A year ago, we set to work on an artifical intelligence-based platform that could take public company documents and filter them to quickly determine detailed information about companies – specifically mining explorers – and the people, money, and projects behind them.

We used this platform in the months since for our own research as we’ve finetuned it and added to it, and it’s turned out to be great at picking out interesting deals we might otherwise have missed.

Today, it drew 15 companies out of the database that it identified as ‘increasingly interesting’ based on news, stock movement, trading volume, and project fundamentals.

And so we share it with you, to help fill out your watchlist and maybe spot some new winners for your portfolio.

Where there’s a commercial connection between us and a company listed, you’ll see it disclosed.

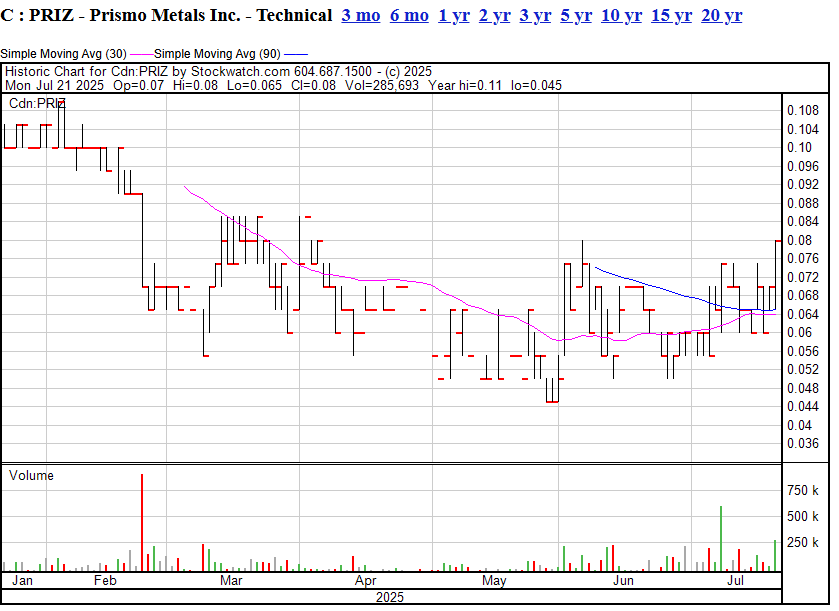

Prismo Metals Inc. (CSE: PRIZ) – $4.5M Market Cap

Prismo Metals Inc. (CSE: PRIZ) – $4.5M Market Cap

Status: Revving engines

Website: prismometals.com

What They Have: Prismo is a junior explorer with precious metals projects in Mexico. Its flagship assets are the Palos Verdes silver-gold vein in Sinaloa (next to Vizsla Silver’s high-grade discovery) and the Los Pavitos gold project in Sonora. Prismo also recently acquired the historic Silver King and Ripsey silver-copper properties in Arizona, expanding into base metals.

Why the Stock Moved: Over the past six months, Prismo’s share price saw extreme volatility. Early in 2025 the stock spiked on excitement around high-grade silver drill results and speculation about its Arizona acquisitions. However, a subsequent financing and broader market cooling pulled shares down to new lows by late spring. Recently, improved silver prices and news of an experienced new President renewed investor interest. The stock has stabilized off its lows and volume has picked up as Prismo gears up for more drilling at Los Pavitos and Silver King. Investors are closely watching if Prismo can replicate larger neighbors’ success.

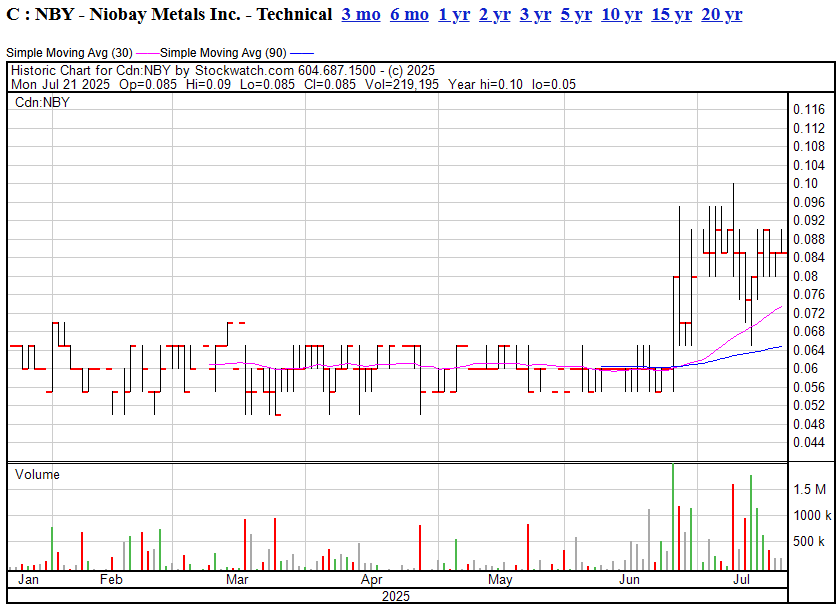

Niobay Metals Inc. (TSX-V: NBY) – $9.1M Market Cap

Status: New price levels

Website: niobaymetals.com

What They Have: Niobay is focused on critical minerals, primarily niobium. It owns the James Bay Niobium deposit in Ontario (one of the world’s most significant undeveloped niobium resources) and the Crevier niobium-tantalum project in Quebec. Niobay also holds exploration-stage assets including a large claim package for lithium near Crevier.

Why the Stock Moved: Niobay’s stock has doubled in the last few months due to major technical milestones and shifting sentiment on critical metals. In June 2025, the company announced its first-ever delivery of niobium and tantalum oxide from a pilot plant at Crevier to potential customers – a significant step towards commercialization. This progress, enabled by government grants, demonstrated the viability of its process and excited investors. Additionally, Niobay began a new drill campaign at Crevier and reported that key First Nations agreements are in place, reducing prior project uncertainty. With niobium seen as strategic for green technologies (and peers like NioCorp gaining attention), Niobay’s turnaround from a C$0.05 stock to around C$0.09 reflects renewed confidence in its ability to advance a unique critical mineral project in Canada.

