A March 3, 2025 Highballer Roundup

Greg Nolan March 3, 2025

After a steady two-month-long stair-step higher, the precious metal finally took one on the chin. For some, this was a necessary reprieve, a welcome cooling off as the momentum ushering in multiple assaults on fresh all-time highs was relentless and unsustainable. While top callers, those ever eager to deride the ‘barbarous relic,’ proclaim this is it—’this is as high as she goes‘—the metal’s fans contend, ‘make no mistake… it’s headed higher… much higher.’ Count me among the latter.

I noted in a recent offering that a pulse has been detected in the junior exploration arena. While that’s true for a select few—companies reporting broad intervals of potentially economic porphyry mineralization—it’s a twitchy market. Volumes are thin, and trade is often dominated by shoot-from-the-hip types—short-term traders looking to book a few pennies profit. This trading behavior is bound to change as resource-hungry predators—producers with lean project pipelines growing increasingly desperate to bulk up their mineral inventory—kick M&A into a whole new gear.

For now, if a single round of assay-related newsflow doesn’t exceed expectations, selling ensues; the stock gets dumped wholesale… core fundamentals be damned.

A few recent examples…

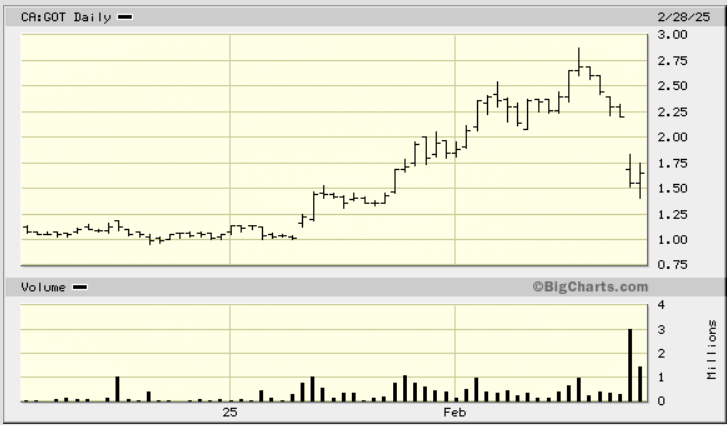

Goliath Resources (GOT.V) – (GOTRF.OTC)

- 139.03 million shares outstanding

- $229.39M market cap based on its recent $1.65 close

- Corp Presentation

Goliath dropped a final round of assays from its high-grade Golddigger Property in the prolific Golden Triangle of northwestern BC on Thursday, following up on a series of high-grade hits that included drill hole GD-24-260 (34.52 g/t AuEq over 39.00 meters).

The bar was set exceeding high for subsequent rounds with GD-24-260, even after claims of grade smearing were raised.

‘9.39 g/t AuEq Over 10.17 Meters’ was highlighted in the text of last Thursday’s headline. The market wasn’t impressed…

The Golddigger property and its multiple high-grade zones—12 stacked gold veins stretching vertically over 1.2 kilometers—reside in one of the most geologically prospective regions on the planet. For the Goliath faithful, Golddigger stands out as one of the more important high-grade discoveries in recent years.

Quoting the February 27 press release: All 8 original layers identified through drilling and modelling on Surebet (Surebet Upper, Surebet Lower, Bonanza, Golden Gate, Whopper, Goldzilla, Eldorado and Big One) have all been significantly expanded and remain wide open with strong additional expansion potential. 4 new zones have been confirmed and modelled in 2024 bringing the total gold-rich stacked layers to 12, all of which remain wide open for expansion.

Expect an aggressive multiple-rig program this coming field season.

Amarc Resources (AHR.V) – (AXREF.OTC)

Amarc reported a final round of (highly anticipated) assays from its new AuRORA discovery, along with three additional ’emerging copper-gold systems,’ at its JOY Project in the Toodoggone-Kemess porphyry region of north-central British Columbia. Mining giant Freeport-McMoRan can earn (up to) a 70% interest JOY via staged investments of $110 million.

The highlight interval from this round was 132.00 meters of 1.71% CuEq (1.87 g/t Au, 0.63% Cu and 5.2 g/t Ag) including 90.00 meters 0f 2.26% CuEq (2.53 g/t Au, 0.81% Cu and 6.5 g/t Ag). Righteous values, but the market voted with its feet.

