s power supply for the first time in 2024, with solar and wind energy continuing to grow at rates of 17% and 16% annually, respectively.

This expansion is driven not just by the escalating demand for electricity but also by the fact it’s starting to cost less to use renewable energy production. This is a pivotal factor encouraging more investors to consider green energy as a lucrative and responsible investment choice, regardless of your politics.

Bros and sisters, you can finally have your cake and eat it too.

Investing in green energy is increasingly seen as a promising avenue for both financial growth AND sustainability, especially at a time when global energy markets are rapidly evolving to meet new environmental standards and economic demands. War in Europe isn’t helping, and trade battles are making home-grown energy super important going forward.

The cold hard facts of the matter are that governments are increasingly looking at nuclear power as a long term solution to the growing needs of the grid, with solar and wind hamstrung only by the need for massive amounts of battery metals to make them more useful during off-peak times.

- On the nuclear side, uranium is the fuel.

- On the electric vehicle side, lithium is the fuel, due to how light lithium batteries are.

- On the wind and solar side, if we’re talking large scale municipal grid-based battery needs that don’t need to be lightweight, increasingly there’s a call to switch from lithium to vanadium battery technology.

So if a company came along on the public markets that had projects involving uranium, lithium, and vanadium exploration, you might think that was a good across-the-table bet on the future of green energy.

Sadly, simply exploring for metal is not enough.

There are a lot of companies out there supposedly ‘exploring’ for metals, but that only gets you so far and, frankly, takes quite some time and money to even get off the ground. Much of the time, those explorers are smoke and mirrors. raising money to pay themselves for raising money.

To take an exploration company to production means actually:

- Finding good projects

- Raising millions of dollars to explore them

- Advancing those projects in a meaningful way

- Having enough respect in the boardroom that they can bring in much bigger partners to move things along

Bonus points if you’re not roped into a single commodity that can have both high times and low, potentially causing your stock to collapse through no fault of your own.

Having several bets is handy, but only if those side bets are real.

And, at the risk of sounding repetitive, to make those side bets real you need:

- (Again) The projects to be worthy.

- Raising even more money.

- To advance all your projects, not just the shiniest one.

- And to bring in partners to take some of that work off your back.

That’s a hard combination to find. Usually it comes from years of grinding, a little luck, and lots of blood and tears along the way, with a legion of investors churning in and out along the way.

OR you can find a company that’s already done a lot of that work before they went public, that is about to go public in, like, hours.

Enter SAGA METALS.

Saga Metals Corp. comes to market this week with a focused approach on exploring and developing critical minerals on the east cost of Canada, specifically in Quebec, and Newfoundland and Labrador.

As mining jurisdictions, you’d be hard pressed to find two that are better places to develop a mine plan than those two Canadian provinces.

Quebec is so into mining that the government regularly hands out grants to support critical metals industry development, and their government-backed investment funds take an active role in many projects.

Newfoundland and Labrador, for a few decades, clamped a moratorium on mining, specifically uranium exploration between 2008-2011, while it figured out the best approach to developing that province’s natural resources, but recently the blinders have come off and they are all in on opening up the industry anew.

In fact, for three of the last four years, Newfoundland and Labrador has been ranked in the Fraser Institute’s top ten best mining jurisdictions worldwide, coming #4 in 2022, behind Nevada, Western Australia, and Saskatchewan.

Quebec has been in the top ten for all four years.

So Saga has arguably set up in the right place, provincially, but how about on a more micro level?

In other words, ‘is it where the action is’?

Proximity is everything:

On the uranium side, Saga has a project in Labrador that is really interesting.

On the uranium side, Saga has a project in Labrador that is really interesting.

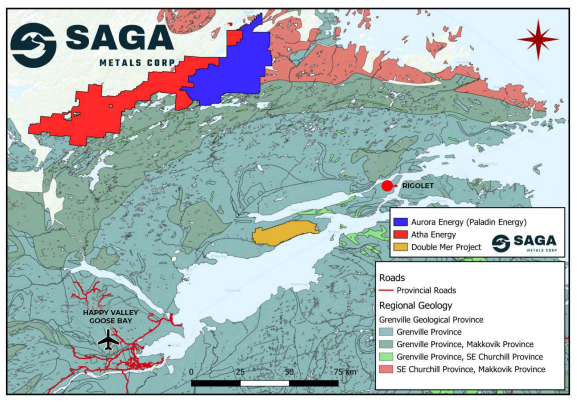

Sure, we’ve all seen the million projects in Saskatchewan trying to prove they’re each better than the others, but while those pups all crowd the bowl over on the prairies, on the Maritimes there’s been an opportunity for Saga to grab something great in the Double Mer project, just west of Rigolet, that nobody has been watching.