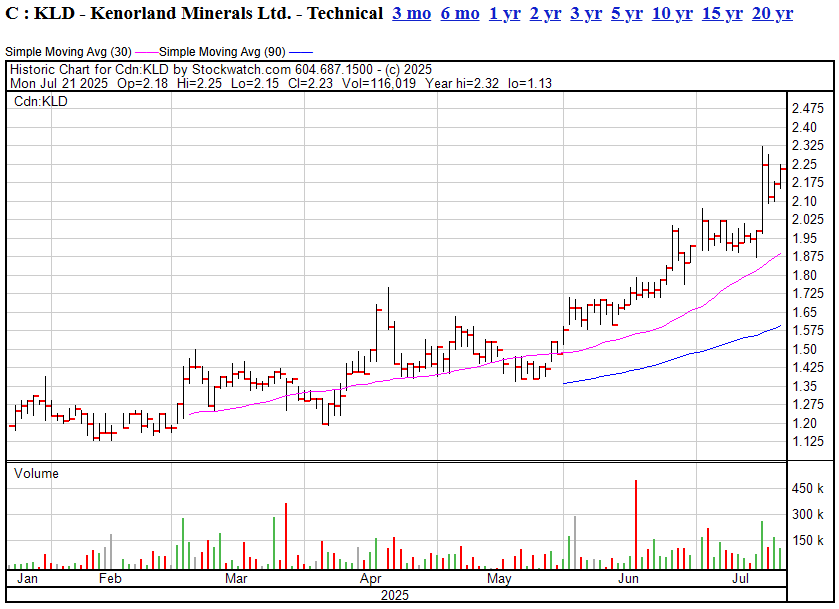

Kenorland Minerals Ltd. (TSX-V: KLD) – $172.3M Market Cap

Status: Climbing Everest

Website: kenorlandminerals.com

What They Have: Kenorland is a prolific project generator exploring for gold and base metals across North America. It has multiple joint-venture partnerships (with Sumitomo, Newmont, Centerra, etc.) funding exploration on its properties. Key projects include the Regnault gold discovery in Quebec (Frotet project), where Kenorland holds a royalty, and early-stage gold projects in Ontario (South Uchi) and Manitoba. It also has exploration-stage base metal projects, often optioned to bigger miners.

Why the Stock Moved: Kenorland’s share price has climbed steadily to near all-time highs on the back of successive exploration successes. In the past half-year, the company announced spectacular high-grade gold drill results at Regnault (e.g. 6.7m grading 30 g/t Au at depth), confirming that discovery’s scale. At the same time, a maiden drill program in Ontario led to a brand-new gold discovery over a 5 km trend at South Uchi. These finds validate Kenorland’s project-generator model. Additionally, Kenorland secured new joint ventures – notably a deal with Centerra Gold on three Ontario projects – bringing in partner funding. With a strong $24M working capital and multiple shots at big discoveries, investor sentiment turned very bullish. The stock’s strong uptrend reflects growing expectations that Kenorland’s pipeline could yield the next major gold deposit, while its partnerships de-risk the exploration spend.

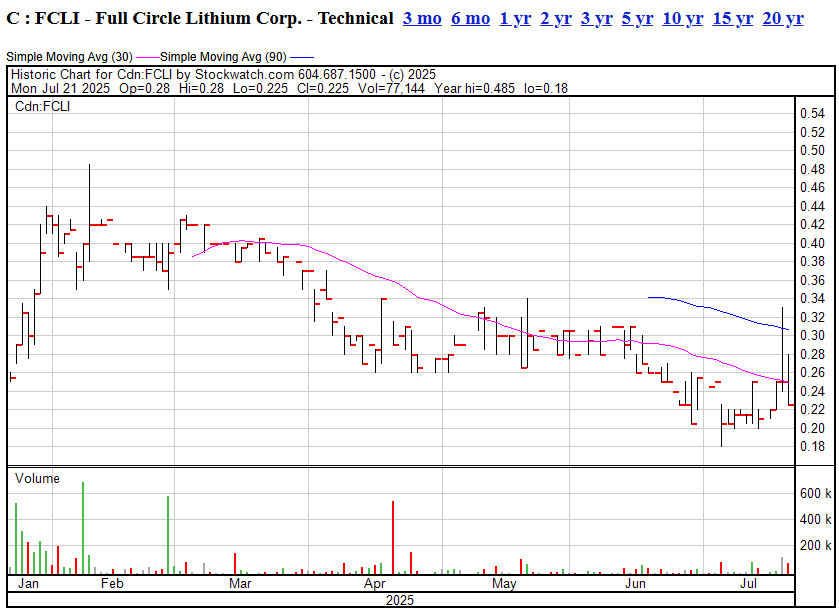

Full Circle Lithium Corp. (TSX-V: FCLI) – $19.0M Market Cap

Status: Good entry level

Website: fullcirclelithium.com

What They Have: Full Circle is an emerging player in the battery recycling and safety niche. The company is building a lithium-ion battery recycling business and has a processing facility in Georgia, USA. Uniquely, Full Circle has developed a proprietary lithium battery fire extinguishing agent called FCL-X – a chemical solution to rapidly put out EV battery fires. It also markets this product (now available to fire departments and even on Amazon).

Why the Stock Moved: FCLI’s stock saw a surge and pullback this year in response to milestones in its battery safety division. In Q1 2025, the company began generating revenue from FCL-X sales (~$384k in its first quarter of sales) and signed distribution partnerships, including an MOU with Itochu of Japan for Asia distribution. Full Circle also garnered industry validation – in July 2025 its FCL-X agent achieved UL Class A fire safety certification, unlocking broader U.S. market access. These developments drove the share from around $0.18 to nearly $0.45 at its peak. However, the stock has since cooled to about $0.25 as the initial euphoria gave way to a focus on execution. Investors are now watching how quickly Full Circle can scale up sales of FCL-X and advance its recycling operations, which will determine if the recent momentum can be regained.