The weakness in both Goliath and Amarc may represent a buying opportunity, but with winter having slammed the door shut on drilling for the next few months, assay-related newsflow will be limited.

Radisson Mining (RDS.V) – (RMRDF.OTC)

- 345.91 million shares outstanding

- $103.77M market cap based on its recent $0.30 close

- Corp Presentation

The recent drill hole assays released from Radisson’s (RDS.V) O’Brien Project were good, but apparently… not good enough.

Highlights from the Feb 26 press release:

- OB-24-358 intersected 8.36 g/t Au over 15.0 metres within a broad mineralized interval with multiple veins, including 56.0 g/t Au over 1.0 metre and 41.1 g/t Au over 1.0 metre;

- OB-24-327 intersected 10.32 g/t Au over 4.1 metres including 18.30 g/t Au over 1.5 metres;

- OB-24-350 intersected 46.40 g/t Au over 1.0 metre;

- OB-24-339 intersected 10.05 g/t Au over 1.3 metres; and

- OB-24-351 intersected 9.89 g/t Au over 2.9 metres including 17.90 g/t Au over 1.4 metres

Though the selling was on low volume, traders took profits, ignoring the potential for an endgame here.

The company also released positive Metallurgical results on Feb 3, highlighting the following values:

- Gold recovery of 86% based on a simple flow sheet of Gravity-Leach;

- Gold recovery of 90% based on a Gravity-Flotation-Regrind-Leach flow sheet;

- Gold recoveries of between 94% and 96% based on the sale of a flotation concentrate in a Gravity-Flotation-Concentrate Sale flow sheet after consideration for payability factors of 90% to 95% respectively; and

- Average arsenic values of 4% to 0.5% in whole rock and 4.6% in flotation concentrate, consistent with precedent projects in Québec’s Abitibi and offtake threshold limits for concentrates of high-grade gold projects.

Loyal shareholders believe these results qualify as a major de-risking event and are one step closer to an endgame.

Collective Mining (CNL.TO) – (CNL.NYSE)

- 77.68 million shares outstanding

- $685.94M market cap based on its recent $8.83 close

- Corp Presentation

One company that stands out amidst the junior sector carnage is Collective Mining, a company highlighted in these pages last October when the stock was trading in the $4.30 range.

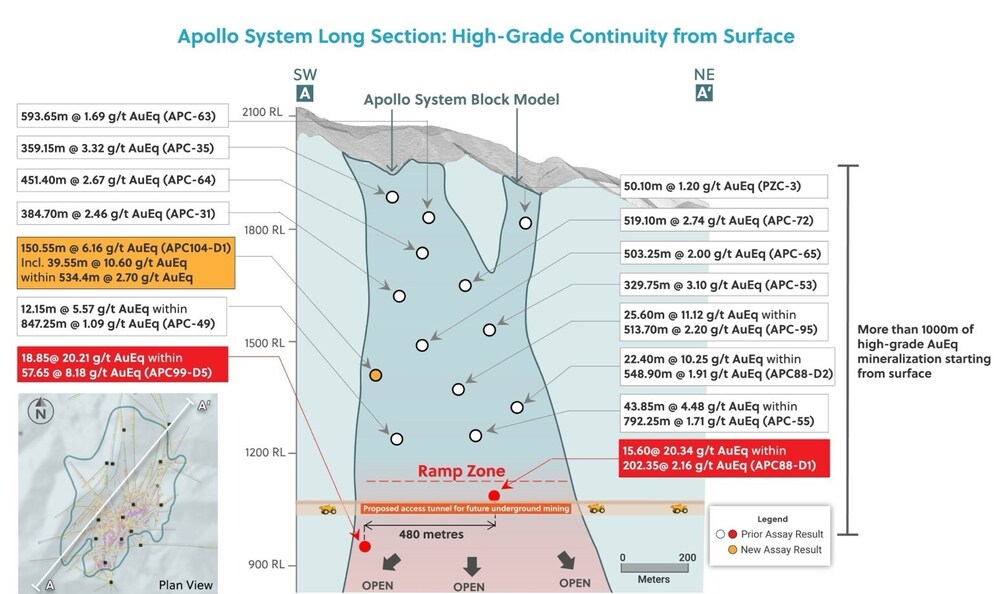

Collective continues to exceed even the loftiest expectations as it pushes its Guayabales Project along the exploration curve with an aggressive 60k meter, six-rig program.

