DISCLOSURE: This article includes mention of companies that are clients of Equity.Guru

Hand to god, Equity.Guru isn’t the biggest penny stock information site out there. I wouldn’t even say we’re top 20, in terms of traffic.

But there’s something this group has worked years to cultivate that is far more important than quantity of clicks on a story, and that’s the quality of clicks.

We’ve a golden track record of never selling our audience short, never having to apologize for talking about a deal, and though we can’t always get them right, of being conscious of when it’s time to get out of a deal, even if that company is a sponsor of the site.

We’ve never sold you, the reader, out. We don’t short companies, we don’t say nice things just because the cheque cleared, and if we get one wrong it’s us that’ll be the first ones to say so.

That said, we’ve had the hot hand this month, with almost everything we’ve written about having delivered strong investor returns in the time since.

Frankly, it’s unprecedented.

Some of these we just got the timing right, others reflect added interest after we spotlighted a deal, some are ** client companies, others are just things we saw and liked.

But all of them are wins, so it’s time for us to take a rare victory lap where we’re going to toot our own horn for a change.

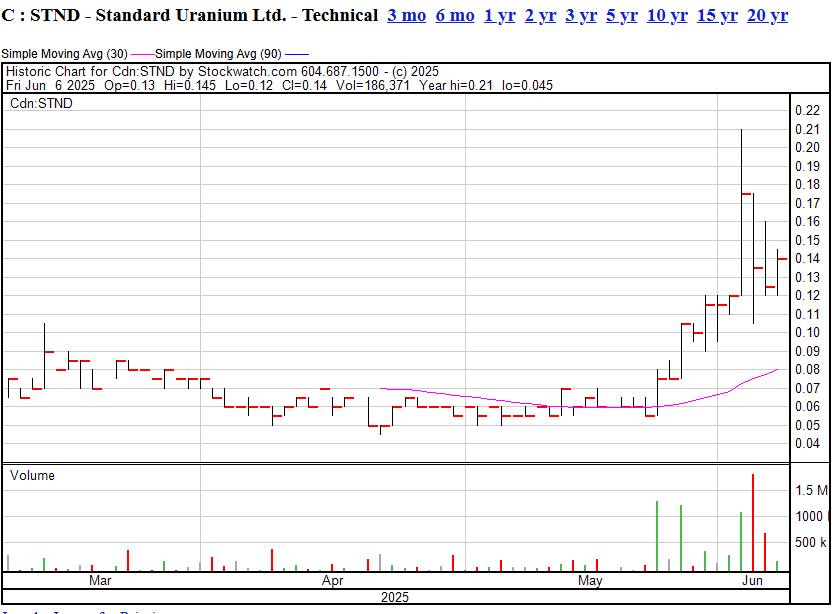

1. Standard Uranium (TSXV: STND) **

1. Standard Uranium (TSXV: STND) **

Flagship Project: Davidson River – Athabasca Basin, Saskatchewan

-

Geology: Basement-hosted uranium targets analogous to NexGen’s Arrow and Fission’s Triple R deposits. Situated along the Warrior, Bronco, and Thunderbird conductors—prospective zones rich in graphitic metasediments and faulting. Top notch crew that had wins with Arrow previously, have added partnered-up side projects to balance the books, and are now getting in front of boardrooms filled with mining royalty.

-

Techniques: Utilizing advanced multiphysics (ambient noise tomography, gravity) to refine subsurface mapping.

-

Stage: Pre-resource, high-potential early exploration. Upcoming targets well-defined, now they’re getting to specifics.

Price Action: Stock was long flat but surged over 200% in the last month, driven by renewed uranium sentiment and promising geophysical work and – we’ll say it – our coverage, which has since led the company to come on as a client.