Located right on the waterfront, the Double Mer is just south of a substantial project run by the $2 billion Paladin Energy (PDN.ASX), which last week laid out a billion dollar-plus bid to buy Fission Uranium (FCU.T).

Paladin holds six deposits with a total of 127.8 million lbs of mineral resources, and the granddaddy of them all is the Michelin project, which alone has 127.8 million lbs, just up top of Saga’s Double Mer.

The Double Mer was worked in the 70’s and again in 2006, through 2008, with millions of dollars spent finding targets and building infrastructure. Then the government pulled up stakes for a few years and everything stopped, and eventually it all fell out of common institutional knowledge that the thing even existed.

Saga dug the property up again, and now gets the benefit of those millions already spent on building a loading dock, a winterized camp, and lots of flights over the top, scintillometers on the ground, magnetic surveys, and soil geochemistry.

TIME TO DRILL?

Almost, but to get there properly, Saga has committed to spending a bit over half a million dollars updating the facilities, doing a baseline water study, more geological and structural mapping, and a $200k sampling program so that the drills can be sent out post haste.

Okay, terminology time:

- Scintillometers are handheld machines that go ding when they hit radioactivity

- Soil sampling/geochemistry is when folks pick up a handful of ground and test it to see whether any of the metal they’re chasing is present naturally

- Magnetic surveys look for metal in the ground, using magnets to get a reading on what’s under the soil, sometimes using planes and sometimes by folks walking the property

- All of this is done because it’s cheaper, faster, and easier to do over a lot of ground, to find the best places to drill, because the drill gives exact data

If you’re into the technicals, consider these are the levels a typical explorer looks for:

- 0-100 ppm U3O8 is considered low grade.

- 100-300 ppm U3O8 is regarded as average grade.

- Over 400 ppm U3O8 is classified as high grade.

At Double Mer, 79 of the 182 historic rock samples taken had over 500ppm of U3O8, 14 had over 2000ppm, and one killer rocked over 4200ppm.

So, let’s just agree this is worth looking deeper into.

But how does this project look on our earlier mentioned ‘list of things to take an explorer to the big time?’

- Finding good projects – check

- Raising millions of dollars to explore them – so far, so good

- Advancing those projects in a meaningful way – again, check

- Having enough respect in the boardroom that they can bring in much bigger partners to move things along – to be continued, but having a monster as your neighbour – especially a monster that has shown it wants to eat other monsters, is definitely a plus

OK, uranium is good, but what else you got?

On the lithium side, there are plenty in the markets right now who think lithium is way out of favour and not worth investing in, BUT…

- We know there’s only going to more demand for lithium going forward, regardless of where it is today

- The price of lithium today is low because of very short term factors that wont continue for long

- If you find a lithium project that WASN’T a project til you got there, and lines up right next to another discovery that a giant mining company is VERY committed to, maybe you roll the dice

Behold, the Legacy Lithium project.

Alright, let’s go through what you’re looking at, starting in the west.

That’s Winsome Resources with a discovery called the Adina Project (the left-most yellow star), which has quickly become one of the top 5 largest lithium projects in the world, with an inferred mineral resource of 78 million tonnes at 1.15% Li2O.

Ladies and gentlemen, that’s a beauty. A region maker.

Quickly, others came to town, including Azimut (AZM.V) and Soquem (a subsidiary of Investissement Québec), Australia’s Loyal Lithium (LLI.ASX), and the $166.88B AUD mining gigantor known as Rio Tinto (RIO.NYSE). They’ve all worked their patches and found great results too, so Winsome looked at the geological trend their Adina project sits on, and casually ventured east beyond their neighbours’ properties and established the Tilly Project (the right-most yellow star) which they’re very into.

And what they found at the Tilly was, yes, the trend does keep going east.

Right into Saga’s backyard.

Saga has 34,243 hectares in their Quebec land package, with only 20% of that even having been explored to date.

Saga has 34,243 hectares in their Quebec land package, with only 20% of that even having been explored to date.

But that 20% has already identified 100+ documented pegmatite outcrops.

Lithium comes in two flavours – rock and brine. For mine, you want the rock (or pegmatites), because they’re faster to process and generally much higher quality, so Saga having 100+ of them so early on is a big deal.

Look at them all – the yellow dots indicate pegmatite samples and are plentiful, stretched over a 9km area with a 5km strike length.

Also important is that little patch to the southeast, which shows, while there’s a bouquet of opportunity in that rich patch in the north, it may well run on in a significant way to the south.

Saga took 437 grab samples in August 2023 on the Legacy project and 57 of those contained anomalous LCT.

Note to the less technical: ‘Anomalous’ means they’re different from background readings, or an anomaly. Those are good spots to dig in more.

SO IS IT TIME TO DRILL?

Not yet, friend, but Saga has committed to spending nearly half a million dollars on developing field lodging, satellite imagery analysis, geophysical surveys, geological mapping, and a geochemical survey.