The company, founded by the same team that developed and sold Continental Gold to Zijin Mining for $2 billion, appears to be onto another world-class deposit(s) at Guayabales. And loyal shareholders are betting on a repeat of that past success.

The drill results reported in a February 24 press release highlight values from its Apollo zone, the most advanced discovery made to date at Guayabales (there are currently four drill rigs probing Apollo’s subsurface stratum).

Drill hole APC104-D5, highlighted in the text of this February 24 headline, was designed to intercept the same high-grade sub-zone discovered in hole APC104-D1 but at a deeper elevation. APC104-D1 carried values of 6.16 g/t AuEq over 150.55 meters within a broader interval of 2.70 g/t AuEq over 534.40 meters (see press release dated December 16, 2024).

Zooming in on APC104-D5…

- 497.35 metres @ 3.01 g/t gold equivalent from 147.30 metres including:

- 106.35 metres @ 9.05 g/t gold equivalent from 147.30 metres including

- 24.85 metres @ 25.42 g/t gold equivalent from 209.60 metres

- Towards the end of the drill hole, a new high-grade area was discovered at the footwall contact between the Apollo breccia body and country rock, which assayed 15.00 metres at 5.39 g/t gold equivalent. Follow up drilling to chase this contact zone is being planned as part of the 2025 program.

- On a grams X metres basis, APC104-D5 is the highest-grade intercept ever drilled at Apollo yielding 1,499 g/t gold equivalent. To date, the Company has drilled seventeen gold equivalent accumulation intercepts at over 1,000-grams x metres at Apollo.

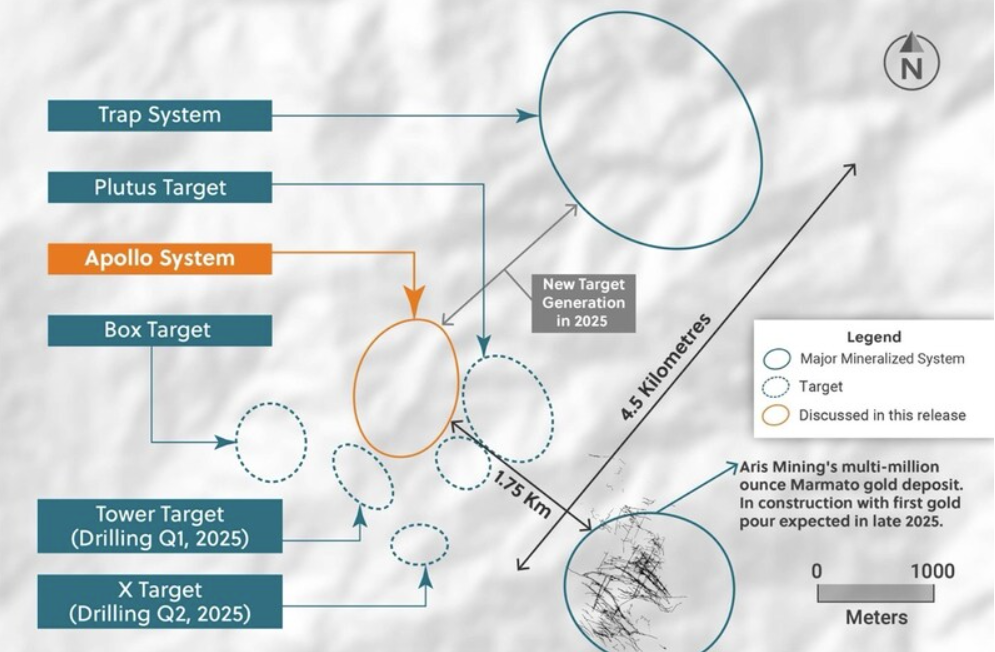

As the above map shows, Apollo is one target among many (note the proximity of Aris’ Marmato Au deposit). Apollo is evolving into a large-scale, bulk-tonnage, high-grade copper-silver-gold-tungsten porphyry system. The company’s current focus is expanding Apollo, stepping out along strike of the recently discovered Trap system, and tagging a new discovery at its Tower, X, and/or Plutus targets.

