In relation to the stockmarket, most people assume ‘promo’ is a dirty practice; a ‘wretched hive of scum and villany,’ as Obi Wan might have put it.

And, yeah, I guess.

It’s also an industry I’m involved in, and have been for a dozen years now, so I have a pretty good view of how the business runs; both on the good side and bad.

REAL TALK

On a long enough timeline, the average ‘Vancouver mining play’ doesn’t work out. That’s just the facts of the business, it being a speculative ‘high risk, high reward’ exercise, but that’s also no different to how things are in the US tech startup sector, or the venture capital game.

Typical Outcomes in a VC Portfolio

(From studies by Horsley Bridge, CB Insights, and industry VC data)

- ~65%–75% of VC investments return less than invested capital (i.e., they lose money. go broke, or break even).

- ~10%–20% generate moderate returns (1–5×).

- ~5%–10% deliver big wins (10× or more), and these drive the entire fund’s success.

Junior miners are no different.

High-Risk Reality: Junior Miners

Estimated Success Rates (based on decades of mining industry data):

- 0.5% to 1%: Become producing mines

- ~5%: Get acquired or generate a material return (>5×)

- ~10–15%: Deliver a moderate return (2–5×)

- ~80–90%: Fail to generate returns, get delisted, or become zombies

Junior miners generally start with a lease on some land that has sat for millions of years waiting for someone to put a hole in it, and then they raise money so a hole can indeed be put.

If that hole misses ore, either by a metre or by a mile, it’s a stinker, the money is gone, and everyone walks away, usually to their next patch of land.

But if it hits, and sometimes it does so almost by accident – we all get to buy condos.

In short, one good mining deal pays for a dozen middling to shitty deals, on the long failure-riddled road to production.

But a ‘good deal’ doesn’t always have to get to production. And your definition of ‘good’ may differ from mine, depending on where we each got into the deal, and out of the deal.

