A month ago I heard a pitch in a small boardroom in Vancouver. The room was packed to the gills with money guys, brokers, and dealmakers.

And William McClain.

Anyone who can read can go research Volt Lithium (VLT.V), the company that was pitched that day, but the reports you find online won’t tell you about that room, the experienced knowledge of the collected brains at the table, and the quiet confidence of McClain, a guy with an understated, underhyped demeanour who told the story in a manner akin to someone who knows they’re into something good, that time will prove that out, and that if your intent is to use his company for a quick profit rather than a long term push, he’s not your guy.

I spent more than the usual amount of time talking to McClain in Toronto at PDAC last month, and in doing so heard him pitch it to others several times. on stage, in an elevator, while wolfing down sushi at a food court.. His intent was often just to give the twenty second version, but folks would start asking questions, and he’d answer and they’d ask more and, before you knew it, the elevator would be heading down again.

Some IR guys sound like they should be handing you a plastic bag filled with fruit during their pitch – “For you my friend, five bucks!”

Others sound like a 1970’s vacuum cleaner, droning away with only marginal variance in volume and pitch, enjoying pitch #709 with the same non-enthusiasm as the 708 before.

Others still mask their lack of knowledge and/or belief with tech terms and buzzwords and appeals to trust them because “this is a big one, everyone’s calling me, we’re way oversubscribed.”

But when Volt is pitched, it’s with a matter of factness that often ends with the words, “I know, right?”

I’m not on Volt’s payroll, and though I’ve bought some on the open market, I’m not an insider or privy to anything not in public documents.

But I like this.

Volt Lithium Corp is a Calgary-based company engaged in extracting lithium from the wastewater that comes up during oil drilling.

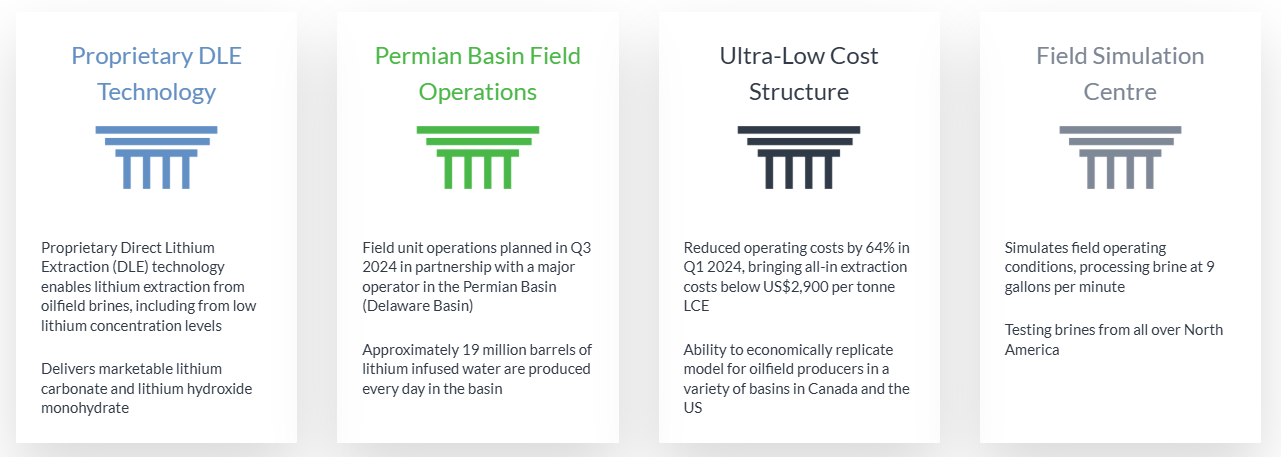

Instead of digging giant holes or building evaporation ponds, Volt uses a proprietary Direct Lithium Extraction (DLE) process to turn salty brine brought up as waste water from oilfields into battery-grade lithium chemicals. They achieved their first lithium production in September 2024 at a site in West Texas, partnering with a major oilfield operator. Their operating costs are impressively low—under US$2,900 per tonne of lithium carbonate equivalent (LCE), which is well below many competitors.

With lithium demand expected to surge over 1,000% between 2020 and 2035, and a projected supply gap of over a million tonnes, Volt is looking to fill part of that need in a cost-effective, environmentally gentler way that doesn’t involve needing to make discoveries or invest massive amounts of capex. Their tech has shown strong results, their business model is built around partnerships with oil producers, and they’re one of the first to commercially extract lithium from oilfield brines in North America.

If they can scale, they could be a high-margin, low-footprint contributor to the EV revolution with no exploration risk.