In layman’s terms, all the things you’d do to better know exactly where those drills should go, post haste.

But how does this look on our earlier mentioned ‘list of things to take an explorer to the big time?’

- Finding good projects – check

- Raising millions of dollars to explore them – so far, so good

- Advancing those projects in a meaningful way – again, check

- Having enough respect in the boardroom that they can bring in much bigger partners tp move things along..

FUNNY YOU SHOULD ASK.

VANCOUVER, B.C. – July 3, 2024, Saga Metals Corp. (the “Company” or “Saga”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce the execution of an option to joint venture agreement on June 27, 2024 (the “Option Agreement”) with Rio Tinto Exploration Canada Inc. (“RTEC”) for its Legacy Lithium Project in the renowned James Bay Lithium District.

Excuse my language but OH SHIT.

Under the Option Agreement, RTEC has the option to acquire an initial 51% interest (the “First Option”) in the Legacy Lithium Project over a period of four (4) years, which it may exercise if it satisfies the following conditions:

- Cash payments totaling C$410,190 on or before August 11, 2024.

- Exploration expenditures totaling C$9,571,100, including a firm commitment to spend not less than C$1,709,125 in the first 20 months of the effective date of the Option Agreement.

- C$273,460 in cash payments to Saga ($68,365 per year) and additional payments of C$225,000 in aggregate, being equal in amount to the underlying claim acquisition amounts owed by Saga to the vendors from whom it acquired the Legacy Lithium Project.

After earning the right to acquire an initial 51% interest, RTEC will have the option to increase its interest in the Legacy Lithium Project to 75% (the “Second Option”) over a period of five (5) years following the four (4) year First Option term, by incurring exploration expenditures totaling an additional C$34,182,500 in exploration expenditures.

LAYMAN’S TERMS: Instead of spending the millions of dollars needed to get this project advanced to production, Saga has let the big ass neighbour with gobs of cash and machines and people take 51% of the property, for a free ride. Saga keeps half of a property that will conceivably be worth far more having a lot of work done to it, with the chance it could go all the way to production without Saga having to drop one more dollar on it.

In one fell swoop, Saga managed to bring in not just a partner but a HUMUNGOUS partner who can do the work with its eyes shut, AND enough cash to do most of its 2024 work program scheduled for the Double Mer uranium project, AND the prospect of working alongside one of the biggest mining groups around in a meaningful way, getting them that boardroom cred.

To be clear: If you’re sitting here doing your due diligence on Saga and its team, understand Rio Tinto has FAR MORE ABILITY to do that due diligence than you, and have decided the Saga team and property are legit.

I take them at their word.

Why Invest in Saga Metals Corp?

I mean, guys, all of the above should be a lot of good reasons already, but in the last few days, another shoe has dropped at the Legacy project, and it’s this:

VANCOUVER, B.C. – Tuesday, July 2, 2024, Saga Metals Corp. (the “Company” or “Saga”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce that it has entered into an asset purchase agreement (the “APA”) dated May 17, 2024 with two arm’s length private vendors (the “Vendors”), pursuant to which the Company will acquire a 100% interest in 606 mining claims covering an area of 31,347.76 hectares in the Eeyou Istchee James Bay region of Québec (the “Amirault Property”).

I’ll save you the dig – remember that little southern bit of the legacy, where I mentioned some small findings may indicate there’s a bit more ‘there’ there?

The Amirault project is right up alongside that. [See right]

That’s right, if Rio Tinto enjoys what it finds at the Legacy project, Saga has the next wedge of land all set to go, and they paid for it with Rio Tinto’s cash ($200K) and 4m shares.

Baller moves, folks.

BUT WHAT ABOUT THAT VANADIUM?

Jesus man, give me a minute to catch my breath.

Okay – Vanadium.

Actually, titanium and vanadium, both of which are great for high-tech and strategic applications, including aerospace and military sectors, as well as in energy storage solutions. Also vanadium alloys are prime candidate materials for the structural component of fusion reactors due to their low activation properties, high thermal stress factors, and radiation resistance.

- Vanadium alloys are employed in the aerospace industry for making components that require high strength-to-weight ratios, such as jet engines and airframes.

- In automotive manufacturing, vanadium steel is used for applications that require exceptionally high strength and durability, such as gears, axles, and crankshafts.

- One of the most promising applications of vanadium is in the energy storage sector, specifically in vanadium redox flow batteries. These batteries are used for grid energy storage, linked to renewable energy sources like solar and wind. VRFBs are highly efficient, have a long lifespan, and can be fully discharged without damage, which makes them ideal for stabilizing power supplies and enhancing the efficiency of energy grids, as opposed to lithium-ion batteries.