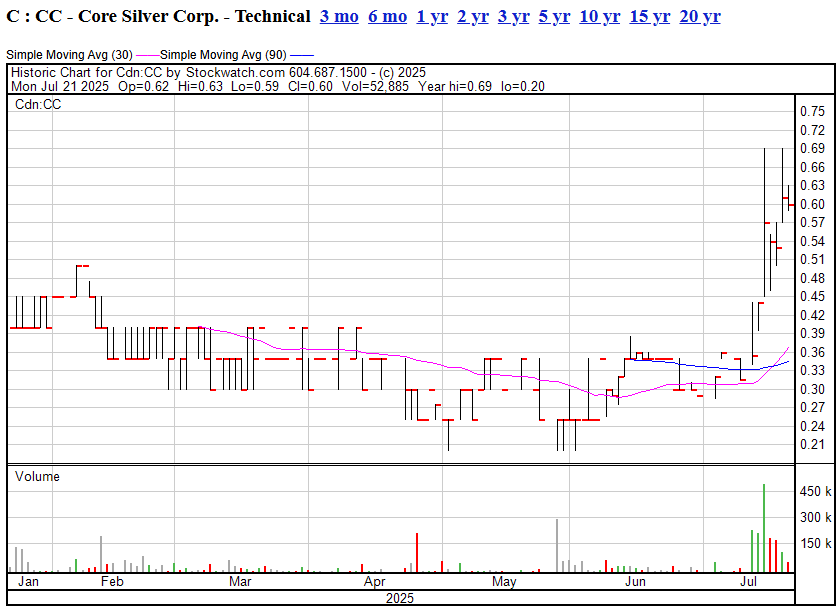

Core Assets Corp. (CSE: CC) – $7.6M Market Cap

Status: Pop!

Website: coreassetscorp.com

What They Have: Core Assets (recently renamed “Core Silver Corp.”) is a mineral explorer advancing the Blue Property in northwestern British Columbia. This property hosts two main targets: the Silver Lime project, where drilling has hit high-grade carbonate-replacement (CRD) style zinc-silver mineralization (e.g. 11.8m of 10.6% Zn, 16 g/t Ag), and the Laverdiere skarn/porphyry copper prospect. Core has outlined a large mineralized system and believes a porphyry copper “hub” may lie at depth feeding these zones.

Why the Stock Moved: Core’s stock quintupled earlier this year after it announced evidence of a significant porphyry copper center at Laverdiere and continued to report long high-grade intercepts at Silver Lime. Enthusiasm peaked around February 2025 when the company revealed a 3D model suggesting a “donut-shaped” geophysical anomaly with 3.24% copper at surface – interpreted as a porphyry target. Shares hit $1+ (pre-consolidation) on speculation that Core could hold a major discovery. In June, the company executed a 10-for-1 share consolidation and rebranded to emphasize silver, while raising $1.8M to fund more drilling. Post-consolidation, the price settled around $0.60. The stock’s wild ride reflects early excitement tempered by dilution and the long road to proving a deposit. Going forward, results from new drilling on the Blue Property will determine if Core Assets can recapture its highs, but a recent jump piques interest.

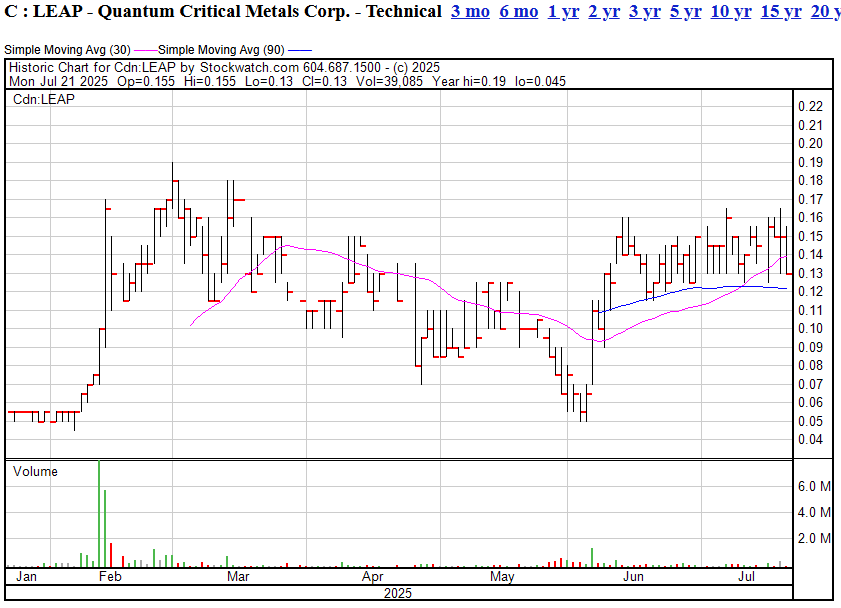

Quantum Critical Minerals (formerly Durango Resources) (TSX-V: LEAP) – $16.0M Market Cap

Status: Smart shift brings eyeballs

Website: quantumcriticalminerals

What They Have: After several years dragging its ass, Durango has transformed into a multi-commodity explorer now focusing on critical minerals. The company acquired a package of five properties in early 2025 targeting lithium, rare earths, antimony, and copper-gold. Its flagship is the NMX East lithium project in Québec, adjacent to Nemaska Lithium’s deposit, where Durango drilled and intersected pegmatites containing elevated lithium, rubidium, and cesium. The now re-branded Quantum Critical Minerals also has copper-gold projects in B.C.’s Babine region (Babine North/South) and antimony and rare earth prospects acquired in Ontario and Québec.

Why the Stock Moved: LEAP’s share price rocketed from mere pennies to over $0.15 within months as it rebranded and pivoted into the critical minerals boom. Announcements in Q1 2025 of lithium-bearing pegmatite drill hits at NMX East, high-grade gold-silver sample results at its Babine project (e.g. 110 oz/ton silver), and strategic acquisitions of antimony and rare earth properties energized investors. The company’s name change in March 2025 to Quantum Critical Metals reinforced its focus, and sentiment lifted further when the Canadian government emphasized critical metal development. Having peaked around $0.19, the stock now trades in the mid-teens cents, reflecting both profit-taking and anticipation of follow-up drilling results. Durango’s aggressive expansion and critical metals narrative have clearly struck a chord with the market.