Company Overview

Volt Lithium is developing a new category of lithium production in extracting lithium from oilfield brines. Volt retrofits existing infrastructure to extract lithium on-site, reducing the need for new construction or mining. Their field operations are primarily in West Texas (Permian Basin), with plans to expand to North Dakota and Canada. In September 2024, they hit a major milestone by producing battery-grade lithium carbonate from brine at their Texas site, albeit on a small scale.

So their next step was to scale up and see if the tech operated in the same way in a 10k barrel-per-day operation.

Well, hello there.

“The first 90 system tests have been critical in understanding the full capabilities of our Generation 5 field unit,” commented Alex Wylie, president and chief executive officer of Volt. “We’re especially pleased that scaling up to a 10,000-barrel-per-day system continues to deliver 99-per-cent extraction results. These insights will guide our next steps toward automating the unit for greater throughput and cost optimization.”

The Opportunity

The world is in a lithium rush, driven by electric vehicles, consumer battery demand, and grid energy storage. Global lithium demand is expected to rise over 1,000% from 2020 to 2035, with supply likely falling short at various points.

Volt is perfectly timed to benefit from this boom, offering a North American-based, low-cost, tariff-agnostic, and scalable source of lithium that turns waste into value.

Oilfields in the U.S. generate tens of millions of barrels of water daily—all of it potential lithium feedstock – and most of it just goes straight back underground at some expense, so what Volt is doing helps everyone – the producers circulate cleaner groundwater, the wastewater partner companies receive a new revenue source, and Volt can sit and watch the lithium tanks fill up every day.

Technology

Volt uses a three-stage process:

- Brine Treatment: Removes up to 99% of contaminants.

- Direct Lithium Extraction (DLE): Their proprietary tech grabs lithium ions from the treated brine with 99% recovery.

- Concentration & Refining: Converts lithium into battery-grade carbonate or hydroxide.

This all happens without needing fresh water or massive evaporation ponds, which makes it environmentally beneficial. The process is continuous, scalable, and can handle brines with low lithium concentrations (as little as 30 mg/L) or high.

Competitive Differentiators

- Low Cost: All-in costs under $2,900/tonne LCE—lower than most hard rock or salar projects.

- Quick Cycle Time: Lithium is extracted in 30 minutes, versus months or years for traditional methods.

- Modular and Scalable: Field units can be quickly deployed at existing oilfields, plugging into wastewater lines.

- No Freshwater Use: Environmentally friendly and ESG-friendly.

- Partner Model: Oil producers provide the brine, land, and infrastructure; Volt brings the tech, everyone wins.

- Full Product Suite: Produces lithium chloride, carbonate, and hydroxide in-house without major infrastructure spend.

Compared to traditional mining or South American evaporation, Volt’s approach is faster, cleaner, and less capital-intensive.

So the tech is solid, the business model is simple, the risk is low.

But can they raise money?

Financial and Operational Milestones

- 2023: Demonstration plant opens in Alberta, showing 64% cost reduction.

- Q3 2024: First small scale lithium production achieved in Texas.

- Q4 2024: Operating capacity reaches 10,000 barrels/day.

- 2025 Goal: Reach commercial sales and positive cash flow.

- 2025 Expansion: Field unit planned for North Dakota with $2M in grant funding just received.

The company has no debt and raised capital via equity and partnerships, including a $1.5M strategic investment from a Permian operator.

So, yeah – responsibly raising cash, bring in dilution-free grants, and with a partnership and technology model that doesn’t rely on massive spending.

Risks and Considerations

- Pre-Revenue: No commercial sales yet; still in field pilot phase.

- Technology Scaling: Proven at pilot scale, and again at mid-scale, but full commercial rollout still pending.

- Capital Needs: Will require more funding for scale-up, but not nearly as much as if they were explorng per the traditional lithium model.

- Partnership Dependence: Relies on oilfield operators for brine access.

- Commodity Prices: Lithium prices can be volatile, but cost to extract is attractive right now.

- Competitive Landscape: Other DLE players are racing to market, but Volt has sa big head start, time-wise and tech-wise.

Conclusion

You can see why I like this, and why McClain doesn’t mind telling the story, and why folks are interested.

The word ‘lithium’ doesn’t help Volt’s share price in the current market because most lithium companies are stuck in that early-to-mid stage exploration grind where they look like everyone else and struggle to raise money because timelines are too long.

But there’s lithium explorers and there’s lithium producers, and Volt is perilously close to the latter.

WATCHLIST

— Chris Parry

FULL DISCLOSURE: No commercial connection, but I’m a buyer.

Leave a Reply