- Vanadium is primarily used to produce high-strength steel alloys. It helps increase the strength, toughness, and wear resistance of steel, which is crucial for applications requiring durable, high-performance materials.

That last one is interesting because, while Saga Metals has a titanium/vanadium project at the Radar property in Labrador, they ALSO have a Labrador-based iron ore project that I haven’t even mentioned yet..

That’s right – TWO properties that are admittedly early stage, but continue that ‘across the table’ bet.

Brother, to be able to grab iron ore and the metals (titanium and vanadium) that make that iron stronger, AND the uranium needed for nuclear fuel AND the lithium used in EV batteries, all within a reasonably expensive Uber ride from one another (okay, you’d probably want a rental), that’s an incredible cross pollination of useful elements, great projects, fat neighbours who have already locked in on a partnership, great jurisdictions, and committed advancing of them all.

An Exceptional Project Portfolio:

- Legacy Lithium Project, James Bay, Quebec

- Vast Potential: Covering over 65,849 hectares in an area marked for extensive development under Quebec’s Plan Du Nord.

- Rich in Lithium: Identified extensive LCT pegmatite occurrences, making it a prime candidate for lithium mining.

- Strategic Location: Rio Tinto. Nuff said.

- Double Mer Uranium Project, Central Labrador

- Significant Size: Encompassing 25,600 hectares with considerable historical exploration indicating substantial uranium deposits.

- High-Grade Discoveries: Recent assays have shown promising uranium grades, vital as nuclear power gains traction as a sustainable energy source.

- Critical for Clean Energy: With nuclear energy’s resurgence as a green energy solution, Double Mer stands to contribute significantly to the global uranium market.

- Strategic location:

- Strategic Location: Positioned within a region known for significant lithium findings, enhancing the prospectivity of the property. nice and close to Paladin Energy.

- North Wind Iron Project, Labrador Trough

- Historically Proven: The region has a longstanding history of iron production, and initial drillings indicate robust iron presence.

- Economic Significance: Iron is essential for various industrial applications, including construction and manufacturing, critical for supporting green technologies.

- Strategic Location: Right up close to Labmag and Abaxx Technologies within the Labrador Trough.

- Radar Titanium-Vanadium Project, Labrador

- Access and Scale: Spanning 17,250 hectares with good infrastructure, this project focuses on titanium and vanadium—metals crucial for high-strength alloys and energy storage technologies.

- Diverse Applications: Both metals are vital for defense, aerospace, and burgeoning technologies like redox flow batteries, highlighting the project’s strategic importance. Remember what I said about vanadium alloys importance to the structural component of fusion reactors.

- Strategic Location: Rio Tinto’s Lac Tio project, a Titanium-Vanadium project is just southwest of Radar.

What about the management team?

Led by industry veterans with extensive experience in mining and green technologies, CEO Michael Stier heads a team with extensive experience on the technical and market side.

But is it a good time?

Saga is coming to market LITERALLY at the best time, right as Rio Tinto has locked in on them and a week after Paladin bid for Fission Uranium. I mean, by god, if that’s not THE PERFECT time to come to market, what are we even doing here?

Okay. I’m done. Spent.

Thanks for getting to this point, I hope you indeed learned some things and feel like I do, that this is beyond ‘just another mining explorer.’ These guys have put together a compelling company that hits the market AFTER they’ve shown their abilities, not before. They’re not asking you to take a flier on something, they’ve shown their work and their excellence at pulling together a slate of properties AND raising enough money to work them AND building relationships with massive players AND spreading their bets in a way that makes sense and largely insulates them from single-metal market slumps.

To come to market already ahead of many companies that have been on the markets for several years is worthy of respect.

And to follow the due diligence of Rio Tinto gives me comfort in the deal.

Here is a recent CEO interview with Michael Stier!

— Chris Parry

FULL DISCLOSURE: Saga is a client company of Equity.Guru. By all means consider me conflicted but everything in this piece is information found in the corporate deck.

VANCOUVER, B.C. – Tuesday, July 2, 2024, Saga Metals Corp. (the “Company” or “Saga”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce that it has entered into an asset purchase agreement (the “APA”) dated May 17, 2024 with two arm’s length private vendors (the “Vendors”), pursuant to which the Company will acquire a 100% interest in 606 mining claims covering an area of 31,347.76 hectares in the Eeyou Istchee James Bay region of Québec (the “Amirault Property”).

VANCOUVER, B.C. – Tuesday, July 2, 2024, Saga Metals Corp. (the “Company” or “Saga”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce that it has entered into an asset purchase agreement (the “APA”) dated May 17, 2024 with two arm’s length private vendors (the “Vendors”), pursuant to which the Company will acquire a 100% interest in 606 mining claims covering an area of 31,347.76 hectares in the Eeyou Istchee James Bay region of Québec (the “Amirault Property”).

Leave a Reply