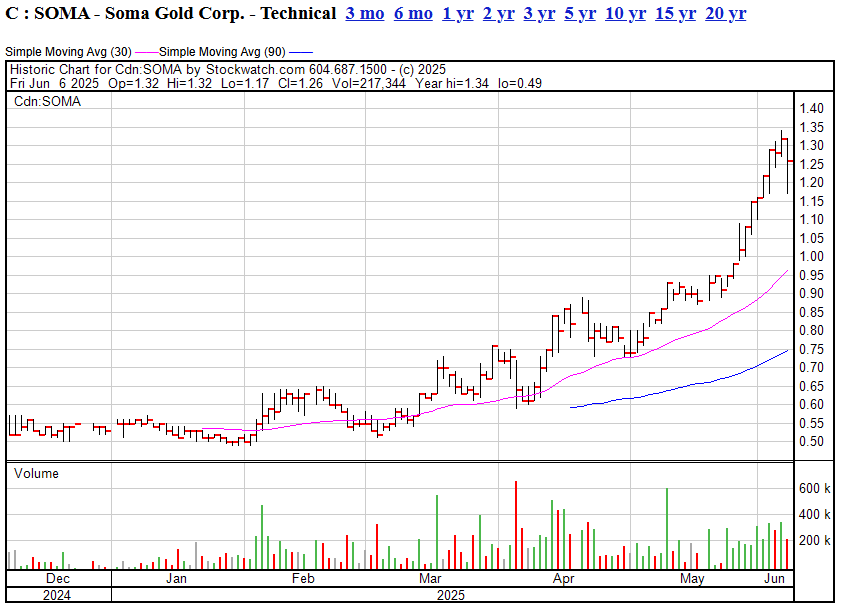

2. Soma Gold (TSXV: SOMA)

Flagship Project: El Bagre Gold Mining Complex – Antioquia, Colombia

-

Geology: Epithermal gold deposits along the Otú fault system. Cordero and Nechí veins average grades over 7 g/t gold.

-

Infrastructure: Operating two mills with combined capacity of 675 tpd, expandable to 1,400 tpd. Underground development in progress.

-

Production: Active producer; over 7,000 oz AuEq per quarter with low AISC and plans to double reserves through exploration.

Price Action: We told you back in February this was a monster in the making, and it’s now a double from there. Real world producer is up ~60% just in the last month, driven by increased production and strong drill results confirming high-grade zones. Not a client, but we told you anyway.

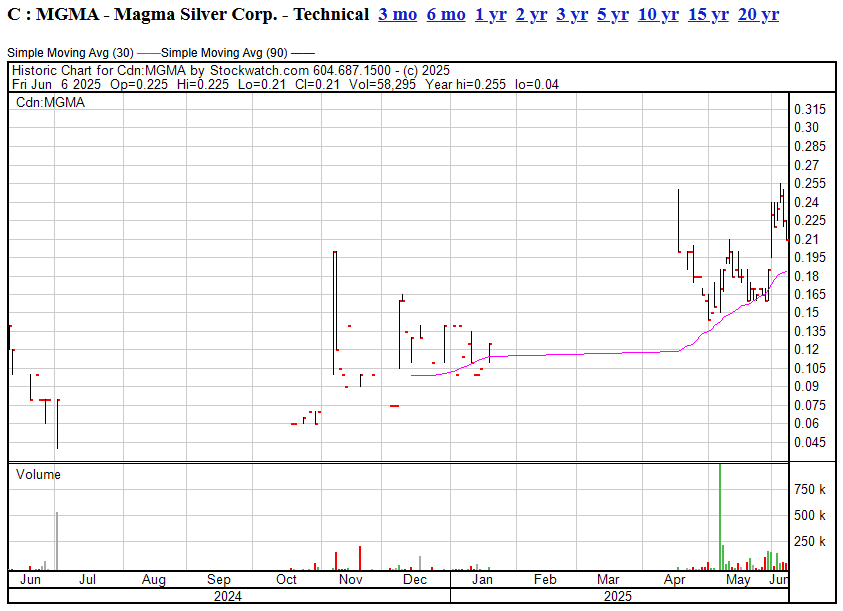

3. Magma Silver (TSXV: MGMA)

Flagship Project: Niñobamba – Ayacucho, Peru

-

Geology: Silver-gold project with both high- and low-sulfidation epithermal systems. Historic trenching includes 56m @ 1.03 g/t Au + 99 g/t Ag.

-

Targets: Multiple breccia-hosted and veined zones across an 8-km corridor. Strong potential for bulk-tonnage silver-gold discovery.

-

Work: Re-evaluation of historic data and new fieldwork underway, focused on drill target generation.

Price Action: Came back to life sfter being dormant a while, we spotted it being retooled and mentioned it, then it gained ~55–60% over the month, sparked by company relaunch, new technical team, and revitalized marketing efforts.