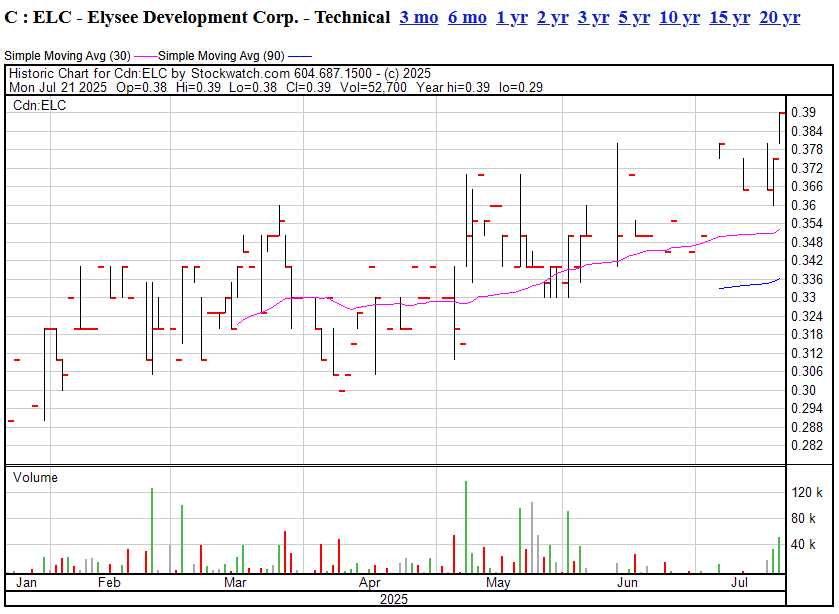

Elysee Development Corp. (TSX-V: ELC) – $11.0M Market Cap

Status: Smarter than most

Website: elyseedevelopment.com

What They Have: Elysee is a resource-focused investment holding company with a portfolio of public and private mining company investments rather than exploration properties of its own. Elysee’s strategy is to deploy capital into promising junior miners and metals ventures and actively trade positions. Its top holdings recently include a private vanadium producer (US Vanadium LLC) and stakes in gold and copper producers like Calibre Mining, Arizona Sonoran Copper, Dundee Precious Metals, and others. The company often pays dividends or buys back shares when profitable.

Why the Stock Moved: Elysee’s stock has steadily climbed to multi-year highs, largely thanks to its strong financial performance in early 2025. In Q1 2025, Elysee reported net income of $1.92 million ($0.07 per share) – an eightfold increase over the prior year quarter. This surge came as the firm realized big gains from some investments, benefiting from a rally in gold stocks and a takeover bid in one of its holdings (Calibre Mining). The company’s Net Asset Value (NAV) rose to $0.49/share, well above the stock price at the time, suggesting the stock was undervalued. Elysee also announced a share buyback program in May 2025 to repurchase up to ~5% of its shares, signaling confidence. These factors – strong earnings, rising NAV, and share buybacks – have driven ELC shares from the high $0.20s into the high $0.30s. Investors are appreciating Elysee’s track record of savvy investments and returns to shareholders, making it a rare micro-cap that’s fundamentally profitable.

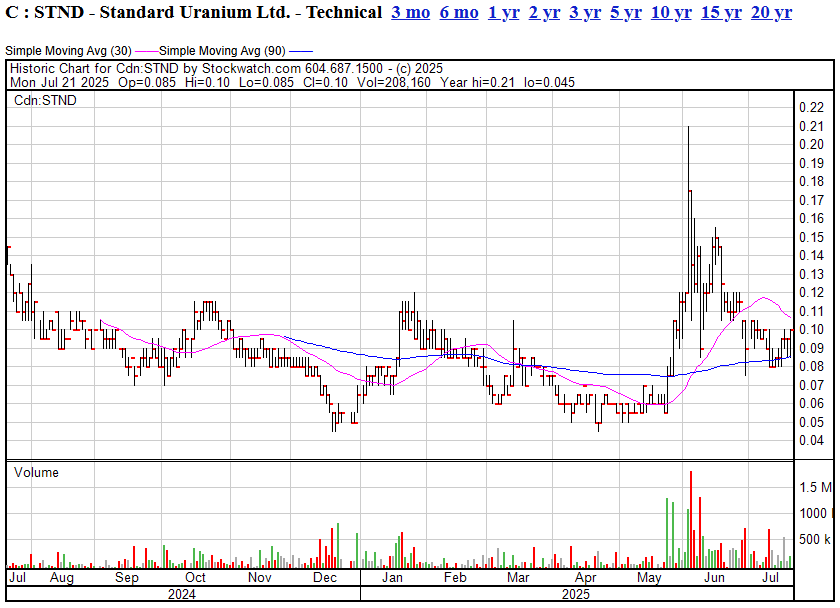

Standard Uranium Ltd. (TSX-V: STND) – $6.8M Market Cap

Standard Uranium Ltd. (TSX-V: STND) – $6.8M Market Cap

Status: Pullback opportunity

Website: standarduranium.ca

What They Have: Standard Uranium is exploring for high-grade uranium in Canada’s Athabasca Basin. Its flagship Davidson River project, in the southwest Athabasca, sits adjacent to NexGen’s Arrow deposit and Fission’s Triple R deposit. Standard also owns early-stage uranium properties in Saskatchewan (Sun Dog project in the north Athabasca) and in Manitoba. It has optioned out some projects – for example, its Sun Dog and others are under joint venture/earn-in agreements, bringing in partner funding.