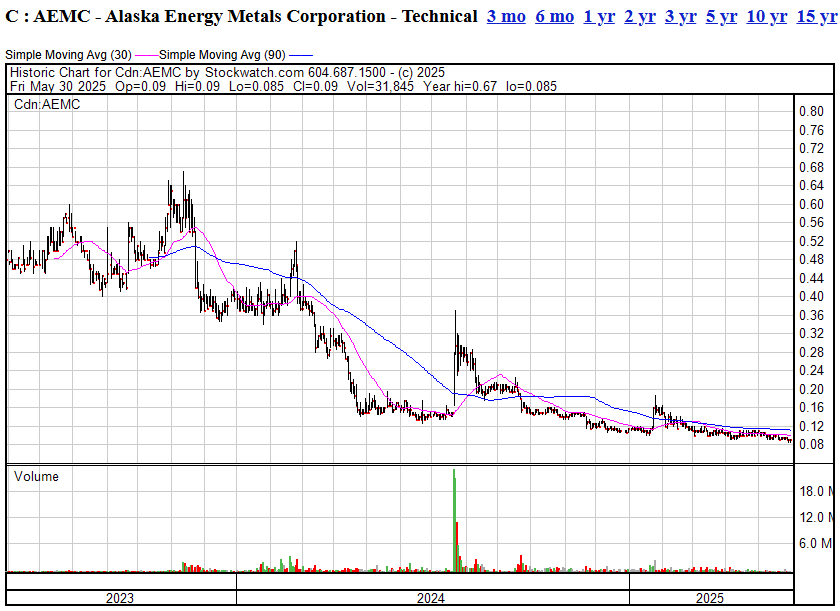

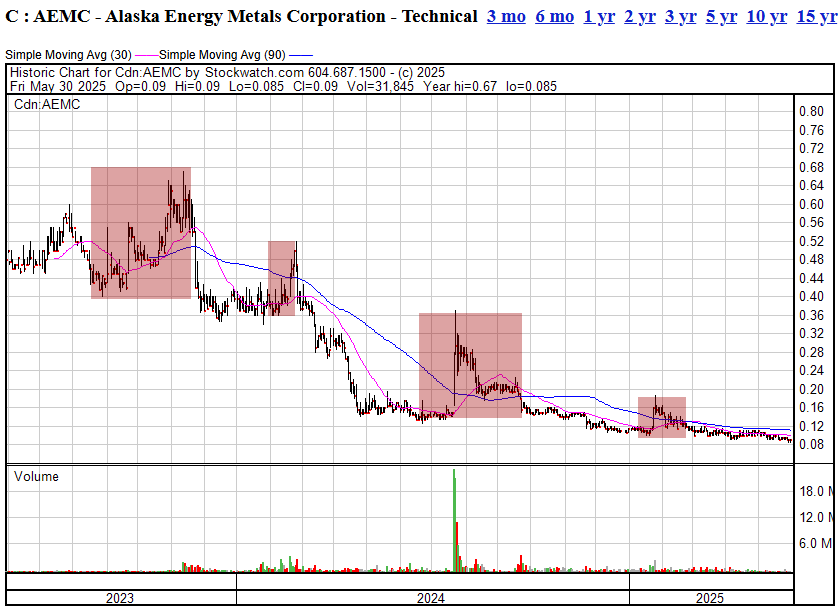

Lemme lay out a share chart for you.

This is Alaska Energy Metals (AEMC.V), a company with a project I quite like, but for a while there the project was almost unimportant.

AEMC was a fully fledged balls to the wall ‘promote.’ A lot of money was spent promoting this thing, several times over a few years.

Obviously, that’s not a great chart if one looks at it on a long timeline. But hidden in that chart is consistent short term wins, if you look at the chart as a series of short trades where one gets in and out at the right time.

To be clear, if you put this stock in your TFSA in mid 2023 and have never touched it since, you’re hurtin’ for certain. Sorry you have to eat cat food now.

But what if you bought in at $0.15 in mid-2024 and saw the stock quickly go to $0.37, hit your trigger, and took that 140% win?

In fact, even if you didn’t sell at $0.37 because, hey, who among us can always pick the top – even if you watched it fall all the way back to $0.20, where it sat for more than a month, you still made 30% profit in a few weeks if you sold.

Let’s look at that chart again, with the wins noted.

If you bought this stock consistently, but ONLY when the promo was running and trading volume was high, and you didn’t waste time taking your profits, you managed to get:

- $0.40 to $0.68 over three months in 2023 (70% increase)

- $0.36 to $0.52 over a month in early 2024 (44.44% increase)

- $0.15 to $0.37 over a few days in mid-2024 (146.67% increase)

- $0.10 to $0.18 over a few days in early 2025 (80% increase)

That’s a fucking incredible score on a stock that most would consider, over the course of a year, to be a massive flop.

In fact, if I was a stock picking god with no sense of ticker loyalty or greed and simply put $10k in at the start of the AEMC promo campaigns and yoinked it back out every time the promotion moved the stock significantly, I could have 10x’ed my stake durng a period where THE STOCK LOST 85% OF ITS VALUE.

Check it.

$0.40 → $0.68

-

Gain: 70%

-

$10,000 × 1.70 = $17,000

$0.36 → $0.52

-

Gain: 44.44%

-

$17,000 × 1.4444 ≈ $24,555

$0.15 → $0.37

-

Gain: 146.67%

-

$24,555 × 2.4667 ≈ $60,540

$0.10 → $0.18

-

Gain: 80%

-

$60,540 × 1.80 ≈ $108,972

Final Value (Compounded):

$10,000 → $108,972

Total return: +989.7%

AEMC IS THE BALLS, YO.

Now, obviously it’s not – they do still have that project I like and, hey, maybe at some point it catches fire on the technical side, but nobody is going to argue, right now, the company is struggling and the promo juice may be harder to squeeze going forward.

The point remains, thst promo spending made this thing MOVE several times, and if you timed your investment at the beginning of that spending and moved out before it ended, you did great.

Which is why there’s no shortage of folks who’ll line up to put money into private placement financings of companies like this that have plans to fire some (or even most) of that financing dough directly out the door, into the pockets of large market awareness firms and investor relations companies that, if we’re honest, generally struggle to prove any sort of verifiable return on the investment.

Stockhouse, CEO.CA, MarketOne, Native Ads, Proactive Investors, INN, Steve Darling in front of a green screen, some guys in Germany you won’t hear from again in about four months, a kid with a Twitch stream who doesn’t know he’s supposed to disclose his conflicts, even this fucking walking SEC violation find themselves on the receiving end of the spend.

PS: This is what happened next to that idiots ‘to the moon’ pick a day later:

Sad trombone.

And that’s the other side of market awareness programs – when the sell-off hits, there’s someone inevitably on the other end who bought the hype and ate shit on the bunny hill while everyone else is on the lift to the next ski run.