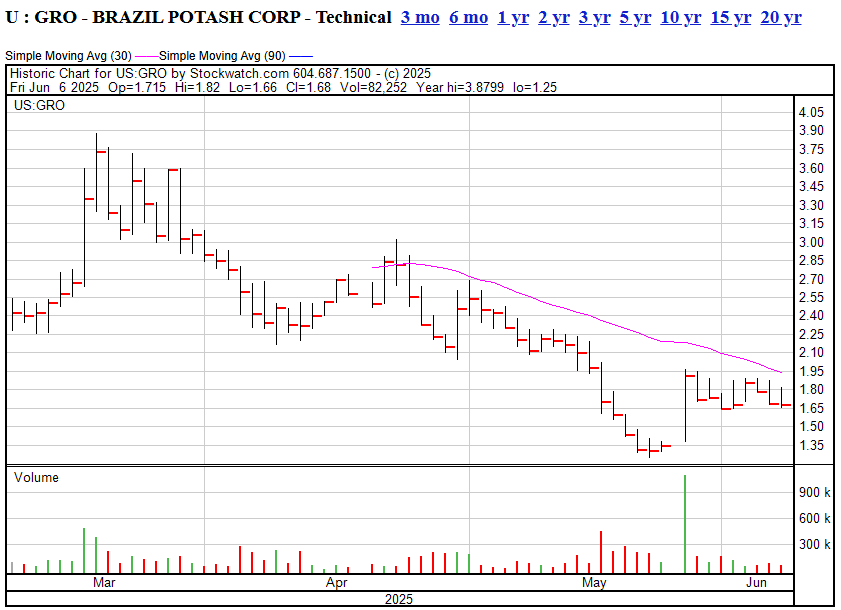

4. Brazil Potash Corp. (OTC: GRO) **

4. Brazil Potash Corp. (OTC: GRO) **

Flagship Project: Autazes Potash Project – Amazonas, Brazil

-

Geology: Sedimentary basin potash deposit, ~1 billion tonnes inferred, targeting sylvinite mineralization at ~800–1,000m depth.

-

Engineering: Shaft access design with two vertical shafts, processing facility, and riverside port planned for barge transport.

-

Development: Fully scoped DFS-level project; permitting is the major constraint, with Indigenous consultation ongoing.

Price Action: Client company: This one had rough times for a few months but shares have climbed moderately (~10–15%) on recent momentum from infrastructure prep and investor optimism over project resolution (and maybe because we wrote it up right before the turnaround?). We think there’s a lot of room to run on this one due to regional opportunities and the big boys who’ve backed it, but potash as a sector is under-loved so, head on a swivel.

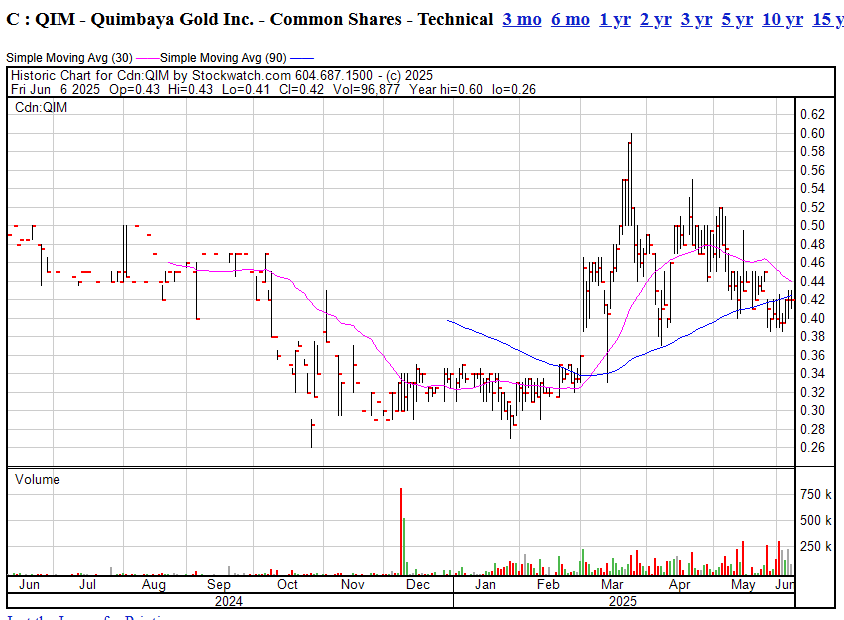

5. Quimbaya Gold (CSE: QIM)

Flagship Project: Tahami South – Segovia-Zaragoza Belt, Colombia

-

Geology: High-grade epithermal gold-silver veins in a prolific historic district. Surface sampling includes values up to 11.2 g/t Au.

-

Exploration: Early-stage mapping and geochemistry confirmed multiple parallel vein sets. LiDAR and drone surveys refining drill targets.

-

Potential: Excellent location surrounded by producing mines; viewed as a first-mover in an underexplored segment of a proven camp.

Price Action: We literally wrote about this at the six month low, and nobody else was covering this one when it rose by more than a double subsequently. After some profit taking, it’s still up over ~50% in past four months, mainly on strong sample assays and positive early-stage technical outlook.

So if you see us in the street and you rode any of these to fortune, buy us a beer and set us up with a friend. Thanks man.

— Chris Parry

FULL DISCLOSURE: STND and GRO are client companies, the others have no commercial connection.

1. Standard Uranium (TSXV: STND) **

1. Standard Uranium (TSXV: STND) **

Leave a Reply