Why the Stock Moved: Standard Uranium’s share price quadrupled from late 2024 into early 2025 as the uranium market strengthened and the company secured important partnerships. By spring 2025, uranium spot prices were robust, and Standard announced that three of its projects had earned joint-venture partners committing over $23M in exploration spending – a strong validation. The stock hit a high of around $0.21 when excitement about drilling at Davidson River (adjacent to major discoveries) peaked. In mid-2025 the company undertook a $1.6M financing. The share price has since pulled back to about $0.10. The volatility reflects alternating optimism and patience: investors bid up Standard on uranium sector tailwinds and its strategic JVs, but the stock gave back gains as the wait for an actual high-grade discovery continues. It remains highly reactive to drill news and uranium price sentiment.

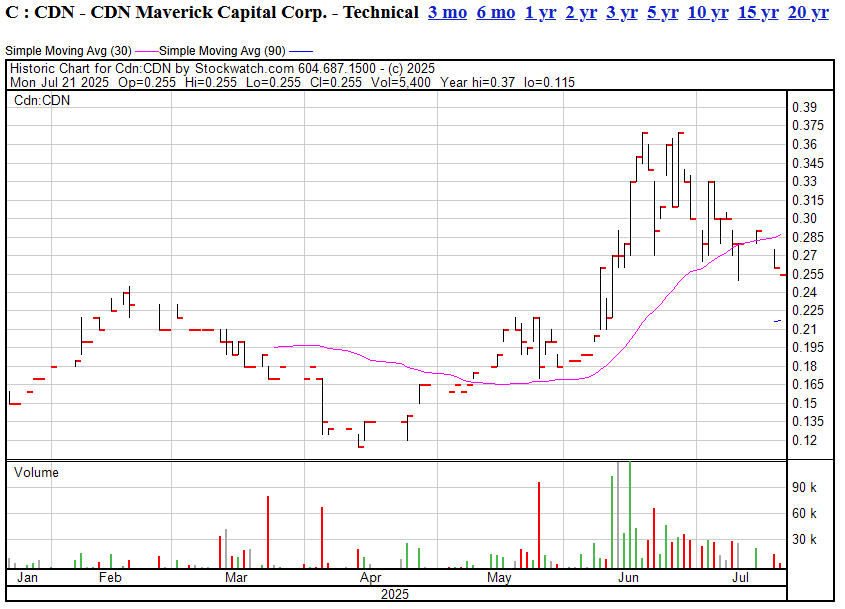

CDN Maverick Capital Corp. (CSE: CDN) – $4.5M Market Cap

Status:

Website: cdnmaverickcapital.com

What They Have: CDN Maverick is an exploration venture company with a focus on lithium projects. Notably, Maverick owns a 100% interest in the 7,000 ha Northwind Lake lithium property in Ontario’s “Electric Avenue” pegmatite district – located just 10 km from Frontier Lithium’s PAK deposit. It also acquired a large 40,000 ha lithium prospect in Québec and optioned the Nevasca lithium brine project in Argentina. In addition, Maverick has legacy assets like the Rainbow Canyon gold property in Nevada and owns about 1.6 million shares of Noram Lithium (TSXV:NRM)

Why the Stock Moved: CDN Maverick’s stock rode the lithium wave to a 52-week high this year. Starting around $0.10, the shares spiked to ~$0.37 by May 2025 as the company announced its strategic acquisitions in Ontario and Québec, expanding its lithium footprint just as regional investment was heating up. The Northwind Lake deal placed Maverick next to a high-grade lithium resource (Frontier’s PAK), which sparked speculation that Maverick’s ground could host similar pegmatites. Furthermore, Noram Lithium – one of Maverick’s key investments – revealed a massive resource upgrade at its Zeus project, boosting the value of Maverick’s stake. However, as lithium market sentiment cooled into summer and Maverick issued new shares to fund exploration, the stock settled back to the mid-$0.20s. Overall, in the last 4–6 months investors reacted strongly to Maverick’s bold moves in the lithium space, propelling the stock higher on future potential despite the early-stage nature of its projects. Overall, nobody is disappointed right now.

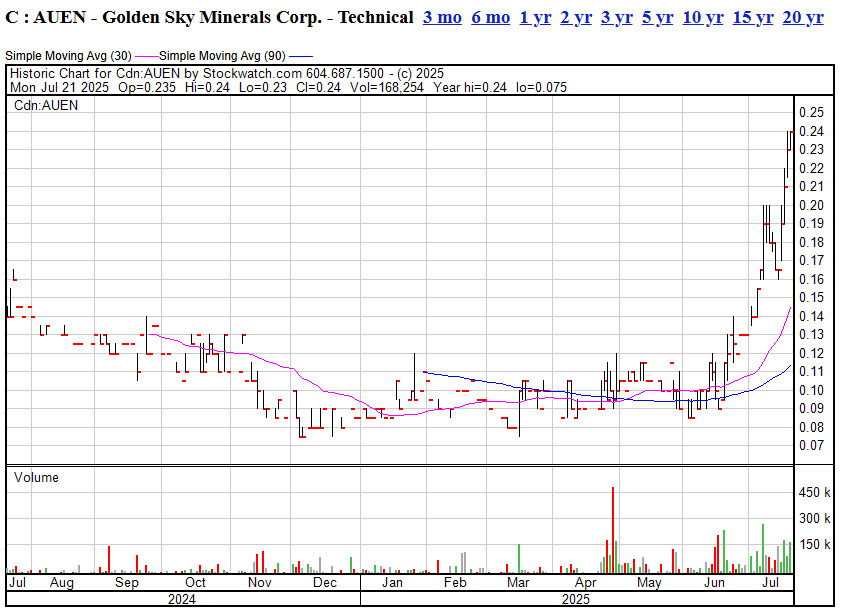

Golden Sky Minerals Corp. (TSX-V: AUEN) – $4.7M Market Cap

Status: The McEwen pop

Website: goldenskyminerals.com

What They Have: Golden Sky is a Canadian exploration company with gold and copper-gold projects. Its core focus is the Rayfield property in British Columbia’s Quesnel Trough – a porphyry copper-gold target where surface sampling and geophysics suggest a sizeable system. Golden Sky also has two Yukon gold projects, Hotspot and Lucky Strike, which have delivered promising gold intercepts (e.g. 5.36 g/t Au over 22m at Lucky Strike). Additionally, the company staked the Auden property in Ontario for lithium potential.

