Disclaimer: This article has been paid for by Prismo Metals. See disclosures at the bottom of the page.

Disclaimer: This article has been paid for by Prismo Metals. See disclosures at the bottom of the page.

There’s silver in the ground many places you look—lots of it. Always has been. The trouble isn’t finding it, it’s getting people to believe in it. That’s what makes Prismo Metals’ latest move so compelling. They’re not just talking about the future of silver—they’re standing on it. Literally.

In the hills near Superior, Arizona, tucked just a few kilometers from one of the world’s largest undeveloped copper deposits, lies the old Silver King mine. First tapped in 1875, this high-grade freak of nature produced millions of ounces of silver back when mining was more pickaxe than precision. Back when men with mules and whiskey guts pulled 10,000 ounces per ton out of the shallow ground. And then, as fast as it boomed, it was gone.

But here’s the thing: the King never died. It just got forgotten.

Now it’s getting a second act.

Prismo Makes Its Move

Prismo Metals has announced it’s securing the ‘hole in the donut’ of Arizona’s largest unmined copper project, with not one, but two historic mine projects: Silver King and Ripsey.

Both are in Arizona’s famed copper belt, surrounded by the monstrous Resolution Copper deposit (Rio Tinto + BHP), and both are past producers with high-grade roots and almost no modern exploration, providing tremendous exploration upside.

They’re raising a quick $250K through a tight $0.05 placement that will go into the ground, not boardroom furniture.

This isn’t just a land grab—it’s a tightly stitched, boots-on-the-ground plan to put silver back on the menu.

Geology Doesn’t Lie

Silver King isn’t a mystery. It’s a vertical pipe—steep, dense, and potentially loaded. Historically mined on 8 levels down to 300 meters, it’s a textbook example of the old-timer strategy: take the visible ore, ignore the fringes, move on.

What’s left?

-

Upper zones that were skipped due to complex mineralogy and just happen to be rife with anitmony, which used to be ignoreable but now brings a premium.

-

Lateral extensions have been barely touched.

-

Deeper feeder systems were never drilled.

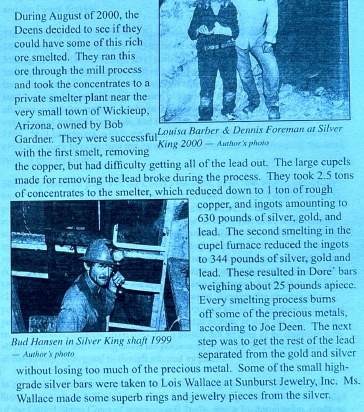

Documents [seen right] reveal that in the late 1980s and early 1990s, the Deen family rehabilitated the original vertical shaft of the Silver King mine using submersible pumps and began small-scale production—without drilling. They focused on remnant ore from historic workings and still encountered extremely high grades, including:

Documents [seen right] reveal that in the late 1980s and early 1990s, the Deen family rehabilitated the original vertical shaft of the Silver King mine using submersible pumps and began small-scale production—without drilling. They focused on remnant ore from historic workings and still encountered extremely high grades, including:

“…occasional pockets of ore grading in the hundreds of ounces per ton silver.”

That’s without modern exploration tools. Just by poking around old stopes.

But here’s the kicker: they never explored deeper than the historic levels (~300 meters), and the vertical mineralized pipe remains open at depth. That’s potentially a rich, untapped feeder zone lying dormant beneath a known high-grade structure.

Some of those assays? 400–600 oz/t silver. With 0.2–0.5 oz/t gold, plus copper in the mix.

There’s a reason Prismo’s starting with a 1,000-meter drill program. They know exactly where they want to go: four elevation levels along the pipe, lateral offsets, and—if they get the pumps going—deeper down the throat of the system.

And Ripsey? It’s less famous but equally promising. Historic production came from veins traced over 400 meters of strike and 160 meters of vertical extent. Dr. Craig Gibson’s own samples returned 15.9 g/t gold and 275 g/t silver over 0.75m in one spot, 8.7 g/t gold + 3% copper and 9% zinc over a meter in another. Again—zero modern drilling.

If you’re betting on silver, this is the kind of rock you want in your back pocket.

Macro Winds at Their Back

Here’s the bigger picture.

Silver is in a strange place right now. Prices have pushed over US$30/oz in 2025, driven by a perfect storm of supply constraints, green tech demand, and inflation hedging. But investor sentiment? Still lagging. Gold gets the headlines, lithium gets the hype, copper gets the policy support.

Silver? Still waiting for its breakout moment.

But the undercurrents are strong:

-

Industrial demand: Solar panel manufacturers can’t get enough silver. Every EV battery, every 5G antenna, every AI server farm—more silver.

-

Monetary hedge: As central banks inch toward digital currencies and fiscal credibility erodes, silver becomes the poor man’s gold. Tangible. Transferable. Trusted.

-

Production gaps: Major silver mines are aging. Grades are dropping. New discoveries are rare. High-grade, low-cost projects—especially in stable jurisdictions—are golden.

This is the setup.

What Prismo Is Really Doing

Prismo isn’t trying to be First Majestic. They’re not building a billion-dollar silver empire. They’re surgical. They’re opportunistic. They’re reviving past producers that were left behind because they were too small for the majors and too complicated for the retail herd.

But times change.

Silver King, in the shadow of Resolution, is now more valuable because of what’s around it. Infrastructure is in place. Geopolitical risk is near-zero. And the whole belt is drawing renewed attention. You could drive there from the nearest town in an Uber. Though it’s surrounded by Resolution, there are no access issues.

And if Prismo drills into continuity? If they hit modern-scale intercepts with historic-grade roots? The rerate could come fast.

Add in their Hot Breccia copper play nearby—and suddenly you’re not just holding a silver junior. You’re holding an Arizona copper-silver explorer with leverage to two of the hottest critical metals on the planet.

The acquisition terms are structured with three targets in mind: optionality, scalability, and speed.

-

Silver King Option Deal:

-

Stage 1: Prismo gets 50% by spending US$3 million over 3 years and issuing 3 million shares.

-

Stage 2: An additional 30% comes with another US$3 million spend and a US$1 million cash payment + 2 million more shares by year 5.

-

Final 20%: Held by the Optionor, but subject to standard dilution and buyout clauses.

-

-

Ripsey Mine Option Deal:

-

Simpler. One million shares now, US$10K within 6 months, and US$1 million within 5 years. No minimum spend commitments.

-

Last Word

Silver isn’t sexy—until it is. Then it’s a frenzy.

The market always looks for leadership when silver runs. And leadership comes from ounces, from news, from drill core that glints in sunlight and turns retail heads.

Prismo isn’t a household name. Yet. But they’ve just dropped a shovel into potentially one of the most compelling silver comeback stories of the decade. Old ground. New eyes. Low price. Tight plan.

Sometimes the smartest move in the market is the one hiding in plain sight.

For more, listen to the boots on the ground folks telling you straight.

— Chris Parry

FULL DISCLOSURE: Prismo Metals is an Equity.Guru marketing client and you should consider this information to be potentially conflicted by that relationship. Do your own due diligence before making any investment decision. We may purchase PRIZ stock at any time.

Leave a Reply