If you’re the type of investor who attends investor conferences, you’ve no doubt found yourself in the familiar scenario where dozens – even hundreds – of mining explorers stand before you, each behind a card table with some flyers and a backdrop with a map and a picture of a guy in a hard hat, and you think to yourself “how do I differentiate between these guys?”

Oh, you have a great project? So does the next guy.

Oh, it has great technicals? Yeah, the next guy too.

Oh, experienced board of directors? Weird, that sounds familiar.

I’m a pitch man, so when I’m hearing about a potential investment opportunity, I like to land on companies that don’t sound like the same old folks doing the same old things, the same old way. Give me something to work with. Give me something different. A fresh take. Something to think about, or something that shows you’ve been thinking.

Sadly, this doesnt occur often. I hear more, “the market hasn’t been kind to us” than I do “We’re executing our plan.”

SKYHARBOUR RESOURCES (SYH.V) is a breath of fresh air and, to its credit, always has been.

CEO Jordan Trimble and I spoke briefly in passing today, and I asked him how he was going.

He said, in short – “We’re busy. We’re just constantly busy.”

Trimble’s company is a mid-sized uranium explorer/prospect geenerator and busy is an understatement.

Not ‘busy diluting his stock’ – in fact, Trimble pointed out Skyharbour hasn’t done a non-flow through financing since 2020, though it has performed work on its properties in each of the years since, and sits on a decent wedge of cash.

And not ‘busy waiting for the market to be great’ – in fact, Skyharbour’s list of projects continues to attract partners who often pay for the privilege of working their properties, allowing the company to cover its costs without having to keep going back to the market for a top-up.

So how do they do it? How do they cover their costs WHILE growing AND finding new partners AND advancing projects?

STEP 1: LOTS OF PROJECTS

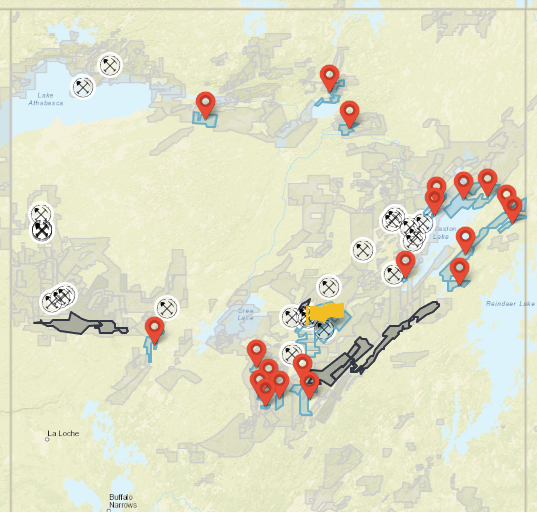

That’s 29 projects right there on that map, with three where SYH is the optionee, and the others where they’re the operator.

Ten of those are drill-ready, which is a number you don’t see often. Sure, there are other companies out there with a Pokemon card-like collection of properties, but they’re usually of limited use, cobbled together on the cheap, not progressing, and waiting for shell companies that are desperate for a reason to be, to come along and flip some cash for one of them.

But Skyharbour’s projects are either ready to roll, or actively rolling, either at Skyharbour’s behest or at the hands of a partner.

STEP 2: LOTS OF PARTNERS

Example 1: Skyharbour acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine. Moore is an advanced-stage uranium exploration property with high-grade uranium mineralization at the Maverick Zone including highlight drill results of 6.0% U3O8 over 5.9 metres at a vertical depth of 265 metres.

Example 2: Adjacent to the Moore Uranium Project is Skyharbour’s recently optioned Russell Lake Uranium Project from Rio Tinto, which hosts historical high-grade drill intercepts over a large property area with robust exploration upside potential.

You want more?

Through earn-in option agreements, Skyharbour has joint-ventures with:

- Orano Canada Inc.

- Azincourt Energy

- Thunderbird Resources (ASX)

Skyharbour also has four active earn-in option partners including:

- Basin Uranium Corp.

- Medaro Mining Corp.

- North Shore Uranium

- Tisdale Clean Energy

STEP 3: LOTS OF REVENUE

Most prospect generators could only dream of managing one or two deals like these, but Skyharbour has now got earn-in agreements with over $33 million in partner-funded ventures, $27 million worth of shares in their partners, and $20 million in potential cash incoming from those projects.

That’s roughly $80 million in value generated without actually selling off a property, which isn’t bad for a company with a $62 million market cap, as of the time of writing.

Toss in $4.6 million in cash at hand as a bonus, and the value proper of the 29 projects they hold, and this whole fucking set-up is basically an arbitrage.

While competitors are continually needing to go back to the market to raise more money, Skyharbour just sits by the mailbox and waits for the cheques from their partners to roll in.

And when they do sell a project, they make a profit.

STEP 4: LOTS OF WORK

You know, I misspoke just now when I said Skyharbour sit by the mailbox waiting for doughbucks to land. Looking at their newsflow, they obviously do no such thing.

Skyharbour’s properties get worked, either by partners, or by management proper.

Skyharbour Resources Ltd. has commenced a 2,500-metre summer drill program at its 100-per-cent-owned, 35,705-hectare high-grade Moore uranium project. The project is located approximately 15 kilometres east of Denison Mine’s Wheeler River project and proximal to regional infrastructure for Cameco’s Key Lake and McArthur River operations in the Athabasca basin, Saskatchewan.

And a month before, not just more work but a new discovery.

Skyharbour Resources Ltd. is pleased to announce initial results from Phase One of its 2024 winter drill program at the 73,294 hectare Russell Lake Uranium Project (“Russell” or the “Project”) [..] High-grade, sandstone-hosted mineralization up to 2.99% U 3 O 8 was intersected over 0.5 metres in hole RSL24-02 at the new Fork Zone, within an interval of 0.721% U 3 O 8 over 2.5 metres from 338.1 to 340.6 metres downhole just above the unconformity. This is the best drill result historically at the project representing a new discovery in a newly delineated target area and will be a top-priority target in the upcoming summer drill program.

So, to recap: Money in pocket, money coming in, share holdings in partners, big brother partner JVs, loads of smaller companies doing work for the right to earn in, dozens of properties with more being staked regularly, work being done, new discoveries..

And, did I mention, when they do raise money (with flow-through and charity flow-through offerings, meaning the cassh goes into the ground), they raise it in large amounts from large institutions?

SKYHARBOUR CLOSES $6.37 MILLION PRIVATE PLACEMENT OF FLOW-THROUGH UNITS

Skyharbour Resources Ltd. has closed a non-brokered private placement financing for total gross proceeds of $6.37-million. The private placement was subscribed for by several strategic institutional investors. The funds will be used for various exploration programs in 2024 including multiple drill programs throughout the year planned for the company’s co-flagship Russell and Moore Lake uranium projects.

Brothers and sisters, Skyharbour Resources; put some respect on their name.

— Chris Parry

FULL DISCLOSURE: Not a client company though, in the interest of openness, they’ve been a client company several times previously, and we hold stock in the company because they’re just great at what they do and the market lets you have shares at a discount.

Leave a Reply