Why the Stock Moved: Golden Sky’s stock surged from under $0.10 to a recent high of $0.24, catalyzed by a major endorsement and improving project outlook. In April 2025, renowned mining figure Rob McEwen (founder of Goldcorp) made a strategic investment in Golden Sky – a $220k convertible debenture that, if converted, would give him ~9.2% ownership. This vote of confidence from a legendary gold investor significantly boosted market sentiment, practically overnight doubling the share price from the $0.10–$0.12 range. The funds are being used to advance Rayfield, where earlier in January the company reported rock samples up to 0.5% copper and defined new drill targets via IP surveys. With drilling at Rayfield imminent (and copper prices strong), plus no overhang from warrants (a large block expired, tightening the float), Golden Sky’s stock has maintained its upward momentum. Investors now view this tiny explorer more seriously given McEwen’s backing and the potential for a major porphyry discovery.

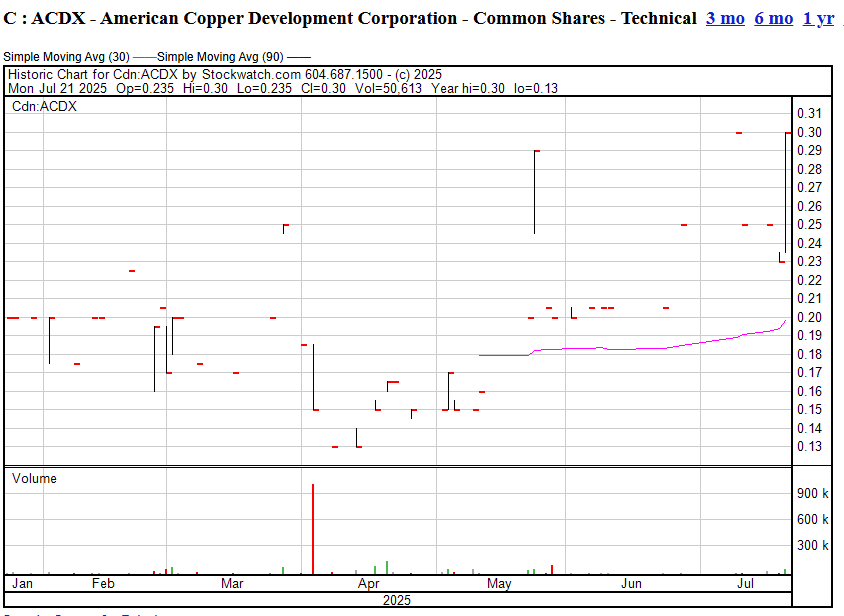

American Copper Development Corp. (CSE: ACDX) – $5.5M Market Cap

Status: Barely trading but still ascendant

Website: american-copper.com

What They Have: American Copper is advancing the Lordsburg Copper Project in New Mexico, a district-scale copper-gold porphyry target. Lordsburg lies at the intersection of two prolific copper trends and comes with a historic mine camp. American Copper consolidated the property in 2022 and has since completed geophysical surveys and a maiden drill program. In 2023, it confirmed a large porphyry system at Lordsburg, with maiden holes intercepting broad zones of copper (e.g. 44m of ~1.0% CuEq). The company also holds the Chuchi copper-gold project in British Columbia, though that has been optioned out to a partner.

Why the Stock Moved: ACDX stock rallied from around $0.10 late last year to roughly $0.30–$0.35 at its peak this spring. The run-up was driven by drilling success and strategic interest. In late 2023, American Copper’s drilling at Lordsburg hit high-grade copper-molybdenum-silver, validating the project’s potential. The stock gained steadily on those results and the subsequent expansion of the land package. Notably, major miner Hudbay Minerals had been an early shareholder, and speculation arose that Hudbay or others might partner on Lordsburg. (Hudbay’s involvement became public, though it later trimmed its stake). By Q2 2025, American Copper reduced debt by 90% through renegotiation of property payments, which improved its balance sheet and further buoyed the stock. After hitting a high on drilling news, the shares have settled around the $0.30 level. Investors are awaiting the next round of drilling – positive results could ignite another leg up for this USA-based copper play. Volume is anemix, so if it gathered any sort of market momentum, it should move quick.

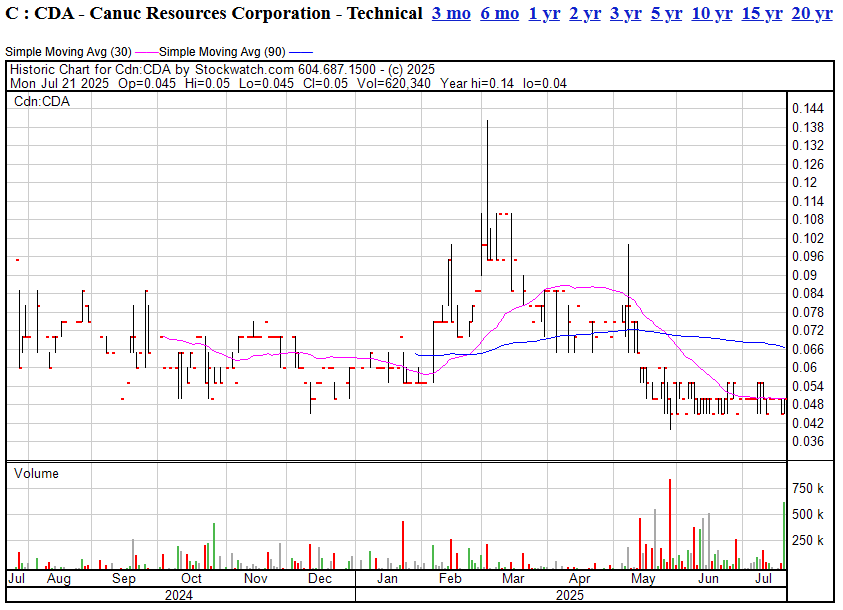

Canuc Resources Corp. (TSX-V: CDA) – 4.1M Market Cap

Status: Bigger is better

Website: canucresources.ca

What They Have:

Canuc is a junior exploration company with a renewed focus on Ontario gold after completing its merger with MacDonald Mines in 2025. The combined company now controls the expanded SPJ Project near Sudbury—one of the most prospective iron-oxide-copper-gold (IOCG) districts in Ontario. SPJ includes the past-producing Scadding Gold Mine, the Alwyn copper-gold trend, and a pipeline of nearby gold-copper targets. The merged land package consolidates strategic ground along the McLaren Fault system, giving Canuc a dominant position in a historic camp with underexplored potential.