As noted above, four rigs are currently turning at Apollo. Additionally, one rig is testing the Trap target and another is probing San Antonio. A seventh drill rig is due to arrive any day now.

A couple of new ideas

Everyone is scouring geologically prospective landscapes in search of the next Apollo. Though these deposits are exceedingly rare, kicking rocks in the same region would be my plan. That brings to mind Quimbaya.

Quimbaya Gold (QIM.C) – (QIMGF.OTC)

- 34.8 million shares outstanding

- $12.53M market cap based on its recent $0.36 close

- Corp Presentation

I was drawn to this one when Chris Parry featured it over at Equity Guru roughly four weeks back (Chris has a good eye for these early-stage plays).

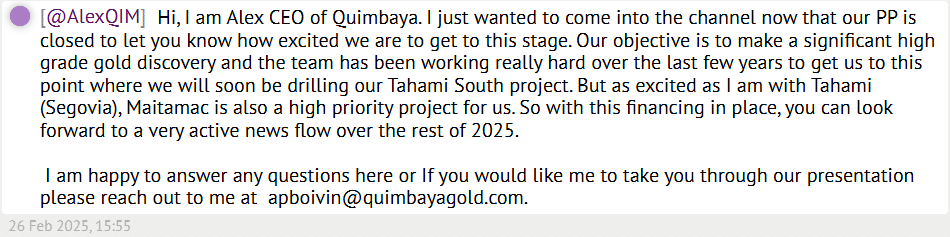

Quimbaya Gold’s (QIM.C) CEO will buy his stock if you won’t

Quoting Parry at the top of the article:

Alexandre Boivin’s first deal on the public markets was based in Colombia and went from ten cents to thirteen bucks.

Anyone who has played slots knows, when you win a jackpot first time out, you’ve got a new hobby going forward, so Boivin showing up in Colombia again with Quimbaya Gold (QIM.C) is hardly a surprise.

What may be a surprise is just how ‘in’ to this deal Boivin is. In short, if you’re not going to buy the stock when it’s cheap, he’s going to.

Management owns a whopping 41.49% of the company, and Boivin isn’t stopping at the 38% he personally owns.

Aside from Quimbaya’s tight share structure and insider alignment, the company controls three projects in the mining-friendly department of Antioquia, Colombia: Segovia (Tahami Project), Puerto Berrio (Berrio Project), and Abejorral (Maitamac Project). Rather than states or provinces, Colombia is divided into 32 departments.

The Tahami (South) project is teed up for a first pass 4k meter drill campaign. Note its proximity to Aris Mining’s Segovia project where the M&I resource currently stands at 3.6 million high-grade ozs (bottom center, map below).

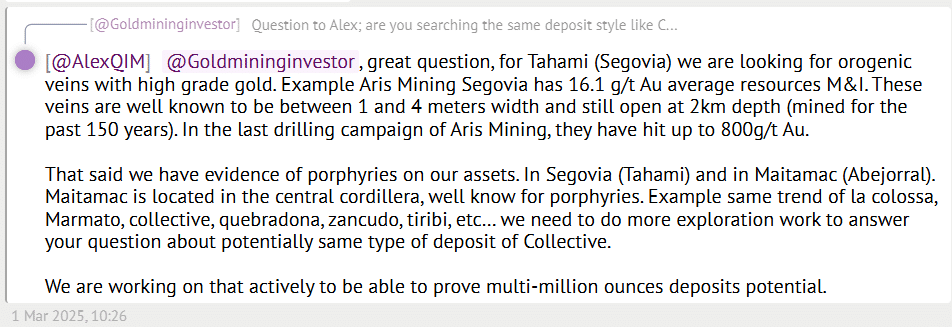

Alexandre Boivin appears to be a very accessible CEO—he recently began taking questions over on the QIM channel at CEO.CA...

When asked if they are targeting the same type of deposit as Collective Mining’s Apollo discovery, CEO Boivin responded…

Worth your due diligence, this one. Note: I don’t currently own the stock but intend to establish a position in the coming days.

