I told you.

I 100% told you, and if you listened, you made an 80% profit in two months.

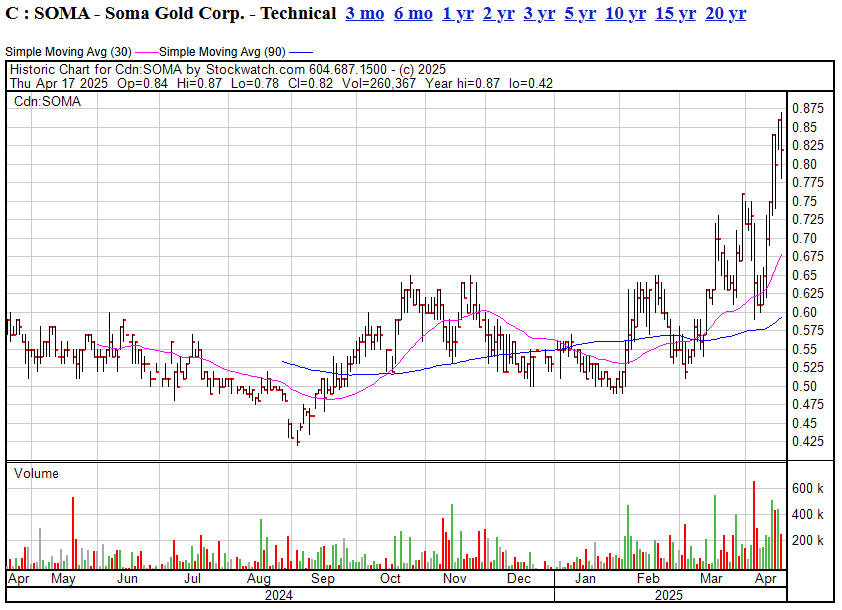

Soma Gold Corp. (SOMA.V) continues to demonstrate its commitment to operational excellence and community engagement in Colombia, as evidenced by its recent Q1 2025 performance and strategic initiatives, which is exactly whst I told you was going to happen back in my February article when the stock was $0.52.

Now?

Why is SOMA popping off?

There are a lot of gold explorers out there, and when gold prices are jumping, as they are now, a lot of those explorers get to ride the wave upwards, but a lot of those explorers may never move forward, let alone get to production, while SOMA is already there.

Operational Performance:

In the first quarter of 2025, Soma Gold produced 6,643 gold-equivalent ounces, aligning closely with its budgeted target of 6,636 ounces. This production was achieved from processing 38,855 metric tonnes of ore, which constituted 52% of the total 75,093 metric tonnes mined. The remaining 48% comprised waste material.

Notably, the average gold price realized during the quarter was $2,848 USD per ounce, a significant increase from $2,033 USD in Q1 2024, positively impacting revenue despite a lower average ore grade due to ongoing development work in the Upper Cordero and Lower Venus zones .

Strategic Developments:

-

El Limon Mill Rehabilitation: The rehabilitation of the El Limon mill is progressing ahead of schedule and under budget, with expectations to resume operations by mid-June 2025. This upgrade is anticipated to enhance processing capacity and efficiency

-

Community Engagement: Soma Gold has been approved for a Colombian tax program that permits the allocation of income taxes directly to capital projects benefiting local communities. This initiative underscores the company’s dedication to social responsibility and sustainable development .

-

Small-Scale Mining Integration: The company is formalizing agreements with small-scale miners operating on its properties. Two such mines are preparing to transport material to the El Limon mill upon its reopening, aiming to boost overall gold output by 10% in 2025

Financial Highlights:

Soma Gold made a $2.5 million payment towards its Conex loan, reflecting prudent financial management and a focus on strengthening its balance sheet.

Market Response:

Investors have responded positively to Soma Gold’s operational and strategic progress, with the company’s stock reaching a new 52-week high of $0.86 CAD on April 16, 2025.

As Soma Gold advances its projects and community initiatives, it continues to solidify its position as a key player in Colombia’s gold mining sector – NOW, not in five years time.

— Chris Parry

FULL DISCLOSURE: Not a client company, but I am buying.

Leave a Reply