Why the Stock Moved:

Canuc’s share price moved significantly in early 2025 after announcing the MacDonald Mines acquisition. The all-share deal was seen as accretive, combining assets and providing scale for future exploration. Investor interest was boosted by new drill results confirming high-grade gold zones at Scadding (e.g. 5.06 g/t Au over 5.4m), along with potential for IOCG-style copper-gold mineralization over broader structures. The market viewed the merger as an opportunity to reposition Canuc as a serious district-scale explorer in Ontario. Since then, shares have traded steadily but drifted to a 5c base, where someone is steadily accumulating.

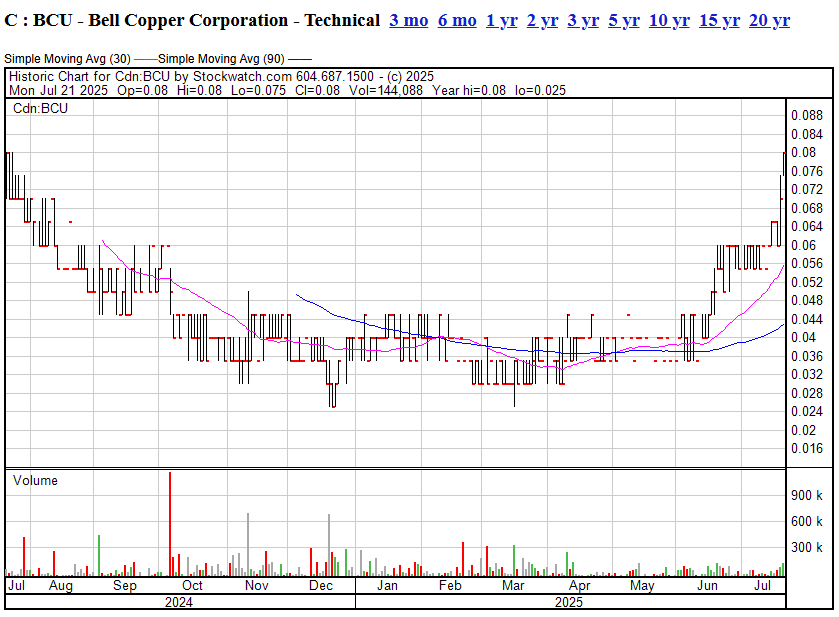

Bell Copper Corporation (TSX-V: BCU) – $11.9M Market Cap

Status: The skate ramp

Website: bellcopper.net

What They Have: Bell Copper is exploring for a giant porphyry copper deposit in Arizona. Its primary focus is the Big Sandy project, where Bell has drilled deep holes through gravel cover and hit indicators of a large Laramide-age porphyry system. Notably, hole BS-3 at Big Sandy encountered a thick sequence of copper sulfides (with chalcocite, bornite, etc.) and hydrothermal alteration, suggesting it may be the upper “cap” of a porphyry – possibly the offset top of the adjacent Diamond Joe deposit. Bell also has the Perseverance project under JV with Cordoba Minerals, targeting another deep copper system.

Why the Stock Moved: After a long quiet period, Bell Copper’s shares have climbed from roughly $0.03 late last year to around $0.08 recently. The resurgence is due to growing evidence that Big Sandy is a significant discovery in the making. In early 2025, independent research by the Arizona Geological Survey and University of Arizona confirmed that Big Sandy’s drill samples are geologically linked to the known Diamond Joe porphyry (same age and mineral patterns). This validates Bell’s theory that Big Sandy could host the rest of that copper deposit. Moreover, Bell extended its permits for more drilling and has been actively seeking a major mining partner to fund the next phase. Although drilling was temporarily paused in mid-2024 due to technical issues, the company announced plans to drill 8 new deep holes through 2025. The stock’s gradual move up reflects increasing investor optimism (and perhaps some strategic accumulation) now that Big Sandy’s potential is clearer. Each step that de-risks this project – be it technical studies or securing funding – has been met with a positive stock reaction.