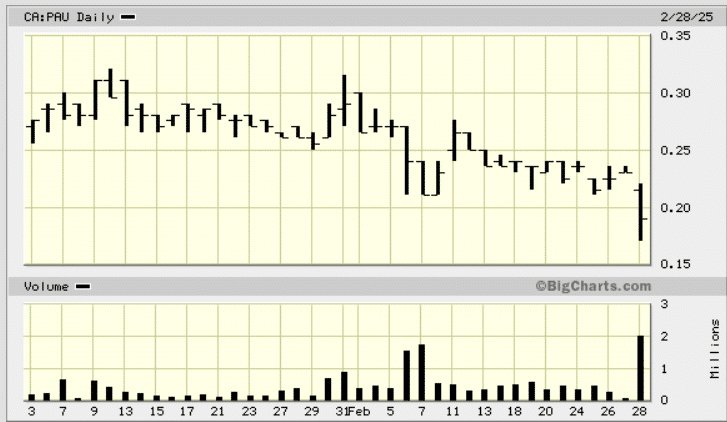

Provenance Gold (PAU.V) – (PVGDF.OTC)

- 127.29 million shares outstanding

- $24.18M market cap based on its recent $0.19 close

- Corp Presentation

Even though I’ve been following Provenance’s progress for over a year, I don’t believe I’ve mentioned the company in these pages before now.

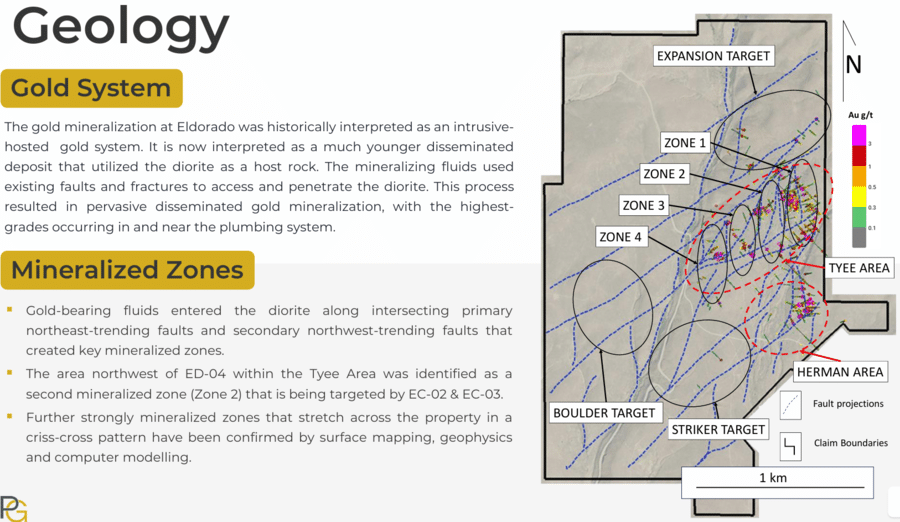

The company’s flagship asset—Eldorado—resides in the state of Oregon, which, admittedly, isn’t a jurisdiction one typically associates with gold mining. But there is gold in these subsurface layers. According to the company’s website:

Historic drilling included 236 reverse circulation holes and six core holes totaling 21,867 meters. The latest non-compliant resource estimate, conducted by Ican Minerals in 1997 was 1,980,000 oz Au with 90,000,000 contained tons at a grade of 0.753 g/t gold (0.022 oz/t).

Historic drilling also encountered high-grade breccia zones. These breccia areas are likely complex volcanic pipes and geological structures that host high-grade gold within a large low-medium grade envelope.

In the summer of 2023, Provenance launched an 11-hole RC drill campaign to revisit the mineralization encountered decades earlier. According to a December 14, 2023 press release, the company tagged ‘significant gold mineralization’ in every hole.

Highlights:

- ED-04 – 137.16 meters of 1.639 g/t gold

- ED-07 – 114.3 meters of 3.085 g/t gold

- ED-11 – 118.872 meters of 3.278 g/t gold

In the late summer of 2024, the company set out to test the system at depth with a modest three-hole core program.

According to a December 9, 2024 press release, their first core hole from that program (EC-01), drilled to a depth of 338.18 meters, tagged an impressive 2.01 g/t Au over 288.34 meters from surface. EC-01 included a higher-grade sub-interval of 3.07 g/t Au over 175.26 meters.

EC-01 was the standout from this modest campaign. The two remaining holes, released a few days back on February 28, encountered the following broad intervals of mineralization:

- EC-03 – 0.8 g/t gold over 154.23 meters from surface (including 3.02 g/t gold over 13.72 meters);

- EC-02 – 0.501 g/t gold over 156 meters (including 0.94 g/t gold over 32 meters).