That’s why regulators are constantly playing catch-up; they view the promo as the work of bad actors, and sometimes it is (cough)Wall St Reporter(cough), but the other side of that issue is, if a company DOESNT promote itself, if it DOESN’T tell its story to new investors, isn’t that letting existing shareholders down?

Doing promotion is RESPONSIBLE, even if NOT ALL PROMOTION IS RESPONSIBLE.

Telling the story of a company WITHOUT rocketship emojis, or stock charts with upward arrows drawn all over them in MS Paint, and promises of instant riches, and the appropriate disclosures, and putting those marketing agreements out in news releases so investors can see what they cost, what they’ll buy, and when they end… That’s actually helpful. That’s good stuff.

Which is why I have a trading pattern that I use a fair bit. When I see a company put out several news releases that tell us they’re about to do promo, maybe they;ve raised some cpaital and maybe even rolled back the stock, perhaps the insiders have doled out a few stock options, I total up the planned promo spend, and I plot out the dates that spend is going to be allocated, and I have my buy and sell price locked in.

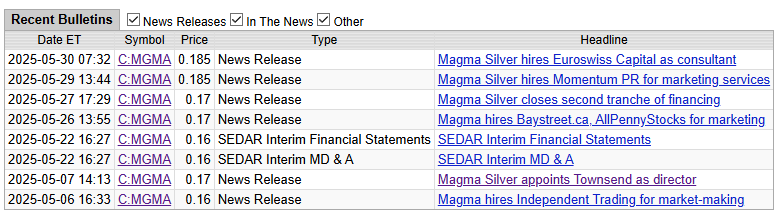

Take Magma Silver (MGMA.V).

I noticed this deal was retooling a few weeks back.

Early. Ignored. Structurally cheap. But sitting on historic data, proven mineralization, and the kind of district-scale asset that used to get bought—not buried.

For mine, hey, don’t buy a share of it just yet. There’s no crazy rush. It’s only just turned the lights back on after a long spell retooling.

But keep your eye on Magma because, when things do move on this low volume whisper play, they may move faster than you think.

WELL, WHAT DO YOU KNOW, THEY DID.

Up to $0.24, a 20% return already on the $0.2o I came in. But what’s more interesting?

The news flow.

Euroswiss Capital, Momentum PR, AllPennyStocks, Baystreet, even a market maker – all in the space of a week.

What else do we see? SECOND TRANCHE OF FINANCING.

What else? A DIRECTOR WITH A HISTORY OF PROMO.

If we dig a little further back, what do we see? A 1:4 STOCK ROLLBACK.

Promo, capital, a tight share structure, and Mike Townsend? That’s the holy quartet of Vancouver junior deals.

In my last story about Magma, I went over the bones of the property and why this project could be interesting on the path to maybe one day producing, and though I’m looking at this right now with a short term mindset, a decent property at the heart of a good old fashioned promote makes the promote that much better.

UNDERSTAND:

- If we’re looking at this ticker as a dividend to be returned for my pension in ten years, the project is everything and the promote and any day-to-day moves are irrelevant.

- But if we’re looking at it for some quick cash while the deal guys are churning through, the project is just editorial content.

Here’s the tale of the tape from a promoter-focused perspective:

- Euroswiss Capital: $60k from June 1 to November 30.

- Momentum PR: $60k (and a bunch of options) from June 1 to November 30.

- BayStreet: $120k from June 1 for three months to August 31.

- AllPennyStocks: $13.5k from June 1 to August 31,

- Independent Trading Group: $5.5k p/mth from May 6.

That’s $259k spent to bring a 20% stock increase SO FAR and the programs haven’t even kicked off yet.

So if you’re in, like, nowish, and you held to the week before the first of those deals ends (mid-August), I feel like we may have a reasonable chance there’ll be some chance to make a profit there.

Will you want to set a stop loss trigger so you can exit quickly in the case of a big up or down move? Maybe.

Will you feel greasy? Maybe, but the idea here is to make money, not prove your morality, and there’s nothing wrong with playing trends you’ve a good idea are coming your way.

BOTTOM LINE:

For the $259k spent, Magma just went up $500k in value on day one, which is an incredible return on its investment with a minium of 89 days remaining on each element of its spend – especially with $1.5m having been raised going in.

— Chris Parry

FULL DISCLOSURE: Not a client. No commercial interest. But, as I’ve said before, I’m watching, I’ve been in Mike Townsend promotes before, and I may go in – as an investor or vendor – at any point.

Leave a Reply