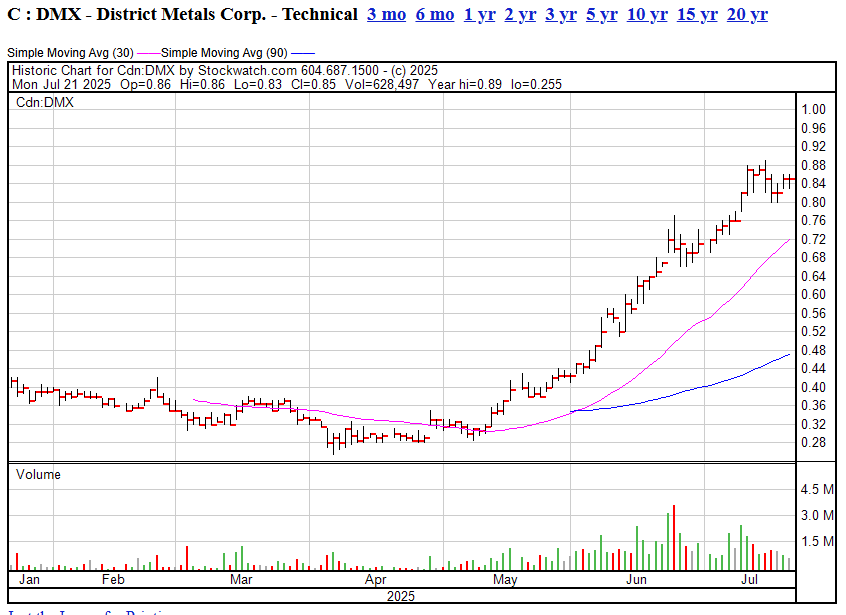

District Metals Corp. (TSX-V: DMX) – $132.8M Market Cap

Status: The steadiest climber

Website: districtmetals.com

What They Have: District is a Swedish-focused exploration company with two flagship assets. First, the Tomtebo and Stollberg properties in Sweden’s Bergslagen mining district, where District is exploring for high-grade zinc-silver-lead-copper VMS (volcanogenic massive sulfide) deposits. It has already drilled impressive massive sulphide intercepts at Tomtebo (e.g. ~29m of stringer and semi-massive sulfides with copper, zinc, lead, silver) and has a joint technical collaboration with Swedish mining giant Boliden on these properties, including shared exploration budgets. Second, District acquired the Viken property in Sweden, which contains the Viken deposit – a gigantic uranium-vanadium-molybdenum resource (historically one of the world’s largest undeveloped uranium resources).

Why the Stock Moved: District Metals has been one of the standout junior mining performers of 2025, with its stock price surging from around $0.25 to the $0.80–$0.90 range. Several factors converged: (1) Boliden Partnership – In February, District announced Boliden would increase funding by 50% (to C$3M) for Tomtebo/Stollberg exploration in 2025. Having a producer like Boliden actively involved lent huge credibility and meant District can aggressively drill with less dilution. (2) Swedish Uranium Upside – In early 2025 Sweden lifted its ban on uranium mining. This instantly made District’s 100%-owned Viken uranium-vanadium deposit a strategic asset. Viken contains a historic resource with hundreds of millions of pounds of U₃O₈ and V₂O₅, and investors re-rated the stock on this latent potential. (3) Capital Raise and Listing – District raised $6M in May (at ~$0.65, a strong price), bringing in institutional investors and ensuring it’s fully funded. It also obtained a secondary listing on Nasdaq First North in Sweden, attracting European interest. (4) Exploration Results – Ongoing drilling at Tomtebo continues to expand known zones and identify new targets, reinforcing that it’s a district-scale system. All these positives have dramatically lifted DMX’s valuation. The market now views District as a diversified Swedish metals play with both near-term discovery potential (Boliden-backed polymetallic drilling) and a giant longer-term uranium asset, which together justify the strong stock performance. This stock chart is an all-timer.

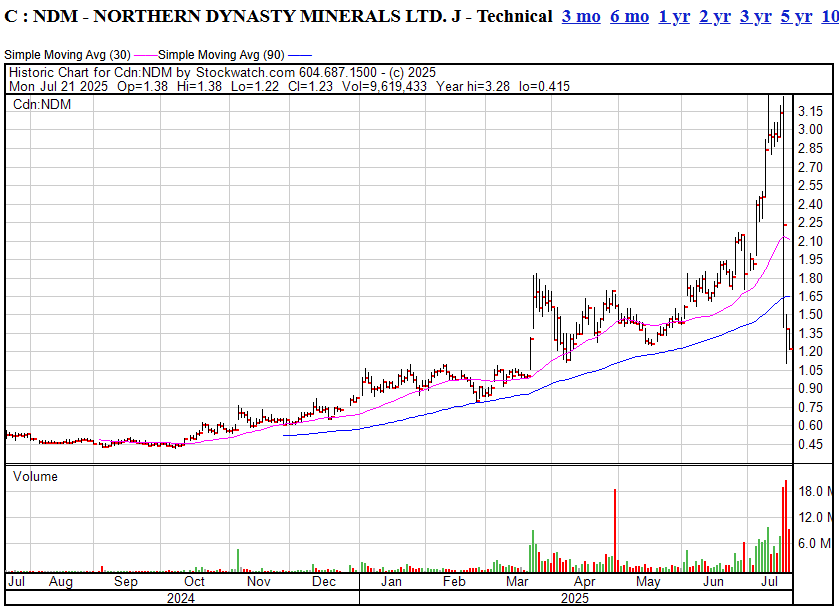

Northern Dynasty Minerals Ltd. (TSX: NDM) – $662.6M Market Cap

Status: The all-in bet

Website: northerndynastyminerals.com

What They Have: Northern Dynasty is the company behind the enormous Pebble Project in southwest Alaska – one of the world’s largest undeveloped copper-gold-molybdenum deposits. Pebble boasts resources on the order of 6.5 billion tonnes, containing tens of millions of ounces of gold and over 50 billion pounds of copper. However, it has faced lengthy environmental and regulatory battles, with US federal permitting denied in 2020. Northern Dynasty’s sole focus is advancing Pebble through appeals and eventually into development via a partner.

Why the Stock Moved: NDM’s stock price experienced a roller coaster in the past 4–6 months, swinging from all-time lows around C$0.40 to as high as C$3.27 before plunging back to near C$1.23. The catalyst was changing perceptions of Pebble’s permitting odds. In early 2025, speculation grew that a more favorable political climate or legal rulings could overturn the EPA’s veto of Pebble. In particular, Northern Dynasty pursued appeals in federal court challenging the EPA’s decision. Meanwhile, global copper supply concerns and Alaska’s state government showed support for mining projects, which fueled hope that Pebble might get another chance. The stock absolutely soared through the winter as retail and institutional investors piled in, betting on a reversal of Pebble’s fortunes. By spring, Northern Dynasty took advantage of the spike to raise capital, and reality set in that legal processes will take time. The share price pulled back from its peak but remains substantially higher than late 2024 levels. This reflects a resurgence of optimism (albeit with volatility) around the idea that the massive Pebble deposit could yet be developed – a prospect which, if it materializes, would be a game-changer for the company.

— Chris Parry

FULL DISCLOSURE: Where marked, Standard Uranium and Prismo Metals have existing marketing programs with Equity.Guru. This should be considered a conflict. They did not pay for mention in this article, nor did they have editorial say in the story, but potential investors should do their own due diligence.

Prismo Metals Inc. (CSE: PRIZ) – $4.5M Market Cap

Prismo Metals Inc. (CSE: PRIZ) – $4.5M Market Cap

Leave a Reply