These last two results didn’t meet the market’s expectations (EC-01’s 3.07 g/t Au over 175.26 meters hit set the bar high).

Historical drilling at Eldorado was limited to a reach of roughly 100 meters. The company now has evidence that the mineralization extends to greater depth.

What’s on deck? The company is planning an aggressive RC and core campaign consisting of infill and stepout drilling. Regional targets will also see the biz end of the drill bit. Quoting Provenance’s CEO Rauno Perttu from the December 2024 press release: “We are now planning a much larger drill program for 2025 to extend the mineralized zones further and test other prospective zones that appear to be broader and more intensely altered than our initial ones.”

Other (non client) companies generating noteworthy headlines since my last report…

AbraSilver Resource (ABRA.V) – (ABBRF.OTC)

Abitibi Metals (AMQ.C) – (AMQFF.OTC)

- Feb 20 – Abitibi Metals Drills 3.47% CuEq over 5.25 Metres Within 1.61% CuEq over 18.55 Metres at B26 Deposit

Amerigo Resources (ARG.TO) – (ARREF.OTC)

Apollo Silver Corp. (APGO.V) – (APGOF.OTC)

ATEX Resources (ATX.V)

Aurion Resources (AU.V) – (AIRRF.OTC)

- Feb 24 – Aurion Intersects 7.92 g/t Au over 13.60 m in a Step-out Hole at Kaaresselkä, Risti Property

Kenorland Minerals (KLD.V) – (KLDCF.OTC)

- Feb 12 – Kenorland Commences 2025 Winter Drill Program at the South Uchi Project, Ontario

- Feb 18 – Kenorland Commences 2025 Winter Drill Program at the Chebistuan Project, Quebec

ONGold Resources (ONAU.V) – (ONGRF.OTC)

- Feb 25 – Red Sucker Lake First Nation Invites ONGold to Resume Exploration at Monument Bay Gold Project

Orogen Royalties (OGN.V) – (OGNRF.OTC)

Probe Gold (PRB.V) – (PROBF.OTC)

Prime Mining (PRYM.V) – (PRMNF.OTC)

- Feb 19 – Prime Announces 2025 Outlook for its High Grade Gold Silver Los Reyes Project and Drilling Status Update

- Feb 24 – Prime’s Fresnillo Generative Target Extended by 120 metres

Red Pine Exploration (RPX.V) – (RDEXF.OTC)

Ridgeline Minerals Corp. (RDG.V) – (RDGMF.OTC)

Skeena Resources (SKE.TO) – (SKE.NYSE)

Summa Silver (SSVR.V) – (SSVRF.OTC)

Teuton Resources (TUO.V)

West Point Gold (WPG.V) – (WPGCF.OTC)

- Feb 19 – West Point Gold Expands Gold Chain Land Package by 30%

- Feb 24 – West Point Gold Infill Sampling Significantly Expands Mineralized Zones; GC24-30 to 89.5m of 1.08 g/t Au and GC24-32 to 51.16m of 1.21 g/t Au

- Feb 26 – West Point Gold Resumes Maiden Resource Drill Program at Gold Chain and Appoints Conrad Nest as New Independent Director

One last note…

Aftermath Silver (AAG.V) – (AAGFF.OTC)

- 289.69 million shares outstanding

- $139.05M market cap based on its recent $0.48 close

- Corp Presentation

I haven’t looked at Aftermath Silver close enough yet, but the values highlighted in the company’s February 27 press release, values flowing from a Phase 2 drill campaign at its Berenguela project in southern Peru, struck me as decent – Aftermath Silver Reports 156m From Surface of 290g/t Ag, 1.12% Cu and 7.3% Mn In Eastern Zone Step Out.

I know there is often a concern when manganese forms part of the polymetallic mix, but my understanding is the Mn won’t adversely impact Cu-Ag recovery rates at Berenguela. The market’s reaction on Thursday, Feb 27, was a bit of a head-scratcher (the stock closed in the red). Current prices may represent an opportunity.

END

– Greg Nolan

Full disclosure: Highballer has no business relationship with any of the companies featured above. The author, Greg Nolan, owns stock in Radisson Mining (RDS.V) and ONGold Resources (ONAU.V).

Leave a Reply